Please the abstract book

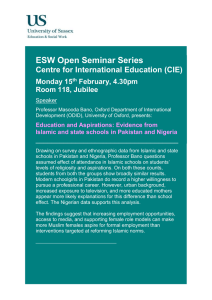

advertisement