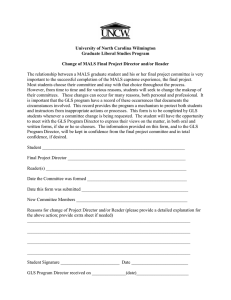

nature - GLS

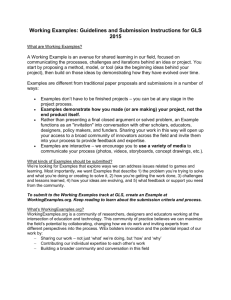

advertisement