PDF - PA Legal Ads Online

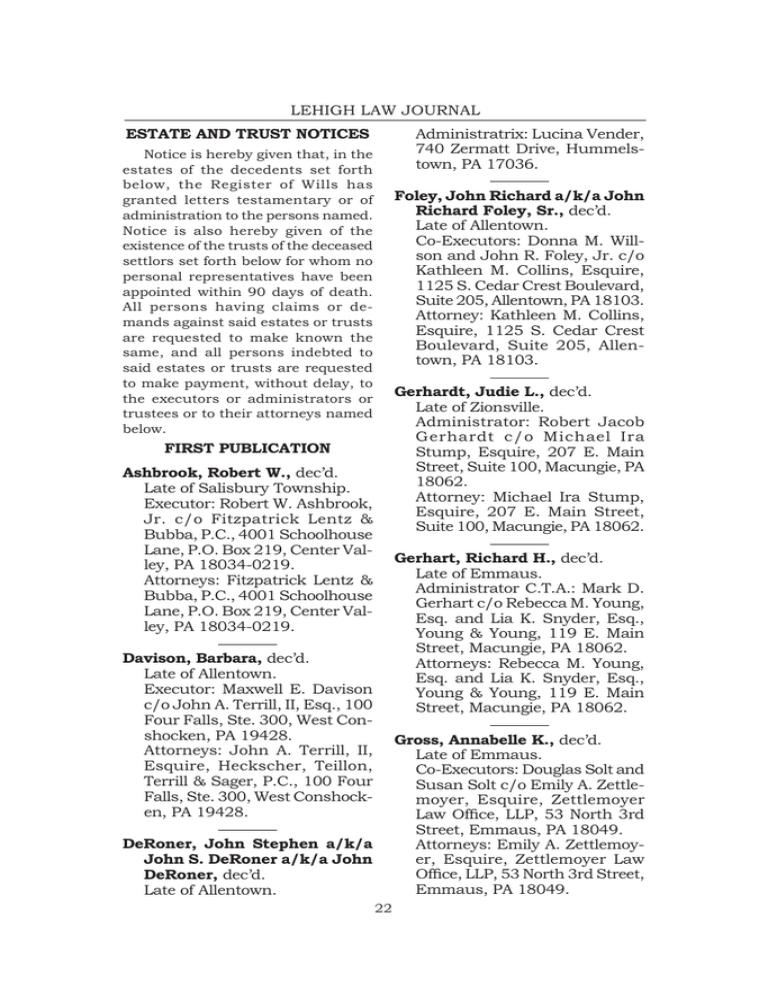

advertisement