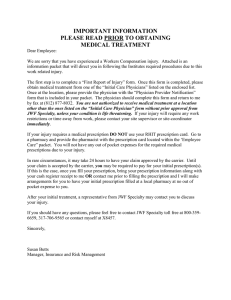

All Savers Insurance Company Compass Plus

advertisement