Official City of Los Angeles Charter (TM) and Administrative Code (TM)

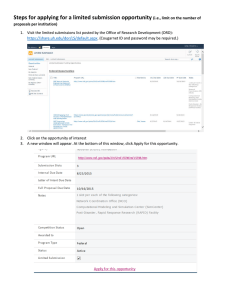

advertisement