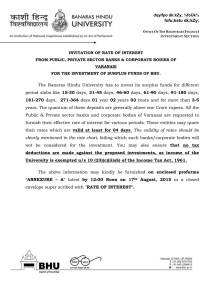

1 ODISHA ELECTRICITY REGULATORY COMMISSION

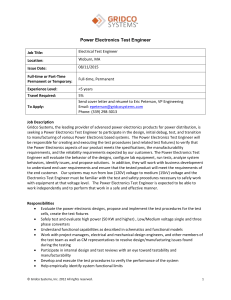

advertisement