Zainab Abdulrahim, Halima Abdusalam, Toyin Abegunde, Nicholas Abolo-Tedi, Bassem Abou-Nehme, Amos Abu, Emmanuel Abutu, Moses Achibong, Roland Achor, Odey Adamade, Eric Adams,

Funmi Adedibu, Kunle Adegun, Kemi Adekunle, Taiwo Adeniji, Ade Adeola, Abosede Adesalu, Bola Adesola, Philip Aduda, A.F. Afolabi, Faosat Afolabi, Olusegun Aganga, Clement Agba, Damilola

Agbaje, Victor Agboh, Pius Agboola, Dan Agbor, Donna Aimiuwu, Abiodun Aina, Emmanuel Ajayi, Konyin Ajayi, Smith Ajibola, T.O. Ajiboye, Ayo Akande, Funmi Akande, Raphael Akigbe, Johnson

Akinnawo, Joba Akinola, Femi Akinrebiyo, Oghogho Akpata, Olumide Akpata, Peter Akper, Fausta Alakwe, Ugo Alex-Orji, Carlos Algandona, Diezani Alison-Madueke, Abba Aliyu, Andrew Alli, Deji

Alli, Charles Allison, John Alonge, Longe Alonge, Sam Amadi, Jonah Amedu, Seun Amoda, Amaitari Andabai, Steve Andzenge, Nike Animashaun, Kehinde Anuwe, Chibuzor Anyanechi, Yemi

Anyanechi, Emily Arden, Richard Arkutu, Kerryn Arnott, Jones Arogbofa, Oluseye Arowolo, Anthony Asaikpe, Solomon Asamoah, Wola Asase, Femi Atilade, Jerome Avuke, Austin Avuru, Mary

Awolokun, Adeola Awolola, Phillip Awolu, Saheed Ayinde, Adedapo Ayoade, Johnson Ayokanmbi, Uwakwe Azikiwe, Seynabou Ba, Joseph Babatunde, Akin Bada, Anshu Bahanda, Sundeep

Bahanda, Bunu Bakar, Babatunde Bakare, Lothar Balling, Wasoudeo Balloo, Ladi Balogun, Yinka Balogun, Bjoern Banholzer, Kate Baragona, Antonio Barbalho, Peter Barrett, Kobus Bastiaanse,

Kim Beazley, Praveen Beeharry, Mohammed Bello, Mohammed Bello Adoke, Teslim Belo-Osagie, Boma Benebo, Oliver Berger, Manuel Berlengiero, Paul Biggs, Umar Bindir, Waziri Bintube, Dave

Blackley, Hadi Bley, Janos Bonta, Anthony Bosco, Etienne Bourguignon, Martin Brack, Tarun Brahma, Bola Braimoh-Tokura, Petra Brantmark, Arnaud Braud, Peter Breese, Heike Brehm, Cam

Brockie, Angelique Brooksbank, Danny Brouillard, Roger Brown, Muhammadu Buhari, Musa Bukar, Jack Buonanno, Jeremy Burke, Barry Burland, Eva Busse-Ladipo, Jessica Cairns, Ferdinand

Calice, Henry Camp, Miana Capuano, Anna Caro, Belen Castuera, Hanna Cecile, Chris Chijiutomi, Ike Chioke, Brian Christaldi, Francis Chuckwu, Onyinye Chukwu, Vincent Chukwu, Ebi Clarke,

Paula Coetzee, Gordon Combs, Stuart Connal, Vicky Copeman, Ruhi Cosgun, Suzanna Cullinane, Modupe Dabiri, Omotayo Dada, Bekinbo Dagogo-Jack, Federica dal Bono, Christopher Dall, Suzie

Daniels, Keith Darby, Joseph Dawha, Alain de Cat, Virginia de Ujfalussy, Jan Decker, Marco DeSouza, Dan Dexter, Ulrich Dibelius, Beryl Diezun, Haliru Dikko, Funke Dinneh, Anne Drakeford, Judith

Drion, Berthold Dyballa, Anthony Ebelendu, Antje Eck, Eugene Edeoga, Frank Edozie, Louis Edozien, Daniel Edwards, Itohan Ehiede, Oyinda Ehiwere, Nicholas Ehizenigah, Gloria Ejekwu, Sophie

Ejelue, Idowu Ejere, Antigha Ekaluo, Eyo Ekpo, Nasir El-Rufai, Omoyeme Elabor, Oseni Elamah, Kunle Elebute, Gbolahan Elias, Keith Ellis, Paul Eluhaiwe, Godwin Emefiele, Samuel Eneaya, Gerhard

Engel, Boris Entschewitsch, Edaiken N'Uselu Eradiauwa, Omo N'Oba Erediuawa, Oze Erediauwa, Raymond Eromosele, Wolemi Esan, Efosa Evbuomwan, Francis Evbuomwan, Nnaemeka Ewelukwa,

Emeka Eze, Sandeep Fakun, Joe Faruggia, Dele Faseemo, Ademola Fashiku, Ajibade Fashina, Babatunde Fashola, Mojisola Fashola, Lanre Fatimilehin, Emmanuel Faton, Erik Fernstrom, Mark

Fitzpatrick, Alan Follmar, Albert Folorunsho, Awoala Fredericks, Nomsa Fulbrook-Bhembe, Andrew Gaines, Richard Games, Sanusi Garba, Kabiru Garkuwa, Rajeev Garside, Jérôme Gastaud,

Olakanmi Gbadamosi, Emmanuel Gbahabo, Tony Giustini, Nasir Giwa, Jennifer Gladstone, Wolfgang Goetsch, Andrew Goh, Kamal Govender, Alastair Gow-Smith, John Gower, Hans Grabow,

Robert Grant, Benito Grimaudo, Antra Grundsteina, Todd Grzech, Veronique Gubser, Christelle Guerin, Pankaj Gupta, Radhika Gupta, Kanneng Gwom, Ato Gyasi, Karen Hadra, Ana-Katarina

Hajduka, Stephanie Hammond, Paul Hanrahan, Ken Hansen, Omotayo Hassan, Emma Hay, James Head, Conor Healy, Elizabeth Hennessy, Jorge Henriqueto, Michael Hermsdorf, Dave Herron,

Olivia Higgs, Taco Hoencamp, Crispin Holliday, Keiko Honda, Neil Hopkins, Dean Horton, Nadege Huart, David Hunt, Abba Ibrahim, Audu Ibrahim, Sadiq Ibrahim, Henry Idahagbon, Isuan Idonije,

Isuan Idonije, Godknows Igali, Fortune Igbinakenzua, Alpheus Igbokoyi, David Ige, Phillip Ihenacho, Julius Ihonvbere, Patrick Ikhariale, Sadiku Ilegieuno, Jonathan Inggs, Igbinidu Inneh, Tom

Inugonum, Itorobong Inyang, Georgia Iordanescu, Ade Ipaye, Mahmoud Isa-Dutse, Chukwuka Isichei, Oluwole Iyamu, Anslem Iyora, Janina Jablonski, Chris Jackon, Ankit Jain, Tom Jamieson,

Roland Janssens, Astrid Jarrousse, Andrew

Jerijan, Abdul Jimoh, Jaeyoung Jin, Seyi Johnson, Andrew Johnstone, Goodluck Jonathan, Marcus Jungenkrueger, Akeem Kadiri, Sumit Kanodia,

Sabine Kapschak, Mohammad Kari, Adamu Kasimu, Mack Kast, Michael Kehrwald, Caroline Kennedy, Ryan Ketchum, Abhay Ketkar, Killian Khanoba, Youngha Kim, Elizabeth Kimura, Peter King,

Rahul Kitchlu, Markus Kluczka, Jo Knights, Boladale Kolade, Fatusi Kolawole, Pimhein Kool, Gernot Koop, George Kotsovos, Olaf Kreyenberg, Olakunbi Kurunmi, Dele Kuti, David Ladipo

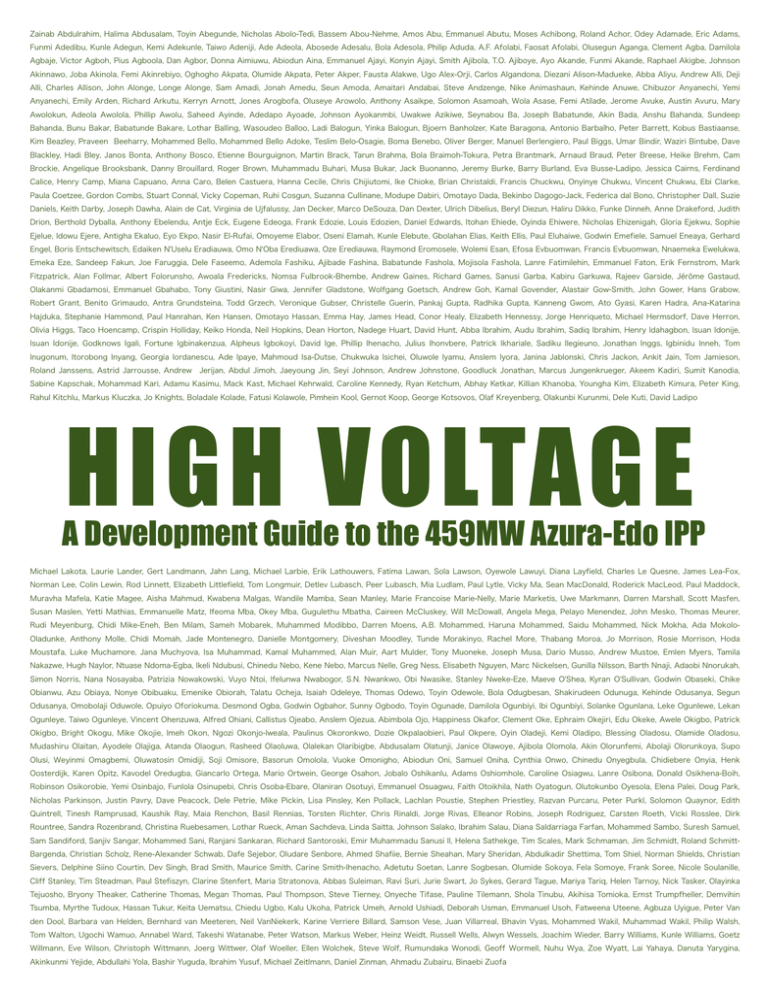

HIGH VOLTAGE

A Development Guide to the 459MW Azura-Edo IPP

Michael Lakota, Laurie Lander, Gert Landmann, Jahn Lang, Michael Larbie, Erik Lathouwers, Fatima Lawan, Sola Lawson, Oyewole Lawuyi, Diana Layfield, Charles Le Quesne, James Lea-Fox,

Norman Lee, Colin Lewin, Rod Linnett, Elizabeth Littlefield, Tom Longmuir, Detlev Lubasch, Peer Lubasch, Mia Ludlam, Paul Lytle, Vicky Ma, Sean MacDonald, Roderick MacLeod, Paul Maddock,

Muravha Mafela, Katie Magee, Aisha Mahmud, Kwabena Malgas, Wandile Mamba, Sean Manley, Marie Francoise Marie-Nelly, Marie Marketis, Uwe Markmann, Darren Marshall, Scott Masfen,

Susan Maslen, Yetti Mathias, Emmanuelle Matz, Ifeoma Mba, Okey Mba, Gugulethu Mbatha, Caireen McCluskey, Will McDowall, Angela Mega, Pelayo Menendez, John Mesko, Thomas Meurer,

Rudi Meyenburg, Chidi Mike-Eneh, Ben Milam, Sameh Mobarek, Muhammed Modibbo, Darren Moens, A.B. Mohammed, Haruna Mohammed, Saidu Mohammed, Nick Mokha, Ada MokoloOladunke, Anthony Molle, Chidi Momah, Jade Montenegro, Danielle Montgomery, Diveshan Moodley, Tunde Morakinyo, Rachel More, Thabang Moroa, Jo Morrison, Rosie Morrison, Hoda

Moustafa, Luke Muchamore, Jana Muchyova, Isa Muhammad, Kamal Muhammed, Alan Muir, Aart Mulder, Tony Muoneke, Joseph Musa, Dario Musso, Andrew Mustoe, Emlen Myers, Tamila

Nakazwe, Hugh Naylor, Ntuase Ndoma-Egba, Ikeli Ndubusi, Chinedu Nebo, Kene Nebo, Marcus Nelle, Greg Ness, Elisabeth Nguyen, Marc Nickelsen, Gunilla Nilsson, Barth Nnaji, Adaobi Nnorukah,

Simon Norris, Nana Nosayaba, Patrizia Nowakowski, Vuyo Ntoi, Ifelunwa Nwabogor, S.N. Nwankwo, Obi Nwasike, Stanley Nweke-Eze, Maeve O'Shea, Kyran O'Sullivan, Godwin Obaseki, Chike

Obianwu, Azu Obiaya, Nonye Obibuaku, Emenike Obiorah, Talatu Ocheja, Isaiah Odeleye, Thomas Odewo, Toyin Odewole, Bola Odugbesan, Shakirudeen Odunuga, Kehinde Odusanya, Segun

Odusanya, Omobolaji Oduwole, Opuiyo Oforiokuma, Desmond Ogba, Godwin Ogbahor, Sunny Ogbodo, Toyin Ogunade, Damilola Ogunbiyi, Ibi Ogunbiyi, Solanke Ogunlana, Leke Ogunlewe, Lekan

Ogunleye, Taiwo Ogunleye, Vincent Ohenzuwa, Alfred Ohiani, Callistus Ojeabo, Anslem Ojezua, Abimbola Ojo, Happiness Okafor, Clement Oke, Ephraim Okejiri, Edu Okeke, Awele Okigbo, Patrick

Okigbo, Bright Okogu, Mike Okojie, Imeh Okon, Ngozi Okonjo-Iweala, Paulinus Okoronkwo, Dozie Okpalaobieri, Paul Okpere, Oyin Oladeji, Kemi Oladipo, Blessing Oladosu, Olamide Oladosu,

Mudashiru Olaitan, Ayodele Olajiga, Atanda Olaogun, Rasheed Olaoluwa, Olalekan Olaribigbe, Abdusalam Olatunji, Janice Olawoye, Ajibola Olomola, Akin Olorunfemi, Abolaji Olorunkoya, Supo

Olusi, Weyinmi Omagbemi, Oluwatosin Omidiji, Soji Omisore, Basorun Omolola, Vuoke Omonigho, Abiodun Oni, Samuel Oniha, Cynthia Onwo, Chinedu Onyegbula, Chidiebere Onyia, Henk

Oosterdijk, Karen Opitz, Kavodel Oredugba, Giancarlo Ortega, Mario Ortwein, George Osahon, Jobalo Oshikanlu, Adams Oshiomhole, Caroline Osiagwu, Lanre Osibona, Donald Osikhena-Boih,

Robinson Osikorobie, Yemi Osinbajo, Funlola Osinupebi, Chris Osoba-Ebare, Olaniran Osotuyi, Emmanuel Osuagwu, Faith Otoikhila, Nath Oyatogun, Olutokunbo Oyesola, Elena Palei, Doug Park,

Nicholas Parkinson, Justin Pavry, Dave Peacock, Dele Petrie, Mike Pickin, Lisa Pinsley, Ken Pollack, Lachlan Poustie, Stephen Priestley, Razvan Purcaru, Peter Purkl, Solomon Quaynor, Edith

Quintrell, Tinesh Ramprusad, Kaushik Ray, Maia Renchon, Basil Rennias, Torsten Richter, Chris Rinaldi, Jorge Rivas, Elleanor Robins, Joseph Rodriguez, Carsten Roeth, Vicki Rosslee, Dirk

Rountree, Sandra Rozenbrand, Christina Ruebesamen, Lothar Rueck, Aman Sachdeva, Linda Saitta, Johnson Salako, Ibrahim Salau, Diana Saldarriaga Farfan, Mohammed Sambo, Suresh Samuel,

Sam Sandiford, Sanjiv Sangar, Mohammed Sani, Ranjani Sankaran, Richard Santoroski, Emir Muhammadu Sanusi II, Helena Sathekge, Tim Scales, Mark Schmaman, Jim Schmidt, Roland SchmittBargenda, Christian Scholz, Rene-Alexander Schwab, Dafe Sejebor, Oludare Senbore, Ahmed Shafiie, Bernie Sheahan, Mary Sheridan, Abdulkadir Shettima, Tom Shiel, Norman Shields, Christian

Sievers, Delphine Siino Courtin, Dev Singh, Brad Smith, Maurice Smith, Carine Smith-Ihenacho, Adetutu Soetan, Lanre Sogbesan, Olumide Sokoya, Fela Somoye, Frank Soree, Nicole Soulanille,

Cliff Stanley, Tim Steadman, Paul Stefiszyn, Clarine Stenfert, Maria Stratonova, Abbas Suleiman, Ravi Suri, Jurie Swart, Jo Sykes, Gerard Tague, Mariya Tariq, Helen Tarnoy, Nick Tasker, Olayinka

Tejuosho, Bryony Theaker, Catherine Thomas, Megan Thomas, Paul Thompson, Steve Tierney, Onyeche Tifase, Pauline Tilemann, Shola Tinubu, Akihisa Tomioka, Ernst Trumpfheller, Demvihin

Tsumba, Myrthe Tudoux, Hassan Tukur, Keita Uematsu, Chiedu Ugbo, Kalu Ukoha, Patrick Umeh, Arnold Ushiadi, Deborah Usman, Emmanuel Usoh, Fatweena Uteene, Agbuza Uyigue, Peter Van

den Dool, Barbara van Helden, Bernhard van Meeteren, Neil VanNiekerk, Karine Verriere Billard, Samson Vese, Juan Villarreal, Bhavin Vyas, Mohammed Wakil, Muhammad Wakil, Philip Walsh,

Tom Walton, Ugochi Wamuo, Annabel Ward, Takeshi Watanabe, Peter Watson, Markus Weber, Heinz Weidt, Russell Wells, Alwyn Wessels, Joachim Wieder, Barry Williams, Kunle Williams, Goetz

Willmann, Eve Wilson, Christoph Wittmann, Joerg Wittwer, Olaf Woeller, Ellen Wolchek, Steve Wolf, Rumundaka Wonodi, Geoff Wormell, Nuhu Wya, Zoe Wyatt, Lai Yahaya, Danuta Yarygina,

Akinkunmi Yejide, Abdullahi Yola, Bashir Yuguda, Ibrahim Yusuf, Michael Zeitlmann, Daniel Zinman, Ahmadu Zubairu, Binaebi Zuofa

Copyright © 2016 by Amaya Capital Limited (including its subsidiaries and affiliates)

All rights reserved

i

CONTENTS

1

Introduction

3

2

The Development Dashboard

5

3

Choosing the Right Co-Sponsors & Advisers

9

4

Negotiating the Key Project Agreements

13

5

Obtaining Key Permits & Approvals

35

6

Attracting & Securing the Equity Capital

38

7

Attracting & Arranging the Debt Capital

42

8

Negotiating the Direct Agreements

48

9

Credit Enhancement: Obtaining World Bank PRG & MIGA Cover

51

10

Developing Key Operational Policies & Manuals

54

11

Escaping the Matrix of Conditions Precedent

57

12

The Full Tally

60

13

Lessons Learned

68

Glossary

71

ii

1

INTRODUCTION

The Azura-Edo IPP is at the forefront of a new wave of large scale, project-financed, greenfield

independent power plants (IPPs) currently being developed in Nigeria. Financed with debt and

equity sourced from a consortium of local and international financiers, Phase 1 of the project

comprises: a 459MW open cycle gas turbine power station; a short transmission line connecting

the power plant to a local substation; and a short underground gas pipeline connecting the power

plant to the country’s main gas-supply. The power that it generates will be consumed in millions

of homes and businesses across the country and it will create over 1,000 jobs during its

3

construction and operation. Phases 2 and 3 of the project will then take the total capacity up to

1,500MW.

As a summary of the project, the bland paragraph above is factually correct; but it offers no

backstory. It teleports the reader to the final destination instead of ferrying her through the twists

and turns of the development journey. For, as we shall see in the chapters that follow, piloting an

IPP development project requires a good deal of patience and perseverance. Clearly the team

propelling and managing the craft is critical; but it’s also important to have a good set of

navigational instruments on board and sufficient funds to keep the whole enterprise above water.

Yet when Azura embarked on its own journey back in 2010, its navigational aids were extremely

rudimentary. We set off with the right intentions but with little visibility of the river ahead and

often not the right equipment to hand; our boat careened down certain sections of the river at

breakneck speed; and there were a number of occasions where we nearly capsized. Needless to

say, we would like the journey for other explorers to be a little easier.

To that end, this short development guide has been prepared to help other prospective IPP

developers understand the bends in the river. More specifically, we illustrate: the scope of the

activities they may have to engage in; the time intensity of these activities; and the effort that will

need to be expended during the course of the development period.

It is a trite but true observation that the most important input into the production of electrical

energy is human energy. The Azura-Edo IPP is a classic example of this. This guide is dedicated to

the many hundreds of people who were actively involved in its incubation and development,

whether as a sponsor, employee, lender, adviser, contractor, sub-contractor, regulator, insurer,

legislator, or policy maker. And as we move further into the construction phase of the project,

many hundreds more will join these ranks.

Please forgive us, therefore, if you can’t find your name on the book jacket (and let us know so

that we can include it in the next edition). There were far too many of you to fit on just one page,

even though we shrunk the font to the smallest we could. We have merely taken a sample drawn

from each of the key participating organisations with a view to providing a partial illustration of

the scale of the collective action that has been poured into this project.

As at the time of writing, we are 6 months into the 30 month construction cycle; there are 450

workers on site; we have suffered no lost time injuries; and progress is ahead of schedule.

Although we still have a steep mountain to climb before the turbines generate their first kilowatt

hours of electricity, we look forward to publishing the second volume of “High Voltage” in mid

2018 under the subtitle: “A Construction Guide to the Azura-Edo IPP”.

4

2

THE DEVELOPMENT DASHBOARD

As shown on the following page, the development dashboard created by Azura’s Management

Team consists of a set of 9 “dials” representing the universe of “essential elements” that had to be

assembled before the full Notice to Proceed could be issued to the Contractor. The significance of

the dials is important to recognise. The circle represents the "Azura Wheel" denoting continuous

forward motion and the inter-dependence of each spoke of the wheel.

From the very outset, one of the key mantras that we adopted was: “work hard; work smart; and

work in parallel”. So the wheel was a great way for us to visualise the need to keep juggling all the

5

balls in the air whilst continuing to press forward towards our goal. In the chapters that follow, we

examine each of these 9 dials in greater detail.

“The Nine Development Dials”: Azura’s Navigational Dashboard

Project

Agreements

en

s

e'

tc.'

mun

Oil

'Pip

eli

n

e'L

ic

i.es

Stanbi

Direct

Agreements

CCA%

An

cil

la

ry

%A

gr

ee

m

en

%Ag

ree

me

nt%

o an

vere

d%L

Ran

IBRD%Covered%Loan%Agreement%%

t'Ba

d'M

erch

an

CDC$

DEG$

%A

gr

ee

m

inaDon

en

%Agree

t%

ment%

on

pe

ra

D

oo

'

MIG

A%C

o

Standard'Chartered'Bank'

nk'

SRA%

Subord

'D

IBTC$

'

Due'Proces

s'

g'

Bu

il

din

Business'Permit'

se,'T

ariffs,

'E

)'

X'im

pact

s'

on

a.

en

s

rova

us'app

isp

'D

FX

Reinsurance'Approval'

Importa.on'

'

F I)

eb

t'P

oo

l'(D

e'L

ic

Oil

'Pip

eli

n

IC F

FI)

SUBA%

ts%

oa

n%A

gre

em

ents

%x%4

%

ACTS%

FMFM$

Credit

Enhancement

Operational

Policies

PPA#DA#

Tick Box

CPs

ESAP)

ls)

tro

Co n

an c

ial)

CRS)

li

mp

a

po

)Re

nce

r5n

g)

Construc5on)Budget)

CS

oli

R)P

cy)

CSR)

FGN%

HSE)

OMA#DA#

CMS)

6

era

5

ng

)Bu

d

CBGT)

ge

t)

OBGT)

)

ies

olic

s)P

rce

fet

y)P

olic

ies

)

p

y%A

ntr

)Sa

ou

He

alt

h)&

st%C

so u

)Re

FGN%

o

A%H

MIG

Op

CP#

CP#

HR)

CP#

CP#

CP#

CP#

CP#

CP#

CP#

CP#

CP#

C

P#

C

P#

C

P#

C

P#

C

P#

C

P#

C

P#

CP#

C

P#

C

P#

C

P#

C

P#

CP#

CP#

CP#

CP#

CP#

CP#

CP#

CP#

CP#

C

P#

C

P#

C

P#

C

P#

C

P#

C

P#

C

P#

CP#

CP#

CP#

CP#

C

P#

CP#

CP#

CP#

CP#

C

P#

C

P#

CP#

C

P#

C

P#

CP#

CP#

CP#

C

P#

C

P#

CP#

CP#

CP#

C

P#

CP#

CP#

CP#

CP#

CP#

CP#

C

P#

CP#

CP#

CP#

C

P#

CP#

CP#

CP#

CP#

CP#

CP#

C

CP#

C

CP#

CP#

P# C C

C

P#

P# C

C C C C C C

P#

P# C

C

P# P# P#

C C

C

CP#

CP#

CP#

CP#

P# C

CP#

CP#

C

P# C

C P# P# P# P#

P# P# C

C

P#

C

C C C

P# C

P# C C

C

C

P# C

C P#

CP#

CP#

C P# P# C C C P P P C C C

C P#

P#

CP#

CP#

P P

P#

P#

P# C

C P P P

C P#

CP#

CP#

C P#

P# C

P#

P#

P C C

C

C

C

C

C

P

P# C

P# C

C P#

CP#

CP#

C P P

C C C C C C C

C P#

P#

P#

P C

CP#

CP#

P#

P#

C P

P# C

C C P P P P P P P C C

C P#

P C

P# C

C

C

C

C

CP#

CP#

P

P

C

C

C P#

C P

P C

P

P

P# C

CP#

CP#

C

P#

P#

P#

P#

C P#

C C C C C C C

P C C

P#

P#

P C

C P

CP#

CP#

C P P C C P P P P P P P C C

C

C

C

C

P

C

C

P# C

C P# C P

C P P

P P C

C P

P C

P C

P#

P#

CP#

CP#

P#

P#

P#

P#

C

C

CP#

CP#

P# C

P

P

C P

C

C

C

C

C

C

C P# C P

P C C P P C P C

C

C

CP#

CP#

C P P

C P

P#

P#

P#

P#

P

P# C P

P#

P C

P#

P#

C

C

C P

C

C

P C

P C

CP#

CP#

CP#

CP#

C P

C

C

C P

P#

P C

C

C

P C

P#

P C

P# C P# C P# C P C P

P#

CP#

CP#

C

C

C P

P C

P#

P#

C

C

P C

P C

CP#

CP#

P# C P C P C P

P#

P#

P#

P C

CP#

CP#

C

C

C

C

P#

P#

C

C

P C P

P C

P

P C

CP#

CP#

P#

P#

P# C P C

P#

C

C

C

P#

P#

C

C

PC

PC

CP# C

CP#

P CP CP

P

P#

P#

C

C

C

C

CP#

CP#

P# C

P#

P

P

PC

C

P#

P#

C

C

P#

P#

CP#

CP#

C

C

CP C

P

P

PC

C

P#

P#

C

C

CP#

CP#

CP

P# C

P#

PC

C

C

CP

P

P

P#

P#

C

C

P

PC

C

C

CP#

CP#

P#

P#

C

C

P

P

CP#

CP#

P# C

P#

C

C

P#

P#

C

C

PC

P

P

CP#

CP#

C

C

CP

C

C

P#

P#

P

P

C

C

C

C

C

C

P#

P#

P

PC

P# P

P#

C

C

C

CP#

CP#

P

P#

P#

CP#

CP#

P

P

C

C

C

C

P#

P#

PC

C

C

CP#

CP#

C

C

CP

C

C

P# P

P#

P

P#

P#

C

C

P

P

P

P

P#

P#

C

C

C

C

C

C

C

C

CP# CP#

CP#

P#

P#

C

C

P#

P#

P

P

CP#

CP# CP#

P

P

PC

C

C

C

C

CP

C

C

C

C

P#

P#

C

C

P#

P#

P#

P#

P

P

P

P

P

P

P#

P#

C

C

C

C

C

C

CP# CP# CP#

C

C

C

C

C

C

CP# CP# CP#

C

C

PC

P#

P#

P

P

P#

P#

CP

P

P

P#

P#

P#

P#

C

C

C

C

P

P

C

C

C

C

C

C

C

C

P

P

C

C

CP# CP# CP#

CP# CP# CP#

P

P

C

C

P#

P#

P#

P#

P#

P#

P#

P#

PC

C

C

CP

P

P

C

C

C

C

C

C

P

P

C

C

C

C

PC

P#

P#

CP

P#

P#

C

C

CP# CP# CP#

P#

P#

P

P

P#

P#

CP# CP# CP#

C

C

C

C

PC

P

P

C

C

CP

C

C

P#

P#

C

C

C

C

P

P

P#

P#

PC

C

C

P#

P#

CP#

CP# CP#

C

C

CP

P

P

P#

P#

C

C

CP# CP#

CP#

P

P

C

C

P#

P#

PC

C

C

C

C

CP

P#

P#

C

C

P

P

C

C

P#

P#

P

P

PC

P#

P#

C

C

CP#

CP#

C

C

CP

C

C

P#

P#

CP#

CP#

C

C

P

P

P#

P#

CP#

CP#

PC

P

P

C

C

C

C

CP

C

C

P#

P#

C

C

C

C

P#

P#

P#

P#

CP#

CP#

P

P

CP

PC PC

C

C

P#

P#

C

C

CP

CP#

CP#

C

C

C

C

CP

P#

P#

CP#

CP#

P#

P#

C

C

PC PC

P

P

CP

P#

P#

PC

C

C

C

C

CP

P#

P#

C

C

CP#

CP#

PC

P#

P#

P

P

CP

CP#

CP#

P C

C

C

P#

P#

C

C

C P

C

C

C

C

CP#

CP#

P C

P#

P#

P#

P#

P C

C P

C P

C

C

P

P

CP#

CP#

P#

P#

C

C

C

C

C P

P C

P C

P#

P#

C

C

C

C

C P

CP#

CP#

P C

P#

C P

P C

C

C

P#

P# C P#

P#

P#

C P

P C

C P

CP#

CP#

C

C P

C

C

P C

CP#

CP#

P#

P#

P C

P C

C P

C

C

C P

C P

P#

P#

P C C

P#

P#

CP#

CP#

C

C

C

C

C

P

P#

P#

C

C

P C

C P

P C

C P P

C P

P C C

P#

P# C

CP#

CP#

CP#

CP#

P#

P#

C P

P#

P#

P C

C

C C P

C

P

P C

C

C

C P

C

C

C

C

P P C C C C C C C P P

C P

P C

P#

P#

CP#

CP#

P# C

P P P P P P P

C

P C

P#

P#

P#

C P

P C C

C P# C P#

CP#

CP#

C P P

C

C

C

C

C

CP#

CP#

P

P C

C P

P# C

C P#

P C C C

P#

P#

C C P

P#

P#

P#

P#

CP#

CP#

C P

P C

P P

P

C C C C C C

C

C

P# C

C

C

C

C

C P#

CP#

CP#

C P

P P P P P P P P

P C

P# C

CP#

CP#

P#

P#

P#

P#

C

C P#

P# C

P C C

C P#

C P P

C

C

CP#

CP#

C

C

P

P#

P#

P# C

CP#

CP#

C P#

C

C

P C C C C C C C C C P

P#

P#

P#

P#

P P

P

C

C

C P#

P# C

P# C

CP#

CP#

C P#

C

C

P P P P P P

C

CP#

CP#

P# C

P# C C

CP#

CP#

P# C

C P#

P#

P#

C P# P#

C P#

P#

C

C

P# C

C C P#

P# C C C C

C P#

P# C

CP#

CP#

C P#

CP#

CP#

CP#

CP#

P# P#

P#

C C C

P#

P#

C P#

P# C

C

C

P# C

P# P# P# P# P# P#

C P#

C

P# C C

P# C

C P# P#

CP#

CP#

CP#

CP#

P# C

C P#

CP#

CP#

C P#

P#

C

C

C

P# P# C

P#

C

C

C

C

P# C

P#

P# C

P#

C

CP#

CP#

P# P# P# P# P# P#

C

CP#

CP#

P# C

P#

CP#

CP#

P# C

P#

C

C

P# C

P#

C

CP#

CP#

C

C

P# C

P#

C

C

P# C

P#

C

C

CP#

CP#

P# P#

CP#

CP#

P# P#

CP#

CP#

C

C

P#

P#

P#

P#

P#

C

C

CP#

CP#

P#

P#

CP#

CP#

C

C

CP#

CP#

C

C

P#

P#

C

C

C

P#

P#

CP#

CP#

CP#

CP#

P#

P#

P#

P#

P#

CP#

CP#

CP#

CP#

CP#

CP#

CP#

CP#

CP# CP#

CP#

CP#

CP#

CP#

CP#

CP# CP# CP# CP#

CP#

CP#

CP#

CP#

CP#

CP#

CP# CP#

CP#

CP#

CP#

CP# CP# CP# CP#

CP#

CP#

CP#

CP#

CP#

CP#

CP#

CP#

CP#

CP#

CP#

CP#

CP#

CP#

CP#

C

P#

Fin

ern

al)

Co#o

t%

p%Agm

Governance)Policies)

Int

Co

E&S)Ac5on)Plan)

val%

pro

Communica5ons)Policy)

%

LC%Inde

mnity%Ag

mt%

ire

ct#A

gr

ee

m

en

t

#

PPA#Direct#Agreement#

A#D

PC

O

LeCer%of%Credit%

MIGA%

)

CP#

CP#

n

ma

Hu

t

gm

y%A

O&M#Direct#Agreement#

gm

t)P

lan

cy)

SCB%

S)M

tee

%

MIGA%Loan%

Guarantee%

oli

n)P

DM%PRG%

E&

y%G

ua

ran

5o

%

mt

%Ag

ESMP)

uit

it

mn

de

LTSA#DA#

DM

IBRD%

roj.

LC%P

MIG

A%E

q

%In

t#

en

m

ee

gr

ct#A

ire

AZURA%

ro

%P

LC%P

RG

%

j. %

p

rru

EPC#DA#

AZURA%

t%

m

Ag

FC)

DM

#D

SA

GSPA#DA#

EPC#Direct#Agreement#

t#

LT

#D

PA

GS

JPM%

t%

gm

C%A

)Co

#

t

en

m

ee

gr

#A

ct

ire

GCA#Direct#Agreement#

en

m

ee

gr

#A

ct

ire

R&

NBET%

5

An

A#D

GT

GCA#DA#

ABC)

CP#

CP#

CP#

CP#

CP#

CP#

CP#

CP#

CP#

CP#

CP#

CP#

CP#

CP#

CP#

PCOA#DA#

MZLA%

CTA%

GOV)

GTA#DA#

LCLA%

ement%

Local%Loan%Agre

Me

zz%L

oa

ent%

eem

n%Agr

im

s%C

Due'Process'

o

tenD

e%Re

Shar

h'D

I%L

%9%

2%

g'

Bri3

s

DF

DFLA%

s%x

t

en

em

gre

n%A

s%x

din

C'(

Hedging%Agreement%

FCMB$

'

Bu

il

HDGA%

FI)

c'IBTC'

en

s

e'

tc.'

Business'Permit'

se,'T

ariffs,

'E

'Licen

Gener

a.on

)'

X'im

pact

)'

FI

tch'D

n'D

Us'

Reinsurance'Approval'

s'

'(Du

or

%Ag

ree

me

nt %

t%

greemen

%Terms%A

on

erc

red

it

t

en

m

ee

gr

s%A

a.

Int

nt

vals'(w

ith'F

ICA%

FMO$

Common

en

s

'

a

rm

Ge

G'(

ry'

ICF$

MGLA%

u

co

Ac

CD

KFW$

EDSG'

FI)

First'City'Monument'Bank'

nk'

'Ba

KfW

IBLA%

%

s'

ts%

%

n

l'D

na

FMO

OPIC'(US'DFI)'

OPIC$

men

gree

ty%A

ts

en

em

gre

n%A

I

C'(

a

rn

te

DE

isp

Lending

Agreements

Loa

IF

'

nal'DFI)

terna3o

FMFM'(In

'D

'

IFC$

3o

renc

h'DFI

cto

'app

ro

i.es

ri

Secu

)'

s'

'Fa

Vario

us

mun

ents

cum

Prop

arco

'(F

en

t

'of

FX

Com

Insurance'

o

ty%D

Importa.on'

I.I.O.'

NAICOM'

ang

e'

SCTY%

BPP'

HAGF'

ns

FML&P'

Com

s'

EDSG'

NAICOM'

Insurance'

s'

en

t

FML&P'

I.I.O.'

ge'

nion

HAGF'

ns

ri

ecu

0%S

x%1

nion

PRO$

NESREA'

k'

I)'

or

tga

ge

'Co

s'B

an

'DF

'M

on

O

ity'M

mun

Com

NOTAP'

xch

an

g'&

ra.

CBN'

Fore

ign

'E

din

AG’s

'Legal

'Opi

Sie

me

n

dish

Swe

it

erm

rt'P

ist

eg

SON'

Bu

il

f'R

S

s'

po

'Im

ON

'

te

ca

'

mits

at

l'Per

'St

enta

EIA

ronm

s'Envi

Variou

No'Objec.on'to'PPA'&'PCOA'

o

rt.'

Ce

po

AC'Im

NAFD

NAFDAC'

mits'

rt'Per

fi

r.

'Ce

nd'(

n'

FMEnv'

'&

t

en

em

Import'Duty'Waivers'

ge

'Co

RMB$

dfu

Swe

'Duty

'Wai

vers

'

FMF'

SB$

l'

nta

me

.o

DPR'

ron

Imp

ort

tra

rests'

'Inte

urity

g'

of'Sec

pin

am

'St

'&

on

ra.

ist

eg

CU

DA

're

gis

AG’s

'Legal

'Opi

'M

or

tga

SCB$

SWED$

Envi

x'R

AS

Y

NAPIMS'

.on'

Ta

NCS'

ess'

NERC'

stra

Regi

FIRS'

NOTAP'

xch

g'&

Lending

Institutions

NIPC'

CAC'

'Licen

r)%

so

Co,S

,Sp

Co

Ald

wy

ch

%(

AIIM

%(

on

Fore

ign

'E

din

Cla

Busin

n'

ls'(w

ith'F

ponso

r)%

Amaya%&%ACEI%(Co,Sponsor)%

ERM%(ESIA)%

Permits

& Approvals

c.o

erfe

ty'P

Vario

%TA

X)%

%Tax)%

it%&

G%(

Au

d

KP

M

Peda

bo%(A

udit%&

%

FPCG%

ENVA%

'

te

ca

l'

ial)

nc

CBN'

Bu

il

ry'

cto

'Fa

'of

on

ra.

OUs'

ity'M

mun

Com

SON'

UUBO%

ERM%

ri

Secu

'

ist

eg

%

po

'Im

ON

its

erm

rt'P

fi

r.

'Ce

nta

me

its'

'Perm

port

AC'Im

NAFD

NAFDAC'

TRIN%

f'R

)%

FMEnv'

t'&

NESREA'

n

me

'

mits

ate

l'Per

'St

enta

EIA

ronm

s'Envi

Variou

BPP'

No'Objec.on'to'PPA'&'PCOA'

Import'Duty'Waivers'

FMF'

S

ina

PEDA%

Le

ga

l)

TEMP%

Imp

ort

o

rt.'

Ce

%(F

ne

)%

%(ESIA

KPMG%

UU

BO

%(

(Legal

tra

.o

n'

'Duty

'Wai

vers

'

NAPIMS'

DPR'

n

iro

En v

r)%

rests'

'Inte

urity

g'

of'Sec

ponso

CU

DA

're

gis

pin

am

x) %

Ta

to

GT%

AS

Y

EDSG%

'St

%(

on

lds

Fie

h

%(Co,S

Trinit

y%

ccord

EnvA

a

Gr

%T

nt

s

Templars%(Legal)%

al)%

hnic

a%(Tec

nt

or

on

'&

Jiyod

JIYO%

Sp

on

EDSG

PB%Power%(Technical)%

PB%

o,

ra.

%(C

ist

eg

)%

uers )%

ce

ran

M

AR

NCS'

.on'

d%Val

su

rance

)%

NERC'

stra

Regi

(Lan

ce

)%

FIRS'

ARM%

)%

or

ess'

NIPC'

ALDW%

x'R

Ta

simu%

ur

an

n

k%I

Insu

Ins

Ris

AON

%(

IB%(

al%

Pc

AON%

li

Po

k%(

SC

AIIM%

u%Ka

Adam

Ris

De

SCIB%

Busi

n

'

.o n

rfec

'Pe

urity

CAC'

Sec

APHL%

AKAS%

DERI%

Gener

a.on

Co-Sponsors

& Advisors

C

P#

C

P#

C

P#

C

P#

C

P#

C

P#

C

P#

C

P#

C

P#

C

P#

C

P#

C

P#

C

P#

C

P#

C

P#

C

P#

C

P#

C

P#

C

P#

C

P#

For some of our readers, the data contained in this guide may, at first sight, appear rather dry and

devoid of the salt of life (the blood, the sweat, the tears) that always seasons a good narrative. It is

important, therefore, that we start off with a brief summation of the years of toil that were spent

on this project even before the contractor began to work on the site.

To gauge the full extent of this endeavour, we took a cumulative reading at the end of Dec 2015 of

the billable hours logged by the sponsors, the lenders and their respective advisers. As shown in

the chart below, the total came to circa 145,000 hours for the sponsors/lenders and an additional

76,000 hours for their advisers.

But what about the hours of work expended by our project counterparties (i.e. our gas supplier,

our off-taker, our EPC Contractor, etc)? We didn’t have the heart to ask them to furnish us with

detailed estimates of the thousands of man-hours they had expended on the project. Instead, we

conservatively assumed that the total number of hours expended by the sponsor/lender side of

the negotiating table would be equal to the aggregate of the hours spent by all the parties sitting

on the other side.

Hence, the total amount of time devoted to the Azura-Project as at Dec 2015 was approximately

442,000 hours. If we use the OECD average for the number of hours per worker per year (of 1,765

hours), we deduce that more than 250 person-years of work were spent developing the AzuraEdo IPP before the construction crew mobilised to site. That’s a whole quarry full of human salt.

Cumulative hours expended on the Azura-Edo IPP as at Dec 2015 (est.)

Sponsors/Lenders

145,000

Project Counterparties

221,000

S/L Advisers

76,000

7

Moreover, as shown in the timeline below, the hundreds of individuals who committed their time

to this project did so over a six year stretch of time during which the Nigerian electricity supply

industry underwent a complete change of ownership and control. There was never a dull day.

Conception to Birth: Overall Project Timeline of the Azura-Edo IPP

Execution of GSPA

Apr 2014

Execution of EPC & OMA

Apr 2014

1st Draft of ESIA Scoping Study Submitted to FMEnv

Dec 2010

Final Approval of Gas Tariff

Nov 2014

Kick-Off meeting with TCN

Feb 2011

Execution of Shareholder Agreement

Nov 2014

1st Sesssion with NBET on PPA

Nov 2011

CTA and Loan Agreements Signed

Nov 2014

SCB Hired as Global MLA

Feb 2012

Contractor Starts Work at Site

Jan 2015

JDA Signed with Co-Equity Sponsor

Apr 2012

Execution of MSA/TSA

Jan 2015

Kick-Off Meeting on GTA

May 2012

ITB for EPC Contractors

Nov 2011

Appointment of ESIA Adviser

Dec 2010

FEED Studies

Dec 2010-Jul 2011

Start of Project

2009

MOU with EDSG

Nov 2010

2010

2011

Waiting for FGN Legal Opinion

Feb-July 2015

11th Session with NBET on PPA

Apr 2013

Execution of GCA

Jun 2014

Registration of C of O

Jun 2012

Execution of PPA

Apr 2013

2013

2014

8

Satisfaction of CPs

Aug-Dec 2015

Execution of GTA

Jul 2014

First Draf of LOS (PCOA)

Jul 2012

RAP Approval by WB

Feb 2012

2012

Demobilisation Pending FGN Legal Opinion

Feb 2015

Final FMEnv Approval of ESIA

Feb 2013

1st Draft of ESIA to WB

Nov 2011

Execution of PCOA

Oct 2014

2015

Financial Close

29 Dec 2015

Contractor Remobilises to Site

5 Jan 2016

2016

2017

3

CHOOSING THE RIGHT CO-SPONSORS & ADVISERS

The success of any project-financed IPP is critically dependent on the quality of the co-sponsors

and advisers selected by the project’s lead sponsor. In Azura’s case, the lead sponsor (Amaya

Capital) sought, from the very beginning, to find a group of like minded co-sponsors and advisers.

But what does “like minded” actually mean in this context? It is a multivalent word that captures

a range of attributes including: sharing the same vision as the founders; understanding the

entrepreneurial nature of the development process; a capacity to burn the midnight oil; tried and

tested experience on other projects coupled with an open mind to innovative solutions; and a

good sense of humour (particularly helpful in the most testing periods).

9

The circular chart below shows the entire array of co-sponsors and advisers that were

instrumental to the development of the Azura Project.

su

on

Co ,S

so

r)%

p on s

or)%

ALDW%

Ald

wy

ch

%(

Co

,Sp

ARM%

%( C

M

AR

)%

ran

PB%Power%(Technical)%

r)%

onso

EDSG%

ng)%

%T A

X)%

%(Acc

ounJ

it%&

Peda

bo

UUBO%

ENVA%

)%

10

ny

%S e

cre

tar

y)%

ial

nc

ERM%

ty%(Le

gal)%

ina

KP

M

G%

mp

a

%( F

ne

PEDA%

IA)%

KPMG%

r)%

o,Sp

Trini

to

t

(Co

lds

Fie

GT%

rn

)%

ax

d %( E S

ccor

EnvA

an

Gr

o

%T h

%( T

UU

BO

%

ERM%(ESIA)%

l )%

nica

h

c

e

a%(T

n

to

o

o

ns

Templars%(Legal)%

(A

ud

Jiyod

Sp

o,

%(C

EDSG

)%

ce

ranc

e)%

luers

d %V a

ce

)%

AIIM%

AIIM

%(

%(Lan

ra

n

n

k%I

(Insu

su

Ris

JIYO%

(In

al%

Jc

PB%

AON

%

IB%

li

Po

k%(

SC

simu

Ri s

De

SCIB%

AON%

u%Ka

Adam

DERI%

Amaya%&%ACEI%(Co,Sponsor)%

APHL%

AKAS%

FPCG%

TEMP%

TRIN%

The timeline chart below shows the dates when each of these co-sponsors and advisers first

started working on the Azura project.

Grant Thornton (Tax)

Jan 2012

Adamu Kasimu (Land Valuation)

Feb 2012

Aldwych (Co-Sponsor)

Jun 2010

ERM (ESIA)

Nov 2010

PB Power (Technical)

Sep 2011

EDSG (Co-Sponsor)

Nov 2010

DeRisk (PRI)

Apr 2010

Envaccord (ESIA)

Nov 2010

UUBO (Legal)

Jun 2010

1 May 2010

1 Sep 2010

Trinity (Legal)

Sep 2011

1 May 2011

ARM (Co-Sponsor)

May 2012

Pedabo (Audit)

Oct 2011

KPMG (Audit & Tax)

Feb 2011

1 Jan 2011

Fieldstone (Financial)

Mar 2012

Templars (Legal)

May 2012

AIIM (Co-Sponsor)

Dec 2011

1 Sep 2011

1 Jan 2012

1 May 2012

Jiyoda (Technical)

Nov 2012

AON & SCIB (Insurance)

Jun 2012

1 Sep 2012

1 Jan 2013

ACEI (Co-Sponsor)

>> Late 2013

1 May 2013

1 Sep 2013

In the preceding chapter, we noted that the sponsors and lenders’ advisers had clocked up a total

of 76,000 man-hours of work (as at Dec 2015). As shown in the chart below, over 80% of this time

was spent on legal and financial advice. This statistic, in turn, points to the fact that the key

challenge in the construction of a privately financed power plant is not the engineering and

construction challenge. It is the financing challenge.

Breakdown of the total time spent by the sponsor/lender advisers

Technical/Other

10%

Environmental

8%

Legal

34%

Financial

48%

11

More specifically, this chart illustrates the unique set of challenges inherent in a limited-recourse

project-financing. A limited recourse project-financed transaction is very different to a corporate

financed deal. In a corporate financed transaction you borrow money against a balance sheet. You

have real assets which you can post as security for your borrowing. By contrast, in the case of a

project-financed IPP, like Azura, the banks are lending to a special purpose vehicle whose only

assets comprise the web of contractual agreements between the project company, its supplier and

its offtaker. The Azura project is made up of dozens of different contracts. And each and every

clause, in each and every contract, must be scrutinized ad nauseam by the banks because these

contracts are the sum total of their security.

12

4

NEGOTIATING THE KEY PROJECT AGREEMENTS

This chapter summarises the development history of the key project agreements that underpin

the Azura-Edo IPP. These agreements define the universe of risks faced by the project; and they

also allocate - between the various project stakeholders - the responsibility for bearing and

mitigating these risks.

13

The chart below depicts the full suite of contractual agreements that underpin the Azura-Edo IPP.

It should be noted, however, that the financing agreements (depicted by the little green circle at

the bottom of the wheel) are so numerous that they have their own dedicated chapters (Chapters

6 & 7).

DEMAN

D#

Agre

eme

nt#

Ag

re

em

en

t#

>o n #

Ga

s

#S u

pp

ly#

l l #Op

t#

en

m

ree

g

A

n#

GTSA#

Grid#Con

nec>on#A

greemen

Anc

t#

illa

ry#S

erv

ice

s#A

gre

em

ent

#

GCA#

>o

ta

n #E

C#of#O#

D#

LAN

ica

N#

AC

UA

TIO

EV

#

#

14

TLSEA#

>o n

FINANCE#

a

ccup

$$#

ASA#

nt

me

ee

gr

#A

#O

e#of

l #S

i on

ficat

ns

xte

Cer>

er

vic

es

#A

Turn

gr

key#

ee

Co n

m

stru

en

c>on

t#

#C o n

trac

t#

bs

Te

ch

n

#

CK

Su

Finance#

#

ON

TI

UC

TR

NS

EPC#

TO

na

te

CO

TSA#

o

GTA#

sp

an

r

T

nt#

s#

Ga

greeme

A

#

y

r

a

t

n

ppleme

GTA#Su

ent#

r#Agreem

e

e

in

g

n

#E

Owner’s

#

ent

m

e

e

Agr

#

s

e

rvic

e

S

#

mt

Mg

MSA#

a>

ort

DS

ain

#M

g#T

erm

#S e

rvi

ce#

Ag

ree

Constru

me

c>on#In

nt#

suranc

e#

GSPA#

FEE

s#&

OEA#

#

t#

ance

en

m

n su r

nal#I

ee

gr

e#A

nc

Op

L on

PCOA#

Put#C

a

OMA#

Power#Purchase#Agreement#

OIAs#

LTSA#

CIAs#

PPA#

ra>o

Op e

E

OP

S#

N

O

TI

A

R

On the previous page, we illustrated the wheel of contractual agreements with the acronyms of the

individual contracts. In the chart below, we take this same wheel and reveal the identities of each

of the counterparties to these agreements. Our public sector counterparties are highlighted in

green; our private sector counterparties are highlighted in blue; and the piebald Gas Supply

Agreement reflects the fact that Azura has two counterparties on this agreement: (Seplat, private

sector) and NPDC (public sector).

NBET%

bs

Ag

re

em

en

t

ly%

pp

o

t%

en

m

ree

g

n %A

ment%

e

e

r

g

A

%

ntary

ppleme

Grid%Con

necHon%A

greemen

Anc

t%

illa

ry%S

erv

ice

s%A

gre

em

ent

%

Ho

n %E

i on

%

Ho n

%

ica

15

a

ccup

Debt%&%

Equity%

TCN%

nt

me

ee

gr

%A

%O

e%of

l %S

ns

xte

ficat

Te

ch

n

aH

ort

NGC%

ta

CerH

er

vic

es

%A

Turn

gr

key%

ee

Co n

m

stru

en

cHon

t%

%C o n

trac

t%

Su

Siemens%

&%JBN%

%S u

s

Ga

GTA%Su

Finance%

Aldwych%

%

Agre

eme

nt%

n sp

a

r

%T

ement%

e

r

g

%A

r

e

%Engine

Owner’s

%

ent

m

ree

g

A

s%

ice

v

r

t%Se

m

Mg

APHL%

Ga

s

na

te

PB%

Power%

Seplat%

&%

NPDC%

Ho n %

ain

AON%&%

SCIB%

g%T

erm

%S e

rvi

ce%

Ag

ree

Constru

me

cHon%In

nt%

suranc

e%

l l %Op

%M

L on

Put%C

a

s%&

Siemens%

%

t%

ance

en

m

n su r

nal%I

ee

gr

e%A

nc

Op

raHo

Op e

PIC%

Group%

MoF%&%

NBET%

Power%Purchase%Agreement%

AON%&%

SCIB%

EDSG%

TCN%

NGC%

TCN%

The timeline chart below shows the (first) date of execution of each of these project agreements

with the exception of the Certificate of Occupancy (registered on 9 June 2012) and the Power

Purchase Agreement (first signed on 22 April 2013). These first two documents can be thought of

as the “parent” documents for everything else that followed. For without the land on which to

build the power plant and an off-take agreement from a credible customer, it is nigh impossible

for a developer to conclude any of the other project agreements.

In the sections that follow, we will take a closer look at the various steps (and volume of work)

involved in negotiating each individual agreement.

After the C of O and the PPA: The Execution Dates of the other Project Documents

Ancillary Services Agreement

24 Jun 2014

Grid Connection Agreement

24 Jun 2014

GSPA Addendum Agreement

1 Dec 2014

Long Term Service Agreement

2 Jul 2014

Gas Supply Agreement

14 Apr 2014

Owner’s Engineer Agreement

4 July 2014

EPC Contract

30 Apr 2014

Loan Agreements

25 Nov 2014

GTA Supplemental Agreement

22 July 2014

1 Jul 2014

1 Sep 2014

Management Services Agreement

23 Jan 2015

Put Call Option Agreement

22 Oct 2014

Gas Transportation Agreement

22 July 2014

O&M Agreement

5 May 2014

1 May 2014

PPA Addendum Agreement

1 Dec 2014

Technical Services Agreement

29 Jan 2015

Substation Extension Agreement

3 Dec 2014

1 Nov 2014

16

1 Jan 2015

Construction Insurance Cover

26 Feb 2015

1 Mar 2015

1 May 2015

SECTION 1

LAND ACQUISITION

The Azura-Edo IPP is recognised to be of public interest and therefore the project’s land

acquisition process was led by the Edo State Government (“EDSG”). However, in tandem with

the EDSG-led land acquisition process, Azura implemented an integrated stakeholder

engagement process to understand and adequately reflect upon the potential impacts (in terms of

the environmental and social issues) associated with land acquisition and resettlement. Under the

guidance of the World Bank, Azura’s daily interaction with the local communities was then used

to develop a Compensation Plan and a Resettlement Action Plan (“RAP”).

The land acquired by the Azura facility was previously owned by the inhabitants of three different

communities (Orior-Osemwende, Ihovbor-Evboeka and Idunmwowina-Urho-Nisen) and the

number of individuals with a purported claim to compensation was just over 1,000 persons. Not

surprisingly, the process of enumerating and assessing the value of each individual claim proved

to be extremely time consuming and labour intensive.

The importance and sensitivity of the exercise (and the need to insure that it was carried out to

World Bank and IFC standards) necessitated the employment of three different sets of

environmental experts, namely: the ERM Group; Environmental Accord; and Adamu Kasimu &

Associates.

It is worth noting that we had to commence the land acquisition process (in late 2010) before we

had agreed any of the key project documents including the Power Purchase Agreement (“PPA”).

In the conventional development cycle (at least in mature markets) this approach would be seen

as “the wrong way round” since the developer would normally seek to execute the PPA and other

key project documents before the land was acquired or at least have an option on acquiring the

land subject to the execution of other project documents. However, in Azura’s case, we had to take

that risk up front in order to “get a seat at the negotiating table” with key counterparties such as

our off-taker and our gas supplier.

17

Land Acquisition & Compensation - the Key Protagonists

PURCHASER

VENDOR

LENDERS

Azura

Edo State Government

The 5 Lead Arrangers

World Bank Group (RAP Adviser)

Local Communities

Clifford Chance (Lenders’s Counsel)

Trinity & Templars (Legal Counsel)

Individual Land Owners

Olaniwun Ajayi (Lenders’ Counsel)

ERM (E&S Adviser)

Royal Haskoning (Lenders’ E&S Adviser)

Environmental Accord (E&S Adviser)

A. Kasimu & Associates (Land Valuer)

Land Acquisition Timeline - Charting the Major Milestones

1st Draft of EIA Scoping Study Submitted to FMEnv

Dec 2010

EDSG Notice of Revocation

Jun 2011

Initial World Bank Feedback

Jul 2011

Census and Asset Inventory

8-20 Sep 2011

Application for C of O

Feb 2012

Disclosure of RAP in World Bank's Info Shop

Mar 2012

World Bank Approval of RAP

Feb 2012

MOU with EDSG

Nov 2010

2011

Enumeration Survey

22-29 Aug 2011

2012

Sign Off by Each Claimant

Mar-Apr 2013

C of O Awarded

Jun 2012

Second Set of Payments by Azura

26-30 May 2014

First Set of Payments by Azura

11-21 Nov 2013

2013

2014

18

First Set of Payments by EDSG

Nov 2014 - Feb 2015

2015

2016

SECTION 2

THE POWER PURCHASE AGREEMENT

The first formal engagement between NBET and Azura began on 29 November 2011 when NBET

sent to Azura (along with several other prospective IPPs) a draft Power Purchase Agreement

(“PPA”) for New Build Independent Power Projects. Subsequent to Azura’s initial review of this

draft PPA, the first meeting between the parties was held in Abuja a day later (on 30 November

2011). Present at this initial meeting were NBET’s counsel (Hunton & Williams and G. Elias &

Co).

Over the course of the subsequent three years, the parties held successive rounds of negotiations.

These took place via: face-t0-face “round table” sessions; conference calls; and the iterative

exchange of (literally) hundreds of red-lined drafts of each successive draft of the Power Purchase.

On 22 April 2013, a landmark day in the history of Nigeria’s power sector, the parties signed the

country’s first PPA between NBET and a project-financed IPP. But it wasn’t until 1 December

2014 before the final set of schedules to the PPA were concluded and the PPA Addendum

Agreement was signed.

PPA Timeline - Charting the Dates of the Major Face-to-Face Negotiation Sessions

Session 3 Abuja

28 Feb - 1 Mar 2012

Session 7 Abuja

10 Sep - 12 Sep 2012

Session 1 Abuja

29 Nov 2011

Session 13 Abuja

22 Apr - 2 May 2014

Session 8 Abuja

19 Sep 2012

Session 4 Abuja

21 Mar 2012

Session 5 Abuja

20 May 2012

Session 6 Abuja

2 Jul 2012

Session 2 Abuja

27 Feb 2012

1 Jul 2012

Session 14 Abuja

30 Jun - 31 July 2014

Session 10 Abuja

19 Feb - 21 Feb 2013

Session 11 Washington DC

3 Apr - 14 Apr 2013

Session 15 Abuja

10 Jul - 11 July 2014

Session 16 Abuja

12 Nov - 14 Nov 2014

Execution of PPA

22 Apr 2013

Session 9 Abuja

14 Nov - 15 Nov 2012

1 Apr 2013

Session 12 Washington DC

12 Nov - 16 Nov 2013

1 Jan 2014

19

1 Oct 2014

Execution of PPA Addendum

1 Dec 2014

1 Jul 2015

PPA Negotiations - the Key Protagonists

POWER PURCHASER

POWER PRODUCER

LENDERS

NBET

Azura

The 5 Lead Arrangers

Hunton & Williams (Legal

Counsel)

Trinity (Legal Counsel)

Clifford Chance (Lenders’ Counsel)

G. Elias & Co (Local Counsel)

Templars (Legal Counsel)

Olaniwun Ajayi (Lenders’ Counsel)

Nexant (Financial & Legal

Advisers)

Fieldstone (Financial Advisors)

Lummus (Lenders’ Technical

Adviser)

World Bank Group (Adviser to all

Parties)

World Bank Group (Adviser to all

Parties)

World Bank Group (Adviser to all

Parties)

The chart below provides a partial measure of the flow of email traffic between Azura and NBET

between 2011 and 2014.

No. of emails to/from NBET and Azura’s Senior Management

1,500

No. of emails

1,200

900

600

300

0

2011

2012

2013

2014

2015

What is particularly interesting about this chart is that it shows how the engagement between

NBET and Azura more than doubled in 2014 (the year after the PPA was first executed).

At first sight, this might seem counterintuitive. Indeed, the natural presumption for an outside

observer would be to assume that most of the hard work was over by the time the first draft of the

PPA was signed in April 2013. The reality, however, was very different and it is instructive to

examine the reasons why.

The first reason has already been alluded to, viz. the fact that the schedules to the PPA still needed

to be negotiated. And the process for so doing was highly time-consuming, not least because the

20

negotiations over the tariff schedule and the various technical schedules required both sides of the

negotiating table to undertake a tremendous amount of detailed (and iterative) data analysis.

The second reason derives from the close intersection between the PPA and the PCOA and the

fact that NBET took the lead (from the Government’s side) in negotiating the PCOA. As will be

illustrated in the next chapter, the negotiation of the PCOA - which was finally signed in October

2014 - proved to be just as challenging as the negotiation of the PPA.

21

SECTION 3

THE PUT CALL OPTION AGREEMENT

The need for credit enhancement by the Sovereign Government (to backstop the payment

obligations of NBET) was linked to the recognition that it might take several years before NBET

could demonstrate, by reference to a track record of sufficient longevity, that it had the capacity

to meet its payment obligations in a timely and reliable fashion. Without such credit

enhancement, it is simply not possible to raise the capital required to finance a project of this

kind.

The initial round of discussions suggested that this backstop was likely to take the form of a

Federal Government Letter of Support (“LoS”) akin to the instruments used by a number of other

Sub-Saharan countries to help catalyse project-finance IPPs. However, by the time the first draft

of the PPA was executed in April 2013, the Federal Government counterparties had opted for a

different structure which became known as the Put Call Option Agreement (“PCOA”).

As for the parties responsible for the negotiation of the PCOA, they comprised all the institutions

responsible for the negotiation of the PPA. But the universe of protagonists whose views and

interests were factored into the PCOA was expanded to include the Ministry of Finance

(representing the FGN); the Office of the Attorney General (Legal Counsel to the Ministry of

Finance); the Ministry of Power; and the Nigerian National Petroleum Corporation (which

provided a Parent Company Guarantee to the Ministry of Finance and NBET to help mitigate

their exposure under the PCOA in the event of a failure by the Nigerian Gas Company to transport

gas to the project).

PCOA Negotiations - the Key Protagonists

POWER PURCHASER

FGN GUARANTOR

POWER PRODUCER

LENDERS

NBET

Ministry of Finance

Azura

The 5 Lead Arrangers

Hunton & Williams

Ministry of Power

Trinity

Clifford Chance

G. Elias & Co

Office of the Attorney General

Templars

Olaniwun Ajayi

Nexant

NNPC

Fieldstone

Lummus

World Bank Group

World Bank Group

World Bank Group

World Bank Group

22

No. of emails to/from Azura’s Senior Management with an LoS or PCOA Heading

500

No. of emails

400

300

200

100

0

2012

2013

2014

LoS

2015

PCOA

PCOA Timeline - Charting the Major Milestones

First Draft of LoS

30 July 2012

Second Draft of LoS

9 Oct 2013

Signed PCOA Term Sheet

23 Apr 2013

1 Jan 2013

Final Draft of PCOA Agreed

10 Oct 2014

Initial Draft of Full Form PCOA

17 Jun 2013

Third Draft of LoS

13 Nov 2012

1 Jul 2012

First Agreed Draft of PCOA

2 May 2014

Multiple Iterations of PCOA

Jul 2013 to Apr 2014

1 Jul 2013

1 Jan 2014

23

1 Jul 2014

PCOA Executed

22 Oct 2014

1 Jan 2015

1 Jul 2015

SECTION 4

THE GAS SALES & PURCHASE AGREEMENT

The bankability of any project-financed gas-fired IPP is critically dependent on the negotiation of

a long-term Gas Sales & Purchase Agreement (“GSPA”) with a credit-worthy gas supplier on

terms that are acceptable (and recognisable) to the providers of non-recourse debt.

In Azura’s case, the journey towards a bankable GSPA required the expenditure of an

extraordinary amount of time, capital and patience. Indeed, it is fair to say that the smooth linear

path depicted below bears little correlation to the sturm und drang involved in: the multiple

rounds of face-to-face negotiations; the iterative exchange of redlined documents; and the receipt

of the necessary approvals from NBET; NERC; NPDC; and Azura’s lenders.

By the time the GSPA between Azura and Seplat Petroleum Development Company PLC

(“Seplat”) was finally executed in April 2014, most of the key protagonists felt as if they had just

completed an ironman triathlon.

GSPA Timeline - Charting the Major Milestones

Draft GSPA disclosed to NBET, NERC and World Bank

Jan 2013

Full Form GSPA submitted to Seplat

15 May 2013

Multiple Iterations of GSPA

May 2013 to Feb 2013

Letter of Intent secured

Dec 2010

Gas Suppy Due Diligence

Jan 2011 to Jun 2012

2011

GSPA Initialed

Feb 2013

GSPA Term Sheet agreed

Jun 2012

2012

Seplat Due Diligence on Azura

Feb 2013

2013

GSPA Executed

Apr 2014

2014

24

Final Approval of Gas Tariff by NERC

Nov 2014

GSPA Addendun Executed

Dec 2014

2015

2016

GSPA Negotiations - the Key Protagonists

GAS PURCHASER

GAS SUPPLIER

LENDERS

Azura

Seplat

The 5 Lead Arrangers

NBET (Approval i.r.o. Risk Allocation)

NPDC (Field Partner)

Clifford Chance (Lenders’s Counsel)

NERC (Approval i.r.o. Gas Pricing)

Seven Energy (NPDC’s Service Partner)

Olaniwun Ajayi (Lenders’ Counsel)

Trinity & Templars (Legal Counsel)

G. Elias & Co (Legal Counsel)

Lummus (Lenders’ Technical Adviser)

No. of GSPA related emails to/from Azura’s Senior Management

700

No. of emails

560

420

280

140

0

2010

2011

2012

2013

Seven Energy

2014

2015

Seplat

25

SECTION 5

THE GAS TRANSPORTATION AGREEMENT

The site of the Azura-Edo IPP is located about 50km northwest of the Oben Gas Plant (the source

of the gas that will be used to fire Azura’s turbines) and the pipeline that connects the Oben Gas

Plant to the Azura-Edo IPP is owned and operated by the Nigerian Gas Company (“NGC”). Hence

on 20 May 2012, NGC supplied Azura with a draft Gas Transportation Agreement (“GTA”) and

began the two years of negotiations that culminated in the execution of the GTA on 22 July 2014.

An ancillary document called the GTA Supplemental Agreement (that governs the construction of

the 800m spur line between the ELPS and the Azura facility and the gas metering facility) was

also signed on 22 July 2014.

GTA Timeline - Charting the Dates of the Major Face-to-Face Negotiation Sessions

Session 4

30-31 Jan 2014

Session 5

12 Mar 2014

Session 6

27 Mar 2014

Session 7

14-15 Apr 2014

Session 8

16 May 2014

Session 9

30 May 2014

Session 10

12-13 Jun 2014

Session 11

26 Jun 2014

Session 2

14 Aug 2013

Session 1

21 May 2012

1 Oct 2012

Session 12

9 Jul 2014

Session 3

4-5 Nov 2013

1 Jul 2013

1 Apr 2014

26

Execution of GTA & Supplemental Agreement

22 Jul 2014

1 Jan 2015

1 Oct 2015

GTA Negotiations - the Key Protagonists

GAS SHIPPER

GAS TRANSPORTER

LENDERS

Azura

Nigerian Gas Company

The 5 Lead Arrangers

NBET (Approval i.r.o. Risk

Allocation)

NNPC (Parent Company)

Clifford Chance (Lenders’s

Counsel)

NERC (Approval i.r.o. GTA Pricing

& Risk)

Department of Petroleum

Resources

Olaniwun Ajayi (Lenders’ Counsel)

Lummus (Lenders’ Technical

Adviser)

Trinity & Templars (Legal Counsel)

Siemens (EPC Contractor)

As can be seen from the Timeline Chart on the preceding page, after the first meeting between

NGC and Azura in May 2012, the parties agreed that any further face-to-face discussions on the

GTA should take place after Azura had made further progress in its GSPA negotiations such that

NGC could be supplied with precise details of the upstream gas supplier(s) and the likely

interconnection points with the Escravos Lagos Pipeline System. This watershed was reached in

August 2013 whereupon the parties commenced a series of intensive negotiations that involved

monthly meetings, numerous conference calls and the iterative exchange of multiple redlined

drafts of the GTA and the Supplemental Agreement.

No. of GTA related emails to/from Azura’s Senior Management

300

No. of emails

240

180

120

60

0

2012

2013

2014

27

2015

SECTION 6

THE GRID CONNECTION AGREEMENT

The site of the Azura-Edo IPP is located directly adjacent to the Benin North Sub-Station which

makes the physical evacuation of power on to the Grid far easier than is the case with projects that

are remote from the nearest high voltage interconnection point. However, the contractual

arrangements governing the relationship between Azura and the Transmission Company of

Nigeria (“TCN”) still required extensive negotiations (not least because these documents were

being negotiated de novo and all parties were conscious that they would form the template for

other IPPs).

As shown in the chart below, the entire process took nearly 4 years from start to finish. Will this

be the same for other IPPs in Nigeria? Certainly not. The contracts between Azura and TCN are

highly replicable. Nevertheless, it would still be prudent for other IPPs to plan on a 24 month

end-to-end cycle (i.e. from the point where they commence their evacuation studies to the point

where they have agreed all the design drawings with their EPC Contractor and have executed the

Grid Documents with TCN).

Grid Connection Timeline - Charting the Major Milestones

Multiple Iterations of GCA

May 2013 - Jun 2014

Kick off meeting with TCN

17 Feb 2011

Design Drawings

Jul 2011 - May 2013

Evacuation Study

Feb-July 2011

Cooperation Agreement

18 Mar 2013

Provisional Connection Approval

12 Jul 2011

2011

2012

ASA Executed

24 Jun 2014

Application for GCA

3 May 2013

2013

2014

28

GCA Executed

24 Jun 2014

TLSEA Executed

3 Dec 2014

2015

Grid Connection Negotiations - the Key Protagonists

POWER PRODUCER

POWER TRANSMITTER

LENDERS

Azura

Transmission Company of

Nigeria

The 5 Lead Arrangers

NBET (Approval i.r.o. Risk

Allocation)

NIAF (Legal Counsel)

Clifford Chance (Lenders’s

Counsel)

NERC (Approval i.r.o. Risk

Allocation)

Olaniwun Ajayi (Lenders’ Counsel)

Trinity & Templars (Legal Counsel)

Lummus (Lenders’ Technical

Adviser)

Jiyoda Engineering (Technical

Adviser)

Parsons Brinckerhoff (Technical

Adviser)

Siemens (EPC Contractor)

No. of GCA related emails to/from Azura’s Senior Management

600

No. of emails

480

360

240

120

0

2011

2012

2013

29

2014

2015

SECTION 7

THE EPC CONTRACT & THE LONG TERM SERVICE AGREEMENT

The engineering, procurement and construction (“EPC”) of the Azura-Edo IPP is being carried

out by a consortium composed of Siemens AG, Siemens Nigeria Ltd and Julius Berger Nigeria

PLC. Siemens is also the manufacturer of the heavy equipment used in the plant and has

contracted to service this equipment under a Long Term Service Agreement (“LTSA”).

Ex post, that all sounds very neat, simple and effortless. In reality, however, both the tendering

process and the subsequent contract negotiations proved to be long and grueling affairs. Indeed,

it is fair to say that, ex ante, neither Azura not its counterparties could have anticipated the full

extent of the rigors that would be imposed upon them by the interlocking constraints of:

international competitive bidding; World Bank requirements; NBET requirements; and lender

requirements.

After the initial front end engineering design (“FEED”) studies had been completed, the general

procurement notice was issued in October 2011 and in late November of the same year, 21 prequalified bidders received the formal invitation to bid (together with all the supporting

documentation). A total of 17 firms pre-qualified to receive the invitation to bid, from countries

including the following: USA, France, Germany, Italy, Greece, South Africa, Egypt, Israel, Saudi

Arabia, Kuwait, India, China, Korea, and Japan. These firms were required to tender for the

provision of fully wrapped turnkey EPC and long term maintenance services for the Project.

More than a year later (after the completion of multiple bidding rounds), a preferred bidder was

finally appointed for both the EPC Contract and the LTSA. And the workload increased still

further from this point as the parties settled down for the long haul of contract negotiations which

lasted for 18 months before concluding with the execution, respectively, of the EPC Contract in

April 2014 and the LTSA in July 2014.

EPC & LTSA Negotiations - the Key Protagonists

EMPLOYER

CONTRACTOR

LENDERS

Azura

Siemens/JBN Consortium

The 5 Lead Arrangers

Parsons Brinckerhoff (Technical

Adviser)

Siemens AG

Clifford Chance (Lenders’s

Counsel)

Trinity & Templars (Legal Counsel)

Siemens Nigeria Ltd

Olaniwun Ajayi (Lenders’ Counsel)

ERM (E&S Adviser)

Julius Berger Nigeria PLC

Royal Haskoning (Lenders’ E&S

Adviser)

NBET (influencing Risk Allocation)

30

EPC & LTSA Timeline - Charting the Major Milestones

Receipt of 1st Round EPC & LTSA Bids

23 Mar 2012

Preparation of Bid Documents

Jul-Nov 2011

Receipt of 3rd Round EPC Bids

2 Nov 2012