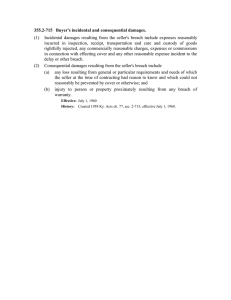

Damages in Lieu of Performance because of Breach of Contract

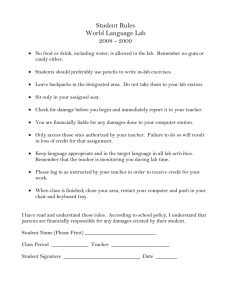

advertisement