Project Specific CBA Methodology

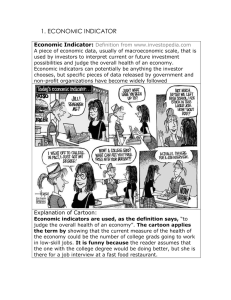

advertisement