Total Cost of Ownership (TCO) Analysis

Linux on HP BladeSystem vs. Sun Solaris and x86

Rack-Mounted Servers

Robert Frances Group

July 2005

HP sponsored this study and analysis. This document exclusively reflects the analysis and opinions of

the Robert Frances Group (RFG) author, who has final control of its content.

120 Post Road West, Suite 201

Westport, CT 06880

http://www.rfgonline.com

Executive Summary

The Robert Frances Group’s total cost of ownership (TCO) calculation measures four drivers of

cost – including hardware, software, labor and overhead – and factors in growth in the number of

server infrastructure from deployment to one year after deployment, and then a static number of

devices thereafter. The Linux on HP BladeSystem solution had the lowest TCO in all cost

categories, with hardware acquisition providing the largest cost advantage. After three years, the

TCO for an 8-server blade Linux on HP BladeSystem (Blade rack) solution was found to be

$185,770, 9.4 percent lower than a comparable x86 rack-mounted solutions (x86 rack) and 16.8

percent lower than a Sun Solaris rack-mounted servers (Sun rack). In the area of server hardware

costs, the study found the Linux on HP BladeSystem solution to have the lowest acquisition cost

per 8-server blade configuration throughout the model’s timeframe. At initial deployment, its

cost is 6.2 percent lower than the equivalent x86 rack solution, and 30 percent lower than a Sun

rack-based solution. After 3 years, with the solution fully built out to 250 servers, the HP

BladeSystem cost advantage rises to 13.8 percent vs. x86 rack and 29.2 percent vs. Sun rack.

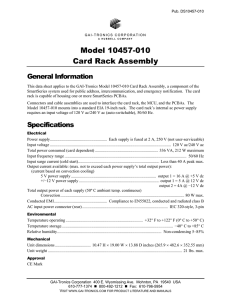

Overall 3-Year TCO Components of 3-Year TCO

Linux on HP BladeSystem

x86 Rack-Mounted

Solaris on SPARC

$2,082,618

$2,314,434

$2,680,299

Hardware

$883,266 $1,368,737

$927,429

$945,094

SW

$1,661,091

$1,714,219

$1,836,555

$1,672,358

Labor

$1,908,387

Overhead

Software costs had little discernable impact on differences in TCO across the three platforms

examined in the study. For all platforms, software costs were tabulated to be approximately 15

percent of overall TCO throughout the three-year timeframe but excluded the costs of custom

applications. The labor associated with deploying and maintaining a solution is one of the most

important drivers of TCO differentials, accounting for an average of 27.1 percent of TCO. The

average labor cost (per 8 blades) for the HP BladeSystem solution was 14.4 percent lower than

the x86 rack solution and 15.3 percent lower than the equivalent Sun rack solution. After 3 years,

the total labor costs for the HP BladeSystem solution were 20.2 percent lower than x86 rack and

18.2 percent lower than Sun rack. One of the key drivers of low labor TCO for Linux on HP

BladeSystem is the ease of deploying new systems, defined in the study as provisioning,

configuration and integration. The HP BladeSystem advantage in this area is most evident in the

first year of deployment, as the solution scales. During this interval, the cost differential for x86

rack rises from 13.4 percent to 17.8 percent. For Sun rack the cost difference is even larger,

rising from 14.7 percent to 19.9 percent.

In comparing the overhead of HP BladeSystem vs. x86 rack and Sun rack, the findings reinforced

previously held assumptions. Looking at overhead as a whole, the 3-year TCOs of both x86 rack

and Sun rack exceeded that of HP BladeSystem by 9.6 percent and 13 percent, respectively. The

key driver of lower overhead for Linux blade was data center costs. The three-year TCO related

to data center costs were30 percent higher for the x86 rack solution and 40 percent higher for the

Sun rack solution versus the HP BladeSystem solution.

Copyright © Robert Frances Group, Inc. All rights reserved.

2

Goals and Methodology

White Paper Goals

HP engaged the Robert Francis Group to perform an analysis comparing the TCO of a Linuxbased solution running on an HP BladeSystem platform to that of similar solutions running on:

•

x86 rack-mounted servers with a mix of industry standard operating systems

•

Sun Solaris on Sun SPARC rack-mounted servers

Within the study, TCO is defined broadly to include the server hardware itself, as well as all

software, labor, storage and associated overhead costs. Each of these cost categories are in turn

broken down into their constituent elements (e.g., software types). The goal of the analysis is to

understand the cost dynamics of these environments along two dimensions. First, how do costs

vary over a 3-year ownership interval, holding the scale of the solutions constant? Second, how

do these costs compare as the solution is scaled up over its first 12 months? This dual approach

was used to underscore the sensitivity of blade TCO to changes in the solution scale that would

not be apparent if a “constant number of servers” approach was solely employed.

Sample selection and data gathering

Of the 10 companies RFG interviewed, six ran Linux on HP BladeSystem environments, two ran

x86 rack-mount servers and two ran Solaris-SPARC rack-mount servers. To expand the number

of data points in the study, the six Linux on HP BladeSystem respondents were also asked for

their expected hypothetical costs if they had deployed on the x86 and Solaris-SPARC rack

environments, respectively. While respondent size and industry were not used as selection

criteria, the majority of respondents would be classified as service-oriented companies, with

Linux on HP BladeSystem respondents concentrated among large banks, insurers and financial

service providers. This generally reflects the earliest adoption of blade servers. In addition to the

interviews, RFG also leveraged its extensive data on Sun and x86 implementations drawn from

approximately 25 interviews.

Data for the study was gathered using a two-track approach. To obtain qualitative and select

quantitative information, RFG conducted telephone interviews with IT personnel such as

architects, distributed computing directors and managers. The majority of quantitative

information was obtained through a standalone instrument, administered after the discussion.

This made it more feasible for respondents to gather data from multiple sources or forward it to

other individuals.

System Profiles and Pricing Assumptions

For Linux on HP BladeSystem respondents, the core system used was the HP ProLiant BL20p.

Within respondents’ installed base, a total of eight configurations were identified, determined by

type and number of processors, RAM, internal storage and SAN connectivity. For each customer,

the number of servers within each configuration group was tracked. Thus, if a customer had

multiple configurations, costs were calculated separately for each group. Server costs were

calculated as an expense in the period the purchase was made (depreciation was not calculated or

tracked) using two sources. First, customers were asked what they paid on a per-blade basis (as

well as the approximate discount off list they received). Second, RFG used HP’s Web-based

pricing and configuration tool to generate a list price for each configuration group that could be

used for cross-checking purposes. After accounting for discounts, the configured price was

Copyright © Robert Frances Group, Inc. All rights reserved.

3

compared to the customer’s stated price. All fell within 3 percent +/-. The final element to be

accounted for in calculating blade server costs were shared system resources, such as equipment

racks, system enclosures, power distribution, cooling and cabling. Based on discussions with

respondents and RFG research, these costs were assumed to be $3,500 per enclosure for the HP

ProLiant BL20p. The TCO model also assumed a ratio of 8 blades to one enclosure. As such, the

total server cost for each respondent was calculated as:

# servers with

( Configuration

1

X

Price/blade with

Configuration 1

)

+

servers with

( #Configuration

1

X

)

$3,500

8

This was calculated for each server configuration employed by the respondent. To determine the

cost of x86 and Sun rack-mounted systems, the same approach was made, with the obvious

exception of enclosures. To determine these costs, RFG needed to identify corresponding

systems for x86 and Solaris-SPARC rack-based solutions, respectively. As with pricing, this was

determined through a mix of respondent guidance and RFG research. The systems ultimately

chosen for comparison were the HP ProLiant DL380 and the Sun Microsystems Sun Fire V240.

As with the HP ProLiant BL20p, eight configurations of these systems were identified and priced.

Qualitative Findings

Overview of Implementations

The architectures of solutions covered in the study fell under two respondent-defined categories:

•

Grid or “grid-like”—In which a cluster of blade servers are controlled by a dispatching

server to perform a particular function (e.g., calculating security pricing). This also

would include massively parallel processing architectures, in which large amounts of

computing power are generated by pulling together a large number of blades into a single

entity. With numerous subtle variations, this category represented approximately 80

percent of profiled systems.

•

Three-tiered—Including tiers for Web serving, Web application services and backend

databases. Elements include load-balancing, security/DMZ, LDAP server, etc. Within

this architecture, the blade servers were used across all tiers. This represented

approximately 20 percent of profiled systems.

The number of processors per blade is a key decision made by architects. The pattern seen in the

study was that most respondents (about two in three) maintained a strategy of uniformity

throughout, while others slightly modified their approach as they developed more experience

using blades. These changes were typically downward, with respondents shifting a larger share

of their computing to smaller scale systems (e.g., from a mix of four-way and dual processor to

Copyright © Robert Frances Group, Inc. All rights reserved.

4

all dual, or from all dual-processor systems to a mix of single and dual. The goal in all cases was

to obtain more granularity and flexibility as they scaled (“We didn’t want to overbuild.”).

Within the profiled solutions, the majority of deployed applications were complex, proprietary

and/or highly customized, reflecting the highly specialized needs of the banking and financial

services sectors. Respondents also generally specified that their preference was to focus their

blade-based deployments on applications where horizontal scalability was deemed especially

important. Examples cited by respondents include:

•

•

•

•

•

•

Risk management

Transaction processing

Customer self-service processing

High-volume database access

Data mining (generally off the shelf, e.g., Cognos)

Document management(e.g., LDMS)

Finally, in the area of storage, respondents were found to employ a mix of SAN, attached and

internal. Roughly one half of respondents employed internal or attached storage, citing its main

focus on maximizing application performance. The other roughly one half of respondents that

used SAN storage cited flexibility as the central driver of its storage strategy.

Goals: Why Blades?

Asked unaided why they selected blade technology in general, respondents typically cited a

combination of factors—one primary, one still important but secondary. The most common

were:

• Optimizing application performance/low cost—Performance: “We are compute intensive.

The architecture we chose gave the ability to separate blade servers into different

dispatchers, which enabled us to leverage the full capabilities of the application. Cost:

Our goal is to minimize our cost per CPU, and the most important thing is simply to have

the capacity to add capacity.” Source: Large bank.

• Faster deployment/more virtualization—Faster: “We have to be extremely responsive to

our internal customers, which means we need to minimize operational bottlenecks—from

getting management approval for every server to getting them from the loading dock.”

Virtualization: “We're definitely moving in the direction of more virtualization, and

blades enhance our ability to do this.” Source: Large financial services provider.

• Need for standardization/processing throughput—Standardization: “We had a hodgepodge of systems that needed upgrading. We wanted something that was easy to grow

and manage.” Throughput: “Our strategy is to stripe data across many systems – as

opposed to striping data across many spindles – to get maximum performance. Blades are

ideal for that.” Source: Large consumer information services provider.

• Need for standardization/systems management—Standardization: “The situation before

was that every project had its own hardware, software stack and systems management

infrastructure. The idea is to have numerous standardized commodity units in the

infrastructure.” Systems management: “We needed to be sure we had an easy way to set

up servers to handle new workloads as they came up.” Source: Large insurance provider.

• Faster application deployment/”commoditized” hardware —Faster: “We wanted to have

an on-demand environment where we can reduce time-to-market for new applications.

Rather than having a 30- to 60-day deployment cycle, we can do it same day.”

Commoditized: “Our ultimate goal is to treat hardware as a commodity, and blades did

this.” Source: International bank.

Copyright © Robert Frances Group, Inc. All rights reserved.

5

•

Standardization /ease of management—Standardization: “Having an industry-standard

platform makes it easier on our customers and our internal developers. Once it became

clear that blade technology was here to stay, it became a no-brainer.” Management: “We

get the power we need by pulling together a large number of systems into a single entity;

this can include thousands of nodes in the single system. With blades, we saw

tremendous savings in cabling as well an ability to manage them as a single entity.”

Source: European information services provider.

TCO Findings

Overall TCO

As discussed, RFG’s TCO calculation factors in growth in the number of servers from

deployment to one year after deployment, and then a static number of servers thereafter. For the

average implementation, the number of servers rose from 120 at deployment, to 170 after 6

months to 250 servers at year 1—and held at that level through years 2 and 3. As Exhibit 1

shows, Linux on HP BladeSystem TCO is the lowest throughout the first three years, followed by

x86 rack-mounted servers and SPARC on Solaris rack-mounted servers. At deployment, the gap

is smallest between Linux blade and x86 rack. In the first year, as the number of servers grows,

this gap grows modestly, while the TCO difference between Sun rack and x86 rack narrows

modestly.

In the last two years of the model, the TCO for HP BladeSystem diverges from x86 rack and Sun

rack at about the same rate. After three years, the TCO for an 8-blade HP BladeSystem solution

was found to be $185,770, 9.4 percent lower than x86 rack ($205,033) and 16.8 percent lower

than Sun rack ($223,273). As Exhibit 2 on the following page shows, the overall cost of an HP

BladeSystem solution rises from $2.5 million at deployment (with 120 servers) to just

Exhibit 1

Overall 3-Year TCO (per 8 Blade/8 Server Configuration)

$225,000

$175,000

$125,000

At Deployment

6 Months

1 Year

2 Years

3 Years

Linux on HP BladeSystem

$166,658

$152,870

$126,080

$155,861

$185,770

x86 Rack-Mounted

$175,558

$164,557

$137,218

$171,036

$205,033

Solaris on SPARC

$199,524

$186,432

$154,328

$188,737

$223,273

120

170

250

250

250

# of Servers Deployed

Source: RFG 2005

Copyright © Robert Frances Group, Inc. All rights reserved.

6

Exhibit 2

Overall 3-Year TCO (for Full Solution)/Components of 3-Year TCO

$7,500,000

$5,000,000

$2,500,000

At

Deployment

6 Months

1 Year

2 Years

3 Years

Linux on HP BladeSystem

$2,504,031

$3,259,954

$4,069,238

$5,030,424

$5,995,711

x86 Rack-Mounted

$2,713,160

$3,509,182

$4,603,896

$5,695,396

$6,792,637

Solaris on SPARC

$2,997,846

$3,975,662

$4,980,931

$6,091,484

$7,206,138

120

170

250

250

250

# of Servers Deployed

Linux on HP BladeSystem

x86 Rack-Mounted

Solaris on SPARC

$2,082,618

$2,314,434

$2,680,299

Hardware

$883,266

$1,368,737

$927,429

$945,094

SW

$1,661,091

$1,714,219

$1,836,555

$1,672,358

Labor

$1,908,387

Overhead

Source: RFG 2005

under $6 million after 3 years (with 250 servers). In absolute dollar terms, the TCO gap for x86

rack rises from $200,000 to nearly $800,000 after three years. By comparison, the Sun rack TCO

differential grows from almost $500,000 at start-up to $1.2 million. As the lower portion of

Exhibit 2 shows, the HP BladeSystem solution had the lowest TCO in all cost categories, with

hardware acquisition providing the largest cost advantage. The following sections explore the

underlying cost factors driving these TCO differentials in greater detail.

Servers

In the area of server hardware costs, the study found the HP BladeSystem solution to have the

lowest acquisition cost per 8-blade configuration (see Exhibit 3) throughout the model’s

timeframe. At initial deployment, its cost is 6.2 percent lower than the equivalent x86 rack

solution, and 30 percent lower than a Sun rack-based solution. After 3 years, and with the

solution fully built out to 250 servers, the HP BladeSystem cost advantage improves to 13.8

percent vs. x86 rack but the advantage remains roughly the same vs. Sun rack (29.2 percent). The

study found that for the HP BladeSystem solution, the cost of shared system resources

(enclosures, etc.) are equal to or less than x86 and Sun rack depending on the network and storage

infrastructure deployed.

Copyright © Robert Frances Group, Inc. All rights reserved.

7

Exhibit 3

3-Year TCO: Server Hardware (per 8 Blade/8 Server Configuration)

$70,000

$65,000

$60,000

$55,000

$50,000

$45,000

$40,000

At

Deployment

6 Months

1 Year

2 Years

3 Years

Linux on HP BladeSystem

$45,226

$44,389

$44,953

$44,953

$44,953

x86 Rack-Mounted

$48,202

$49,948

$52,136

$52,136

$52,136

Solaris on SPARC

$65,000

$64,944

$63,472

$63,472

$63,472

120

170

250

250

250

# of Servers Deployed

Source: RFG 2005

Software

Software costs had relatively little impact on differences in TCO across the three platforms

examined in the study. For all platforms, software costs were tabulated to be approximately 15

percent of overall TCO throughout the three-year timeframe. Within this general category, the

largest subcomponents were systems management software (~60 percent) and operating system

software (~25% for Linux blade and x86 rack, but zero for Sun rack). For the solutions profiled,

third-party software accounted for a very low share of software costs. This in large part reflected

the heavy use of proprietary and/or highly customized software by the broadly defined financial

sector, to which most respondents belonged.

For a number of respondents, the total investments in highly customized applications ran into the

millions. This presented two problems. First, there was considerable uncertainty as to whether

these costs should be classified as “software” or “labor,” since the development was performed

using internal staff. Second, the sheer magnitude of these costs threatened to distort the TCO

results by making software appear to be a more important determinant of TCO than it is in reality.

To circumvent these problems, the study excluded the costs of custom applications.

Labor

Labor associated with deploying and maintaining a solution is one of the most important drivers

of TCO differentials. As Exhibit 4 shows, the average labor cost (per 8 blades) for the HP

BladeSystem solution was 14.4 percent lower than the x86 rack solution and 15.3 percent lower

Copyright © Robert Frances Group, Inc. All rights reserved.

8

Exhibit 4

3-Year TCO: Labor Component (per 8 Blade/8 Server Configuration)

$60,000

$55,000

$50,000

$45,000

$40,000

$35,000

$30,000

$25,000

At

Deployment

6 Months

1 Year

2 Years

3 Years

Linux on HP BladeSystem

$46,917

$38,707

$27,293

$34,787

$42,409

x86 Rack-Mounted

$54,780

$46,974

$34,009

$43,472

$53,113

Solaris on SPARC

$55,356

$47,732

$33,271

$42,480

$51,816

120

170

250

250

250

# of Servers Deployed

Source: RFG 2005

than the equivalent Sun rack solution. As the number of servers deployed grew through year 1,

labor cost per server fell for each category. From that point, the labor costs for the x86 and Sun

rack solutions grew proportionally faster than the HP BladeSystem solution. After 3 years, the

total labor costs for the HP BladeSystem solution were 20.2 percent lower than x86 rack and 18.2

percent lower than Sun rack. One of the key drivers of low labor TCO for Linux blade is the ease

of deploying new systems, defined in the study as provisioning, configuration and integration.

As Exhibit 5A on the following page shows, the HP BladeSystem advantage in this area is most

evident in the first year of deployment, as the solution scales. During this interval, the cost

differential for x86 rack rises from 13.4 percent to 17.8 percent. For Sun rack the cost difference

is even larger, rising from 14.7 percent to 19.9 percent. Respondents pointed to two main factors

as having the biggest impact on HP BladeSystem TCO:

• “Adaptive” Availability—A number of respondents pointed to HP’s Instant Capacity

(iCAP) program—in which preconfigured server blades are delivered and activated only

when needed—as providing major savings in acquisition and deployment. “Say we buy

three chassis full of blades—24 blades. We order it and get it all on the data center floor

in one fell swoop. If I was to buy them sequentially, that would be 24 trips to the loading

dock, 24 approvals, 24 cabling requests, etc. The fact that we only have to do this once

with blades cut our turnaround time to a day and produces substantial operational

savings.”

• Cabling Efficiency—A reduction in cabling complexity was cited universally as a major

benefit of the HP BladeSystem solution. The core of this benefit is the reliance on the

server blade backplane instead of discrete cabling, which enables resources to be

reallocated without the need to physically change cabling (as is the case with rackmounted servers). “Our biggest savings is reduced cabling infrastructure. This includes

not just the labor of putting this cabling into place but also the ongoing maintenance

required.”

Copyright © Robert Frances Group, Inc. All rights reserved.

9

Exhibit 5A

Labor Costs: Provisioning, Configuration & Integration (per 8 Blade/8 Server Configuration)

$40,000

Linux Blade

x86 Rack

Sun Rack

$35,000

At Deployment

6 Months

1 Year

2 Years

$21,520

$20,988

$17,257

$21,520

$20,988

$21,520

$20,988

$17,257

$10,000

$17,257

$15,000

$29,732

$24,425

$28,974

$38,132

$20,000

$37,556

$25,000

$32,553

$30,000

3 Years

Exhibit 5B

Labor Costs: Systems Management (per 8 Blade/8 Server Configuration)

$30,000

Linux Blade

x86 Rack

Sun Rack

$25,000

$0

At Deployment

6 Months

1 Year

2 Years

$25,054

$20,577

$17,465

$13,718

$8,732

$8,351

$6,859

$10,643

$9,868

$8,546

$11,422

$10,812

$5,000

$9,667

$10,000

$16,702

$15,000

$26,197

$20,000

3 Years

Exhibit 5C

Labor Costs: Break-fix & Support (per 8 Blade/8 Server Configuration)

$9,000

Linux Blade

x86 Rack

Sun Rack

$8,000

$7,000

At Deployment

6 Months

1 Year

2 Years

3 Years

Source: RFG 2005

Copyright © Robert Frances Group, Inc. All rights reserved.

10

$4,804

$6,084

$4,575

$4,003

$5,070

$3,812

$3,336

$2,000

$4,225

$8,131

$6,412

$5,736

$3,177

$3,000

$5,801

$4,000

$4,697

$5,000

$7,357

$6,000

Another driver of lower labor-related TCO for Linux blade solutions was systems management,

which would include the labor associated with infrastructure and application monitoring,

reallocation of capacity, change and patch management, automated workflow provisioning, and

remote management. As Exhibit 5B shows, reported systems management costs for x86 rack

were 18 percent higher than Linux blade after 3 years. Respondents saw the cost of Sun rack

systems management as being 21.5 percent higher than Linux blade after 3 years. Specific

examples of the systems management benefits cited include:

• More Flexible Resource Allocation—A large bank uses HP BladeSystem servers in a

series of grids that run back-office applications. By using blades, the respondent can

share capacity across different grids (and grid dispatchers) more efficiently. This in turn

has enabled a major improvement in application performance. “Now we can use any free

blade for any batch process or compute intensive process. That's the biggest gain.

Before they had computations running on 180 servers overnight, now they are able to cut

back down to 130. It shortens batch time by two to three hours.”

• Cable Management Efficiency—A large provider of credit information uses blades in a

grid on which it runs extremely high volume database applications. “We had spent a ton

of money on cable management alone. Blades enabled us to achieve big operational

savings by making our wire management much simpler.”

• Software Deployment—A large insurance provider that uses blades in a grid-based risk

management solution cited efficient software distribution as a major benefit. “Under our

old [fragmented] systems, we were spending too much of our resources on things like

patch and change management. Combined with the standardization of our systems, we

expect the tools available under the new [blade] infrastructure to streamline [patch and

change management], and probably cut that portion of our systems management in half.”

• General Efficiency—One respondent, a large international bank, commented that “Linux

systems administration efficiency is five times as efficient as UNIX-based. Now we are

managing 100 servers per administrator, compared to 20 under UNIX.”

System repair and replacement (i.e., break-fix) was also a significant source of TCO advantage

for HP BladeSystem solutions. As seen in Exhibit 5C (on the previous page), the TCO delta of

HP BladeSystem vs. x86 and Sun rack solutions grows steadily in the three years from

deployment. For Sun rack, the total three-year costs related to break-fix are 4.8 percent higher

than Linux blade. Break-fix costs for x86 rack, by comparison, are 24.9 percent higher.

The importance of this benefit of HP BladeSystem was clearly evident from RFG’s discussions.

The most immediate—and most frequently cited—benefit was the extremely short time required

to replace individual blades when they go down. Because failed blades can be replaced

modularly, with no cabling issues, the time required is negligible. Though cited less frequently,

the software side of replacement—mainly self-configuration, under which a new blade

automatically seeks out the management server and downloads the software to configure itself—

was also cited as a benefit.

Overhead

In the context of the study, overhead was defined to include the cost of data center real state (i.e.,

“floor tiles”), power, cooling and security/fire control. As a proportion, overhead as a share of

TCO nearly doubled from year 1 to year 3 (to between 26 and 28 percent for all environments).

In comparing HP BladeSystem to x86 rack and Sun rack, the findings reinforced previously held

assumptions. Looking at Overhead as a whole, the 3-year TCOs of both x86 rack and Sun rack

exceeded that of HP BladeSystem by 9.6 percent and 13 percent, respectively (see Exhibit 6).

The key driver of lower overhead for Linux blade was a data center cost. The three-year

Copyright © Robert Frances Group, Inc. All rights reserved.

11

Exhibit 6

3-Year TCO: Overhead Component (per 8 Blade/8 Server Configuration)

$60,000

$50,000

$40,000

$30,000

$20,000

$10,000

At Deployment

6 Months

1 Year

2 Years

3 Years

Linux on HP BladeSystem

$24,615

$22,417

$17,156

$34,311

$51,467

x86 Rack-Mounted

$26,526

$24,372

$18,968

$37,936

$56,903

Solaris on SPARC

$27,631

$24,850

$19,710

$39,419

$59,129

120

170

250

250

250

# of Servers Deployed

Source: RFG 2005

TCO related to data center costs was 30 percent higher for the x86 rack solution and 40 percent

higher for the Sun rack solution than Linux on HP BladeSystem solutions. This of course relates

to the higher levels of density achievable through blade server solutions (estimated by one

respondent as being roughly 5 to 10 times that of rack-mounted servers). This attribute factored

into many respondents’ decisions to implement a blade solution, but was generally not the

deciding factor.

Conclusions

One of the clear sentiments expressed by respondents was the idea that blade server technology:

1.) is mature enough to handle most production applications 2.) is “the next step in server

evolution” in terms of the ability to replace failed systems quickly and 3.) is one of the best

options for companies seeking to consolidate, standardize and/or “virtualize” their architectures.

In looking at the TCO of HP BladeSystem vs. x86 and Sun rack, there was a relatively clear

consensus that the HP BladeSystem had the lowest over a 3-year ownership period. The other

point of broad agreement was the idea that blades’ biggest cost advantages were operational and

labor-related—not in the cost of the systems themselves. At the root of this was the undeniable

benefit of cabling simplicity, which had ramifications both for upfront provisioning as well as

ongoing system maintenance and repair.

RFG also concludes that while a good deal of blade servers’ widely perceived benefit of having

lower overhead was well-founded, some findings were surprising. To some extent, respondents

were affected by their companies’ specific situations. For example, respondents with highly

constrained data center space and large number of systems tended to emphasize data center cost

reductions enabled by blade density. Others—both large and medium-sized—saw strong appeal

and cost savings from the ability to scale horizontally in a highly granular way. HP’s iCAP

Copyright © Robert Frances Group, Inc. All rights reserved.

12

program dovetailed strongly with this desire, as well as the need to shorten and streamline the

deployment of new systems in response to growing resource needs. For blade technology, the

issue of cooling is considered important to respondents, who realize that the need to

accommodate cooling requirements of new processor and memory technology will enter into their

data center space planning and possibly affect server density regardless of the form-factor

deployed.

Copyright © Robert Frances Group, Inc. All rights reserved.

13