2005 - Brinker International

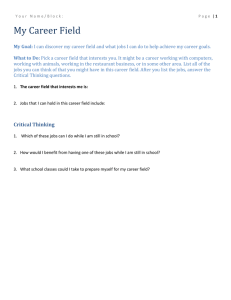

advertisement