Volume 86 · March 2010 International Journal for Industry, Research

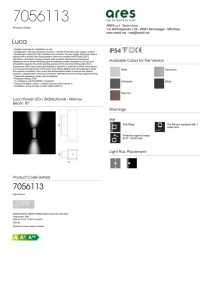

advertisement