Assessment of Kronos

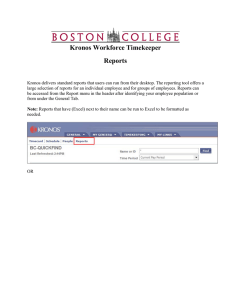

advertisement