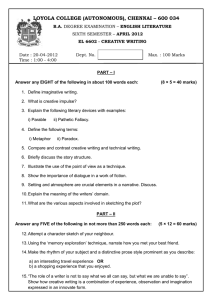

november 2014 skills examination

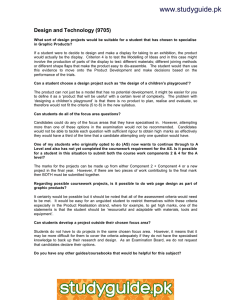

advertisement