2014 Annual Report - Waterloo North Hydro

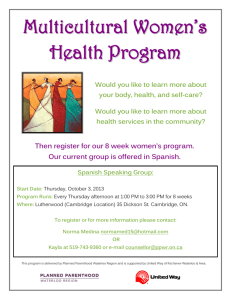

advertisement