Portuguese Tax System

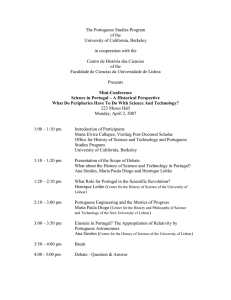

advertisement