line of

SIGHT

HOME COUNTRY BIAS

WHY IT CAN UNDERMINE RETIREMENT PORTFOLIOS

EXECUTIVE SUMMARY

When it comes to defined contribution (DC) investors and their equity portfolio allocations,

the numbers tell an intriguing story.

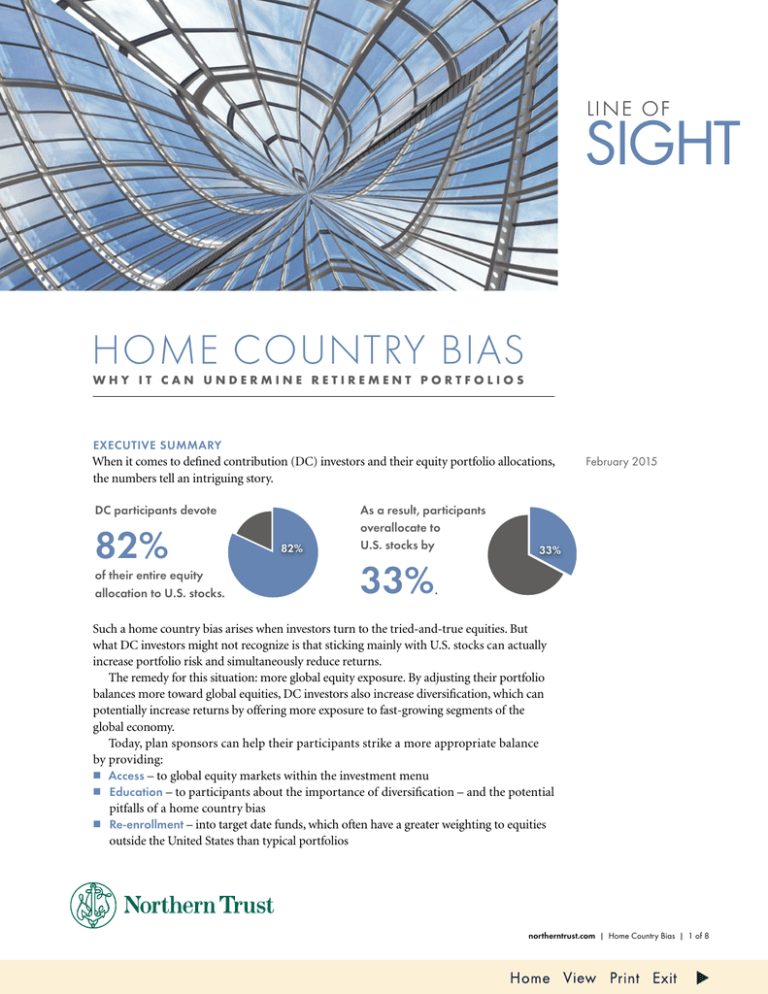

DC participants devote

82%

of their entire equity

allocation to U.S. stocks.

82%

As a result, participants

overallocate to

U.S. stocks by

February 2015

33%

33%

.

Such a home country bias arises when investors turn to the tried-and-true equities. But

what DC investors might not recognize is that sticking mainly with U.S. stocks can actually

increase portfolio risk and simultaneously reduce returns.

The remedy for this situation: more global equity exposure. By adjusting their portfolio

balances more toward global equities, DC investors also increase diversification, which can

potentially increase returns by offering more exposure to fast-growing segments of the

global economy.

Today, plan sponsors can help their participants strike a more appropriate balance

by providing:

■■ Access – to global equity markets within the investment menu

■■ Education – to participants about the importance of diversification – and the potential

pitfalls of a home country bias

■■ Re-enrollment – into target date funds, which often have a greater weighting to equities

outside the United States than typical portfolios

northerntrust.com | Home Country Bias | 1 of 8

DC Equity Allocations

DC plan participants overallocate to U.S. stocks, a phenomenon known as “home country

bias.” In fact, the Northern Trust DC Tracker1 suggests participants hold 82% of the equity

portion of their DC portfolios in U.S. equities.2 A home country bias can lead to suboptimal portfolio allocations with higher risk and lower returns. Although recent market

conditions favored maintaining a higher allocation to U.S. equities, there are fundamental

reasons to avoid this home country bias as a rule when looking forward, which we

highlight in this research.

Since so many people rely on their DC accounts as the primary vehicle to fund

retirement, asset allocation should allow for diversified, risk-efficient, long-term ways

to grow account balances. There are at least two approaches that offer more-efficient

stock allocations:

■■ Market-weighting based on global stock market capitalizations, and

■■ Geographic revenue weighting using geographic revenue sources.

Both methods result in a higher allocation to non-U.S. stocks that should benefit

participants over the long run by introducing greater portfolio diversification and

the potential for greater returns.

Defining the Bias

Our 2013 DC Tracker revealed that DC participant portfolios exhibit a home country bias,

with only 18% of their equity allocation invested outside the United States. This compares

to a 51% representation of non-U.S. equities within the MSCI All Country World Investable

Market Index, a key index representative of the global equity market. The difference between

the market weight of 51% and DC participant portfolio exposure of 18% to non-U.S. equities

implies a 33% overweight bias toward U.S. stocks on a market-weighted basis. The bias jumps

to 54% when measured against geographic revenue weighting.

CALCULATING THE HOME COUNTRY BIAS

Proxies by Which to Compare

By Market Weight

By Geographic Revenue

DC Participant

Actual Allocation

U.S. Equity

Allocation

49%

28%

82%

International

(Non-U.S. Equity

Allocation)

51%

72%

18%

Geographic-revenue home country bias

(toward U.S.) = 54%

Market-weight home country bias (toward U.S.) = 33%

Sources: 2013 Northern Trust DC Tracker; Northern Trust Five-Year Outlook: 2014 Edition; MSCI

2 of 8 | northerntrust.com | Home Country Bias

RE-THINKING “INVEST IN WHAT YOU KNOW”

Home country bias exists for several reasons. Behavioral economics and psychology show

that people are more comfortable with the familiar and tend to heed the adage, “invest in

what you know.” Negative headlines regarding accounting standards, corporate governance,

government intervention and liquidity in developing nations may fuel investor discomfort.

It’s important to note that the bias could also stem from the emphasis placed on U.S. stocks

over international equities. According to the Plan Sponsor Council of America,3 a typical

DC plan offers nearly three times more U.S. equity funds than international ones. With relatively few international options from which to choose, it’s not surprising DC participants

would have an overweight in their portfolio. This partly is due to the fact that indices and

investment strategies focused on overseas markets are relatively new. For example, the

Dow Jones Industrial Average™ Index for U.S. equities was first calculated in 1896.4 In

contrast, the MSCI Emerging Markets Index, one of the most widely followed developing

world indices, was not created until 1988.5

However, U.S. investors saving for retirement might do well to look past the familiar

U.S. equity benchmarks and toward overseas markets, especially those in developing

nations that are expected to outperform domestic U.S. markets over time. Here are some

reasons behind this forecast.

MODERNIZATION

Modernization of governments and private industries since the early 1990s fostered

freer cross-border trade and allowed some previously export-dependent nations to

establish their own internal markets. This had a material impact on the world economy.

For instance, in 1988 emerging markets represented 1% of the world equity market

capitalization.6 By 2013, that figure had increased to 11%.7

CATCHING UP

As international markets, especially developing nations, continue to modernize their

internal economies, it is likely their share of the global economy will continue to increase.

The International Monetary Fund (IMF) projects that the combined share of global gross

domestic product (GDP) for the most populous emerging market countries – China and

India – is set to balloon to almost 40% by 2030 from 24% in 2011.8

Let’s consider where the U.S. economy and equity markets stand relative to the rest

of the world.

Biased Proportions

The U.S. share of the global equity opportunity set is disproportionate to its population and

economy, as measured by GDP. The United States represents 5% of the world’s population

and 23% of its GDP, but it accounts for nearly half of the global equity opportunity set. In

striking contrast, the developing world (including emerging markets and frontier markets)

accounts for 70% of the world’s population and 37% of global GDP – but only 11% of the

global equity opportunity set.9

northerntrust.com | Home Country Bias | 3 of 8

A LOOK AT THE GLOBAL DISPROPORTIONS

Global Equity

Market

Global GDP

Global Population

United States

49%

23%

5%

Developing World*

11%

37%

70%

Source: Northern Trust Five-Year Outlook: 2014 Edition

*Developing world includes emerging markets and frontier markets

Biased Growth

What could cause these proportions to change? The United States is considered a developed market because it has some of the highest levels of infrastructure, standards of living

and financial market development in the world. Meanwhile, developing countries are

playing catch-up. This leads to three consequences. First, developing nations have more

low-hanging fruit at their disposal. For example, while the United States already has one

of the most sophisticated transportation systems in the world, many emerging nations

are just now building ports and highways for more efficient transportation of goods. The

gains from improvements to basic infrastructure reverberate through a country’s economy more readily than higher-level changes. Second, because developed nations already

experimented with different development strategies, developing nations have a historical

roadmap of policy examples from which to choose. Finally, the developing world can skip

some stages in development altogether. For instance, unlike the United States where there

is a bank seemingly on every corner, large portions of Africa lack the brick-and-mortar

infrastructure and instead access banking services through mobile platforms. In fact, three

quarters of the countries that use mobile banking most frequently are located in Africa.10

We can see these trends reflected in real (inflation-adjusted) GDP growth rates from

1970 through 2014. Whereas the U.S. average increase was 2.8% during this period, the

developing world experienced average growth of 5%. These growth differentials are

even more striking after compounding.

A COMPARISON OF HISTORICAL GROWTH RATES

10

8

% Growth

6

4

2

0

–2

United States

Source: Northern Trust; USDA Economic Research Service

4 of 8 | northerntrust.com | Home Country Bias

Developing

2012

2014

2010

2008

2006

2004

2002

2000

1998

1994

1996

1992

1990

1988

1984

1986

1982

1978

1980

1974

1976

1972

1970

–4

While there may be short-term fluctuations, we believe these trends will continue

in the medium- to long-term. According to the IMF, real economic growth in the

United States is expected to be 3% per year over the next five years, while the equivalent

projection for some parts of the developing world is much higher: 7% for China, 6%

for emerging Asia ex-China and 5% for Africa and the Middle East. As a consequence,

Northern Trust expects U.S. equity markets to return 7% per year in the next five years,

while the emerging market equivalent is 9%.11

These growth rates should not be considered in isolation because that would ignore

one of the most important benefits from expanding beyond the U.S. equity allocation:

diversification. Broadening the equity allocation to more international jurisdictions not

only increases the probable return profile but also potentially lowers the risk profile. This

is because one nation’s equity market gains may offset a different country’s negative

equity market performance.

CHOOSING A WEIGHTING STRATEGY

While there may not be a “right” way to determine global equity allocations, there

are many good reasons why investors should consider either a market or geographic

revenue weighting.

WEIGHTING ALTERNATIVES TO ADDRESS THE BIAS

Geographic

Revenue Weight

Market Weight

(by source of revenue)

(by market capitalization)

Pacific

ex-Japan

5%

Emerging

Markets

13%

Japan

8%

U.S.

47%

Emerging

Markets

32%

Europe

ex-UK

15%

UK

8%

Canada

4%

Pacific

ex-Japan

3%

Japan

13%

U.S.

28%

Europe

ex-UK

17%

Canada

3%

UK

4%

Source: Northern Trust, MSCI. Data as of December 2012, as published in “Investment Strategy Commentary:

Heading Overseas,” September 3, 2013.

northerntrust.com | Home Country Bias | 5 of 8

Market Weighting

The market weight is a weighted average of the dollar value of global equity markets. As

you can see in the market weight pie chart, the U.S. dominates by market capitalization,

with 47% of the market. Efficient market hypothesis suggests markets are efficient in the

long run, where efficiency implies that security prices reflect underlying value. Market

participants who successfully spot and profit from divergences in price and value should

survive in the long run and help the market remain an efficient pricing mechanism over

time. Thus, any deviation from market weights is an active bet that the market is not pricing

securities efficiently.

Geographic Revenue Weighting

Geographic revenue weighting is based on geographic sources of revenue regardless of firm

domicile and is an investment theme we recognize as “asset classes without borders.” 7, 11 The

goal of this approach is to better align stock allocations to economic output.

Whereas the United States accounts for nearly half of the world’s market capitalization, it accounts for 28% of the global weights by sources of revenue – and even less when

measured by GDP. On the other hand, while emerging markets account for 13% of the

world by market capitalization, these countries account for nearly a third of the world

when measured by GDP or by sources of revenue. When viewed from this perspective,

exposure to emerging markets becomes increasingly important. For instance, according to the Organization for Economic Co-operation and Development, China’s share of

world GDP is expected to balloon to 28% by 2030 from 11% in 2011. Because geographic

revenue weighting is a relatively recent concept, it is transitioning from theory to practice

as its real track record is still being established, with MSCI’s 2012 launch of its Economic

Exposure Indices providing a step in that direction.

WHICH WEIGHTING?

When choosing a global equity weighting, there are several considerations to review. Given

the long-term nature of DC plan investments, we believe using a market-weighted approach

is the more appropriate choice. It is easily implemented through a time-tested benchmark

such as the MSCI All Country World Index (ACWI). In addition, this methodology has

transitioned from theory to practice with a proven track record as investors have accessed

global equity markets using market-weighted indices for several decades.

6 of 8 | northerntrust.com | Home Country Bias

YOUR ACTIONS. THEIR OUTCOMES.

Today, plan sponsors can help their participants

overcome the downside of home country bias

by providing the following:

1. Access to Global Equity Markets

Work with your record-keeper or consultant to

review your investment menu. Does it foster a better

balance between U.S. and international equity options?

To gauge the extent to which your participants may

overallocate to U.S. equities, you should consider

the following question: Does the plan offer enough

investment options to ensure participants can avoid

the bias?

If your menu does not have a global equity option,

consider adding one that uses a broad investment

strategy benchmarked to an index like the MSCI

ACWI or the MSCI ACWI Investable Market Index

(ACWI-IMI), which also includes small-cap equities

in developed and emerging market countries.

DC PLANS ADOPTING DB PLAN ALLOCATIONS

Many defined benefit (DB) plans have longer performance records than DC plans and are directly managed

by investment professionals, leading DC plans to adopt

their time-tested strategies. This includes using equity

allocations that lower the home country bias. For example,

DB plan allocations to home country stocks of the world’s

six largest pension markets – Australia, Canada, Japan,

Switzerland, the United Kingdom and the United States –

fell to 44% in 2013 from 65% in 1998, according to a

2014 Towers Watson study.12 Further, a 2013 poll by

Pyramis Global Advisors revealed that U.S. mid-market

pension plans expect to reduce their exposures to U.S.

stocks and increase their exposures to emerging markets

and global investments in the next two years.13

2. Education About Home Country Bias

Perhaps participants are not aware they are displaying a home country bias. Or, they may

intentionally choose to overallocate to U.S. equities, unaware of the adverse effects.

■■ Identify those participants who exhibit a bias and make them aware of their asset

allocation – and the diversification benefits they could achieve if they adjusted their

asset mix to include non-U.S. equities.

■■ Ask your record-keeper or investment managers if they have content that can be

used to educate participants about the longer-term advantages of a more globalized

allocation to equities.

Raising the awareness level and providing education about the benefits of a more

globally diversified asset mix will help empower participants to make better asset

allocation decisions.

3.Re-enrollment into a qualified default investment alternative (QDIA)

For many plan participants, inertia is sometimes too powerful a force to overcome. One

way to turn this into an advantage is by implementing re-enrollment into your plan’s

QDIA, which often includes multi-asset class strategies, such as target date funds. These

options offer participants professionally managed solutions that may incorporate more

globally diversified equity exposure, minimizing potential home country bias.

northerntrust.com | Home Country Bias | 7 of 8

HELPING PARTICIPANTS

In today’s DC environment where individuals increasingly are responsible for their own

investment outcomes, asset managers, consultants and plan sponsors must empower

them to make better investment decisions. This includes helping DC investors overcome

their reliance on U.S. stocks and adopting allocation strategies that provide broader,

deeper exposure to non-U.S. stocks, preferably using a market-weighted approach.

Reducing home country bias in their retirement portfolios may produce more optimal

asset allocations and potentially improved retirement outcomes.

ENDNOTES

1, 2 Northern Trust’s Defined Contribution Tracker, Northern Trust, December 31, 2013. The DC Tracker serves as

a barometer for participant flows within a universe of 85 DC plans, representing $190 billion, a subset of the

total DC assets managed or serviced by Northern Trust.

3 Plan Sponsor Council of America 56th Annual Survey of Profit-Sharing and 401(k) Plans.

4 Dow Jones Industrial Average™ Fact Sheet.

5 MSCI.

6, 9 Northern Trust “Point of View,” International Completion Strategies, 2010.

7, 11 Bloomberg and MSCI, as cited in Northern Trust, “Five-Year Outlook: 2014 Edition,” July 2014.

8 Wessel, David, En Garde, “WSJ.Money” interview with International Monetary Fund Managing Director

Christine LaGarde (May 2013).

10 “The Economist,” Mobile Money in Africa http://www.economist.com/node/21553510 (April, 2012).

12 Towers Watson (Global Pension Asset Study 2014) (January 2014).

13 Pyramis, U.S. Corporate Mid-Market Pulse Poll (December 2013).

We hope you enjoy the latest presentation from Northern Trust’s Line of Sight. By providing research, findings, analysis

and insight on the effects and implications of our changing financial landscape, Line of Sight offers the clarity you need

to make better-informed decisions.

Head Office: 50 South La Salle Street, Chicago, Illinois 60603 U.S.A. Incorporated with limited liability in the U.S. Products and services provided by subsidiaries of Northern Trust Corporation may vary in

different markets and are offered in accordance with local regulation. Northern Trust Asset Management comprises Northern Trust Investments, Inc., Northern Trust Global Investments Limited, Northern Trust Global

Investments Japan, K.K., NT Global Advisors, Inc. and investment personnel of The Northern Trust Company of Hong Kong Limited and The Northern Trust Company.

This material is directed to professional clients only and is not intended for retail clients. For Asia-Pacific markets, it is directed to institutional investors, expert investors and professional investors only and should

not be relied upon by retail investors. For legal and regulatory information about our offices and legal entities, visit northerntrust.com/disclosures.

Past performance is no guarantee of future results. All material has been obtained from sources believed to be reliable, but its accuracy, completeness and interpretation cannot be guaranteed. This information does

not constitute investment advice or a recommendation to buy or sell any security and is subject to change without notice. Returns of the indexes also do not typically reflect the deduction of investment management

fees, trading costs or other expenses. It is not possible to invest directly in an index. Indexes are the property of their respective owners, all rights reserved.

Important Information Regarding Hypothetical Returns – Where hypothetical portfolio data is presented, the portfolio analysis assumes the hypothetical portfolio maintained a consistent asset

allocation (rebalanced monthly) for the entire time period shown. Hypothetical portfolio data is based on publicly available index information. Hypothetical portfolio data contained herein does not represent the

results of an actual investment portfolio but reflects the historical index performance of the strategy described which were selected with the benefit of hindsight. Components of the hypothetical portfolio were

selected primarily utilizing actual historic market risk and return data. If the hypothetical portfolio would have been actively managed, it would have been subject to market conditions that could have materially

impacted performance and possibly resulted in a significant decline in portfolio value.

northerntrust.com | Home Country Bias | 8 of 8

Q 56199 (2/15)