The energy business

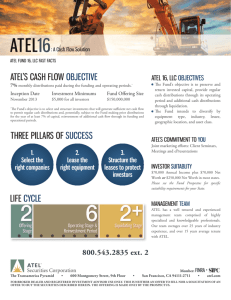

advertisement