The Operating System Network Effect and - Rong Luo

advertisement

The Operating System Network Effect and Carriers’ Dynamic

Pricing of Smartphones in US

Rong Luo

∗

Department of Economics, University of Georgia

October 23, 2015

Abstract

The utility a consumer realizes from owning a smartphone increases with its operating system (OS) network size. Due to their ability to internalize competition across

OSs, telecom carriers choose lower two-year contract prices for smartphones with large

OSs. In this paper, I first analyze a two-period theoretical model to explain the intuition of multi-network carriers’ pricing strategy. Then I design a structural model

of consumer demand and the carrier dynamic pricing game for smartphones, and empirically study the impact of the OS network effect and carriers’ pricing strategy on

the smartphone industry. I estimate the model using product level data from August

2011 to July 2013 in the US. I deal with the empirical challenges of dynamic prices

for multi-product carriers, high dimension continuous state variables, and asymmetric

oligopolistic firms in the estimation. The estimate of the OS network effect in consumer

utility is both positive and significant. Two counterfactual cases show that both the

OS network effect and the carriers’ differentiated prices contributed to the smartphone

penetration and the OS concentration.

Keywords: OS Network Effect, Carrier Dynamic Pricing Game, Two-Year Contract,

Asymmetric Multi-Network Sellers, Value Function Approximation, MPEC.

∗

Email: rluo@uga.edu

I am very grateful to my advisors Mark Roberts and Paul Grieco for their constant support and very

helpful comments. I would also like to thank Kathleen Nosal, Martin Hackmann, Thomas Jeitschko,

Hiroyuki Kasahara, Kala Krishna, Kenneth Judd, Robin Lee, Huihui Li, Shengyi Li, Charles Murry, Peter

Newberry, Joris Pinkse, Paul Schrimpf, Marc Rysman, Mo Xiao, Hongsong Zhang, and participants in PSU

IO workshop, 13th Annual International Industrial Organization Conference, and CEPR-JIE School and

Conference for their thoughtful comments. All errors are my own responsibility.

1

1

Introduction

In markets with network effects, such as the computer and smartphone markets, consumers

value the size of the installed consumer base. Due to the network effect, the current price

of a product affects its network size and thus future demand. This leads suppliers to make

dynamic pricing decisions, whether the suppliers are single-network sellers or multi-network

sellers. However, in this paper I show that the multi-network sellers choose lower prices

for products with larger networks while single-network sellers do the opposite and that

the multi-network sellers’ pricing strategy leads to high consumer adoption rate and high

network market concentration.

The multi-network sellers’ pricing strategy can be applied to the US smartphone industry. These products are subject to a network effect that arises through the operating

systems for two reasons. First, application stores generate an indirect network effect. Application developers choose to develop more apps for large OSs. In return, more consumers

adopt large OSs because of the greater number and better quality of applications. Second,

there is a direct OS network effect. Friends and family members prefer adopting the same

OS. The benefits of doing so include convenient communication (e.g., FaceTime, iMessage),

as well as ease of sharing files and purchases, and lower learning costs.

Telecom carriers act like multi-network sellers. Each carrier sells products of different

OSs. For example, Verizon sells smartphones with iOS, Android, Blackberry, and Windows

Phone. The carriers offer model specific discounts on smartphone purchases if consumers

sign two-year wireless service contracts. Consumers pay the discounted prices instead of

the manufacturer retail prices. The model specific discounts allow the carriers to internalize

the competition effect across OSs and choose differentiated prices.

Given the background, the goals of this paper are to study the impact of the OS

network effect on the multi-network carriers’ dynamic prices and to measure the impact of

the carriers’ differentiated discounts on the US smartphone market.

To build intuition, I solve a two-period, two-OS theoretical model to compare prices

across OSs in two different settings. In the first setting, one multi-network seller sells

two products with different OS sizes. In the second setting, there are two single-network

sellers, each selling one product. Comparing the two setting, I find that the multi-network

seller chooses a lower price for the large OS than the small OS in the first period while

single-network sellers do the opposite.

The intuition of the difference between the two types of sellers’ pricing strategies is as

2

follows. In a dynamic environment with exclusive product network effects, both types of

sellers would choose low prices to grow the network to attract future customers. However,

they have quite different competitive environments. A single-network seller faces competition from other sellers, and the initial network size of its product determines its market

power. In equilibrium, products with larger initial networks keep their network advantage and have higher prices every period. In contrast, the multi-network seller is able to

internalize the competition effect across networks. It prefers network concentration to competition, because a dominant network can attract more future consumers. Therefore, the

multi-network seller chooses relatively lower prices for initially larger networks to achieve

network concentration.

Based on the intuition above, I then develop a structural model of consumers’ demand

and carriers’ dynamic pricing game for smartphones. I estimate the model using product

level data from August 2011 to October 2013. In the estimation, I deal with several

empirical challenges including dynamic prices of multiple products for each carrier, high

dimension continuous state variables, and asymmetric oligopolistic firms.

The estimation results show that the OS network effect is positive and significant. On

average, 40.79% of a consumer’s utility from purchasing a smartphone comes from the

network effect. This implies that the carriers’ pricing decisions should be dynamic due to

the evolving network sizes and affected by the network sizes.

I study two counterfactual scenarios using the estimates. In the first case, I eliminate

the OS network effect to measure the impact of the OS network effect. I find that, without

the OS network effect, the smartphone penetration rate would decrease by 54.69% and the

largest OS share difference would decrease by 31.66% to the end of October 2013. In the

second case, I eliminate the carrier discounts on two-year contracts. Without the carriers

discounts, the smartphone penetration rate would decrease by 29.06% and the largest OS

share difference would decrease by 11.18%. Thus, both the OS network effect and carrier

discounts are important to smartphone penetration and OS concentration.

The paper proceeds as follows. In Section 2, I discuss the related literature and contribution of this paper. Section 3 provides the background to the US smartphone industry.

In Section 4, I study a simple two-period, two-OS model to compare prices in two different

supply settings. Section 5 sets up the consumer demand and the carriers’ supply model

for smartphones with two-year contracts. The data used in this paper is described in Section 6. Section 7 discusses identification and estimation details. The estimated results are

presented in Section 8. Section 9 shows the two counterfactual analysis results. Section 10

3

concludes the paper.

2

Literature Review

The main contribution of this paper is to empirically study the impacts of a network effect

on the prices charged by multi-network retailers. Neither the theoretical literature nor

the empirical literature has studied this topic. Theoretical research on the network effect

has focused on the competition between single-network sellers, but not the prices of multinetwork sellers. Katz and Shapiro (1985), Farrell and Saloner (1986), Katz and Shapiro

(1992), Katz and Shapiro (1994), Shapiro and Varian (1999), Rochet and Tirole (2003),

Armstrong (2006), Zhu and Iansiti (2007), Rysman (2009), and Weyl (2010) all study the

impact of the network effect on the prices of either monopolistic or oligopolistic sellers. In

this paper, I focus on the network effect’s impact on multi-network sellers’ prices, which is

shown to be different from the impact on single-network sellers’ prices.

The empirical literature also focuses on markets in which manufacturers choose prices.

This includes papers that study the network effect in the video game industry (Zhu and

Iansiti (2007), Lee (2013), Dubé, Hitsch, and Chintagunta (2010)), the DVD player industry

(Gowrisankaran, Park, and Rysman (2010)), the VCR industry (Park (2004)), the yellow

page industry (Rysman (2004)), the ACH banking industry(Ackerberg and Gowrisankaran

(2006)), video calling technology (Ryan and Tucker (2012)), and the PDA industry (Nair,

Chintagunta, and Dubé (2004)). In all these markets, manufacturers sell products directly

to consumers. In this paper, I focus on the impact of the network effect upon carrier prices

across different OSs.

This paper makes a further contribution by estimating a structural model of dynamic

pricing with asymmetric multi-network carriers. I deal with several empirical challenges

including dynamic prices of multiple products, high-dimension continuous state variables,

and asymmetric oligopolistic firms.

Aguirregabiria and Mira (2007), Pakes, Ostrovsky, and Berry (2007), Kasahara and

Shimotsu (2012) have proposed estimation methods for dynamic discrete choice games.

Bajari, Benkard, and Levin (2007) propose a two-step method that can estimate dynamic

games with continuous choices. Their first step estimates the policy functions and the

second step estimates the model’s parameters using simulated minimum distance estimator.

The two-step method requires monotonicity of the policy functions on shocks and linearity

of the value functions in the model’s parameters. These requirements make the method

4

not applicable to this paper because it is hard to prove monotonicity of policy functions

and the value function is nonlinear in this paper. In addition, without a sufficiently large

number of observations in my data, noise could arise in the first step.

Several papers have studied the dynamic pricing problems of single-product firms. Liu

(2010) and Dubé, Hitsch, and Chintagunta (2010) analyze the dynamic decisions of two

oligopolistic video game console manufacturers. They assume parametric forms of the

policy functions instead of solving for equilibrium. Goettler and Gordon (2011) analyze

the investment and dynamic pricing problem of two single-product microprocessor firms.

Sweeting (2012) tests how accurately dynamic pricing models describe sellers’ behavior in

secondary markets for event tickets. Benkard (2004) use static estimates to solve a dynamic

oligopoly model with four single-product aircraft firms.

With a small number of single-product firms, the dynamic problem could be solved

with value function iteration or policy function iteration. But when there are many firms

and each firm has many products, previous methods are not applicable due to the high

dimension choice space (prices of many products).

Instead, I solve the multi-network carriers’ dynamic pricing game in the estimation. In

particular, I approximate the carriers’ value functions with basis functions and develop an

efficient iterative method to solve the dynamic pricing game. I estimate the model using

Generalized Methods of Moments (GMM) with MPEC, which was introduced by Su and

Judd (2012). The moment conditions are based on the orthogonality between unobserved

shocks and instrumental variables. The carriers’ Bellman equations are constraints on the

value function approximation. The approximation method is motivated by the sieve estimation literature.Ai and Chen (2003) propose a minimum distance estimator with sieve

approximation and show its efficiency. Barwick and Pathak (2011) also use sieve approximations to solve a dynamic maximization problem.

This paper also contributes to the literature on the smartphone industry literature.

Parker and Van Alstyne (2010) analyze innovation and the platform openness control. Zhu,

Liu, and Chintagunta (2011) and Sinkinson (2011) study the incentives and the effects of

the exclusive contracts between Apple and AT&T. Kim (2012) focuses on variations in

consumers’ adoption of mobile apps across different OSs. Boudreau (2012) discusses app

developers’ innovation patterns. Bjorkegren (2014) estimates consumers’ dynamic demand

for mobile phones. Bresnahan, Orsini, and Yin (2014) model and estimate mobile app

developers’ OS platform choice. In this paper, I study the impact of the carrier two-year

contract discounts.

5

3

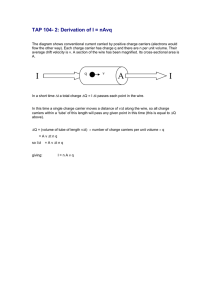

A Two-Period, Two-OS Model of Pricing

In this section, I study a two-period, two-OS demand model and compare two supply

settings to explain the intuition of a multi-network seller’s pricing strategy, which helps to

understand the telecom carriers’ pricing decisions of smartphones.

3.1

Demand Model Setup

There are two smartphone models, A and B, in a two-period economy. The two models

have different operating systems, which are also denoted by {A, B}. Let δj , j ∈ {A, B},

be the consumer utility from the characteristics of model j. Let the market shares of the

two OSs be (nAt , nBt ) at the beginning of period t.

Assumption 1. Without loss of generality, assume that network A has a higher market

share than B in period 1: nA1 > nB1 and that a positive OS network effect exists: γ > 0.1

Assumption 2. The two models have the same characteristics, δA = δB , and the same

unit cost, c = 0.2

Assumption 1 and 2 apply to the rest of this section. Assumption 2 means that the

only difference between A and B lies in their network sizes, so I focus on the network

size effect in this model. Let the total mass of consumers be 1. In each period, only

consumers who do not own smartphones enter the market. So the market size in period t

is Mt = 1 − nAt − nBt .

Consumer i’s utility of buying smartphone j ∈ {A, B} in period t is:

uijt = δj + γnjt − αpjt + ijt ,

in which njt is the share of OS j among all consumers at the beginning of period t; pjt is

the carrier’s smartphone price in period t; ijt is the idiosyncratic utility shock of option

j ∈ {0, 1, 2} in period t; and γ and α are marginal utility of the OS network size and price.

An outside option, not to buy any smartphone, exists in each period. Let the mean

utility of the outside option be zero. Consumer i’s utility of the outside option is ui0t = i0t .

1

There are many reasons that one OS has a higher share than the other. Different OSs may enter

the market in different years. Their companies may have different demand and supply shocks. Different

operating systems may have different openness towards smartphone manufacturers.

2

By normalizing costs to be zero, the prices in this section can be interpreted as markups that the carrier

earns. When the costs are not zero, choosing prices is equivalent to choosing markups.

6

Assume that the utility shock ijt follows a Type-I extreme value distribution and is i.i.d.

across consumers, models, and periods. Then the sales market share of model j in period

t is

sjt =

1+

e(δj +γnjt −αpjt )

.

(δk +γnkt −αpkt )

k=A,B e

P

(1)

An OS network grows due to the new sales of smartphones. At the beginning of the second

period, the market share of OS j ∈ {A, B} is

nj2 = nj1 + M1 sj1 .

(2)

Therefore, the market size in the second period is M2 = 1 − nA2 − nB2 = M1 s01 , where s01

is the market share of the outside option in the first period. The market size in the second

period is the measure of consumers who do not buy smartphones in the first period.

3.2

The First Supply Setting: A Multi-Network Seller

Suppose that one seller sells both models and chooses prices in both periods to maximize

the total discounted profits. The dynamic pricing problem can be solved backwards. The

OS market shares at the beginning of the second period are n2 = (nA2 , nB2 ). The seller’s

profit in the second period is:

π2 (pA2 , pB2 |n2 ) = M2 (sA2 (p2 , n2 )pA2 + sB2 (p2 , n2 )pB2 ).

Denote the maximum profit by π2∗ (nA2 , nB2 ). In the first period, the seller’s profit maximization problem is:

max {π1 (pA1 , pB1 ) + βπ2∗ (nA2 , nB2 |pA1 , pB1 )},

pA1 ,pB1

(3)

where β is the discount factor. The prices in the first period affects the profit in the second

period because the OS shares (nA2 , nB2 ) are determined by both (nA1 , nB1 ) and (pA1 , pB1 ),

as in equation (2). Optimal prices require that the marginal profits from pAt and pBt to be

zeros. The price pAt affects not only the seller’s marginal profit from model A, but also that

from model B. This implies that the multi-network seller can internalize the competition

between A and B.

The following proposition summarizes the properties of the multi-network seller’s op-

7

∗c

∗c

∗c

timal prices in both periods (p∗c

A1 , pB1 , pA2 , pB2 ), where the superscript c means a multi-

network seller.

Proposition 1. The following statements hold for the carrier’s optimal prices.3

∗c

(1) The price of A is lower than that of B in the first period: p∗c

A1 < pB1 .

c∗

(2) The price difference between the two models |pc∗

A1 − pB1 | increases as the OS network

effect γ increases.

(3) The OS market share difference at the beginning of the second period (nA2 − nB2 )

increases in the OS network effect γ.

The first statement of Proposition 1 says that, when the OS network effect exists, the

multi-network seller chooses a lower price for the larger network A than for network B in

the first period. The intuition is that, the seller prefers network concentration, so that the

strong network effect of the dominant OS can make consumers to be willing to pay high

prices in the second period.4

The second statement means that price difference between A and B increases with the

OS network effect parameter γ. This is because that the seller’s incentive of choosing a

lower price for A increases with the OS network effect. The third statement says that the

market becomes more concentrated in the large operating system as the network effect

increases. Hence, the multi-network seller’s pricing strategy can contribute to the OS

concentration.

The discount factor makes an impact on the first period prices. Without the dynamic

effect (β = 0), the two products have the same price in both periods, no matter which

product has a larger network. However, when β > 0, then the large network has a lower

price in the first period, pA1 < pB1 . The prices of A and B in the second period are the

same, pA2 = pB2 , whether the problem is dynamic or not.

The OS network effect influences (pA1 , pB1 ) similarly as the discount factor. If there is

no network effect (γ = 0), A and B will have the same price in both periods. In this case,

the seller’s problem is still dynamic, but the OS sizes do not affect pricing. However, if the

network effect exists (γ > 0), the larger network A will have a lower price than B in the

first period because the seller’s second-period profit increases with the OS concentration.

3

The proofs for the propositions in this section are in the Supplemental Material Section A.

The reason for selling products with different OSs by the carriers is because that consumers are heterogeneous. Some consumers might prefer B no matter how large network A is. So the carrier still sells B,

which can increase its profits.

4

8

I derive Proposition 1 using the logit demand model, which is an ideal choice to compare

multi-network seller’s prices in static and dynamic models. A static logit demand model

would predict that the carrier chooses the same price for both OSs.5 So it provides a clear

benchmark when studying the carrier’s incentive in a dynamic model. When moving from

a static model to a dynamic one, the changes in the seller’s pricing strategy reflect the

impact of the dynamic factors, OS network sizes and market size.

Though I consider a monopoly carrier case, the carrier’s pricing strategy in a dynamic

environment carries over to oligopoly carriers who sell the same set of OSs.6 Because the

competition among the carriers doesn’t change their incentive to take advantage of the

initially larger network.

3.3

The Second Supply Setting: Two Single-Network Sellers

To compare pricing strategies, I now consider two single-network sellers who play a dynamic

pricing game in the two periods. Denote the two sellers by {A, B}. Seller j ∈ {A, B} only

sells smartphone j. In this subsection, I use superscript m to denote the single-network

sellers. For seller j, the profit in each period t is

m m

m

m

m

πjt

(pAt , pm

Bt ) = pjt sjt (pAt , pBt )Mt .

The dynamic problem of seller j is

m m

m m

m

m

max

{πj1

(pA1 , pm

{πj2

(pA2 , pm

B1 ) + βmax

B2 |pA1 , pB1 )}},

m

m

pj1

pj2

I solve the game backwards. The following proposition summarizes the properties of the

∗m ∗m ∗m

sellers’ equilibrium prices (p∗m

A1 , pB1 , pA2 , pB2 ).

Proposition 2. The following statements hold for the single-network sellers’ equilibrium

prices.

∗m

(1) The optimal price of A is higher than that of B in both periods: p∗m

At > pBt , for t = 1, 2.

(2) The OS A keeps its network advantage in the second period, though model A is more

expensive in the first period.

5

Because, in the logit model, the cross-derivatives of prices (αsAt sBt ) are symmetric, so are the carrier’s

two first-order conditions, as shown in Supplemental Material A.

6

I show this in Section A.3 in the Supplemental Material.

9

The first statement of Proposition 2 says that, seller A chooses higher prices than B

in both periods. Because seller A has market power due to its initial OS network size

advantage. Suppose that both models have the same price in the first period, then A’s

marginal profit is greater than B’s. So seller A would increase price. In equilibrium, A’s

price is higher than B’s price in the first period. The second statement says that though

A has higher price in the first period, its network size is still larger than B’s in the second

period.

3.4

Comparing the Two Models

Comparing Proposition 1 and Proposition 2, I find that, the two types of sellers choose

different dynamic pricing strategies. The difference is caused by the difference in their

ability to internalize competition effect. The multi-network seller’s pricing strategy results

in higher OS concentration. In Section 5, I set up an empirical model of the consumers’

demand and the carriers’ pricing of smartphones in the US smartphone industry, which

is more general than the two-period, two-OS setting. In the next section, I introduce the

background of the industry.

4

Background of the U.S. Smartphone Industry

The top four operating systems in the U.S. smartphone industry are Android, iOS, Blackberry, and Windows Phone. Their combined market share increased from 94% in 2011 to

99% 2011 in 2014.7 Every smartphone operating system has an online store where applications can be purchased and downloaded to extend the functionality of the smartphone.

There are indirect and direct network effects at the operating system level.8 The apps

on different operating systems are exclusive. The indirect network effect arises through app

development. Consumers find value in apps because of the additional functionality of their

smartphones. The app developers prefer to sell apps through the more profitable large

operating systems. In this way, the indirect network effect exists at the OS level. There

is also a direct OS network effect. Family members and friends prefer adopting the same

OS because they can enjoy convenient communication methods (FaceTime, iMessage) and

7

Cromar (2010) has a thorough description of the US smartphone industry.

I don’t separately model the carriers’ wireless network effect in this paper. But I add the carrier-OS

fixed effects in consumers’ utility function to control for the carrier specific effects, including the wireless

network network.

8

10

easy ways to share files; they can share their app purchases, and there is a lower learning

cost to use an OS.

A consumer has to choose both the smartphone model and the service provider (carrier)

when buying a smartphone. The top four carriers in the U.S. are Verizon Wireless, AT&T

Mobility, Sprint Corporation, and T-Mobile US. They have varying degrees of network

coverage and different prices for wireless service. According to Kantar World Panel data,

the combined share of smartphone sales for the four carriers during Oct. 2011 to Nov.

2013 is 88.72%.

The wireless carriers offer discounts on smartphones if consumers sign two-year service

contracts. For example, Apple’s retail price of the iPhone 5 was $649 in Oct 2012. Consumers could pay $199 to get an iPhone 5 if they sign a contract with AT&T. If consumers

need to end the contract early, they have to pay early termination fees. Depending on

the number of months left in an contract, the termination fee is between $150 to $350.

According to the Statista.com, the average monthly churn rate for the four carriers is 2%

on average.9

The US Wireless Industry Overview 2011 reported that more than 78% of users were

on two-year contracts. This number includes both the non-smartphone and smartphone

subscribers. The percentage is expected to be even higher for smartphones alone because

they are much more expensive without contracts. The data used in this paper is from Aug

2011 to Oct 2013, during which most smartphone users were on two-year contracts. Hence,

I focus on the consumers’ demand for smartphones with two-year contracts in this paper.

5

An Empirical Model of Demand and Supply of Smartphones

In this section, I design a structural model of consumer demand and carrier dynamic pricing

for smartphones with two-year wireless service contracts. There are four leading wireless

carriers, four operating systems, and hundreds of smartphone models. I assume consumers

make static purchase decisions of smartphones and model that with a random coefficient

demand model. Each carrier sold phones with all the four OSs, but the sets of phone

9

Churn rate is the proportion of contractual customers or subscribers who leave a supplier during a

given time period. Data source is from this link: http://www.statista.com/statistics/ .

11

models vary by carrier and over time.10 The carriers play an infinite horizon dynamic

pricing game.11

One challenge in modeling the consumers’ demand for smartphones is that the sales

market shares are observed at the carrier-OS level, not the smartphone model level. Meanwhile, characteristics and prices data are at the model level in my dataset. To deal with

this data challenge and use as much information on prices and characteristics as possible,

I introduce a carrier-OS specific unobserved demand shock. I explain this in detail next.

5.1

Consumer Demand

Each period, consumers who don’t own any smartphone or have ended previous two-year

contracts enter the market. Each consumer chooses one option from the available choice

set to maximize utility. The choice set in period t is Ωt = {(j, s, c, t)}jsc ∪ {(0, t)}, where j

is a smartphone model, s is the operating system of model j, and c is a carrier. An outside

option (0, t) exists, and it means not buying any smartphone. Let Jt be the total number

of models in Ωt .

If a consumer purchases model (j, s, c, t), s/he signs a two-year wireless service contract

with carrier c. Assume that consumer i’s utility of buying the model is:

uijsct = x0jsc βi − αi (pcjsct + fct ) + γNst + ψsc + ξsct + ijsct .

(4)

xjsc is a K × 1 vector of observed smartphone characteristics. pcjsct is the price of the

two-year contract price of the smartphone. fct is carrier c’s price for wireless services in

the two-year contract.12 Nst is the number of users of OS s at the beginning of period t.

ψsc is a dummy for the carrier-OS pair (s, c). It captures the carrier-OS quality that is

constant across periods. ξsct is the carrier-OS level unobserved quality shock in period t.

It represents the quality shocks in both the carrier level and the operating system level.

ijsct is a consumer idiosyncratic utility shock.

The unobserved quality shocks ξsct is assumed to be carrier-OS specific because the

10

AT&T, Verizon, and Sprint all carried the four OS smartphone models from the beginning of the data.

T-Mobile only started to sell iPhone’s in April 2013.

11

In this paper, I focus on the price decisions of the carriers, given the manufacturers’ wholesale prices

being exogenous. I don’t model the manufacturers’ prices in a Stackelberg leader-and-follower framework, in

which the manufacturers choose prices first and then the carriers choose prices. Since I do model the carriers’

wholesale costs paid to the manufacturers, the simplification of the carriers’ problem is not problematic in

terms of model specification and estimation.

12

I assume that the consumer pays the wireless plan price for two years when signing the contract.

12

market share data are at the carrier-OS level. The implication of the assumption is that the

market share variation across different models in the same carrier-OS group is determined

by their observed characteristics and prices, not by their individual unobserved quality

shocks.

Consumers have different income levels and tastes for the smartphone characteristics.

The parameters θi = (βi , αi ) are consumer specific. Let β be the mean of βi over all

consumers and α be the part of αi that is the same for all consumers. Denote them by

θ = (β, α). Consumer i is described by vi = (yi , vi1 , ..., viK ), in which yi is income and

vik s are independent standard normal taste shocks. Assume that vi is independent of the

unobserved quality shock ξsct . Thus,

βi

!

αi

β

=

!

+ Φvi ,

α

in which Φ is a diagonal matrix that measures the impact of vi on θi . Rewrite the utility

function (4) as:

uijsct = δjsct + µijsct + ijsct ,

where

δjsct = x0jsc β − α(pcjsct + fct ) + γNst + ψsc + ξsct ,

µijsct = [x0jsc ; (pcjsct + fct )]0 ∗ Φvi .

The mean utility of the outside option is normalized to zero. Consumer i’s utility of

the outside option is:

ui0t = i0t .

Assume that the ijsct follows a Type-I extreme value distribution and is i.i.d. across

(i, j, s, c, t). Then consumer i’s probability of choosing product (j, s, c) in period t is:

sijsct (vi ) =

e(δjsct +µijsct )

1+

P

j 0 s0 c0 ∈Ωt

e(δj 0 s0 c0 t +µij 0 s0 c0 t )

.

Let Ajsct be the set of consumer characteristics such that j has the highest utility for

consumers in this set. That is, Ajsct = {vi |uijsct (vi ) ≥ uij 0 s0 c0 t (vi ), for all (j 0 s0 c0 t) ∈ Ωt }.

13

Then the market share of product (j, s, c) in period t is:

Z

sjsct =

sijsct (vi )dF (vi ).

(5)

Ajsct

I aggregate the smartphone model shares to carrier-OS levels, which are observed in

the data. Let Ωsct be the set of models with OS s by carrier c in period t. The market

share of the carrier-OS group (s, c) in period t is:

ssct =

X

sjsct .

(6)

j∈Ωsct

5.2

The Carriers’ Dynamic Pricing Model

The carriers play a dynamic pricing game because of the evolving OS network sizes and

market size. In this subsection, I model the carriers’ costs, the market size, and the carriers’

dynamic pricing game for smartphones. Each period, the carriers observe the OS market

shares and choose the two-year contracts prices of smartphones.13

5.2.1

The Carriers’ Unit Costs

A carrier pays a wholesale cost, a service cost, and an unobserved cost shock on each

smartphone model. Carrier c’s wholesale cost of model (j, s, c, t) is the product of a manufacturer wholesale price rate ωj and the manufacturer retail price pm

jsct . ωj is assumed to

be manufacturer specific.14 It captures the manufacturer’s bargaining power against the

carriers.

In addition to the wholesale cost, carrier c also pays a carrier-OS specific monthly

service cost κsc . It includes the costs of selling a phone, maintaining wireless coverage, and

providing customer service. There is also an unobserved cost shock at model level, λjsct .

Hence, carrier c’s unit cost of selling model (j, s, c) in period t is:

cjsct = ωj pm

jsct + 24κsc + λjsct .

13

(7)

The manufacturers may also affect the two-year contract prices of smartphones by negotiating with

carriers. However, a carrier would only sign a price contract with a manufacturer if the negotiated prices

can maximize its long run profit. Therefore, the carriers are indirectly choosing the two-year contract prices

even if there are vertical contracts between manufacturers and carriers.

14

The wholesale discount might be a function of the OS shares. Intuitively, the manufacturers’ wholesale

prices could be affected by the OS network sizes. However, this effect is already reflected in the manufacturer

retail prices.

14

5.2.2

The Market Size and the Transition of State Variables

Let the cumulative OS market shares be nt = (n1t , ..., nSt ) at the beginning of period t.

S is the number of OSs. Let M be the population for potential smartphone users.15 The

P

OS cumulative shares are: nst = Nst /M . The sum Ss=1 nst is less than 1 because not all

consumers have smartphones at the beginning of period t.

In each period, two types of consumers enter the market, those who do not own any

smartphone yet and those who have finished their previous contracts. The share of the first

P

type consumers is 1 − Ss=1 (nst ). To get the share of the second type consumers, I assume

that each user has the same probability to end his/her current contract every period.16

This probability is fixed to be 1/8 because a contract is 24 months long and one period is

three months in this paper.17 Hence, the market size in period t is:

Mt = {1 −

X

s

nst }M +

1X

7X

nst M = {1 −

nst }M.

8 s

8 s

(8)

The market size decreases with the sum of OS shares. By assumption, the market

size cannot be zero, because 1/8 of the previous users end their contracts and re-enter the

market each period.

At the beginning of period t + 1, an OS has two types of users, previous users from

period t − 1 and new users in period t. Let Ωst be the set of smartphones with OS s in

period t. The transition of the cumulative market share of OS s is:

S

7

7X

nst+1 (nt , pct ) = nst + (1 −

ns0 t )

8

8 0

s =1

5.2.3

X

sjsct (pct (ξt , λt ), ξt ).

(9)

(j,c)∈Ωst

Timing of the Pricing Game and the Carriers’ Bellman Equations

The timing of the dynamic pricing game is as follows. At the beginning of period t, the

carriers observe the state variables, nt . Then the demand and cost shocks (ξt , λt ) are

15

I include the population between age 12-70 as potential smartphone users. It is 75% of the total US

population according to 2010 population age distribution.

16

In reality, the share of consumers who end their contracts in a period should be endogenous. But

tracking the distribution of the smartphone users’ contract status would make this distribution a state

variable for the carriers, which would be extremely complicated to model and estimate.

17

Since one period is three months and the contract is 24 months long. The number of periods left in a

contract at the end of a period is in{0,1,2,...,7}. The assumption that a user has a probability of 1/8 to

end his/her contract is equivalent to that 1/8 of the users will have 0 period left at the end of the period.

15

realized. Each carrier knows all carriers’ demand and cost shocks. The carriers choose

prices simultaneously and consumers make purchase decisions. At the end of period t, the

state variables update to nt+1 and the market enters the next period.

Denote the set of carrier c’s smartphones in period t by Ωct . Let λt be the vector of all

cost shocks in period t. Carrier c’s profit in period t at price pct is:

πct (pct , ξt , λt ) =

X

(pcjsct + fct − cjsct )sjsct (pct .ξt )Mt ,

(10)

(j,s)∈Ωct

As in equation (9), the prices in period t affect the OS market shares in the next period.

So the carriers must make dynamic pricing decisions. Carrier c’s Bellman equation is:

"

Vc (nt ) = Eξ,λ

max

pcjsct (ξt ,λt ),(j,s)∈Ωct

πct (pct , ξt , λt ) + β d Vc (nt+1 (nt , pct (ξt , λt )))

#

,

(11)

subject to equation (9). β d is the discount factor across periods. The expectation is over

the unobserved shocks (ξ; λ), and the carriers choose prices after they observe the shocks.

The value functions are carrier specific because the carriers have different smartphone sets,

wireless service costs, and wireless plan prices.

18

In addition to the i.i.d. assumption of λjsct , I make the following assumption to calculate

the expectations in Vc (nt ).

Assumption 3. (1) The cost shock λjsct follows normal distribution N (0, σλ2 ).

(2) The unobserved quality shock ξsct follows the normal distribution N (0, σξ2 ) and is i.i.d.

across carrier-OS groups and periods.

(3) The cost shock λjsct and the quality shock ξsct are independent with each other.

For any (ξt , λt ), carrier c’s first-order conditions (FOC) with respect to price pjsct is

Mt sjsct (pct , ξt ) + Mt

X

(j 0 ,s0 )∈Ωct

mj 0 s0 ct

c

∂sj 0 s0 ct

d ∂Vc (nt+1 (nt , pt ))

+

β

= 0,

∂pcjsct

∂pcjsct

(12)

18

In an ideal model, the evolving sets of smartphone models and their characteristics should also be

state variables. However, the number of smartphone models by each carrier is relatively stable and the

characteristics of all operating systems are improving in the data, as will be shown in Section 6. To keep

the problem tractable, I don’t add them as state variables.

16

where mjsct denotes the carrier markup:

mjsct = pcjsct + fct − cjsct .

(13)

The price pjsct affects not only the carrier’s current profit, but also its future profit through

the OS network size. The FOC implies that the marginal profit should be zero at the

equilibrium prices.

5.3

Equilibrium

The equilibrium concept used in the carriers’ dynamic pricing game is Markov Perfect

Nash equilibrium (MPNE). In this paper, a MPNE is a subgame perfect equilibrium where

the strategies depend on the past only through the state variables. An equilibrium is a

vector price function, pc (n, ξ, λ), and value functions, Vc (n)s, such that (1) Vc (n)s are the

expected discounted long run profits given pc (n, ξ, λ) and (2) pc (n, ξ, λ) maximizes the long

run profit for each carrier, given the rival’s prices and Vc (n)s.

The dynamic game may have multiple equilibria at the true parameters. But this is

not an issue for identification, as long as the data are from the same equilibrium. In this

paper, I analyze only one market (US) as opposed to multiple markets. So it’s reasonable

to assume that data are from the same equilibrium.

5.4

Discussion of the Demand and Supply Model

I could model the consumers’ dynamic demand for smartphones if the supply side is not

analyzed. It is quite challenging to combine a dynamic demand model with the dynamic

pricing problem of the carriers for two reasons. First, it’s rare to have explicit forms

of the market share derivatives in a dynamic demand model because consumers’ value

functions are unknown. But the derivatives would be required to analyze the FOCs of

the carriers’ dynamic problems. Second, in a dynamic demand model, the carriers’ state

variables would have to include the smartphone ownership distribution. which would be a

long vector (shares of different models and the months left in contracts). It is extremely

hard to solve such a dynamic problem.

The main concern with using a static demand model is that it ignores the consumers’

expectation of future prices and OS network sizes. But the static demand model still gives

the carriers the incentive to make dynamic price decisions. As long as consumers value the

17

OS network sizes, the current prices will always affect the future OS network sizes. The

static model may underestimate the OS network effect because forward-looking consumers

may postpone purchasing a large OS model if anticipating a decrease in price. A static

model would treat this low current demand for a large OS as if that consumers do not

value the OS network effect enough. So the results with the static demand model could be

interpreted as lower bounds of the impact of OS network effect on the industry.

In this paper, I don’t model the carriers’ service prices fct . There are several reasons.

First, each carrier’s plan price rarely changed during the sample periods. Second, the

problem of choosing the optimal service price is not related to the OS network effect

because each carrier sets the same service price for all OSs and models. Third, the very

few service price changes don’t appear periodically. This makes it hard to define a period.

So I take the carriers’ service prices as given.

6

Data

The data used in this paper comes from several sources, and the sample period is from

Aug 2011 to Oct 2013. comScore.com reports the U.S. cumulative smartphone subscriber

market shares every month. Kantar World Panel has been publishing the sales market

shares by carrier for the past three months. Carrier prices and manufacturer retail prices

for smartphones are collected via the web archive website. The smartphone characteristics

data are from phonearena.com. I get household income distribution data from the yearly

Current Population Survey (CPS).

I exclude the population younger than twelve years old and older than 70 years old as

smartphone consumers. This assumption makes the potential market size of smartphone

consumption to be 75% of the population, according to the 2010 US population distribution by age. The average household income increased from $69,677 to $72,641 and the

standard deviation increased from $368 to $499. comScore.com reports the total number

of smartphone subscribers and the cumulative market share of each OS every month. I

calculate the market size Mt and state variables nt from these data.

Each month, the sales market shares by carrier by OS are for the past three months.

For example, the sales market shares in Jan 2012 are for the three months ending in Jan

2012. comScore.com also reports the OS sales shares conditional on the sales shares of

AT&T and Verizon. Combining the carriers’ sales shares and the OS shares within each

carrier, I get the sales market share for each carrier-OS group. One missing piece of the

18

sales data is the conditional OS shares for Sprint or T-Mobile. Since only the joint OS

shares for the two carriers are observed, I assume that their OS share ratio is equal to their

number of models ratio. In the end, there are sales market shares for 16 carrier-OS groups

for 8 non-overlapping 3-months periods (out of 26 consecutive months).

The web archive website has been keeping records of the carriers’ webpages every month

sicne 2008.19 The carriers’ two-year contract prices and the listed manufacturer retail price

of each model can be collected by month. In the sample period, the data has 2283 modelmonth observations. The highest two-year contract price is $399 for the 64 GB iPhones

from multiple carriers.

The monthly wireless plan prices are also from the web archive website. Each carrier

offers multiple wireless plans each month. I use the single line price for medium amount of

data and minutes.20 Verizon’s wireless plan price was the highest at $70 and T-Mobile’s

was the lowest at $50. The average across carriers is $60 per month during 2011 to 2013.21

To match the sales shares data, a period is three months in the structural model.

But the smartphone prices are observed every month. Thus, to use as much information

as possible, I construct consumers’ choice set every period in the following way. If a

smartphone model is observed in multiple months in a three-months period, I treat them

as different choice options in that period. The data are seasonally adjusted when used in

estimation.22

The smartphone characteristics include camera pixels, built-in storage, 4G dummy,

weight, screen size, resolution, processor speed, memory, and battery capacity. All the

characteristics are scaled so that their values are in similar range to compare their coefficients in the utility function.

Table 1 shows the summary statistics of the number of models, characteristics, average

smartphone two-year contract price, and manufacturer retail price by carrier-OS group

by month. All four carriers have more than 10 Android models each month on average.

Windows Phone has the fewest number of models, with an average lower than 2. iOS

models have the highest two-year contract prices and manufacturer retail prices on average.

Windows Phone models have the lowest carrier prices and manufacturer prices.

19

The web archive website link is: http://archive.org/web/

I use the prices for the following minutes and data bundles for the 4 carriers: Verizon (unlimited minutes,

2GB), AT&T (450 minutes, 300MB), Sprint (unlimited minutes, 1GB), T-Mobile (unlimited minutes and

data).

21

This matches the $61 average reported by New Street Research company for 2013.

22

See Supplemental Material Section D.1 for details on removing seasonality from the data.

20

19

20

No. of

Models

4.69

16.15

3.00

1.81

5.07

13.88

3.81

4.81

4.91

11.38

1.65

1.13

4.00

10.62

3.69

1.31

Carrier Price

100$

2.26

1.22

1.45

1.03

1.98

0.98

0.86

0.75

2.04

0.90

1.30

0.79

—

1.58

2.01

1.15

Manuf. Price

100$

6.74

5.04

4.66

4.32

6.47

4.69

4.48

4.36

6.71

4.41

4.53

4.42

6.96

4.05

4.46

3.49

Battery

1000mAh

1.43

1.92

1.31

1.49

1.41

1.90

1.25

1.67

1.43

1.80

1.18

1.57

1.44

1.77

1.39

1.46

Camera

megapixels

7.14

6.86

5.03

5.68

6.75

7.04

5.30

7.82

7.36

5.77

5.06

5.60

7.94

6.10

5.19

5.80

Screen

inches

3.65

4.24

3.01

3.94

3.66

4.31

3.07

4.26

3.66

3.97

2.68

3.77

3.98

5.19

2.94

3.91

Pixel

100/inch2

3.26

2.68

2.60

2.45

3.11

2.66

2.59

2.47

3.28

2.45

2.76

2.57

3.26

2.43

2.61

2.48

Processor

Ghz

1.72

2.60

1.34

1.61

1.66

2.98

1.25

1.81

1.79

2.03

1.11

1.36

2.55

2.62

1.19

1.89

Sales

Share%

17.80

18.94

0.47

0.08

20.75

9.58

1.4

1.36

3.07

11.98

0.38

0.45

0.36

11.44

0.83

0.80

Notes: The first three letters of the OSs are used in the table. For example, “And” is for Android. T-Mobile eliminated the two-year

contract policy since it started to sell iOS models. The sales shares are conditional shares among the listed groups and are recorded

for the sales in the past three months every month.

Verizon-iOS

Verizon-And

Verizon-Bla

Verizon-Win

AT&T-iOS

AT&T-And

AT&T-Bla

AT&T-Win

Sprint-iOS

Sprint-And

Sprint-Bla

Sprint-Win

T-Mobile-iOS

T-Mobile-And

T-Mobile-Bla

T-Mobile-Win

Carrier-OS Group

Table 1: Descriptive Statistics by Carrier-OS group (Average over Months)

The pattern of hardware characteristics across OSs is mixed. iOS models outperform

other models in camera pixels and screen pixels per square inch. Android models have the

best battery capacities, screen sizes, and processor speeds. Android has the highest sales

market shares. Most new iPhone users signed contracts with Verizon and AT&T.

Figure 1 shows the cumulative market shares of the four operating systems from August

2011 to October 2013. The market shares of iOS and Android both increased from below

6% to above 25%. Blackberry’s market share decreased from 10% to less than 5%. The

Windows Phone market share was stable and small, at around 3%.

Figure 1: The Cumulative OS Market Shares Over Time(2009.09-2014.03)

Table 2 shows the results from regressing the contract discounts and manufacturer retail

prices on past month OS shares, model characteristics, and OS dummies. The contract

discount is the difference between a model’s manufacturer retail price and its carrier twoyear contract price. In Column 2, the positive coefficient in front of OS share means that

the carriers give higher discounts to models with higher past OS shares. For example, if

iOS share was 10% higher than Blackberry, then the carriers would give each iOS model

$10 more discount. From Column 3, we can see that the manufacturers charge higher prices

for models with higher OS shares.

21

Table 2: OLS Regressions of Carrier Discounts and Manufacturer Prices ($100)

Variables

OS Share (Lag 1 month)

Characteristics

OS Dummies

Manufacturer Dummies

Month Dummies

Carrier Discounts

1.0331***

(0.3090)

yes

yes

—

yes

Manufacturer Prices

0.3651*

(0.2113)

yes

—

yes

yes

The regression results are consistent with Proposition 1 and 2 in Section 3. The carriers are multi-network sellers, so they use a differentiating pricing strategy to achieve OS

concentration and attract more future consumers. Smartphone manufacturers are singlenetwork sellers because a manufacturer’s products use the same OS.23 The manufacturers

can’t internalize the competition effect across OSs and their market power depends on their

OS sizes.

7

Identification and Estimation

The structural model parameters are θd = (α; β; γ; ψ; Φ; σξ ) in the carrier-OS share equation (6) and θs = (ω; κ; σλ ) in the carriers’ FOCs in equation (12). There are 58 parameters

in total. I use GMM with MPEC to estimate (θd , θs ). The moment conditions are based

on the carrier-OS level unobserved quality shock ξsct in equation (6) and the model level

cost shock λjsct in equation (12).

To apply the data to the model, I first calculate the model level shares in equation

(5) using data on model level characteristics, prices, and the number of OS users. The

model level shares are then used to calculate ξ and λ for a given vector of (θd , θs ). To

calculate ξsct , I aggregate the model level shares to carrier-OS shares, so that they match

the observed carrier-OS shares. See Appendix A for the proof of the inversion from the

carrier-OS sales shares to ξsct (θd ).

To calculate λjsct , I solve the carriers’ FOCs using the model level shares and their

derivatives, so that the observed prices are the equilibrium prices in the carriers’ dynamic

pricing game. One difficulty of solving the FOCs is that the carriers’ value functions

23

Samsung has both Android and Windows Phone models, but more than 90% of Samsung’s smartphones

are using Android.

22

are unknown. To deal with this, I approximate the carriers’ value functions using linear

combinations of basis functions and impose the carriers’ Bellman equations as constraints

on the approximation. Evaluating the Bellman equations involves integrating over random

shocks and solving the pricing game for each possible shock vector. I design an efficient

iteration algorithm to solve the game. The details of calculating ξ and λ, the approximation,

and the algorithm are in Appendix B.

In the rest of this section, I discuss how the data provide identification for the model

parameters and describe the moment conditions and objective function in the GMM.

7.1

Identification

The identification of the demand side parameters comes from the variation of sales market

shares across carrier-OS groups and across time periods. The smartphone prices and the

plan prices identify the supply side parameters.

The variation of market shares and prices across carrier-OS groups identify the price

coefficient, α. But I need to use proper instrumental variables, because the carriers’ prices

are correlated with the shocks, ξsct s. The IVs used include the average characteristics

of models in the same carrier-OS group, Ωs,c,t , that of other OSs by the same carrier,

Ω−s,c,t , that of other carriers, Ω−c,t , and that of all models in period, Ωt . The Ωs are

sets of smartphone models and the subscripts denote the OS/carrier information of the

models. The average characteristics are correlated with prices via the wholesale costs

and the competition among the carriers, but are uncorrelated with demand shocks, ξscr s.

Hence, the average characteristics are valid IVs.24

The variation of the sales shares and that in the past OS network sizes identify the

OS network effect parameter, γ. That is, the stronger the OS network effect is, the higher

the sales shares for the carrier-OS groups with that OS. There is no endogeneity issue

here because the OS network size at the beginning of period t, Nst , is not correlated with

current shock ξsct . The variation of the characteristics and sales shares across carrier-OS

groups identify the mean characteristic parameters in β.

The diagonal matrix Φ has the non-linear coefficients in the consumer specific coefficients. It is identified by the variation of market shares and consumer income distribution

across periods.25 In particular, if the average consumer income increases over time and so

24

Individual model characteristics could also be instruments, but I don’t use them because there are

many models in one carrier-OS group.

25

See Supplemental Material Section C.1 for the details of simulation and normalization of individual

23

do the sales shares, then this implies that the price coefficient decreases with income level.

The structural model predicts model markup and thus the unit cost cjsct . The unit

costs then provide identification for service cost κsc and the wholesale parameters in ω as

in equation (7). I don’t directly estimate the standard variances of the demand and cost

shocks, σξ and σλ . Instead, I calculate them using the demand and cost shocks backed out

from the market share equation and the FOCs. Following Goettler and Gordon (2011), I

use 0.975 as the discount rate, β d , for the three-month period model.

7.2

7.2.1

Estimation

Moment Conditions and Objective Functions

The moment conditions are based on the orthogonality between the IVs and the unobserved shocks, (ξsct ,λjsct ).26 Let (θd0 , θs0 ) be the vector of true parameters. The moment

conditions are:

E[ξsct (θd0 )|Z1sct ] = 0,

(14)

E[λjsct (θd0 , θs0 )|Z2jsct ] = 0.

(15)

Z1sct is the vector of IVs as explained above. Z2jsct is a vector of the variables in the unit

cost equation (manufacturer dummies, carrier-OS dummies), the model characteristics,

xjsct , the numbers of models in (Ωsct , Ωst , Ωct ), the average characteristics over models in

(Ωct , Ωst , Ωt ). There are 44 moment conditions in (14) and 67 in (15).

To get efficient estimates, I use a two-stage GMM. In the first stage, the weight matrix

for the demand side moment conditions is Wd1 = (Z10 Z1 )−1 and that for the supply side

moment conditions is Ws1 = (Z20 Z2 )−1 .27 The second stage uses the optimal weight matrix

estimate Ŵ2 , estimated using the first stage results. The second stage objective function

is:

Q2 (θd , θs ) = (

Nλ

1 X

[Z1sct ξsct (θd ); Z2jsct λjsct (θs ; θd )])0

Nλ

jsct

Nλ

1 X

Ŵ2 (

[Z1sct ξsct (θd ); Z2jsct λjsct (θs ; θd )]).

Nλ

(16)

jsct

income levels.

26

The details of calculating ξ(θd ) and λ(θd , θs ) are described in Appendix B.

27

I use the following way to assign weights on the two sets of moment equations. Each moment condition

on ξsct is repeated for the number of models in Ωsct times, so that there is a vector of moment conditions

[Z1sct ξsct ; Z2jsct λjsct ] for shocks of model (j, s, c, t).

24

8

Estimation Results

Table 3 shows the estimation results for the demand model parameters. The coefficient

estimate of the OS network effect, γ̂, is 0.0418 and significant. This means that a consumer’s

utility of buying a smartphone increases with the number of existing users of the OS for

that model. The network effect is a very important component in a consumer’s overall

utility from buying a smartphone. On average, a consumer’s utility from the OS network

effect is about 40.79% of his/her utility of the whole purchase.

The price coefficient estimate α̂ implies that a consumer’s utility decreases with price.

The interaction between price and income has positive coefficient φ1 . So high income

consumers are less price sensitive.

The estimates of β imply that consumer utility increases with storage, camera pixels,

and 4G feature. But the coefficients for battery, screen size, and pixels are negative. This

is because that the best selling models do not have the most advanced characteristics.

For example, iPhone 5’s battery is 1540mAh, while most other top models have capacities

more than 2000mAh. Similarly, the average screen size for carrier-iOS groups is 3.66 inches,

while that for carrier-Android and carrier-Windows Phone groups are 4.24 and 3.94 inches,

respectively.

25

Table 3: Demand Model Parameter Estimates

Variable

Estimate

Fixed Effects

Estimate

OS Subscribers (M illion), γ̂

0.0418***

(0.0007)

-0.2731***

(0.0120)

0.01420***

(0.0086)

0.0310***

(0.0055)

-0.3379***

(0.0704)

0.1248***

(0.0410)

-1.0008***

(0.3951)

0.3522***

(0.1210)

-0.7273***

(0.0856)

0.1821

(0.1515)

0.1908

(0.3116)

Verizon-iOS, ψ̂iv

4.1023***

(0.8155)

2.5591***

(0.7282)

1.1071*

(0.6047)

3.6198***

(0.7527)

4.6184***

(0.8458)

0.9682

(0.6446)

1.5645***

(0.5366)

2.5305***

(0.6644)

1.0753

(0.8169)

2.0045***

(0.7506)

0.9243

(0.6315)

3.5882***

(0.7360)

2.0908***

(0.004)

0.6807

(0.6694)

0.1648

(0.5915)

2.5361***

(0.5969)

Carrier Price ($100), −α̂

Price*Income, −φ̂1

Storage (GB), β̂1

Battery (1000mAh), β̂2

Camera(100M P ), β̂3

Screen Size (inch), β̂4

Dummy 4G, β̂5

Pixels (100/inch2 ), β̂6

RAM (GB), β̂7

CPU (Ghz), β̂8

Verizon-Android, ψ̂av

Verizon-Blackberry, ψ̂bv

Verizon-Windows, ψ̂wv

AT&T-iOS, ψ̂ia

AT&T-Android, ψ̂aa

AT&T-Blackberry, ψ̂ba

AT&T-Windows, ψ̂wa

Sprint-iOS, ψ̂is

Sprint-Android, ψ̂as

Sprint-Blackberry, ψ̂bs

Sprint-Windows, ψ̂ws

T-Mobile-iOS, ψ̂it

T-Mobile-Android, ψ̂at

T-Mobile-Blackberry, ψ̂bt

T-Mobile-Windows, ψ̂wt

The carrier-OS fixed effects, ψs, measure the unobserved characteristics of these groups

that are constant over time. The results show that iOS has the highest unobserved quality

among all OSs. Windows Phone’s fixed effect is higher than Android. This implies that

the high sales shares of Android is not because of high fixed effects but its advantages in

the number of models and the model characteristics.

Table 4 shows the demand elasticities across carrier-OS groups in May 2013. The

26

(g, g 0 )th element is the sum of model elasticities in the carrier-OS group g when prices

of all products in group g 0 increase by 1%. The own elasticities are stronger than cross

elasticities. The own elasticities of Android are the highest, meaning that consumers’

demand of Android models is the most elastic. The own elasticities of iOS are relatively

small. The cross elasticities show that Android and iOS are closer substitutes for each

other than for other OSs.

Table 4: Demand Elasticities w.r.t. Prices by Group

V-iOS

V-And

V-BB

V-Win

A-iOS

A-And

A-BB

A-Win

Outside

V-iOS

-27.6782

6.8025

1.1953

1.7091

2.5226

7.8039

2.0263

1.5628

0.1215

V-And

2.1620

-75.2417

1.1038

1.5435

2.1620

6.8160

1.8983

1.4131

0.1168

V-BB

0.0042

0.0122

-15.4521

0.0031

0.0042

0.0134

0.0039

0.0028

0.0003

V-Win

0.0964

0.2750

0.0501

-20.3314

0.0964

0.3041

0.0865

0.0638

0.0054

A-iOS

2.2872

6.1677

1.0838

1.5496

-27.9136

7.0757

1.8372

1.4170

0.1102

A-And

0.9686

2.6575

0.4677

0.6664

0.9686

-87.3513

0.7948

0.6103

0.0475

A-BB

0.0354

0.1032

0.0193

0.0263

0.0354

0.1119

-26.2240

0.0240

0.0022

A-Win

0.1487

0.4257

0.0777

0.1078

0.1487

0.4696

0.1342

-18.0246

0.0083

Notes: V: Verizon. A: AT&T. BB: Blackberry.

The last row in Table 4 are the elasticities of the outside option. The elasticity of the

outside option is relatively small compared with other groups. This implies that when

prices of smartphones in one carrier-OS group increase, most consumers switch to other

smartphone models but not to the outside option.

The estimates of the supply side parameters are in Table 5. The wholesale cost coefficients ω are significant. The average wholesale cost ratio is 82.83%. Apple’s wholesale

price ratio is the highest at 85.01%, which means that the carriers pay $552 to Apple for

a $649 iPhone on average. Blackberry’s wholesale price ratio is the second highest among

all manufacturers at 84.21%. Samsung’s wholesale price ratio is the lowest at 80.84%. So

the carriers pay $484 for a Samsung S3 when its manufacturer retail price is $599.

27

Table 5: Supply Model Estimates

Wholesale

price

ratio

b:

Variable

Estimate

Variable

Estimate

Apple, b̂a

0.8501***

(0.0074)

0.8084***

(0.0027)

0.8151***

(0.0028)

0.8305***

(0.0029)

0.8164***

(0.0026)

0.8421***

(0.0043)

0.8354***

(0.035)

0.2462***

(0.0207)

0.2360***

(0.0538)

0.2411

(0.2898)

0.2381**

(0.1253)

AT&T-iOS, κ̂ai

0.2410***

(0.0375)

0.2566***

(0.0389)

0.2418

(0.3795)

0.2407

(0.3811)

0.2185***

(0.0436)

0.2268***

(0.0372)

0.2305

(0.5933)

0.2217***

(0.2257)

0.2121

(0.0100)

0.2281***

(0.0679)

0.2251

(0.6919)

0.2262

(0.2060)

Samsung, b̂s

Motorola, b̂m

LG, b̂l

HTC, b̂h

Blackberry, b̂b

Nokia, b̂n

Monthly

service

cost (100$)

κ:

Verizon-iOS, κ̂vi

Verizon-Android, κ̂vi

Verizon-Blackberry, κ̂vb

Verizon-Windows, κ̂vw

AT&T-Android, κ̂aa

AT&T-Blackberry, κ̂ab

AT&T-Windows, κ̂aw

Sprint-iOS, κ̂si

Sprint-Android, κ̂sa

Sprint-Blackberry, κ̂sb

Sprint-Windows, κ̂sw

T-Mobile-iOS, κ̂ti

T-Mobile-Android, κ̂ta

T-Mobiel-Blackberry, κ̂tb

T-Mobiel-Windows, κ̂tw

The monthly service cost estimates, κ̂s, are at the carrier-OS level. The four carriers’

average monthly service cost estimate is $23.32. Verizon and AT&T have higher service

costs with an average of $24.27. The average of Spring and T-Mobile is $22.36. Comparing

the estimated unit costs with price data, the monthly markups on wireless services for

Verizon, AT&T, Sprint, and T-Mobile are $39.47, $35.50, $37.56, and $27.71, respectively.

Sprint has higher markups than AT&T because it has lower service costs but similar

smartphone and wireless service prices.

Given the estimates, I calculate the carriers’ markups from one two-year contract customer. Take AT&T and iPhone 5 in December 2012 for example. AT&T sells the iPhone

5 at $199 while paying $552 to the manufacturers, which implies a $353 net cost on the

phone. AT&T earns a net margin of $35.50 each month, which makes $852’s total net mar28

gin on the two-year service. So AT&T earns a net profit of $499 from an iPhone 5 two-year

contract customer. The model implied wholesale price and carrier profit on iPhone 5 by

AT&T match the anecdotal evidences.28 Table 6 shows the carrier markups on two-year

contract smartphones by carrier-OS.

Table 6: Carriers’ Markups on Two-Year Contracts by Carrier-OS ($100)

iOS

Android

Blackberry

Windows

Verizon

5.89

6.72

7.39

6.81

AT&T

5.13

5.50

5.65

5.95

Sprint

5.59

6.26

6.52

5.98

T-Mobile

—

4.01

4.19

4.26

The carriers’ markups on Blackberry and Windows Phone models are higher than iOS

and Android models in general. This is because that 1) the carriers give lower discounts

on Blackberry and Windows Phone models and 2) the carriers pay lower wholesale prices

to their manufacturers. Among the carriers, Verizon has the highest overall markups. The

reason is that Verizon has the highest margins on the wireless service. Sprint’s average

markups on contracts are higher than AT&T. T-Mobile’s markups are the lowest due to

their low margins on wireless service.

The carriers’ value functions at any state can be calculated with the approximated

functions.29 Verizon’s value function is the highest among the carriers. AT&T has the

second highest value function. T-Mobile’s value function is the lowest.

9

Counterfactuals

In this section, I study two counterfactual cases to measure the impact of the OS network

effect and the carriers’ two-year contract discounts on consumer demand for smartphones

and the OS market concentration.

9.1

The Impact of the OS Network Effect

In this counterfactual scenario, I eliminate the OS network effect. Eliminating the OS

network effect changes the carriers’ smartphones prices via three channels. First, without

28

29

http://fortune.com/2008/06/19/what-att-pays-apple-for-the-iphone/

The value functions are plotted in Supplemental Material D.2.

29

the OS network effect, the carriers don’t have incentive to use low prices to grow the OS

networks to attract future consumers. So they will increase prices. Second, consumers’

utility of a smartphone decreases after the network effect is eliminated. This drives the

carriers’ prices downwards. Third, the carriers will no longer differentiate models based on

their OS network sizes. This effect reduces the price differences across OSs. The first two

channels affect the overall price levels while the third channel affects the differentiation

across OSs.

I assume that the carriers play a static pricing game when there is no OS network

effect.30 I solve for the equilibrium prices. Table 7 shows the average smartphone price

changes by carrier-OS group. Compared with data, the smartphone prices increase when

there is no OS network effect. So the first channel dominates the second. The prices of

iOS and Android models increase more than Blackberry and Windows. This the result of

the third channel.

Table 7: Average Price Change by Carrier-OS (100$)

Verizon

AT&T

Sprint

T-Mobile

iOS

2.13

2.98

2.44

—

Android

1.34

2.62

1.76

4.06

Blackberry

0.79

2.48

1.60

3.89

Windows

1.30

2.19

2.10

3.77

Figure 2 compares the counterfactual cumulative OS shares with data. The thick curves

with marker show the counterfactual OS shares, and the thin curves without markers are

the observed OS shares. Without the OS network effect, the smartphone penetration

decreases from 45.06% in Aug 2011 to 23.67% Aug 2013. This means that, there are more

consumers who end their contracts than those who buy new smartphones every period.

There are two reasons. First, consumers’ utility of a smartphone would decrease because

the strong OS network effect no longer exists. Second, the carriers’ prices of smartphone

increase significantly as in Table 7. Both effects reduce consumers’ demand.

The impact of the OS network effect is huge, because the OS network effect includes

30

There are for several reasons for this assumption. First, without the OS network effect, the future OS

network sizes would not affect future demand, so the carriers don’t have strong incentives to choose prices

dynamically. Second, if the carriers play a dynamic game, their value functions need to be solved again,

which requires function approximation again and introduces approximation errors.

30

the indirect network effect generated by app stores. When the OS network effect is eliminated, consumers do not get any utility from the smartphone apps, which was the main

functionality of smartphones. Therefore, the smartphone penetration would decrease when

there is no OS network effect.

Figure 2: OS Growth without OS Network Effect

Figure 2 also shows that the OS market would be less concentrated without the OS

network effect. Both iOS and Android’s market shares drop from more than 30% to

below 10%. The joint market share of Blackberry RIM and the Windows Phone is 6.75%,

compared with 6.39% in the data. There are two reasons for the decrease in concentration.

First, large OSs no longer have the network advantage of attracting consumers. Second,

the carriers do not differentiate the OSs based on network sizes anymore.

Table 8 shows the profit comparison by carrier during the sample period. The joint

carrier profit decreases by $53.84 billion (79.13%). This huge profit loss is caused by the

decrease in consumer demand. The profit loss for Verizon, AT&T, Sprint, and T-Mobile

are 76.11%, 78.28%, 84.04%, and 85.97% respectively.

31

Table 8: Profit Comparison by Carrier ($billion)

Estimated

No OS network effect

9.2

Verizon

28.61

6.83

AT&T

20.95

4.55

Sprint

11.72

1.87

T-Mobile

6.77

0.95

The Impact of the Carrier Discounts

In this counterfactual case, I assume that the carriers sell smartphones at the manufacturer

retail prices and decrease the service prices by $15 each month.31 By using the manufacturer’s retail prices, I eliminate the carriers’ price differentiation across OSs. To make this

counterfactual results comparable with the full model, I assume that each consumer uses

a smartphone for two years.

Figure 3: OS Growth without two-year Contract

Compared with data, the popular iOS and Android models are more expensive now

because they had high discounts in the data. Blackberry and Windows Phone models

become cheaper. Figure 4 compares the OS growth paths in this counterfactual case with

data. Without the carrier discounts, the overall smartphone penetration rate would be

31

In fact, carriers started to sell smartphones at the manufacturer prices and decrease monthly service

prices by at least $15 from late 2013.

32

49.30% (86.52 million), compared with 78.36% (137.51 million) in data by the end of May

2013. Because less consumers would be willing to buy the iOS and Android models, which

drew a lot of consumers in the data.

The OS concentration would decrease without the carrier discounts because the larger

OSs no longer have high carrier discounts. Blackberry and Windows Phone would share

9.17% of the market, more than the 6.39% in the data. The lead of Android to Windows

Phone decreases to 11.18%, compared with 28.57% in the data.

iOS and Android would still be the larger OSs for several reasons. First, they still

have the initial OS network advantages, which would lead to higher demand in all periods.

Second, iOS has high fixed effects from the demand estimates and Android has many

models in the market, so consumers’ demand for the two OSs is high.

Table 9 compares the carrier profits. Without the carrier discounts, the four carriers’

joint profit would decrease by $23.52 billion (34.91%) during the sample period. Verizon’s

total profit would decrease by 35.58%, AT&T by 36.71%, Sprint by 30.55%, and T-Mobile

by 34.12%.

Table 9: Profit Comparison by Carrier ($billion)

Estimated

Counterfactual

Verizon

28.61

18.43

AT&T

20.95

13.26

Sprint

11.72

8.14

T-Mobile

6.77

4.46

The two counterfactual cases imply that both the OS network effect and the carrier

discounts have contributed significantly to the growth of the smartphone penetration in the

US and the concentration of the OS networks. The OS network effect is more important

than the carrier discounts.

10

Conclusion

The literature on network effects focused on pricing decisions of single-network firms, but

not multi-network sellers. In this paper, I analyze the impact of a network effect on multinetwork sellers’ dynamic prices both theoretically and empirically. I find that, in a dynamic