Return of Organization Exempt From Income Tax 2003

advertisement

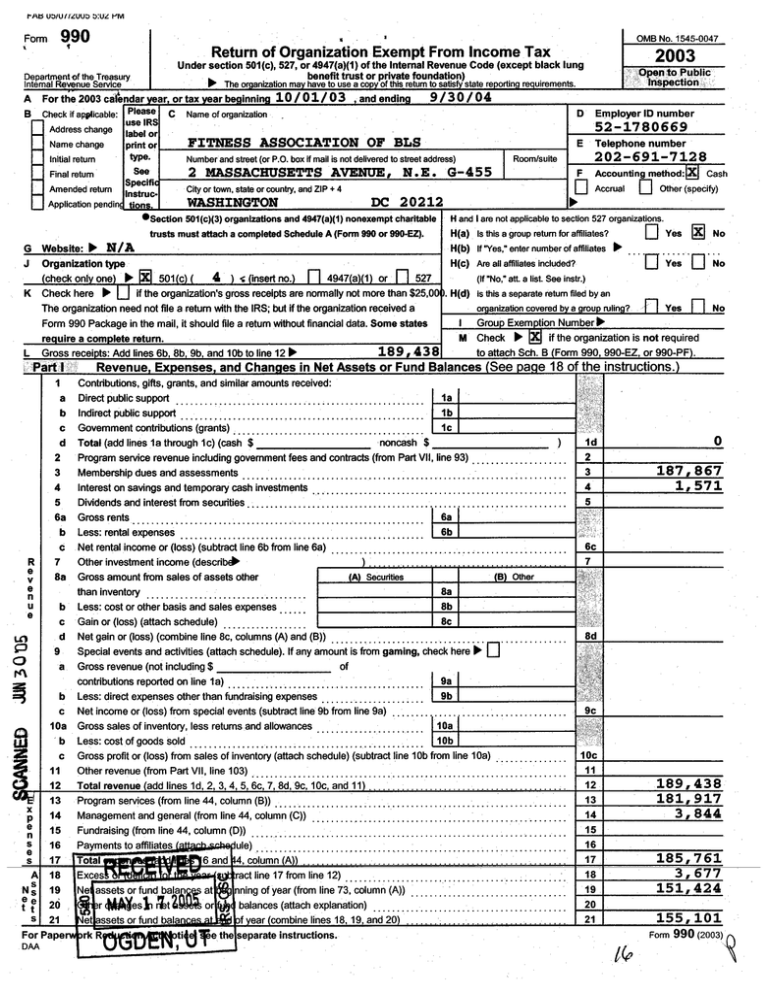

Y-Ht5 V5/V//LUVS OW NM -1 1Form 990 s ' OMB No. 1545-0047 Return of Organization Exempt From Income Tax 2003 Under section 501(c), 527, or 4947(a)(1) of the internal Revenue Code (except black lung Open to Public , Inspection benefit trust or private foundation) 1 The organization ma have to use a co of this return to satis state re porting re quirements . A B For the 2003 calendar e Check if applicable: Please use IRS Address change label or Name change print or type. initial return See Final return $Pecift Amended return InstrucApplication pendin ion . J K L v rt 1 1 d 2 3 4 5 6a b c 7 8a b c d 9 a b c 10a b c 17 - wvV p n e s A NS e tt s , and ending 13 14 15 96 17 18 19 26 21 For Paper DAA 9 / 30 / 04 FITNESS ASSOCIATION OF BLS Number and street (or P .O . box H mail is not delivered to street address) 2 MASSACHUSETTS AVENUE, N.E . G-455 D Room/suite Employer ID number 52-1780669 E Telephone number 202 -691-7128 F Accounting method:X Cash 11 Accrual City or town, state or country, and ZIP + 4 11 Other (specify) Section 501(c)(3) organizations and 4947(a)(1) nonexempt charitable H and 1 are not applicable to section 527 organizations . trusts must attach a completed Schedule A (Form 990 or 990-EZ). H(a) Is this a group return for affiliates? a Yes H(b) If -Yes," enter number of affiliates 1 .ID Gross receipts : Add lines 6b. 8b . 9b. and 10b to line 121 u Lin Name of organization Organization type 4 52 . check only one 1 501 c -; (insert no. 4947( a)(1 ) or Check here 1 if the organization's gross receipts are normally not more than $25, The organization need not file a return with the IRS ; but if the organization received a Form 990 Package in the mail, it should file a return without financial data . Some states a b c R or tax ear beginning 10 / 01 / 03 C H(C) Are ail affiliates included? .. . 1.&I No .Yes . . a. No (If "No," att. a list. See instr.) H(d) Is this a separate return filed by an ...y... . .._...... . . .. I M Grou p Exemption Numberill, Check 1 V if the organization is not required Revenue Ex penses, and Chan ges in Net Assets or Fund Balances See page 18 of the instructions . Contributions, gifts, grants, and similar amounts received : Direct public support 1a Indirect public support . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1b Government contributions (grants) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1c noncash $ ) Total (add lines 1a through 1c) (cash $ Program service revenue including government fees and contracts (from Part VII, line 93) , Membership dues and assessments Interest on savings and temporary cash investments Dividends andinterestfromsecurities . ., , , ; , . ., ., ., . . ., ., . . . . ., . . , ., . ., . ., . . . . . ., . . . . . Gross rents 6a Less rentalexpenses~ . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6b Net rental income or (loss) (subtract line 6b from line 6a) Other investment income (describes -- - -- -- -- - --- - . . . . ... Gross amount from sates of assets other A Securities B other than inventory . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8a Less : cost or other basis and sales expenses . . . . . . 8b Gain or (loss) (attach schedule) 8c Net gain or (loss) (combine line 8c, columns (A) and (B)) Special events and activities (attach schedule) . If any amount is from gaming, check here 1 Gross revenue (not including $ of 9a contributions reported online 1a) . . . . . . . . . . . . . . . . . . . : ., . . . .. . . ... . .. 9b Less : direct expenses other than fundraising expenses . . . . . . . . . . . Net income or (loss) from special events (subtract line 9b from line 9a) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Gross sales of inventory, less returns and allowances 10a less : cost of goods sold 10b Gross profit or (loss) from sales of inventory (attach schedule) (subtract line 10b from line 10a) Other revenue (from Part VII, line 103) , . assets or fund ba'la at r yes~ MU M or assets or fund bala Rqci~~'liql'~~l~otij e~ fee 1rJVVG1~1 W ~ instructions . s a 5 187, 867 1,571 sa 9c 10c 11 12 14 15 16 17 ., , . . . . . 0 6c 7 13 Program services (from line 44, column (B)) . . Management and general (from line 44, column (C)) Fundraising (from line 44, column (D)) Payments to affiliates ~ta~.~~^""~ ed ule) " act line 17 from line 12) , ~ning of year (from line 73, column (A)) balances (attach explanation) 7d 2 18 19 20 189,438 181, 917 3, 844 185,761 4,0 // 151,424 Form 990 (2003) 11 Fomi990'(2003j uz r~q=,j,NE SS ASSOCIATION OF BLS Statement of Part 11 DO not include amounts reported 011 line 6b 8b9b 10b or 16 Of Part I . 22 Grants and allocations (attach schedule) . . . . . . . . . . . . . . . . . (cash $ noncash $ ; ) 23 24 25 Compensation of officers, directors, etc. (C) Management (D) Fundraising and general 26 27 .. . .. . _ . ... . . . ,. . .. 29 Payroll taxes . . . . . : . . . : . . . . ._ . . . . . . 30 Professional fundraising fees . . , 28 29 .. 30 . . . . . . . . . . . :. . . . . . . . . . . _ .: . . . ._ . . . .. . 34 35 . ... . . ... . .... . . ... . , . ... _ . ~~~ . , .~ . . . ... 36 37 38 41 Interest 42 Depreciation, depletion, etc . (attach schedule) . . . . . . . 43 Other expenses not covered above (itemize) :a . . . .. .. . . . . 40 41 42 43a 37 Accounting fees . . . . . . ._ . 32 Legal fees 33 Supplies . . . . . . . . . . . ~ ~ Telephone . : . . . . . : . : . . . . . . . . . . . . Postage and shipping : . . . _ , . . . . . . Occupancy . . . . . : . . . . . . . . . . . . : . . . Equipment rental and maintenance Printing and publications services 25 . . . . . . .~ .~~ .~~ . 27 Pension plan contributions 34 35 36 37 38 Pale 2 22 24 Benefits paid to or for members 26 Other salaries and wages (B) Program (A) Total 23 Specific assistance to individuals 28 Other employee benefits 52-1780669 Ail organizations must complete column (A). Columns (B), (C), and (D) are required for section 501(c)(3) and (4) organizations 31 32 2, 200 33 39 Travel 40 Conferences, conventions, and meetings . . . . . . . . . . . . . . b, : See. .Statement . .1 . ._ . . . ._ . . . . . . . . . . . . c 148 823 186 186 1 , 998 39 710 710 43n 179,696 179,061 635 185,761 181,917 3 , 844 43c 43d e 43e comp leting columns B D , ca these totals to lines 13-15 Joint Costs. Check 1 if you are following SOP 98-2 . 971 11998 d 44 Total functional expenses (add lines 22 - 43). Organizations 2,200 44 Are any joint costs from a combined educational campaign and fundraising solicitation reported in (B) Program services? . . . . . . . . . . . If "Yes," enter (i) the aggregate amount of these joint costs$ 110- ; (ii) the amount allocated to Program services $ CH I) the amount allocated to Management and generaQ 0 Yes , No ; and (iv) the amount allocated to Fundraisinq$ Statement ofProgram Service Accom Program Service Expenses What is the organization's primary exempt purpose? 1 FITNESS CENTER FOR. .EMPLOYEES OF BLS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (Required for 501(c)(3) 8 All orgarnzations must~describe fheir~exem pf purpose achievements in a~clea~ and concise~manner . S (a) orgs ., & 4947(a)(1) of clients served, publications issued, etc. Discuss achievements. that are not measurable . (Section 501(c)(3) and (4) ousts; but optional for a See Statement 2 b c d e Other program services (attach schedule) _ (Grants and allocations $ (Grants and allocations $ (Grants and allocations $ (Grants and allocations $ $ (Grants and allocations f Total of Program Service Expenses (should equal fine 44, column (S), Program services) . . . . . . . . . . . . . . . . .. . . . . . . . . . . . . DAA 1 181 .917 1 ) 1 181,917 Fog 990 (2oos) FAB 05107/2005 5:02 PM Form 990 (2003) Part 1V Note : A s s e t s Accounts receivable Less : allowance for doubtful accounts 48a b 49 50 Pledges receivable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 48a Less : allowance for doubtful accounts 48b Grants receivable . . . . . .. . . .. . Receivables from officers, directors, trustees, and key employees (attach schedule) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Other notes and loans receivable (attach schedule) 51a Less : allowance for doubtful accounts . . . . . . . . . . 51b Inventories for sale or use ... Prepaid expenses and deferred charges . . . . . . . . . . . . . .. . . . .. ... Investments-securities See Stmt 3. . . . 1 []cost 7 . FMV Investments-land, buildings, and equipment : basis . _ . , , _ . . . . . . . . . . . . . . . . , , . . . . . . . . 55a Less : accumulated depreciation (attach schedule) SSb Investments-other (attach schedule) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Land, buildings, and equipment : basis 57a Less: accumulated depreciation (attach schedule) 57b Other assets (describe 1 ) 51a b 52 53 54 55a s 59 60 61 62 63 64a b 65 Page 3 Balance Sheets (See page 25 of the instructions .) 47a b 58 i 52-1780669 45 46 56 57a b i ASSOCIATION OF BLS Where required, attached schedules and amounts within the description column should be for end-of-year amounts only. Cash-non-interest-bearing Savings and temporary cash investments b a FITNESS (A) B eginning of ear 140 120,612 47a 47b Total assets add lines 45 throu gh 58 must e q ual line 74 . . . . . . . . . . . . . . . . . . . . . . . Accounts payable and accrued expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Grants payable . . . . . . . ., . ._ . . . ._ . . . . . . . . . Deferred revenue Loans from officers, directors, trustees, and key employees (attach schedule) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Tax-exempt bond liabilities (attach schedule) . Mortgages and other notes payable (attach schedule) Other liabilities (describe 1 ) (B) End of ear 45 46 140 123,089 47c 48c 49 50 51c 52 53 30,672 54 31,872 55c 56 57c 58 151,424 59 60 61 62 155,101 63 64a 64b 65 0 66 66 Total liabilities add lines 60 throug h 65 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Organizations that follow SFAS 117, check here 1 UX and complete lines . 67 through 69 and lines 73 and 74 . 151,424 67 67 unrestricted e u 68 Temporarily restricted . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 68 t n 69 Permanently restricted 69 q Organizations that do not follow SFAS 117, check here 1 ~ .and s B complete lines 70 through 74 . s a 70 Capital stock, trust principal, or current funds . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 70 e I Paid-in capital surplus, or land, building, and equipment fund 71 71 or t a 72 Retained earnings, endowment, accumulated income, or other funds . 72 s n .. . . . . . .. . . . . 73 Total net assets or fund balances (add lines 67 through 69 or lines 70 through 72 ; column (A) must equal line 19 ; column (B) must equal line 21) . . . . . . . . . . . . . . . . . . . 151, 424 73 74 Total liabilities and net assets 1 fund balances add lines 66 and 73 . . . . . . . . . . . . . 151,424 74 Form 990 is available for public inspection and, for some people, serves as the primary or sole source of information about a particular organization . How the public perceives an organization in such cases may be determined by the information presented on its return . Therefore, please make sure the return is complete and accurate and fully describes, in Part III, the organization's programs and accomplishments . DAA 0 155,101 155,101 155,101 _a+ vI iaWJ J.VL r- ' LESS ASSOCIATION OF BLS Reconciliation of Revenue per Audited Financial Statements with Revenue per Return See page 27 of the instructions. Part IV-A `' a Total revenue, gains, and other support per aucUted financial statements 1 b Amounts included on line a but not on line 12, Form 990 : (1) Net unrealized gains on investments $ (2) Donated services and use a 189,43 8 52-17801 Part IV-B ; Reconciliation of Expenses per Audited Financial Statements with Expenses per Return a b e a . . . . . . . . ... $ Add amounts on lines (1) through (4) " b 185,7 61 (4) Other (specify): E Add amounts on lines (1) through (4) 1 c d R (1) Donated services and use of facilities $ (2) Prior year adjustments reported on line 20, . Form 990 $ (3) Losses reported on line 20, Form 990 $ of facilities $ (3) Recoveries of prior year grants $ (4) Other (specify): . Total expenses and losses per audited financial statements Amounts included on line a but not . on line 17, Forth 990: 4 Line a minus line b Amounts included on line 12, Form 990 but not on line a: (1) Investment expenses not included on line 6b, Form 990 $ (2) Other (specify : Add amounts on lines (7) and (2) . . . Total revenue per line 12, Form 990 1 b c - 189, 438 c d Line a minus line b Amounts included on line 17, R c 185,761 Form 990 but not on line a : (1) Investment expenses not included on line 6b, Form 990 $ (2) Other (specify) : 1 d e Add amounts on lines (1) and (2) . . . 1 Total expenses per line 17, Form 990 d 189, 438 185,761 line c plus line d . . . . . . . . . . .. . . . . . . 1 e line c plus line d) . . . . . . . . 10. e Part V ` List of Officers, Directors, Trustees, and Key Employees (List each one even if not compensated; see page 27 of (u~ ~vonmo, to (S) Title and average (C) Compensation (E) Expense hours per week devoted to (If not paid, enter plans "&edefereedt account and other position -p-, allowances cc Dense ion J . COLEMAN PRESIDENT WASHINGTON DC 3 0 0 0 R . ULICS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ACTING PRES . WASHINGTON .DC 3 0 0 0 A . LOMBARDOZZI TREASURER WASHINGTON DC ~~ 3 0 0 0 J FORD SECRETARY WASHINGTON DC 2 0 0 0 K . MCNALLY DIRECTOR WASHINGTON DC 1 0 0 0 C . ROWAN DIRECTOR . . . . .. . . .. . . . .. . .. .. . . . . .. . . ... . ... . . ... . . 1 0 O O VdASHINGTON .DC . K . DONAHUE . . : . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . DIRECTOR 1 O O O .WASHINGTON .DC A. WALTER DIRECTOR 1 WASHINGTON DC 0 0 0 M . SWARTZ . DIRECTOR 1 0 O O . . . . . . . . . . . . . . . . . .-. . . . . . . . . . . . . . . . . . . . . . . WASHINGTON .DC (A) Name and address . organization and all related organizations, of which more than $10,000 was provided by the related organizations? If "Yes," attach schedule-see page 28 of the instructions. DAA 1 a Yes X~ No Form 990 (2003) FAB 05/0712005 5:02 PM Form 990 2003 FITNESS ASSOCIATION OF BLS Part V1 Other Information See page 28 of the instructions . 76 77 78a b 79 80a b Bia b 82a b 83a b 84a b 85 b c d e f g h 86 b 87 b 88 89a b c d 90a b 91 92 DAA 52-1780669 Did the organization engage in any activity not previously reported to the IRS? If "Yes," attach a detailed description of each activity Were any changes made in the organizing or governing documents but not reported to the IRS? If "Yes, ." attach a conformed copy of the changes . Did the organization have unrelated business gross income of $1,000 or more during the year covered by this return? . . , . . . ., _ If "Yes," has it filed a tax return on Forth 990-T for this year? . . . . . . . . . _ . . . . . . . . . . . . _ . . . . . . _ . . . . _ . . . . . . . . . . . . . . . . . . ,. . . . . , . . . . . Was there a liquidation, dissolution, termination, or substantial contraction during the year? If "Yes," attach a statement Is the organization related (other than by association with a statewide or nationwide organization) through common membership, governing bodies, trustees, officers, etc ., to any other exempt or nonexempt organisation? . . . . . . . . . . . . . . . . . . . . . . . . . If "Yes," enter the name of the organization 1 . . . . , . . . . , . . . . . . . , . . . and check whether it is ~ . exempt or ''nonexempt . Enter direct and indirect political expenditures . See line 81 instructions , _ . , . . . . . . . . . , . . . . . _ . . , . . . 81a Did the organization file Form 1120-POL for this year? . . . . . . . . . . . . . Did the organization receive donated services or the use of materials, equipment, or facilities at no charge or at substantially less than fair rental value? If "Yes," you may indicate the value of these items here . Do not include this amount as revenue in Part I or as an expense in Part II . (See instructions in Part III .) . SAe Stl~lt 4 100,000 82b Did the organization comply with the public inspection requirements for returns and exemption applications? Did the organization comply with the disclosure requirements relating to quid pro quo contributions? Did the organization solicit any contributions or gifts that were not tax deductible? If "Yes," did the organization include with every solicitation an express statement that such contributions or gifts were not tax deductible? N/A 501(c)(4), (5), or (6) organizations . a Were substantially all dues nondeductible by members? Did the organization make only in-house lobbying expenditures of $2,000 or less? _ , . ._ . . . . . If "Yes" was answered to either 85a or 85b, do not complete 85c through 85h below unless the organization received a waiver for proxy tax owed for the prior yeas Dues, assessments, and similar amounts from members 85c Section 162(e) lobbying and political expenditures 85d Aggregate nondeductible amount of section 6033(e)(1)(A) dues notices . . . . . . . . . , . , , . . . . . , . . . . . . 85e Taxable amount of lobbying and political expenditures (line 85d less 85e) . . . . ,,._. 85f Does the organization elect to pay the section 6033(e) tax on the amount on line 85f? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . If section 6033(e)(1)(A) dues notices were sent, does the organization agree to add the amount on line 85f to its reasonable estimate of dues allocable to nondeductible lobbying and political expenditures for the following tax year? 501(c)(7) orgs . Enter : a Initiation fees and capital contributions included on line 12 86a Gross receipts, included on line 12, for public use of club facilities . .' . . .. . .. . ' . . 86b 501(c)(12) orgs . Enter : a Gross income from members or shareholders. . . . . . . . . . . . . . . . . . . . . . . . 87a Gross income from other sources. (Do not net amounts due or paid to other sources against amounts due or received from them .) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 87b At any time during the year, did the organization own a 50% or greater interest in a taxable corporation or partnership, or an entity disregarded as separate from the organization under Regulations sections 301 .7701-2 and 301 .7701-3? If "Yes," complete Part IX 501(c)(3) organizations . Enter: Amount of tax imposed on the organization during the year under: section 4911 1 ; section 4912 1 ; section 4955 1 501(c)(3) and 501(c)(4) orgs . Did the organization engage in any section 4958 excess benefit transaction during the year or did it become aware of an excess benefit transaction from a prior year? If "Yes," attach a statement explaining each transaction Yes Pa e 5 76 77 X X 78a 78b X 79 X 80a X 81b X 82a X 83a 83b 84a X X 84b 85a 85b X X X 8 85h 88 X X 89b Enter : Amount of tax imposed on the organization managers or disqualified persons during the year under 0 sections 4912, 4955, and 4958 1 0 Enter : Amount of tax on line 89c, above, reimbursed by the organization 1 List the states with which acopy ofthis return isfiled 1 . . . . . . . . . . DC ., ._ . . . . . . ., . .__ , . . . ., . . . . . . ., . . . ., ., . . Number of employees employed in the pay period that includes March 12, 2003. (See . . . . . instructions .. .) . . . . . . . . . . . . . . . . . I 90b . . . . . . . . . . The books are in care of 1 MR . A . LOMSARDOZZI located at 1 2 MASSACHUSETTS AVE . , N . E . WASHINGTON, DC Section 4947(a)(1) nonexempt charitable trusts filing Form 990 in lieu of Form 1041- Check here Telephone no. 1 202-691-7$95 ZIP + 4 1 20212 and enter the amount of tax-exempt interest received or accrued during the tax year . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 192 Form 990 (2003) rno va1w ;cwo o.vt nvi r Part Vl'--' 52-1780669 _-Analysis of Income-Producin Activities See page 33 of the instructions . Note : Enter gross amounts unless Otherwise 93 94 95 96 97 Excluded b sec. 512, 513, or 51 (p) tC) xciusior Amount Unrelated business income ' indicated. Program service revenue: (A) Business code - a b c d e f Medicare/Medicaid payments g Fees and contracts from government agencies (B) Amount (E) Related or exempt function code Membership dues and assessments . Interest on savings and temporary cash investments . . . . . . . Dividends and interest from securities Net rental income or (loss) from real estate : a debt-financed property . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . b not debt-financed property . . . . . . . .. . 98 Net rental income or (loss) from personal . . . . .property . . . . . . . . . . ... . .. . . . 99 Other investment income 700 Gain or (loss) from sales of assets .other than .inventory . 101 Net income or (loss) from special events 102 Gross profit or (loss) from sales of inventory . . . . . . . . . . . . . . 103 Other revenue : a 14 income 187,867 1,571 b c d e 4 Subtotal (add columns (B), (D), and (E)) . . . . . . . . . . . . . . . . . . 0 105 Total (add line 104, columns (B), (D), and (E)) . . . . . . . . . . . . . . . . . . . . . . . . . : . Note : Line 105 plus line 1d, Part I, should equal the amount on line 12, Part I . n.. ..a vul Line No. " 94 _s w a_ al'_ w___ 1,571 187,867 1 . .~ .~~ :_L ..~_ .~a `1e ..r a6... 189,438 : ..,.a... . ..a: .. ...,. X Explain how each activity for which income is reported in column (E) of Part VII contributed importantly to the accomplishment of the o anization's exempt pur poses other than b p roviding funds for such purposes ) . OPERATING FITNESS CENTER FOR MEMBERS TO IMPROVE THEIR HEALTH AND FITNESS . Information Regarding Taxable Subsidi address, an( Ad of corporation, nershi , or disre garded entity N/A Percentage of ownershi p intere Nature of activities I Total art X Information Regarding Transfers Associated with Personal Benefit Contracts (See page 34 of (a) Did the organization, during the year, receive any funds, directly or indirectly, to pay premiums on a personal benefit contract? (b) Did the organization, during the year, pay premiums, directly or indirect) Note : If "Yes" to (b) . file Form 8870 and Form 4720 (see instructions) . Under penalties of perjury, I declare that I have examined this return, includi and be ' it is true, collect and comp) . Decl ration of preparer (other th Please ' Sign Here . ign tof offi r ~Q.P1lZ l' ("0 Ie/YI" ~ . Are -~ / ' Type or tint name and title Paid - signature / Preparer's Firm's game (or yours Use Only if self-employed), address, and ZIP + 4 DAA ~u -129 / "ep h E : Godbout 12 Wayne Ave ilver Snrina . MD E Yes IXI No FAB 0211412005 8:15 PM Form 8868 Application for Extension of Time To File an Exempt Organization Return (December 2000) Department of the Treasury OMB No . 1545-1709 Internal Revenue Service 1 File a sepa rate a pplication for each return. 40 If you are filing for an Automatic 3-Month Extension, complete only Part I and check this box 19 If you are filing for an Additional (not automatic) 3-Month Extension, complete only Part II (on page 2 of this form) . Note : Do not complete Part II unless you have already been granted an automatic 3-month extension on a previously filed Form 8868 . Part I Automatic 3-Month Extension of Time- Only submit original (no copies needed) Note : Form 990-T corporations requesting an automatic 6-month extension-check this box and complete Part I only . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . All other corporations (including Form 990-C filers) must use Form 7004 to request an extension of time to file income tax returns . Partnerships, REMiCs and trusts must use Form 8736 to request an extension of time to file Form 1065, 1066, or 1041 . Type or Name of Exempt Organization Employer identification number print File by the due date for filing your return . See instructions . 52-178066 FITNESS ASSOCIATION OF BLS Number, street, and room or suite no. If a P .O . box, see instructions. 2 MASSACHUSETTS AV'ENZJB, N .B . G-45 City, town or post office, state, and ZIP code . For a foreign address, see instructions . WASHINGTON DC 20212 Check type of return to be filed (file a separate application for each return) : Form 990 Form 990-T (corporation) Form 990-BL Form 990-T (sec . 401(a) or 408(a) trust) Form 990-EZ Form 990-T (trust other than above) Form 990-PF " Forth 1041-A , . . ,~ Form 4720 '~; Form 5227 Form 6069 ~ ._ . ,. Forth 8870 If the organization does not have an office or place of business in the United States, check this`box . . . . . . .. . . . . , . .. . , .. .... If this is for a Group Return, enter the organization's four digit Group Exemption Number (GEN~~a ~7 . If -t-h--is is . . . . . . . . . . . . for the whole group, check this box 1 0 . If it is for part of the group, check this box 1 ~ arrci attach a list with the names and EINs of all members the extension will cover . 1 I request an automatic 3-month (6-month, for 990-T corporation) extension of time until - 5 / 16 / 05 to file the exempt organization return for the organization named above . The extension is for the organization's return for : 1 calendar year or 1 ~ tax year beginning 10 / 01 / 03 , and ending - 9 / 30 / 04 . 2 If this tax year is for less than 12 months, check reason: 3a If this application is for Forth 990-BL, 990-PF, 990-T, 472, or 6069, enter the tentative tax, less any nonrefundable credits . See instructions If this application is for Form 990-PF or 990-T, enter any refundable credits and estimated tax payments made . Include any prior year overpayment allowed as a credit Balance Due . Subtract line 3b from line 3a. Include your payment with this form, or, if required, deposit with FTD coupon or, if required, by using EFTPS (Electronic Federal Tax Payment System) . See b c instructions . . .. _ ... . 1 L 0 Initial return 0 Final return Signature and Verification . ._ ~ Change in accounting period $ $ ., . ... .. $ Under penalties of perjury, I declare that I have examined this form, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct, and complete, and that I am authorized to prepare this form . 7 ~- s. Signature Title t L ,~f For Paperwork btedu ion Act Notice, see Instruction DAA s~'SE?4i F. G0D6OUT 1172 YrRYNE AVENUE SILVER SPRING, MARYLAND 20916 Date 002/14/05 Form 8868 (12-2000) FAB FITNESS ASSOCIATION OF BLS 52-1780669 Federal FYE: 9/30/2004 5/7/2005 5 :02 PM Statements Statement 1 - Form 990, Part 11, Line 43 - Other Functional Expenses Total Expenses Description Expenses DC TAXES BANK SERVICE CHARGES MANAGEMENT FEES GROUP EXERCISE INSTRUCTION PROMOTIONAL EXPENSES INSURANCE-GENERAL LIABILITY SOFTWARE STAFF AWARDS YOGA AND PILATES INSTRUCTIONS SMALL EQUIPMENT PURCHASED MUSIC AND LICENSING FEES Total $ $ Program Service $ 602 33 148,712 12,266 3,213 2,344 1,200 968 9,358 514 486 . 179,696 $ Mgt & General S 148,712 12,266 3,213 2,344 1,200 968 9,35$ 514 486 179,061 .$ FundRaising $ 602 33 635 $ 0 Statement 2 - Form 990 . Part 111, Line a - Statement of Program Service Accomplishments FAB OPERATES A FITNESS CENTER FOR EMPLOYEES OF THE BUREAU OF LABOR STATISTICS AND OTHERS TO PROMOTE GOOD HEALTH AND FITNESS AMONG ITS APPROXIMATELY 800 MEMBERS AND OTHERS WITH GYM EQUIPMENT AND EXERCISE PROGRAMS . 1-2 FAB FITNESS ASSOCIATION OF BLS Federal 52-1780669 FYE : 9/30/2004 Statements 5/7/2005 5 :02 PM Statement 3 - Form 990, Part IV. Line 54 - Investments in Securities Description US and State Government U .S . SAVINGS BONDS Beginning of Year 30,672 30,672 End of Year 31,872 31,872 Basis of Valuation Market 3 FAB FITNESS ASSOCIATION OF BLS 52-1780669 federal FYE: 9/30/2004 5/7/2005 5:02 PM Statements Statement 4 - Form 990 . Part VI, Line 82b - Donated Services DONATED GYM SPACE Total Description $ Amount 100,000 100,000 4 --00000-FITNESS ASSOCIATION OF BLS WASHINGTON, D.C. CASH BASIS FINANCIAL STATEMENTS September 30, 2004 and September 30, 2003 --00000-- -00000-CONTENTS Independent Auditor's Report . . .. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. . . :; . . . . .. .. . . . .:. . . . . . . . . . . . . . . . . . . . . . :Page 3 Statements of Financial Position Arising From Cash Transactions (Comparative) . . . .. .. . . . .. .. . . . . . . . . . . . . : . . . .. . . . . . . . . . . . . . . .. .. . . . . . . . . . . . ., . . . . . . . . . . . . . . . . : . . . . . 4 Statements of Activities - Cash Basis and Changes in Cash Balances (Comparative) . . . . . . .. . . . . .. .. . . . . . . . . . . . . . . . . . . . . . .. .. . . . . . . . . . . .. . . . . . . . . .. .:. . . . . . . . . . . . . . . . . . . . . . . . . . . . .. . . . .5 & 6 Notes to Financial Statements . . . . . . . . . . . . . . .. . . . . . . . . . . . . . . . . . . . . . . . . .. . . . . . . . . . . . . . . . . :. . . . . . : . . . . .. . . . . 7 8y 8 --00000-- JOSEPH E. GODBOUT CERTIFIED PUBLIC ACCOUNTANT 1112 WAYNE AVENUE SILVER SPRING, MARYLAND 20910-5601 TELEPHONE: 301 . 588 . 4555 FAX: 301 . 588 . 9044 joegcpe0erols.com INDEPENDENT AUDITOR'S REPORT Officers and Board of Directors Fitness Association of BLS Washington, D .C . I have audited the accompanying statements of financial position arising from cash transactions of Fitness Association of BLS (FAB) (a District of Columbia corporation and a section 501(c) (4) non-profit local association of employees for recreational purposes) as of September 30, 2004 and September 30, 2003, and the related statements of activities - cash basis and changes in cash balances for the years then ended. These financial statements are the responsibility of the management of Fitness Association of BLS . My responsibility is to express an opinion on these financial statements based on my audits. I conducted my audits in accordance with generally accepted auditing standards . Those standards require that I plan and perform the audits to obtain reasonable assurance about whether the statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation . I believe that my audits provide a reasonable basis for my opinion . The organization's policy is to prepare its financial statements on the basis of cash receipts and disbursements, -which is a comprehensive basis of accounting other than generally accepted accounting principles ; consequently, certain revenue is recognized when received rather than when earned, and certain expenses are recognized when paid rather than when the obligation is incurred . Accordingly, the accompanying statements are not intended to present the financial position or the changes in members' equity in conformity with generally accepted accounting principles. In my opinion, the financial statements referred to above present fairly, in all material respects, the assets arising from cash transactions of Fitness Association of BLS at September 30, 2004 and September 30, 2003, and the cash received and expenditures made and changes in cash balances for the years then ended on the cash basis of accounting as described in the preceding paragraph . JOSEPH E. GODBOUT Certified Public Accountant Silver Spring, Maryland December 14, 2004 FITNESS ASSOCIATION OF BLS STATEMENTS OF FINANCIAL POSITION ARISING FROM CASH TRANSACTIONS September 30, 2004 with comparative figures for September 30, 2003 ASSETS Current Assets : Cash in checking account Cash in DOL Credit Union Cash in equipment fund savings account Petty cash fund Card key petty cash Cash in certificates of deposits United States Series EE Bonds, at cost, plus accrued interest (cost $30,000) Noncurrent Assets: (Note A) Total Assets 2004 2003 $26,861 31,770 2 100 40 64,456 $34,459 -021,903 100 40 64,250 31,872 155,101 30,672 151,424 NONE NONE 155 101 15I 424 LIABILITIES AND NET ASSETS Liabilities : Account payable, equipment CASH BASIS Net Assets : Members' equity - cash basis Total Liabilities and Net Assets The acro $ 155 , 101 $ 151 ,424 15S 101 151 424 intes are an integral part of these financial statementsPage 4 FITNESS ASSOCIATION OF BLS STATEMENTS 4F ACTIVITIES - CASH BASIS AND CHANGES IN CASH BALANCES for the year ended September 30, 2004 with comparative figures for the year ended September 30, 2003 2004 Receipts: BLS payroll deductions Non-BLS payments BLS full payments Lockers Initiation fees Interest income Service/late/lost ID fees Class fees Advance payroll deduction fees Short-term fees Incidental income Card key deposits Total Receipts Disbursements: Program Services Management fees Group exercise instruction Fitness equipment purchased Promotional expenses Insurance - general liability Equipment maintenance Software Staff awards Training and travel Yoga and Pilates instructions Group exercise and yoga supplies Small equipment purchased Music and licensing fees Total Program Services Disbursements Page 5 ' 2003 $116,768 40,240 5,800 7,825 2,830 1,571 1,864 10,707 488 185 665 495 $120,736 43,640 6,025 7,635 3,586 2,373 2,029 10,596 808 420 948 560 189,438 199,356 148,712 12,266 -03,213 2,344 1,998 1,200 968 710 9,358 148 514 486 143,805 10,486 3,332 2,363 2,416 2,348 1,200 3,319 455 9,049 167 495 -0- 181 .917 179,435 Supporting Services Annual audit Theft loss Office expenses Insurance - employee dishonesty Postage Taxes Bank services charges/ printing checks Total. Supporting Services Disbursements Total Disbursements EXCESS OF RECEIPTS OVER DISBURSEMENTS Cash at beginning of year Cash at end of year 2004 2003 $ 2,204 -0823 -0186 602 33 3,844 $ 2,000 1,007 863 i ;293 394 835 $6 6,478 185,761 185,913 3,677 13,443 151,424 137,981 101 The accompanying notes are an integral part of these financial statements. Page 6 ` FITNESS ASSOCIATION OF BLS NOTES TO FINANCIAL STATEMENTS September 30, 2004 and September 30, 2003 Note A. Summary of Significant Accounting Policies 1 . Fitness Association of BLS (FAB) prepares its financial statements on the cash basis of accounting; consequently, certain revenue is recognized when received rather than when earned, and certain expenses are recognized when paid rather than when the obligation is incurred. Accordingly, the accompanying statements are not intended to present the financial position or the changes in members' equity in conformity with generally accepted accounting principles . 2 . Any famed assets purchased by FAB become the property of The Bureau of Labor Statistics in accordance with the terms of the facilities agreement in Note E below . 3 . Membership dues are recognized as income in the year in which they are received. Note B. Organization Fitness Association of BLS (FAB) is a non-profit District of Columbia corporation formed to provide an opportunity for Bureau of Labor Statistics employees and others to improve their general health through the use of a physical fitness facility and related programs and activities : FAB is open to all BLS employees, BLS contractors, BLS interns, and Federal employees within close proximity to the Postal Square Building. FAB's primary source of income is from membership dues : The organization served approximately 800 members and other gym users in 2004 and 2003. Note C. Income Taxes The corporation is a Section 501(c) (4) Local Association of Employees for Recreational Purposes and as such is exempt from both Federal and D .C . income taxes under the Internal Revenue Service Code and D .C. Income Tax Rules . Page 7 y Note D. Expenses for Program Services Expenses for program services have been charged with direct costs only, and do not include overhead costs which may be associated with these functions. Note E. Facilities FAB is provided gym space, locker facilities, and almost all of its fitness equipment free of charge by The Bureau of Labor Statistics (BLS) under an agreement dated September 14, 1992 . Under the terms of this agreement, BLS will maintain the facility which will be operated by FAB . FAB will maintain the equipment and bear the cost of any repairs to the equipment . FAB, at its discretion ; may purchase new equipment and replace individual pieces of equipment which wear out or cannot be repaired . Any new equipment purchased by FAB belongs to BLS: This agreement may be terminated by either party upon ninety days written notice . The equipment furnished to FAB by the BLS is mostly ten years old and it is not practicable to determine its estimated annual value to FAB . It is estimated that the annual value of the free space is around $100,000 per year . Note F. Management Contract FAB contracts with a management company to operate the gym facilities and to conduct aerobics and other classes on physical fitness . This contract may be terminated with 90 days written notice by either party. The terms of this contract call for monthly payments of approximately $12,500 through July 31, 2007 . The approximate minimum amounts payable under this contract as of September 30, 2004 are as follows: September 30, 2005 September 30, 2006 September 30, 2007 (1O months) Page 8 $150,000 150,000 125,000 $425 ,000