THE FARMER’S EDGE

April 2007 Volume 12, Number 4

Hurley & Associates

Agri-Marketing Centers

Why Simple Is Hard

Several reports have come out over the past

few weeks and most with surprises. Everyone wanted

an opinion about how high the wheat market would go

after the record cold Easter weekend. When someone asked for my opinion, my answer was – “No one

knows.” Now what kind of answer is that for someone in the marketing business? The fact is, no one

does know – there are too many factors in the market

place, and too many players with different agendas. We have farmers; consumers; commercials; and

speculators with large sums of money. Modern technology has given us access

to more information than we can possibly read or

comprehend. Everyone has an opinion about where

commodities prices are going and why. Those who

specialize in research spend a great deal of time and

effort in trying to accurately assess the supply/demand

fundamentals. Those who watch technical indicators study a number of them to attempt to catch trend

changes. There is a lot of technology available to

watch weather patterns, but it is not yet sufficient to

accurately predict weather much further than a few

days out. In addition there are many people who try

to assess the moral issues involved in agricultural

programs that are established in the political arena. Article after article is being written on the pros and

cons of ethanol as a renewable fuel. One of the latest

articles we read proposed the premise that biofuels are

starving the poor in third world countries. In the early

1980’s there were those who fought against anyone

who farmed over 2,000 acres being called a family

farm and receiving the benefit of many of the agricultural programs of the day. Many similar viewpoints

are being discussed in the current environment. WTO

(World Trade Organization) and NAFTA (North

American Free Trade Agreement) were organized in

an attempt to level the playing field for agriculture

world-wide.

Each of these paragraphs would be considered by many to be three separate ways to look at the

markets. One – fundamental issues such as supply

and demand, second – technical indicators, considered

to be the only true indicator by those who study them

like a science, and three –political issues. Simple is hard because true economics is a

people science-----and all three of these are people

issues. Greed and fear will always be the biggest factor in any economy. Fundamentals will change when

prices get too high or too low in any business. If only

agriculture would see itself as a business. That is a

people problem. Technical indicators in the markets

are nothing short of the sum total of human psychology, and no government in history has ever been able

to successfully achieve morality for its people through

legislation.

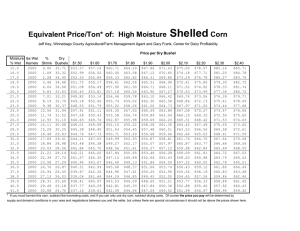

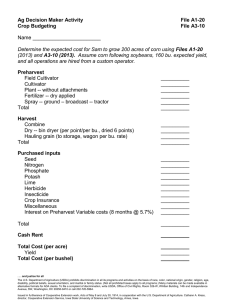

Just for your interest we are including charts

of food, fiber and fuel to let you see how prices have

reacted over the past several months. One could go

nuts trying to watch each of these commodities every

day and determine their relationship to one another,

and at the same time, attempt to specialize in production. At Hurley and Associates, we have chosen not to

be in the business of research. Neither do we devote

all of our time studying every technical indicator. We

certainly don’t pretend to know what will happen in

the political arena, especially in the geopolitical hotbed of the Mideast. We use consultants that we have

found to be the most reliable and consistent over the

past twenty-five years, and who work at the grassroots

level---meaning farmers, consumers, railroads, grain

companies and barge lines. Our specialty is risk management. The obvious thing we can see in these charts

(see chart page insert) is that some good opportunities

came and went. While profitable pricing opportunities

are still there for row-crop farmers, livestock producers and ethanol plants have seen much better chances

to lock in good corn prices to cover feed needs. Farmers in general had opportunities to lock in better fuel

and fertilizer prices. This is why Hurley and Associates has decided to do devote our best efforts to being

a more efficient risk management firm. We work

toward better ways to use risk management tools in all

of these markets every day. We are also stepping up

our educational program to help producers understand

and be comfortable with risk management tools.

It would be much simpler if everyone based

their decisions strictly on good accounting records and

business principles instead of the proverbial “crystal ball”. Accountability is the hardest sell. In many

cases, the lack of accountability makes it difficult for

producers to recognize a profitable opportunity when

w w w. h u r l e y a n d a s s o c i a t e s . c o m

continued on page 2

continued from page 1

Cotton

it presents itself.

The second factor in making simple hard is the

“all I can get” mentality. This is essentially a form of greed

and it gets in the way of good sound business decisions

A close third is the idea that options are for “making money” and not recognizing their insurance value. Failure to use options to protect profits leaves a valuable

tool in the tool box untouched. Even if there are little or

no profits available, options can be used to set floors when

the risk of even greater losses is possible. Usually option

strategies leave the opportunity for higher prices that are

profitable. Buying out of the money calls against forward

sales made early in the year, for instance, is usually a good

option strategy. In the years that these options expire

worthless it leaves a bad taste. However, if you think of

options as another cost of production, in bull market years

like we are in presently in where prices run away – you are

still open for windfall profits. Another benefit is that the

The cotton market finally broke free of the two

cent trading range (basis May from 5470 to 5277) in effect

since our last report. Not surprisingly, the break out was to

the downside the day before the April Supply/Demand and

WASDE reports. The specs had built their gross long position to an all time high while the demand side of the business continued to be unexciting and dull. Monday’s break

appeared mostly technical in nature.

Certainly, the administrations flap with China at the

WTO did not help the bulls cause but neither was it the cause

of the break. Aggressive selling of May against purchases of

July by locals in anticipation of the gigantic “Goldman rolls”

to be done on the close triggered huge sell stops beneath the

lows of the last six weeks. Index funds that are pegged to

the Goldman Sachs Index have a self imposed rule that 20

percent of their long position in the spot month is rolled to

the next month on the fifth through ninth day of the delivery

month. Armed with the knowledge of these “Goldman rolls”

to be done at the close, the aggressiveness of the locals during the session was persistent.

However, the fact that there was sufficient demand

beneath the market to hold the losses to about a cent is impressive. Particularly when you realize the break came on

massive all-time record volume of 73,310 - far surpassing

the previous record daily volume of 68,047 set about two

months ago.

There were no major surprises or market movers

in the April Supply/Demand reports. As pessimistic as it

sounds, the report can best be described as “bearish as expected”. USDA adjusted production downward by 160,000

to bring it in line with the final ginnings figure. Domestic

consumption was reduced by 50,000 bales. The big hit came

as exports were reduced by another 500,000 bales to 13.5

million. All this increased ending stocks by 400,000 to 9.2

million bales - a tall mountain for the bulls to climb.

World numbers showed only small adjustments

with the biggest change being a 500,000 reduction in Chi-

The Farmer’s Edge

increased option values allow you to have less exposure to

losses if you have to buy back contracts due to production

shortfalls.

Another lesson in risk management is seen in the

ethanol profit margin chart (again, see chart page insert).

Profits have dropped dramatically for those who did not

use risk management tools – but for those who did – good

profits were locked in.

The industries that truly understand their business

and the inherent risks are prepared for almost anything

that would change the market outlook. Agriculture simply

needs to put more emphasis on knowing their business and

protecting their risks. Again, no one knows – weather and

politics (people) are simply not predictable.

Huge profits never last forever. SIMPLE IS HARD.

Ida Hurley

nese imports. Chinese demand stayed at record levels but

their policy of showing preference in utilizing their own domestic supplies over cheaper imported cotton is forcing the

US, through the loan, to carry the worlds excess stocks. Last

week a Chinese official commented that they would issue

import licenses (TRQ) only “step by step” to foster (their

domestic) market stability.

Unfortunately, at least for now, the best the bulls

can hope for at this point is that this weeks break in prices

is no more than a slight reduction of the low end of the trading range. Export demand should keep prices well above 50

cents. However, until we resolve the huge (and maybe still

growing) carryout from this year to next, it will be nearly

impossible to sustain old crop rallies above 55 cents. Any

future market rally towards 1,100 points above the prevailing AWP will find heavy commercial offers waiting.

Between now and first notice day for July cotton,

there is a historically reliable trend for July to lose to the

December contract (or Dec to gain on July). According to

Moore Research, the bible of seasonal traders, the only two

years this did not occur in the last fifteen year was 1995 and

1998.

Mike Stevens

© 2007 Hurley & Associates Agri-Marketing Centers of Charleston

Grain Sorghum

Hogs

Prices for hogs are projected higher into Jun/Jul. Hog slaughter was 1-3% larger than expected during first quarter. It is possible that the hog inventory was underestimated

in the December and March quarterly reports. If weekly hog

slaughter continues to exceed projections made based on

the March report, hog prices may fall well short of forecast

summer highs. Pork demand was fairly good in first quarter,

especially export demand. Domestic consumption appeared to

be stronger than a year ago, mostly stimulated to some extent

by high beef prices.

Cash hog prices are forecast to peak in the low/mid

$70s during June and July. Relatively high corn prices will

encourage pork producers to market hogs a few pounds lighter

than when corn prices were relatively low. Marketing at

lighter weights will reduce the amount of pork produced by a

slight to modest amount. Export demand for pork should remain strong through the spring and summer. Hog marketings

are expected to increase seasonally from July into November. Hog prices are forecast to decline to the low $60s in fourth

quarter, close to the average in fourth quarter last year.

BULLISH MARKET FACTORS:

1) Pork export demand remains strong

2) Internationally, a major decline in chicken consumption

continues to support strong export demand for pork

3) Pork prices are competitive with beef and chicken at retail

4) Relatively high corn prices are expected to discourage herd

expansion

5) Retail pork featuring is expected to increase during the

cookout season

BEARISH MARKET FACTORS:

1) Pork export sales may eventually slow due to rising beef

exports

2) Pork production for ’07 is forecast unchanged to up 1% but

may could total less than year earlier if corn prices hit $4 or

higher and hold into the fall

3) Total red meat and poultry production is projected unchanged to up 1% but may be less than last year if corn prices

are high

4) High energy prices may weaken consumer pork buying

A 10 million bushel reduction in exports was the

only change to last month’s USDA supply and demand estimates. At 140 million bushels, this represents the lowest

export figure in 40 years. There is no question that this has

been a drought induced situation as former foreign buyers

have switched to corn to insure adequate year-round supplies. With a much improved moisture situation across the

major sorghum producing areas of the U.S., it is expected

that the export number will improve in the coming season. While drought has been a major culprit in lower foreign

sales, one cannot overlook the fact that the historically

high corn futures prices have also had an impact as feeders

worldwide have been relying more heavily on substitute

commodities, or trimming back on animal numbers and/or

weights.

Planting continues to move north in Texas. The

most recent crop progress shows that approximately 17 percent of the expected acres are planted. Texas is by far the

leader at 59 percent planted, with Louisiana and Arkansas

at 39 and 36 percent respectively. The USDA expects that

sorghum acreage will increase by 9 percent over last year to

7.01 million acres. This would be a welcomed change for

handlers and merchandisers that have watched this market

shrink precipitously over the past decade. While Texas

will see the biggest acreage increase of 45,000, the Southeastern states of Arkansas, Louisiana and Mississippi are

expected to more than double last year’s acreage. Kansas,

while showing a modest 50,000 acre increase over last

year, could see that number increase if we end up finding

wheat acres going to sorghum in a few weeks. The recent

cold snap, while potentially detrimental to wheat in South

Kansas, Oklahoma and some spotted areas in neighboring

states, has so far not seemed to have a significant impact

on sorghum. We did have customers in Central Texas that

received as much as 5 inches of snow on sorghum that was

approximately 6 inches in height, but temperatures did not

stay low enough long enough to be a cause for concern.

With all these acres expected to come back to sorghum, and the much improved moisture situation, merchandisers across the sorghum belt are starting to wonder where

they will put it all come harvest. The potential for a large

supply at harvest is already starting to have an impact on

basis. Old-crop basis at Gulf port locations has fallen to the

20 to 30 over May corn futures level, and is not expected to

improve as foreign have all but disappeared for now. New

crop offers for sorghum delivered to the Texas ports are

lingering in the option December corn futures area. With

little news of vessels being sold at harvest, there is still a lot

of confusion about where harvest time basis will be. Most

suggests that things will get worse before they get better. The past few years has suggested that moving sorghum in

August and September was the most optimal in terms of basis. This may be developing into one of those years where

basis management will have producers trying to store their

sorghum until well into fall. But for sorghum, the problem

of having more bushels to work with will be a welcomed

sight.

© 2007 Hurley & Associates Agri-Marketing Centers of Charleston

The Farmer’s Edge Why Simple Is Hard - Chart Insert

Cent s per Bushel

460

May Corn Futures

460

Cent s per Bushel

560

May KC Wheat Futures

560

450

450

440

440

430

430

420

420

410

410

400

400

390

390

380

380

370

370

360

360

350

350

340

340

330

330

320

320

310

310

300

300

290

290

450

450

440

440

280

9- 19- 31- 10- 22- 4- 14- 27- 9- 22- 1- 13- 26- 8- 20- 30Oct Oct Oct Nov Nov Dec Dec Dec Jan Jan Feb Feb Feb M ar M ar M ar

800

800

780

780

760

760

740

740

720

720

700

700

680

680

660

660

640

640

620

620

600

600

580

580

560

560

9Oct

20- 2- 15- 28- 11- 22- 8- 22- 2- 151- 14- 27- 7Oct Nov Nov Nov Dec Dec Jan Jan Feb Feb M ar M ar M ar Apr

530

520

520

510

510

500

500

490

490

480

480

470

470

460

460

6-Nov

4-Dec

1-Jan

29-Jan

26-Feb

DAP Fertilizer - Gulf

430

26-

430

Dol l ar s per Ton

430

410

410

390

390

370

370

350

350

330

330

310

310

290

290

270

270

250

13-Oct

10-Nov

8-Dec

5-Jan

2-Feb

UREA Fertilizer - Gulf

370

530

2-M ar

30-

250

Dol l ar s per Ton

370

530

520

510

510

500

490

490

480

470

470

460

450

450

440

430

350

350

330

330

310

310

290

290

270

270

250

250

230

230

210

210

430

420

410

9-Oct

540

530

Cent s per Bushel

May Wheat Futures

540

550

430

9-Oct

Cent s per Bushel

820

May Soybean Futures

820

280

550

540

6-Nov

4-Dec

1-Jan

The Farmer’s Edge

29-Jan

26-Feb

26-

410

190

13-Oct

10-Nov

8-Dec

5-Jan

2-Feb

2-M ar

30-

190

© 2007 Hurley & Associates Agri-Marketing Centers of Charleston

Why Simple Is Hard - Chart Insert

Dol l ar s per Bar r el

70

May Crude Oil Futures

70

68

68

66

66

64

64

62

62

60

60

58

58

56

56

54

54

52

52

50

9-Oct

220

6-Nov

4-Dec

1-Jan

29-Jan

26-Feb

May RBOB Unleaded Gas Futures

26-

50

Cent s per Gal l on

220

215

215

210

210

205

205

200

200

195

195

190

190

185

185

180

180

175

175

170

170

165

165

160

160

155

155

150

9-Oct

6-Nov

4-Dec

1-Jan

29-Jan

26-Feb

150

Cent s per Gal l on

195

May Heating Oil Futures

195

26-

190

190

185

185

180

180

175

175

170

170

165

165

160

160

155

155

150

150

145

9-Oct

6-Nov

4-Dec

1-Jan

29-Jan

26-Feb

26-

145

$ per M mbt u

May Natural Gas Futures

8.5

8.5

8.0

8.0

7.5

7.5

7.0

7.0

6.5

6.5

6.0

9-Oct

6-Nov

4-Dec

1-Jan

29-Jan

26-Feb

Ethanol Average Rack Price

275

6.0

26-

Cent s per Gal l on

275

250

250

225

225

200

200

175

150

9-Oct

175

6-Nov

4-Dec

1-Jan

29-Jan

26-Feb

26-

Poi nt s

88

US Dollar Index

88

150

87

87

86

86

85

85

84

84

83

83

82

9-Oct

6-Nov

© 2007 Hurley & Associates Agri-Marketing Centers of Charleston

4-Dec

1-Jan

29-Jan

26-Feb

26-

82

The Farmer’s Edge The corn market was rocked by the USDA’s Planting Intentions Report on March 30, which indicated that U.S.

Farmers would plant over 90 million acres of corn for the

2007/2008 marketing year. Questions abounded, the first

was how much of th e12 million acre increase can really get

planted? Followed closely by what kind of yields can we

expect if we do get that much of an increase? Then we had

Easter week-end with the attendant freezing temperatures

affecting almost all of the southern crop, which was wellemerged. That brings up a whole different set of questions,

how much corn will we actually lose? What happens to the

acres if we do lose some? Cotton? Beans? More corn? Grain

sorghum? How much winter wheat did we lose if any? What

happens to those acres? How does that affect the substitution

of wheat for corn in feed rations? Market analysts are getting

migraines trying to sort it all out. The fact is that many of these questions will only be

answered by our July 15 cut-off for acres certification, others will not be known until harvest. Meanwhile, the market

will nervously bide its time, trading every credible guess and

rumor, trying to balance burgeoning ethanol demand with

unknown acres and unknowable weather possibilities around

the world. This promises to be quite a year!

The USDA is trying to keep track of supply and demand as well as it can be predicted, and in its April 10, supply

and demand report, the U.S. corn ending stocks for 2006/07

are projected at 877 million bushels, up 125 million from last

month based on lower projected feed and residual use. Feed

and residual use is projected at 5,850 million bushels, down

125 million, as the March 1 stocks indicated lower-than-expected use in the December-February quarter. Food, seed,

and industrial use is unchanged this month, despite a small

increase in seed use, based on producer planting intentions

reported in the Prospective Plantings report. Lower projected

food and non-ethanol industrial use offset the increase in seed

use. The season-average farm price is projected at $3.00 to

$3.20 per bushel, 20 cents per bushel lower on the top end

of the range reflecting higher projected carryout, larger 2007

intended area, and prices received by producers to date.

The U.S. balance sheets for grain sorghum and

Corn

Planted Harvested Yield Carryin Production Supply Feed Exports Ethanol Other Ind Demand Carryout CO/Use Price Range

U.S. Corn Supply/Demand (mb)

Apr Apr Mar Apr

USDA

USDA

USDA USDA

04/05 05/06 06/07 06/07

80.9 81.8 78.3 78.3

73.6 75.1 70.6 70.6

160.4 148.0 149.1 149.1

958 2114 1967 1967

11807 11114 10535 10535

12776 13237 12512 12512

6158 6141 5975 5850

1818 2147 2250 2250

1323 1603 2150 2150

1363 1379 1385 1385

10662

11270

11760

11635

2114 1967 752 877

0.198 0.175 0.064 0.075

$2.06 $2.00 $3.00 $3.00

$3.40

$3.20

barley are adjusted this month to reflect small changes in projected use. U.S. grain sorghum exports for 2006/07 are lowered 10 million bushels reflecting lower projected imports by

Mexico. Projected grain sorghum ending stocks are increased

an equal amount. Barley feed and residual use is raised 5

million bushels as the March 1 stocks indicated higher-thanexpected use during the December-February quarter. Barley

ending stocks for 2006/07 are lowered an offsetting amount.

Global 2006/07 coarse grain production is increased

8.1 million tons this month with much of the increase in nonexporter African countries. The biggest increases are for Ethiopia, Nigeria, and Sudan, which together are raised 4.8 million

tons as excellent growing-season weather in these and other

African countries boosted corn, sorghum, barley, and millet output. Global corn production is raised 2.7 million tons

this month reflecting higher output in many African countries

and South America. Corn production for Argentina is raised

0.5 million tons to 22.0 million, as harvest reports continue

to confirm record yields. Despite flooding in key growing

areas of Argentina, part of the crop in the affected areas was

harvested ahead of the late-March downpours. Damage to

remaining unharvested corn is expected to be limited if drier

weather persists. Brazil corn production is raised 1.5 million

tons this month to 49.5 million, reflecting higher official estimates by the Brazilian government for first- and second-crop

area and first-crop yields. South Africa corn production is

lowered to 6.0 million tons, down 1.0 million from last month,

as the El Nino-driven drought continued during March. Production for Thailand is lowered 0.4 million tons this month.

Global 2006/07 coarse grain feeding is reduced

mostly reflecting lower corn feed and residual use in the

United States. Coarse grain feed use is also lowered in Mexico, South Africa, and Thailand, but raised in Argentina and

Brazil. Global exports are nearly unchanged this month for

coarse grains and corn. Corn exports for China are lowered

0.5 million tons as exports for Argentina are raised 0.5 million

tons. Global 2006/07 coarse grain ending stocks are raised 4.6

million tons this month with corn accounting for 4.0 million

tons of the increase. U.S. corn ending stocks are raised 3.2

million tons as feed and residual use is projected lower. Brazil

corn ending stocks are raised 0.8 million tons reflecting higher

expected production. With lower projected exports, ending

stocks for China corn are also raised 0.5 million tons.

World Corn Supply/Demand (mmt)

Apr Apr Mar Apr

USDA

USDA

USDA USDA

04/05 05/06 06/07 06/07

Carryin 103.86 131.28 124.40 124.21

Production 712.63 695.20 693.15 695.85

Supply 816.49 826.48 817.55 820.06

Total Demand 685.20

702.26

729.75 728.24

Carryout CO/Use 131.29 124.22 87.80 91.82

0.192 0.177 0.120 0.126

China Production: 06/07 143.0; unch

Argentina Production: 06/07 22.0; +0.5

© 2007 Hurley & Associates Agri-Marketing Centers of Charleston

The Farmer’s Edge Market Update - Cattle

The cash market for fed cattle is expected to peak

within next 30 days. Live prices have already reached

$100 and are expected to trade around $105-110 the next

couple weeks. Beef prices should continue to increase,

pushing cutout values near $170 or higher on the choice

and $160 or higher on select. While beef production has

declined since February, prices at these projected levels are

expected to be high enough to ration the smaller supply. Prices are expected to trend lower from early/mid May into

July. Live prices on fed cattle are expected to decline to the

upper $80s before bottoming and turning higher into the

fall. Consumer beef buying should increase seasonally as

barbeque season gets into full swing around Memorial Day.

However, retail beef buyers will have contracted for a high

percentage of the weekly needs through June and July. As

a result, even if weekly beef production continues relatively

light through May, packers will have more to sell on the

spot market than in April. Fed cattle prices are expected to

trend back to the mid/upper $90s during fourth quarter.

The April 1 Cattle on Feed report will be released

April 20. March placements are estimated 10-12% more

than year ago. Warmer weather, drying feedlot conditions,

plenty of empty pen space, improving profitability on fed

cattle sales and declining corn prices, all contributed to

increasing the demand for feeder cattle during March. Rising prices for feeder cattle encouraged producer selling. Marketings were strong during March and are estimated

around unchanged vs March ’06. Since March ’07 had one

less slaughter day than last year, marketings at 100% for the

month were the equivalent of 4-5% larger on a day for day

comparison. But, since March placements are estimated

larger than marketings, the April 1 on feed inventory is

estimated down 2% vs down 4% on March 1. Marketings

were current coming into April. Cattle feeders are willing

to continue selling virtually all the cattle packers will bid

on. Consequently, there have more pens of cattle marketed

one to two weeks earlier than originally scheduled. If this

continues through April, average slaughter weights should

continue to decline, further reducing beef production.

Feeder cattle prices are expected to continue

strong to higher while fed cattle prices are increasing. However, feedlot buyers will continue to watch day to day,

week to week changes in corn prices and adjust bids for

feeder cattle accordingly. Feedlot buyer demand will be

mostly good through the spring months. Cattle feeders are

generally bullish on the outlook for fed cattle prices later

this year. But, if corn prices rally to $4 or higher again,

feedlot buyers will lower bids drastically for feeder cattle

as well as buy fewer. Overall supply of feeder cattle and

calves the rest of this year should be equal to slightly smaller than last year. Heavy placements of cattle in feedlots

last year due to widespread drought will limit the supply

available this year. Of course, imports of feeder cattle from

Canada and Mexico can fill at least part of the void.

BULLISH MARKET FACTORS:

1) Availability of well finished, choice fed cattle will be

tight into mid May as feedlot marketings are very current

2) Consumer beef demand should increase seasonally as

cookout season reopens

3) Average slaughter weights are still declining and expected to trend down a few more weeks

4) The drought in ’06 resulted in an increase of 18% in beef

cow slaughter, 12% more total cows were slaughtered than

in ‘05

5) Beef exports are expected to continue relatively light in

’07 but should increase as the year progresses

BEARISH MARKET FACTORS:

1) Imports of feeder cattle from Canada and Mexico will

continue a source of added supply

2) South Korea has not yet resumed importing of U.S. beef

3) High gasoline prices may cause consumers to buy less

beef

4) Threat of discovering another case of Mad Cow Disease

in U.S.

5) Threat of renewed terrorist activities

© 2007 Hurley & Associates Agri-Marketing Centers of Charleston

The Farmer’s Edge Rice

Market Update - Rice Market Update - Wheat

Wheat growers, crop consultants, cattle feeders, flour

millers, and anyone else in the world with an interest in the

2007/2008 wheat crop is watching in abject anticipation as we

try to sort out the extent of damage to the winter wheat crop. Both hard and soft red winter wheat appears to have some

damage. The percent of loss and the number of acres affected

is still being assessed and there will be at least 1-2 week’s delay in the final decisions. The only certainties are that many

have lost some of it, and some have lost all of it, it’s merely

a matter of assigning credible numbers to the categories and

weighing the effect on the markets.

In the USDA’s April 9, supply and demand report,

U.S. 2006/07 ending stocks are projected at 422 million bushels, down 50 million bushels from last month due to increases

in domestic use and exports. Feed and residual use is raised

25 million bushels as the March 1 stocks indicated higherthan-expected use in the December-February quarter. A small

increase in seed use reflects higher winter wheat seedings

reported in USDA’s March 30 Prospective Plantings report.

Exports are raised 25 million bushels to 900 million reflecting

U.S. Wheat Supply/Demand (mb)

Apr Apr Mar Apr

USDA

USDA

USDA USDA

04/05 05/06 06/07 06/07

Planted 59.7 57.2 57.3 57.3 Harvested 50.0 50.1 46.8 46.8

Yield 43.2 42.0 38.7 38.7

Carryin 546 540 571 571

Production 2158 2105 1812 1812

Supply 2775 2727 2498 2498

Food 910 915 925 925

Exports 1066 1009 875 900

Seed 78 78 81 82

Feed/Res

182

153

145

170

Demand

2235

2155

2026

2077

Carryout CO/Use Price Range

World Wheat Supply/Demand (mmt)

Apr Apr Mar Apr

USDA

USDA

USDA USDA

04/05 05/06 06/07 06/07

Carryin 132.60 151.22 147.46 147.88

Production 628.58 621.16 593.11 594.50

Supply 761.18 772.38 740.57 742.38

Total Demand 609.96

Carryout CO/Use 624.50

619.34

621.17

151.22 147.88 121.23 121.21

0.248 0.237 0.196 0.195

Australia Production: 06/07 10.5; unch

Argentina Production: 06/07 14.20; unch

540 571 472 472

0.242 0.265 0.233 0.203

$3.40 $3.42 $4.20 $4.20

$4.30

$4.30

Only minor changes are made to the U.S. 2006/07

rice supply and use projections. On the supply side, all rice

imports are raised 1.0 million cwt to a record 20.0 million cwt with long-grain imports up 1.0 million cwt, while

combined medium- and short-grain imports are unchanged. Imports of fragrant long-grain rice from Thailand, which are

larger than expected through the first half of the marketing

year (based on Census data through January), account for

most of the increase. No changes are made on the use side

from a month ago. Ending stocks of all rice are projected at

31.9 million cwt, 1.0 million cwt above last month, but 11.1

million cwt below a year earlier. The season-average farm

price is projected at $9.75 to $9.95 per cwt, unchanged from

a month ago.

Global production, imports, and exports are raised

The Farmer’s Edge

improved export prospects as U.S. prices, particularly for soft

red wheat, are more competitive in the world market. Adjustments are also made in imports, domestic use, exports, and

ending stocks of wheat by class. The projected range for the

2006/07 farm price is unchanged at $4.20 to $4.30 per bushel. Producers have marketed most of their 2006 production limiting the effect of further price movements on the weighted

season-average farm price.

Global wheat production for 2006/07 is projected at

594.5 million tons, up 1.4 million from last month with nearly

all of the increase in African countries and Mexico. Higher

global consumption more than offsets higher production leaving ending stocks nearly unchanged. Changes in world exports

and imports are also nearly offsetting; however, major export

changes include 1-million-ton reductions for both Canada and

EU-25 and 0.5-million-ton increases for both Kazakhstan and

Russia. Exports are also raised 0.9 million tons for Syria. The

largest increases in projected ending stocks are for Canada,

EU-25, and Pakistan. The largest ending stocks reductions

are for the United States and Syria.

slightly from last month, while beginning stocks, consumption, and ending stocks are lowered slightly. Global production is raised less than 0.1 million tons on a number of

nearly offsetting changes. On the plus side, production is

raised for Egypt, Cote D’Ivoire, Burma, Nigeria, and Venezuela, while production is lowered for Pakistan, Japan, and

Argentina. Exports are raised for Pakistan, Thailand, and

Vietnam and lowered for Burma. Imports are increased for

Colombia, Iraq, and the United States. Global ending stocks

are projected at 78.9 million tons, about 0.2 million tons

below last month, and 2.6 million tons below 2005/06. The

slight decline in ending stocks is due primarily to decreases

for India, Thailand, and Vietnam; which is nearly offset by

increases for Egypt, Cote D’Ivoire, Burma, and Nigeria.

© 2007 Hurley & Associates Agri-Marketing Centers of Charleston

The soybean market has been participating in

the most intense battle for crop acres in recent memory. The March 30, USDA planting intentions report

indicates producers planning to plant over 90 million

acres of corn, a 12 million acre increase over 2006.

While this report was friendly for the soybean market,

subsequent rainy weather has called into question the

ability of producers to get all the corn intended acres

planted. Also, the Easter weekend freeze has damaged some wheat all over the wheat belt and some

of it is damaged badly enough to warrant destroying the wheat crop and replacing with either corn or

soybeans. The choice will be made depending on the

competing markets and weather. Sound confusing? It

is, and will likely continue to be until we get a clearer

picture of corn plantings around May 15. Until then,

we will continue to trade export and feed demand

numbers, weather forecasts and guesses about the

wheat damage.

In its April 9, supply and demand report, the

USDA projected U.S. ending stocks of soybeans to be

up 20 million bushels to a record 615 million bushels

as reduced exports, crush, and seed use are only partly

offset by higher residual use. Soybean exports are

reduced 20 million bushels reflecting slower than expected shipments to date reported by the U.S. Census

Bureau. Soybean crush is forecast at 1,765 million

bushels, down 15 million bushels from last month. The reduction is due to lower projected domestic

soybean meal use and reduced prospects for soybean

meal exports. Although soybean meal exports have

been strong through the first half of the marketing year, sharply higher South American supplies

are expected to reduce the competitiveness of U.S.

soybean meal in the second half of the year. Residual

use is increased this month as indicated by the March

Market Update - Soybeans

U.S. Soybean Supply/Demand (mb)

Apr Apr Mar Apr

USDA

USDA

USDA USDA

04/05 05/06 06/07 06/07

Planted 75.2 72.0 75.5 75.5 Harvested 74.0 71.3 74.6 74.6

Yield 42.2 43.0 42.7 42.7

30,Grain Stocks report.

The U.S. season-average soybean price range

for 2006/07 is projected at $6.10 to $6.50 per bushel,

unchanged from last month. Soybean meal prices are

projected at $190 to $200 per short ton, up $5 on the

low end of the range. Soybean oil prices are projected

at 28.5 to 30.5 cents per pound, up 1 cent on both

ends of the range.

Global oilseed production for 2006/07 is projected at a record 402.9 million tons, up 3.7 million

tons from last month. Soybean production accounts

for almost all of the change. Brazil soybean production is raised 1.8 million tons to a record 58.8 million

tons based on higher yields, especially in southern

states. Soybean production is raised by a combined

2.3 million tons for Argentina and Paraguay. The

Argentina crop is projected at a record 45.5 million

tons, up 1.5 million tons from last month. Despite

heavy rain that fell during the last week in March over

much of the growing area, yields are projected record

high at 2.88 tons per hectare. Soybean production is

also up sharply for Paraguay based on excellent yield

prospects. Other changes include higher soybean

production for Brazil for the 2005/06 crop. The crop

is raised 2 million tons to 57 million tons reflecting

reported crush and export data for the recently completed marketing year.

Global oilseed ending stocks for 2006/07

are increased 3.4 million tons to 67.4 million tons. Most of the increase is due to higher South American

soybean stocks, reflecting sharply higher projected

production for both 2005/06 and 2006/07. Global

vegetable oil stocks are reduced this month mainly

due to reduced palm oil production for Indonesia.

World Soybean Supply/Demand (mmt)

Apr Apr Mar Apr

USDA

USDA

USDA USDA

04/05 05/06 06/07 06/07

Carryin 38.80 48.45 52.23 53.79

Production 215.74 219.93 229.40 233.49

Supply 254.54 268.38 281.73 287.28

Carryin 112 256 449 449

Production 3124 3063 3188 3188

Supply 3242 3322 3642 3642

Total Demand 205.16

Crush 1696 1739 1780 1765

Exports 1097 947 1100 1080

Seed 88 93 87 83

Residual

104

94

79

99

Demand

2986

2873

3046

3027

Brazil Production: Argentina Production: Carryout CO/Use 213.95

223.84

225.51

48.45 53.79 57.50 61.02

0.236 0.251 0.257 0.271

06/07

58.8; +1.8

06/07 44.5; +1.5

Carryout 256 449 595 615

CO/Use 0.086 0.156 0.195 0.203

Price $5.74 $5.66 $6.10 $6.10

Range

$6.50

$6.50

The Farmer’s Edge

© 2007 Hurley & Associates Agri-Marketing Centers of Charleston

Dennis E. Hurley - Chairman of the Board, President and Chief Financial Officer

Ida V. Hurley - Chief Executive Officer

Trent Hurley - Vice President

David Hurley - President of Hurley & Associates, Inc.

Consultants:

Frank McCalla, Bill Hudson, Sid Love, Eric Matsen & Joe Kropf

Hurley & Associates Agri-Marketing Centers

Hurley & Associates, Inc.

415 E. Marshall • P.O. Box 471 • Charleston, MO 63834

Phone: (573)-683-3371 • Toll Free: 1-800-524-0342 • Fax: 573-683-4407

e-mail: mail@hurleyandassociates.com

www.hurleyandassociates.com

Stuttgart, AR

870-673-3680

Glenwood, MN

320-634-4001

Groton, SD

1-866-650-3078

Yuma, CO

970-848-8212

Mankato, MN

507-386-7911

Sioux Falls, SD

605-274-6660

Armstrong, IA

712-868-4500

Wheaton, MN

320-563-8490

Caldwell, TX

979-272-0539

Eldora, IA

866-646-7472

Caruthersville, MO

1-800-597-3628

Canyon, TX

806-655-2395

Reinbeck, IA

800-397-4935

Aurora, NE

402-694-2109

Ruthven, IA

712-837-3716

Omaha, NE

800-228-2316

Albert Lea, MN

507-377-7711

Britton, SD

877-781-0058

Dawson, MN

320-769-2232

Brookings, SD

877-212-2564

Except as otherwise noted, the contents of this newsletter are copyrighted materials of Hurley & Associates Agri-Marketing Centers of Charleston,

Inc. and contain trademarks, service marks and trade names of Hurley & Associates Agri-Marketing Centers of Charleston, Inc. and/or affiliates.

ALL RIGHTS ARE RESERVED.

While the information contained in this newsletter is derived from sources which are believed to be accurate and timely, there may be

inadvertent factual inaccuracies or typographical and other errors, and the information is not warranted or guaranteed for accuracy or completeness. This newsletter is intended merely to provide current, relevant market information. Any opinions expressed herein are subject to change

or correction without notice and Hurley & Associates Agri-Marketing Centers of Charleston, Inc. and its affiliates disclaim all liability for errors

or omissions in these materials, and disclaims all liability for the use or interpretation by others of information contained in this newsletter. We

believe positions are unique to each person’s risk bearing ability, marketing strategy, and crop conditions, and therefore Hurley & Associates AgriMarketing Centers of Charleston, Inc. does not give blanket recommendations.

Decisions based on information contained in this newsletter are the sole responsibility of the reader, and in exchange for receiving this

information, the reader agrees to hold Hurley & Associates Agri-Marketing Centers of Charleston, Inc. and/or its affiliates harmless against any

claims for damages arising from any decisions that the reader makes based on such information. The risk of loss in trading commodities can be

substantial. Therefore, careful consideration should be made prior to trading by any person. Past performance in any commodities or other market

is not indicative of future results, and there is no guarantee that your trading experience will be similar to past performance.