All you need to know about certificates - db-X markets

advertisement

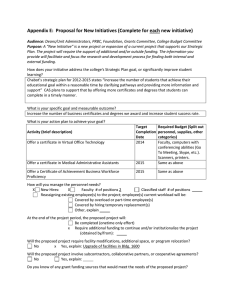

All you need to know about certificates Deutsche Bank Certificates New freedom for investors: opportunities and risks – the decision is yours The right products for all market expectations, for conservative and risk-oriented investors Price information www.db-xm.com n-tv Teletext 770 Additional information Printed on environmentally friendly paper. Deutsche Bank AG X-markets-Team Große Gallusstraße 10-14 60272 Frankfurt/Main, Germany Information hotline +49 (69) 910-38807 Email x-markets.team@db.com © May 2003 Deutsche Bank AG 60262 Frankfurt/Main, Germany 003 88122 00 and certificates offer new freedom to investors: opportunities and risks – the decision is yours Contents The new millennium – new ways to invest The Scenario The new millennium – new ways to invest 3 The Solution New freedom for investors 4 In the 1990s, successful investing was relatively simple: investors merely needed to buy equities. After all, share prices seemed to be going only one way: up. The Success Factors X-pert certificates: Just buy the index Strategy certificates: Systematic outperformance Theme certificates: The optimal diversification for your portfolio Discount certificates: Buy at a discount and lower your risk DoubleChance certificates: Get the most from moderate growth Guarantee certificates: Full protection for your investment Parachute certificates: Keep upside, protect downside BestChance certificates: Optimised investment timing Winner certificates: Act with hindsight Appendix Deutsche Bank Certificates: The right product for any market scenario Glossary: Terms you should know if you want to invest in certificates Important Notice Additional information: Tax regulations in Germany Notes Order form: All products – all brochures 2 Contents 6 8 10 12 14 16 18 20 22 The slump following the euphoria has eliminated billions of euros and dollars. However, the losses were not just tied to “fate”; indeed many investors had invested unwisely. The market developments of the last few years have again brought into focus what it means to invest capital wisely. Instead of simply counting on rising prices, investors should balance opportunities and risks to account for market conditions as well as individual objectives. US economist Harry S. Markowitz already recognised this problem back in 1969, in his article “Portfolio Selection”, for which he later won the Nobel Prize for Economics. According to his findings, a portfolio should be well-balanced, offering profit potential and hedging possibilities for a multitude of possible future developments. Such a balance is difficult to achieve if investors restrict themselves to traditional investments, such as mutual funds or individual shares. These investments are profitable only if prices rise. 24 29 31 32 36 The Scenario 3 A strong team in pole position New freedom for investors Investors assess opportunities and risks The time is right for a new generation of financial products. Deutsche Bank certificates offer investors the freedom to assess the opportunities and risks of their investment choices. Investors’ personal market expectations should drive their investment decisions. Investors assess opportunities and risks There is a wide range of new investment opportunities. For example, there are downside cushions that make it possible to reap a profit even if shares have lost value. Or how about increasing moderate gains without being exposed to additional risk? Or automatically lowering an entry price later on? This brochure describes how to achieve these goals. For more detailed information about individual certificates, please refer to the specific product brochures, which you can order via the order coupon on page 37. Derivatives House, Certificates House and Best Issuer 2002 To be successful in a highly competitive market, each individual team member is important. Our team holds the pole position with our Xavex and X-markets product range – that is why Deutsche Bank is not only the market leader*, but was also awarded the prize of “Best Derivatives Issuer”. Xavex and X-markets, your direct access to Deutsche Bank’s global investment expertise Internet: www.db-xm.com Further information: +49 69 910-38807 What made us the best issuer? a broad range of over 3,500 products; continuous innovation and strong customer focus; trading hours from 8:00 a.m. to 10:00 p.m. CET; fair pricing and narrow spreads; an enthusiastic, service-driven team; Our power to innovate and our outstanding service will keep us at the forefront. Why not try it out yourself? Leading to results.® * Source: Deutsche Börse Exchange Clearing System 4 The Solution X-pert certificates: Just buy the index Fair prices, transparency, no restrictions 1:1 tracking of indices Maximum transparency and liquidity No front-end loads or management fees Broad range of certificates – no fixed maturities Fair prices, transparency, no restrictions Traditionally, investors wishing to diversify their equity investments choose mutual funds. They relied on an established fund manager to continually look for the bestperforming stocks in the market, thus offering real added value to investors. However, this system did not work as smoothly in practice as it did in theory. Only very good fund managers succeed in beating the benchmark index consistently. And mutual funds include frontend loads (selling fees) of up to 5 percent, plus annual management fees and other costs which reduce overall returns. 1:1 tracking of indices So, if it is so difficult to beat the benchmark, why not invest directly in the index? Deutsche Bank X-pert certificates allow you to do so. Their price exactly tracks the performance of the index. The price of the certificate is determined by the subscription ratio. opportunities and risks works in the other direction as well: if the DAX drops to 2,500 the price of the certificate will fall to ¤25. Thus, X-pert certificates ensure you always achieve market performance. Maximum transparency and liquidity Investors must look up the daily value of their mutual funds. But with X-pert certificates investors can calculate the value themselves. All they need to know is the current level of the index and, in the case of foreign indices, the current exchange rate. Of course investors can buy and sell at any time between 8:00 am and 10:00 pm (CET) on any exchange trading day at a price based on the current index level. In addition, the index sponsors’ websites inform investors daily about the individual shares included in the index and their respective weightings. Stock market one-to-one at minimal cost -perts – Index Certificates without maturity With Deutsche Bank’s X-pert certificates, investors enjoy the full benefits of index funds – making the certificates much more cost-effective. There is no front-end load or selling fee either. Buying and selling the certificates costs only a small bid/offer spread in addition to the usual commission charged by custodian banks. In the case of some indices Deutsche Bank does not even charge a spread. An additional advantage of choosing an X-pert certificate based on a total return index such as the DAX is that investors will participate in the price performance of the index and will also benefit from continual reinvestment of the dividends distributed by the companies included in the index. 6 The Success Factors X-pert certificates are available on all major indices, such as the DAX, the TecDAX, the EURO STOXX 50, the Dow Jones Industrial Average, the S&P 500 or the Nikkei 225. In addition, we have issued certificates based on the indices of the exchanges of the Central and Eastern European EU accession candidates and on many EURO STOXX sector indices. The broad range of our products allows investors to build a diversified global portfolio, tailor-made, at low cost and offering maximum efficiency. The time horizon is completely up to the investor; in contrast to many other certificates there are no fixed maturities for X-pert certificates. European equity funds versus STOXX 600 120% 99% 100% 80% 80% 60% 40% No front-end loads or management fees 20% 0% –20% For example: if the DAX trades at 3,000 points, a DAX-based X-pert certificate with a subscription ratio of 1:100 will cost exactly ¤30. If the index rises to 3,500 the price of the certificate will rise as well, to ¤35. This symmetric profile of Broad range of certificates – no fixed maturities Indices are regularly recomposed according to certain criteria, such as market capitalisation or exchange turnover. However, this does not require the services of a fund manager, and therefore there are no management fees to be paid. –40% –19% –14% –32% –34% –52% –60% 2002 –47% 2000-2002 1998–2002 1993–2002 European equity funds (average performance) Dow Jones STOXX 600 Return Index Sources: BVI, Deutsche Bank The Success Factors 7 Strategy certificates: Systematic outperformance Intelligent stock picking Intelligent stock picking The perfect solution: quantitative investment strategies We have lived with two different investing cultures for ages: passive management and active management. Passive management focuses exclusively on transparent and cost-efficient index investments, thus performing neither better nor worse than the market as a whole. Active management focuses on picking stocks that should outperform the index, thus offering the opportunity to beat the market. Unfortunately, active management often fails to achieve its goals. In fact, most active fund managers do not outperform their benchmarks. Better assessment of opportunities and risks Active management takes time and costs money Strategy certificates bring efficiency and professional know-how to investors The perfect solution: quantitative investment strategies Quantitative investment strategies offer a solution to this dilemma. They combine the transparency and objective criteria of index investments with the potential outperformance inherent in active management. This is because shares are not picked subjectively, but by applying systematic objective parameters. An example: numerous research studies have shown that equities with a high dividend yield outperform the market over the long run (see box: “The most important strategies”). Investors who want to benefit from this knowledge for their exposure 8 The Success Factors to European equities will not buy a EURO STOXX 50 certificate, but will instead select the 15 constituents that offer the highest dividend yield. As the market situation changes, they will of course have to adjust and recompose their portfolios (e.g. every six or twelve months), depending on which shares offer the highest dividend yield at the respective time. Better assessment of opportunities and risks The advantages of a quantitative selection method are obvious. The selection process is based exclusively on technical criteria; thus, investors can calculate how the strategy would have performed in the past. This helps to clarify whether the selected approach offers added value in the long term – by way of higher returns – and/or reduced return volatility in comparison to the index. Active management takes time and costs money The challenge of this approach is in its implementation. Even if investors choose only 15 shares and adjust their portfolio semi-annually, they will have to execute up to 30 transactions each year. And as all these transactions involve fees, beating the benchmark becomes difficult. In addition, investors have European blue chips with high dividend yield EuroLeader CertificateTM to do time-consuming research – after all, not every model is based on such an easily-available figure as the dividend yield. basis of certain criteria. The exact parameters are researched and laid down in detail before the certificate is launched. Strategy certificates bring efficiency and professional know-how to investors Deutsche Bank’s investment experts continually analyse a great variety of models, with only the most promising ones resulting in the launch of a new strategy certificate. Costs are no problem either. A management fee of usually 1.0 – 1.5 percent p.a. covers all transaction fees. Dividends are usually reinvested in the basket of shares and passed on to investors. Deutsche Bank has developed its strategy certificates especially to make such professional investment strategies available to private investors. The certificates are based on a basket of shares, which is regularly and automatically adjusted and recomposed on the The most important strategies Value investing: In line with legendary US investment guru Warren Buffet’s mantra, value investors buy only undervalued equities with high earnings quality. The selection is usually based on dividend yields or a low price/earnings ratio. Regular dividend payments are a clear indicator of intrinsic value (“shareholder value”), giving shareholders an objective measure of the value of their investment. In addition, high dividend yields protect the share price to the downside. Growth investing: It is not always value shares that perform best. Growth-oriented investors have their moments of glory, too. They invest in shares promising the highest growth potential. The current share price does not play a role right from the outset because the price level will rise anyway, if the company's earnings growth remains on track. Style switching: Since value and growth cycles follow each other over time, it makes sense to combine the two strategies, as they are both based on logical assumptions. This is made possible by ratios such as the PEG (price/earnings to growth ratio), which establishes a relationship between the share price and its performance. For this purpose, the price/earnings ratio (which can be used to indicate a low valuation) is divided by the long-term forecast for the growth in earnings (the “growth” element) – the lower the result, the better. Other models use parameters such as the Sharpe ratio, known from portfolio theory, in order to determine exactly when to invest in value or growth issues. Momentum: Traders often follow the rule “stay with the trend, the trend is your friend”. And that is exactly what investors do with this strategy. Accordingly, investors regularly buy those issues that performed best in the past (e.g. in the past six months). This indicator is also often used to boost the results of other strategies. The Success Factors 9 Theme certificates: The optimal diversification for your portfolio The need to diversify your portfolio Short-term sector rotation ... ... or long-term mega trends Investment in commodities without the disadvantages of physical buying Alternative investments: strategies focused on absolute returns The need to diversify your portfolio If Wall Street sneezes, Europe develops a cold. This traders’ saying points to an important relationship: equity markets in industrialised countries often move in the same direction, usually following the trend set in New York. So if the overall trend points downwards, investors will not escape it if they have invested exclusively in the large indices covering the whole range of the market, such as the DAX, the EURO STOXX 50 or the S&P 500. This is why it makes sense to diversify portfolios by adding investments in different sectors or exposure to special trends. In doing so, investors might benefit from sector-specific developments, which will enable them to offset temporary losses on some positions and enjoy an overall more stable and/or higher performance from their portfolios. Short-term sector rotation ... Sector-specific investments, such as Deutsche Bank certificates on the sector indices of the EURO STOXX index family, are one way of diversifying portfolios. These products allow investors to put their money into European equities from the automobile, chemical, 10 The Success Factors financial, technology or telecoms sectors. These certificates are particularly interesting for active investors who want to effectively exploit the phenomenon called sector rotation. Depending on the current phase of the economic cycle, cyclical sectors often outperform the market. Only a few months later, however, traders will return to preferring a more defensive strategy. Turnaround speculation on sectors, which have fallen considerably in the past, can be realised using these certificates as well. ... or long-term mega trends In contrast, investors who prefer a more passive approach will select long-term mega trends. Sectors such as biotechnology or internet-related industries hold considerable growth potential in the long run. Investors can fully participate in this outlook thanks to certificates on the respective sector-specific indices or regularly updated equity baskets. Emerging markets are another enticing investment opportunity. Central and East European economies and China often have decoupled from the trends of established markets. This makes Deutsche Bank’s emerging-markets certificates an ideal addition to investors’ portfolios. Collaborative teamwork for success Investment in commodities without the disadvantages of physical buying DB ARIXTM Equity Strategies Transparent Certificate The universe of theme certificates, however, covers a much wider field, since they do not necessarily have to be based on individual shares or equity indices. In fact, just about any asset whose price is determined objectively and regularly can serve as an underlying instrument. Take, for example, commodities and precious metals: Deutsche Bank’s Gold X-pert certificate is always worth the price of one-tenth of a fine ounce troy gold in euros, so it allows investments in precious metals without entailing the disadvantages of the physical purchase of coins or bars – namely physical storage, premium, etc. Alternative investments: strategies focused on absolute returns Private investors can even enter into an altogether different investment segment that has traditionally been reserved for institutional investors: hedge funds. In contrast to mutual funds, whose primary objective is generally just to outperform the benchmark index, hedge funds aim to realise an absolute return. Hedge fund managers want to generate profits independently of the market trend, and to keep the price of their hedge funds more stable (less volatile). Hedge fund certificates can, for example, reflect the performance of a portfolio managed by Deutsche Bank and consist of investments in up to 50 individual funds. Investors can benefit from optimal risk management while participating in numerous promising alternative investment strategies. Additionally, Deutsche Bank AG has also created certificates based on independent hedge fund indices. Types of theme certificates Type Themes Basket certificates Countries: China, Russia, etc Mega trends: biotechnology, nanotechnology, etc Sector certificates Dow Jones EURO STOXX: automobiles, insurance, etc S&P Amex: biotechnology, oil, etc Other theme certificates Asset classes: hedge funds, real estate, private equity, etc Commodities/precious metals: gold, silver, crude oil, etc The Success Factors 11 Discount certificates: Buy at a discount and lower your risk Profit potential limited to price discount Maximum return reached more quickly than with direct investment Stop relying on a bull market to make profits Traditional investors will only realise profits on their investments in mutual funds or index certificates if the underlying markets or equities rise. But what if markets decline or trade sideways – is there no way to realise returns? Limited risk of losses Cap level determines the risk/return profile Securitised short options position Profit potential limited to price discount Fortunately, there is. Discount certificates are the solution – these differ from traditional index certificates and/or equities because they have a set lifetime (usually between 3 and 18 months), and have a maximum redemption (the so-called “cap”). Two scenarios can occur at maturity of the certificate: The price of the underlying is at or above the cap level: the discount certificate is redeemed in cash equal to the value of the cap. The price of the underlying is below the cap level: the investor receives the underlying instrument, or the current price of the underlying in cash. In return for the limited return potential, a discount certificate is always cheaper than its underlying 12 The Success Factors share or index. For instance, a discount certificate with a lifetime of 18 months and a cap of ¤110 euros might cost only ¤80, while the underlying share is trading at ¤100. Thus, the discount is ¤20 (20 percent). Maximum return reached more quickly than with direct investment The upside potential is straightforward: in the best-case scenario, the certificate can rise from ¤80 to ¤110 – the maximum return is 37.5 percent. However, to realise this maximum return, a price rise in the underlying share by only 10 percent (from ¤100 to ¤110) is already sufficient at the maturity of the discount certificate. And even if the stock returns to a level of ¤100 in 18 months’ time, the discount certificate will still bring a profit. It will be worth ¤100 – given the entry level of ¤80 investors will still make a profit of 25 percent, whereas a direct investment would have led to zero profit. Limited risk of losses On the other hand the 20 percent discount protects investors against losses: the share price will have to fall by more than 20 percent, to below ¤80, in order to fall below today’s value of the An opportunity for attractive returns with a risk cushion Discount Certificates discount. And even below this loss threshold the certificate will still outperform the underlying instrument. Only if the share price rises by more than 37.5 percent (the maximum return of the discount certificate) would a direct investment be the better solution. Cap level determines the risk/return profile The cap level is consequently the main determining factor for the certificate’s risk/return profile. The higher the cap, the higher the potential profit; the smaller the cap, the larger the risk cushion. A discount certificate whose cap is considerably below the current price of the underlying instrument allows investors to generate attractive returns even if markets slide. Securitised short options position Theoretically, discount certificates are a securitised form of a short option position: investors buy the underlying instrument and simultaneously sell a call option. The option premium is reflected by the discount. Investing in discount certificates thus becomes more attractive as the markets move more – high volatility leads to high option premiums and sizeable discounts. Please note, however, that the risk/return profile described above applies only if the discount certificate is held until maturity. Risk/return profile at maturity 60% Loss threshold (¤80): 20% risk buffer 40% Profit / Loss Stop relying on a bull market to make profits 20% 25.0% return for sideways market Maximum return: 37.5% 0% Cap level (¤110): maximum return achieved with just 10% share performance –20% –40% –60% 50 60 70 80 90 100 110 120 130 Price of the underlying instrument at maturity 140 150 Discount certificate Direct investment The Success Factors 13 DoubleChance certificates: Get the most from moderate growth No additional risk Double your potential return Even though daily price movements suggest otherwise, most fluctuations in share prices are relatively moderate (at least in “normal” times). Leveraging such a moderate performance would thus be a rather obvious concept. Alternative to direct investment in a share or an index Performance disadvantage only if prices soar Double your potential return Regularly updated product offer Leverage is generally associated with warrants. However, these speculative instruments may not only lead to disproportionate gains, but also to disproportionate losses. If investors do not want to take on additional risk in comparison to a direct investment but would nevertheless like to optimise moderate gains, Deutsche Bank’s DoubleChance certificates are the right choice. Up to a certain cap level, investors can double the performance of the underlying instrument. On the downside, the risk of the certificate is equivalent to that of the underlying. Alternative to direct investment in a share or an index Let’s assume that an investor believes a certain share, which is currently trading at ¤100, will rise by 15 to 25 percent within the next twelve months. Instead of buying shares, the investor buys a 14 The Success Factors DoubleChance certificate with a lifetime of one year, which also costs ¤100 and has a cap of ¤120. Three different scenarios are possible at maturity: The underlying instrument is trading at or above the cap level: the investor has realised the maximum return at a share price of ¤120 – however, that return is not 20 percent (as for the share), but 40 percent thanks to the DoubleChance mechanism. Only if the share price exceeds ¤140 would a direct investment have been more advantageous. If it trades between ¤120 and ¤140, the certificate is still the better investment. The underlying rises, but remains below the cap level: if the share trades between ¤100 and ¤120, the profit is exactly double that of a direct investment. A share price increase of 15 percent will thus result in a return of 30 percent. The price of the underlying declines: below the purchase price of ¤100 the DoubleChance certificate behaves exactly like the underlying share. If, for example, the share price has fallen to ¤90, the certificate will realise a 10 percent loss as well. Performance disadvantage only if prices soar Double your profits without additional risk DoubleChance CertificatesTM This means that there is only one scenario in which the DoubleChance certificate is less advantageous than a direct investment: namely if the share rises by at least double the difference between the purchase price of the certificate and the cap level. As long as prices rise moderately, however, investors can double their returns. And if there are any losses, they are never higher than those of the direct investment. Regularly updated product offer which gains are doubled) include the volatility of the underlying instrument and the lifetime of the certificate. Deutsche Bank regularly launches new DoubleChance certificates, which are in line with prevailing market levels. However, investors should note that the DoubleChance effect always refers to the prices at issuance and at maturity of the certificate. During the lifetime of the certificate, its changes in value may be smaller than that of the underlying share. Thus, it is recommended that investors hold the certificate until its maturity. The factors determining the difference between the purchase price and the cap level (up to Risk/return profile at maturity 60% 40% Profit / Loss No additional risk Maximum return: 40.0% 20% 0% Cap level (¤120): maximum return achieved with just 20% share performance –20% –40% No additional risk exposure –60% 50 60 70 80 90 100 110 120 130 Price of the underlying instrument at maturity 140 150 DoubleChance certificate Direct investment The Success Factors 15 Guarantee certificates: Full protection for investment Two-component structure Flexible specifications Capital protection always refers to maturity date Combine security and profit opportunities Even though equities tend to rise in the long term, recent developments have clearly shown the threat of losses even if investors stay invested for five years or more. Against this background it is quite logical that many investors put security first in new investments – they simply do not want to lose any more money. Two-component structure However, this does not mean that investors necessarily have to give up on potential equities performance to preserve the capital. Guarantee certificates combine full protection of capital with virtually unlimited return potential. These securities always contain two components: Guarantee component: Deutsche Bank will invest a large part of the price paid for a guarantee certificate at issuance – e.g. ¤100 – into a zero-coupon bond. The portion of the certificate price will be calculated exactly so that this component is worth ¤100 at maturity, thus protecting investors’ initial capital investment. If, for example, the certificate has a lifetime of five years and interest rates stand 16 The Success Factors at 4.0 percent p.a. at the time of issuance, ¤82.19 (100/1.045) must be invested in the zerocoupon bond. If the lifetime of the certificate is longer or interest rates are higher, this amount will be lower. The performance component: The remainder (in our example ¤17.81) is invested in the equities market, usually in options on an index such as the EURO STOXX 50. However, as only a minor portion of the issuance price is invested in this component, investors will only partially participate in any upside performance – for instance, to 50 percent, based on the initial ¤100 investment. This means that the certificate will yield a return of only 10 percent if the index rises 20 percent between the certificate’s issuance and maturity. If the index declines over the product lifetime, the options will expire valueless. However, this does not affect your capital investment because the guarantee component protects you from any losses, regardless of the extent of falling share prices. High coupons are possible even in a low-interest environment Opportunity BondsTM always have to cover 100 percent of the issuing price. With a protection level of only 95 percent, investors would assume some risk to their capital, but would also participate in market performance to a larger degree because less money needs to be invested into the bond. Alternatively, the guaranteed amount can also be higher than the issuing price, further reducing the degree of participation in market performance. The performance component can be shaped differently as well. For example, returns can be based on the average gains during the lifetime of the certificate instead of on the index levels at issuance and maturity. Doing so would help to smooth out volatility and enhance the participation rate. Capital protection always refers to maturity date Regardless of specifications, investors should note that the guarantee is only valid at maturity of the certificate. During the first years of its lifetime, the price of the certificate may even fall below the guaranteed amount if the underlying instrument performs poorly. On the other hand, declining interest rates during the lifetime may push the price of the certificate above 100 percent. Investors planning to buy a guarantee certificate should therefore be reasonably sure that they can hold it until maturity, and will not need to redeem it before that time. Risk/return profile at maturity 100% 75% 50% Profit / Loss Combine security and profit opportunities 25% 0% –25% –50% –75% –100% Flexible specifications 0 In practice, there are many possible variations to this basic model. For example, the protection does not Guarantee certificate (50% participation) Direct investment 25 50 75 100 125 150 Price of the underlying instrument at maturity 175 200 The Success Factors 17 Parachute certificates: Keep upside, protect downside Retain return potential Partial cushioning is less expensive Security-oriented investors and car owners are often faced with the same question: do they really need fully comprehensive cover? Full protection of the invested capital, as offered by a traditional guarantee certificate, is very comforting, particularly in view of the experience of the past few years. This level of security, however, comes at a price: the performance participation of guarantee certificates is relatively low, particularly in times of low interest rates and high volatility. Three possible scenarios Parachute will open only at maturity Partial cushioning is less expensive That is why Deutsche Bank’s parachute certificates are an interesting alternative. Possible losses are buffered only up to a limit defined beforehand. At the same time, investors participate in any price increases just as if they had bought the underlying instrument (or at least very close to 100% performance). Three possible scenarios The following example illustrates how this partial protection mechanism works. An index is trading at 100 points when a four- 18 The Success Factors year parachute certificate with a guarantee limit of 25 percent and a participation of 100 percent is issued at a price of ¤100. Three scenarios are possible at maturity: The index trades above the starting level: In this best possible case, investors receive the full performance, in cash. Thus, a rise from 100 to 150 points in four years’ time will result in a return of exactly 50 percent. The index trades below the starting level, but above the protection limit: Normally, investors would have lost money, but this is where the parachute comes into play. As long as the index has not lost more than 25 percent (100 – 75) over the lifetime of the certificate, investors will receive a redemption of the full issue price of ¤100. Keep the upside, protect the downside Parachute CertificateTM the parachute certificate would only lose 20 percent. An index certificate, in contrast, would be down by 40 percent. This shows that profit potential and protection do not necessarily have to be opposites. The protection limit and the participation ratio will depend on both the underlying instrument and the lifetime of the parachute certificate. For current details, please refer to the regularly updated Deutsche Bank product descriptions. Parachute will open only at maturity Investors should consider that the parachute mechanism described will only be effective at maturity of the certificate. During the certificate’s lifetime, its price may fall below the issuing price even if losses on the underlying instrument are still within the protection range. In addition to the current index level, volatility, dividends, the interest rate level and the remaining lifetime will influence market prices of the certificate. Consequently, parachute certificates will not protect investors against shortterm losses. However, they are a useful instrument for conservative, long-term investors who, in principle, expect prices to rise over a four-to-five-year horizon but do not exclude the possibility of a moderate downturn and want to hedge against this eventuality. Risk/return profile at maturity 100% 75% The index trades below the protection level: If the index drops by more than 25 percent, the parachute certificate no longer fully protects against losses. However, thanks to the parachute effect, the losses are always lower than in the case of a direct investment. With the index trading at 60, for example, 50% Profit / Loss Retain return potential 75% protection level (=25% risk buffer) 25% 0% –25% –50% –75% –100% 0 25 50 75 100 125 150 Price of the underlying instrument at maturity 175 200 Parachute certificate Direct investment The Success Factors 19 BestChance certificates: Optimised investment timing Buy today or a few weeks later – it’s the best price that counts Particularly attractive for investors who expect a short-term setback Exploit attractive buying opportunities Everybody knows the situation: an investor has decided in principle to buy a share, but remains uncertain about the timing. Has the price already reached an attractive buying level? Or might it fall somewhat further over the next few weeks, for example, because the company’s quarterly figures might come in below market expectations? Now investors no longer have to leave the answer to fate. With Deutsche Bank BestChance certificates, investors automatically buy at the lower of two prices – either the price at the issuance date or the price at the BestChance date a few weeks later. The only cost they incur for being able to retroactively optimise their chances is that the return of the certificate is capped right from the beginning. Buy today or a few weeks later – it’s the best price that counts Let’s assume that the target share is traded at ¤100. At the same price, investors can buy a BestChance certificate expiring in 13 months, with a return capped at 30 percent. Six weeks are left until the BestChance date. Investors might want to look at three different scenarios: 20 The Success Factors The share price rises continually: If the share trades at a higher price on the BestChance date (compared to the buying date of the certificate), nothing changes. Investors stay invested at an entry level of ¤100, and will benefit from any upside performance at maturity of the certificate. If the price is ¤120 after 13 months, investors receive a return of 20 percent. Only if the share trades above ¤130 (i.e., if the price exceeds the 30 percent cap on the return), the return will be smaller than for a direct investment. The share price falls until the BestChance date, but rises later on: In that case, investors benefit directly from the BestChance mechanism. If, for example, the share trades at only ¤80 when the first six weeks have elapsed, this level will be the entry price for the share. The ¤100 you invested initially will be reinvested at the new price level, so investors will eventually hold 1.25 shares (100/80). If the share price rises again – say, to ¤90 by the maturity date of the certificate – investors will receive a redemption of ¤112.50 (90 x 1.25). This means a return of 12.5 percent. Had investors bought the share at ¤100, they would have lost 10 percent on Profit from optimised timing BestChance CertificateTM their investment. However, the cap on returns is still in place. If the share rises above ¤104 (entry level of 80 euros plus 30 percent), any further performance will no longer be reflected in the certificate. The share price continues to decline: The BestChance certificate will help investors to cushion losses. Let’s assume that the price falls from its initial level of ¤100 to ¤80 at the BestChance date, and then further to ¤70 at maturity. Investors will have to take only the losses incurred after the BestChance date – and the certificate will trade at ¤87.50. Had they bought the share directly at ¤100, they would have lost 30 percent of their capital. Particularly attractive for investors who expect a short-term setback The BestChance mechanism makes the most sense in uncertain times, particularly if short-term setbacks are imminent and the medium-term potential is limited. In such a situation, investors can exploit performance opportunities by securing a lower entry price and simultaneously enjoying a cushion against risks. However, this holds only if investors buy the certificate shortly after its issuance (and in any case before the BestChance date) and hold it until maturity. During its lifetime, the certificate will not necessarily move in line with the underlying instrument. Risk/return profile at maturity 60% 40% Profit / Loss Exploit attractive buying opportunities 20% Maximum return: 30.0% 0% Maximum return is achieved at a level of ¤104 thanks to the lower price prevailing on the BestChance date –20% –40% –60% 50 60 70 80 90 100 110 120 130 Price of the underlying instrument at maturity 140 150 BestChance certificate (performance based on price level at issue) BestChance certificate (performance based on price level on the BestChance date) Direct investment The Success Factors 21 Winner certificates: Act with hindsight Enjoy the benefit of hindsight to structure the best portfolio Only the best performers decide Lower return only in case of a broadly-based, strong market rise The logical answer to the market environment Particularly interesting for sector exposure Enjoy the benefit of hindsight to structure the best portfolio Picture this: investors put ¤100 in each of five selected shares and wait to see what happens. Four years later, they take another look at their portfolios and find that, while most shares performed quite well, one or two did poorly. Now go back in time to the entry date, distribute the ¤500 invested initially between the three best performers and enjoy a remarkable investment success. Only the best performers decide Correlation as a decisive factor No, this is not another stockmarket fairy tale but a very real investment opportunity, brought to investors by the Winner certificates from Deutsche Bank. In contrast to plain vanilla basket certificates, the redemption payment depends only on the best-performing issues during the lifetime of the certificate. This means investors know right from the beginning that their investment return will depend exclusively on the winners – a nice feeling. Lower return only in case of a broadly-based, strong market rise This re-weighting, which does remind one of time travel, becomes possible because the return 22 The Success Factors potential is limited right from the beginning. However, this limit will only have a negative effect on the overall return if all equities included in the basket at the issuance date of the certificate rise strongly (scenario 1). In this case, the Winner mechanism will no longer be an advantage, so the return cap will leave investors in a disadvantaged position compared to a direct investment. The logical answer to the market environment In any other scenario, however, investors would be better off. Usually equities do not rise or fall in parallel because companyspecific factors have at least the same influence on prices as the overall market sentiment. If investors hold five or six different issues in their portfolio, it is therefore very likely that at least one share will underperform or even fall, even if markets rise overall (scenarios 2 and 3). In the case of a traditional investment this would weigh on profits – the Winner certificate, however, will allow investors to disregard these underperformers. And even if equities do fall (scenario 4), the Winner certificate will at least limit losses because the worst performers will be kept out when the average is calculated at maturity. Particularly interesting for sector exposure Correlation as a decisive factor Profit from the best performers Winner CertificateTM These certificates are particularly attractive to investors who want to put their money in specific sectors. In the case of sectorspecific ‘mega trends’ - such as biotechnology or high-tech – uncertainties abound as to which companies will perform best in the long term. With the help of Winner certificates investors not only obviate the risk related to choosing individual issues, but they benefit even more from the best performers and thus optimise their return. However, this is only true to its full extent if investors leave their money invested until maturity. The key factors determining the value of a Winner Certificate are: underlying share prices and the correlation between them. Increases in the share prices will have a positive impact on the value of the Certificate. However, any similar behaviour of the stock prices (‘increasing correlation’) will have a negative effect on the value of the Certificate because it is less likely that there will be any distinct winners or losers in the end. Scenarios for the Winner certificate mechanism Share Underlying #1 Share price at maturity Price at issue date Scenario 1 Scenario 2 Scenario 3 Scenario 4 100.0 130.0 130.0 90.0 80.0 Underlying #2 100.0 125.0 80.0 105.0 80.0 Underlying #3 100.0 160.0 120.0 114.0 100.0 Underlying #4 100.0 140.0 140.0 75.0 90.0 Underlying #5 100.0 105.0 65.0 124.0 100.0 Value of equity basket (5 issues) 100.0 Basket return Value of Winner basket (3 issues) Redemption Winner certificate* Return of Winner certificate 132.0 107.0 101.6 90.0 +32.0% +7.0% +1.6% –10% 143.3 130.0 114.3 96.7 120.0 120.0 114.3 96.7 +20% +20% +14.3% –3.3% Winners Losers * Cap at 120.0 (20 percent) The Success Factors 23 Deutsche Bank Certificates: The right product for any market scenario X-pert Index Certificates Strategy Certificates Theme Certificates Discount Certificates DoubleChance Certificates Time horizon Unlimited Several years or unlimited horizon Several years or unlimited horizon Limited (generally to between 3 and 18 months) Limited (generally to between 3 and 15 months) Underlying instruments Indices, commodities Basket of equities or indices Indices, equity baskets, commodities Indices, individual equities, other investment products Indices, individual equities, other investment products Structure Price of the underlying instrument is continually reflected in a certain subscription ratio (1:1, 1:100 etc). At regular intervals our strategy models select those index constituents that best fulfil certain objective investment criteria (validation on the basis of a retrospective historical simulation). Exact tracking of specialised sector indices, theme baskets of equities, commodity prices or portfolios of hedge funds. Redemption is limited to a maximum amount (cap level) - in turn, the certificate has a price discount compared to the underlying instrument. Redemption is limited to a maximum amount (cap level) – in turn, the certificate performance is double the performance of the underlying instrument (up to the cap level). Profit potential Unlimited and complete participation in all price gains. Unlimited and complete participation in all price gains. Unlimited and complete participation in all price gains. Limited participation up to the cap level. A lower performance of the underlying instrument (compared to a direct investment) is required for the maximum return on the certificate; depending on the cap level, the underlying may even decline. Limited participation up to the cap level. To realise the maximum return the underlying instrument has to rise half as much as in the case of a direct investment. Risk exposure Unlimited and complete participation in all price losses. Unlimited and complete participation in all price losses. Unlimited and complete participation in all price losses. The discount works as a cushion against the risk at maturity; a net loss is only incurred if the underlying instrument loses more than covered by the discount. Unlimited and complete participation in all losses (as in the case of a direct investment). Investment rationale Investment for investors who expect prices to rise (particularly in the long term); efficient alternative to mutual funds at attractive costs (no fees, no performance risk). Investment for investors who expect prices to rise in the long run, but want to outperform the index (and are ready to take the risk of a worse performance in comparison to the overall market). Useful for diversifying the portfolios of conservative investors (e.g. for participation in economic mega trends or in alternative investments) and short-term investors (e.g. for speculation on sector rotation effects). Very flexible instrument for conservative investors who are looking for a risk-buffered investment which offers profits if markets rise moderately, stagnate or decline. Useful instrument for active investors who believe in moderate gains of the underlying and want to maximise them without an additional risk buffer. Risk/return profile (at the end of the lifetime, in comparison to direct investment) 24 Appendix Appendix 25 Deutsche Bank Certificates: The right product for any market scenario Guarantee Certificates Parachute Certificates BestChance Certificates Winner Certificates Time horizon Limited (generally to between 4 and 10 years) Limited (generally to between 4 and 6 years) Limited (generally to 13 months) Limited (generally to between 4 and 6 years) Underlying instruments Indices, equity baskets Indices, equity baskets, individual equities Indices, individual equities Basket of equities Structure The minimum redemption amount at maturity (usually the issue price) is defined in advance; investors participate in positive performance on top of the guaranteed amount. Unlimited participation in price gains; losses are covered at maturity, up to a predefined protection level. Redemption is limited to a maximum amount (cap level) – in turn, the entry level for the certificate is set at the lower of the issue price and the price level at the later BestChance date. Redemption payments at maturity are calculated on the basis of those shares that performed best; underperformers are excluded. In return there is a cap on the maximum yield. Profit potential Partial participation in all price gains. Unlimited, very high degree (up to 100%) of participation in all price gains. Limited participation up to the cap level. A profit is achieved if the price of the underlying instrument, at the BestChance date, is below the price level at issuance and subsequently rises. Limited participation up to the cap level. Focussing on the best performers yields better results compared to a direct investment (exception: strong rise in all issues contained in the basket). Risk exposure Complete or partial guarantee for the invested capital at maturity. Losses are incurred only if the underlying instrument trades below the protection level at maturity (risk is always lower compared to a direct investment). A better price at the BestChance date serves as a risk buffer at maturity; investors will realise only the losses exceeding this downturn of the underlying. Theoretically unlimited participation in all losses; however, these are always lessened compared to a direct investment because underperformers are excluded. Investment rationale Investment for very risk-averse investors who want to avoid losses completely and at the same time partially participate in the performance opportunities of equity markets (as an alternative to bond investment). Investment for safety-oriented investors who expect prices to rise over a period of several years, but also consider a limited downside movement against which they want to hedge their capital. Useful instrument for active investors who are generally optimistic about the underlying instrument, but want to eliminate the risk of timing or believe shortterm setbacks are possible. Add-on investment for investors who want to eliminate the risk resulting from share selection – particularly useful for sectordriven investment. Risk/return profile (at the end of the lifetime, in comparison to direct investment) 26 Appendix Appendix 27 X-press – Expert knowledge for free Glossary: Terms you should know if you want to invest in certificates The investor magazine for warrants and certificates The magazine presents interesting facts about warrants and certificates. X-press focuses on readers who already have some derivatives experience. Readers will get expert tips on trading these products, receive regular updates about new issues by Deutsche Bank and get a lot of interesting and valuable information in each issue. In addition there is a complete survey of all Xavex and X-markets products in a separate booklet. Order your free copy of the magazine: Phone: +49 69 910-38807 Fax: +49 69 910-38673 www.db-xm.com x-markets.team@db.com Please complete the form and fax it to +49 69 910-38673 Yes, I would like to receive the monthly X-press magazine, free of charge. Leading to results.® First name Benchmark: A measure of how a single investment has performed in relation to the development of the market as a whole. Usually the benchmark is a suitable →index; the performance of German equity funds is thus measured in comparison to the DAX. Outperformance: Excess return – the fact that an investment offers a better →return than another investment. Strategy certificates, for example, are designed to ensure an outperformance over the benchmark →index. Opposite: →underperformance. Degree of participation: Indicates the extent to which a certificate lets investors participate in the performance of the →underlying instrument. In the case of index and strategy certificates investors participate to 100% in all gains or losses (unlimited participation). Other certificates offer a lower participation, or cap it. Performance: Development of the price or →return of a share, an index or another investment. Direct investment: Direct purchase of the →underlying instrument, instead of a certificate. Index: Continuously calculated price indicator which aggregates the performance of many individual securities (equities, bonds) in a single figure. Usually adjusted at regular intervals on the basis of transparent criteria (stock exchange turnover, market capitalisation). Issue: Launch of a new certificate. Performance index: An index that does not only cover price developments, but also includes the reinvestment of dividends distributed by companies in the index. Opposite: →price index. Price index: Index which does not take into account dividends distributed by the companies it covers. Opposite: →performance index. Return: Difference in percent between the final value of an investment and the capital invested. Risk cushion (buffer): Amount by which the →underlying instrument of a certificate may fall at most without entailing losses for the investor. Stock picking (active portfolio management): Attempt to identify equities which will outperform the →benchmark, by way of fundamental and/or technical analysis. Subscription ratio: Describes the relation in which a certificate reflects the price development of the →underlying instrument. In the case of certificates on individual shares the subscription ratio is usually 1:1; certificates on indices often have a subscription ratio of 1:10 or 1:100. Underlying instrument: The share, basket of shares, investment product or index on whose price development a certificate is based. Underperformance: The fact that an investment offers a lower →return than another investment. Opposite: →outperformance. Volatility: Intensity of fluctuation in prices or returns, usually measured as a percentage (expressing the statistical concept of standard deviation). For some types of certificates, e.g. discount certificates, high volatility makes for particularly attractive investment perspectives. Name Street address Postcode Number Town/city ZB Appendix 29 X-markets – Listening is fundamental to service Important Notice For more detailed information about the certificates described in this document please consult the individual product brochures. In addition, the “Basic Information on Investments in Securities” will inform you about the opportunities and risks of these certificates. The statements made in this document do not represent investment advice. Talk to us: challenge us Experience the unrivalled service provided by the market leader*: More than 3,500 warrants, WAVEs and certificates Current strike prices, fair pricing with narrow bid/offer spreads Trading hours from 8:00 – 22:00 CET Access via all major banks and discount brokers An enthusiastic team backed by global resources X-markets, your direct access to Deutsche Bank’s global investment expertise *Source: Deutsche Börse Exchange Clearing System More information on our products: Information hotline Email Internet X-press +49 69 910-38807 x-markets.team@db.com www.db-xm.com The expert magazine – updated monthly – free of charge Current prices: Teletext Reuters Quotes via telephone n-tv page 770 (updated every minute) DBMENU 0 18 05 – 95 09 55 Leading to results.® Certificates denominated in a currency other than that of the investor’s home country will be subject to exchangerate fluctuations, which may negatively impact their value, price or return. Changes in exchange rates of the currencies in which index component shares are quoted and of the denominating currency of the individual certificate may affect the market price and the cash redemption payments of such certificate. Moreover, Deutsche Bank cannot make any forecast regarding the price development of any certificate on the secondary market, or about its liquidity. There may be only one market-maker, namely Deutsche Bank AG or one of its affiliated companies. Some of the certificates described in this document pay no dividends to the investor, even if the underlying pays dividends. Please consult the relevant product brochure for detailed information on the dividend treatment. Certificates are not useful for all types of investors, and investing in one of these certificates may entail major legal and tax consequences, as well as risks to the capital invested. Investors should therefore seek professional advice. We urgently advise our clients to discuss such investments with their tax or financial consultant before investing. Prospectuses containing detailed descriptions of the individual certificates are available on request. Please contact your advisor at your local branch of Deutsche Bank AG. (Germany only – EUR 0.12/minute) Appendix 31 Additional information: Tax regulations in Germany General information General information Taxation of private individuals subject to unlimited tax liability in Germany The information given below contains some information about German tax regulations, which may be relevant for investors resident in Germany or subject to German taxation for any other reason. This information does not constitute or represent tax advice. The following statements are based on current German tax laws and their interpretation, which may be subject to change. Any such changes may be introduced with retroactive effect, and may change the tax situation described below to the detriment of the taxpayer. This summary does not purport to deal with all tax aspects which may be important due to the personal situation of an individual investor. Investors are therefore advised to discuss the tax consequences of buying, holding, redeeming, or selling securities with their tax advisor. Taxation of business assets of persons subject to unlimited tax liability in Germany Taxation of non-resident taxpayers under German law Taxation of private individuals subject to unlimited tax liability in Germany For a person who is subject to unlimited tax liability in Germany (i.e. a person whose residence or 32 Appendix usual residence is in the Federal Republic of Germany), and who holds financial investments as private (non-business) assets, profits from capital investments pursuant to section 20 (1) No 7 of the German Income Tax Act (Einkommensteuergesetz – “EstG”) are only incurred if the repayment of the capital is guaranteed and/or the investor can claim interest payments and/or other types of payment in return for the provision of capital. Therefore, a distinction must be between the following types of certificates: The security grants neither interest payments nor the repayment of capital, and the redemption price (and consequently the value of the security) relate exclusively to the value of the underlying instrument. In two letters dated 21 July 1998, and 27 November 2001, respectively, the German Ministry of Finance clarified that revenues from a financial investment are not to be treated as taxable revenues from capital investment provided that the repayment of the invested capital depends exclusively on the uncertain development of an equity index. This regulation applies even if dividends, for example, are included in the calculation of the value of the equity index. In the letter dated 27 November 2001, this view was expressly extended to also cover financial investments for which the repayment of the invested capital depends on the development of a basket of equities, or a single share. This means that profits from the sale or redemption of a security with the characteristics described above are not taxable revenues from capital assets. Profits realised on the sale of private assets: A person who is subject to unlimited tax liability in Germany is exempt from income tax on the sale or redemption of securities held as private assets, provided that more than one year has passed between purchase and sale or redemption. In contrast, profits resulting from the sale/redemption of a security within one year after purchase are subject to income tax (plus a solidarity surcharge equivalent to currently 5.5% of the income tax burden). The profit or loss is equivalent to the difference between the sales proceeds (or the cash settlement paid by the issuer) and the cost of purchase of the security. Where physical deliver of the underlying instrument takes place, the value of this underlying at the moment of its being credited to the creditor’s account is considered in lieu of a cash settlement. Losses are only tax-deductible if less than one year passes until the security is sold or redeemed. These taxdeductible losses may be offset only with taxable profits from private sales of the current, the preceding or the following tax years. The securities guarantee the full repayment of capital, or a guaranteed minimum amount below the issue price, with this minimum amount being Appendix 33 dependent on the price development of an underlying instrument exposed to market fluctuations. Such securities fall under the definition of ‘financial innovations’ pursuant to section 20 (2), sentence 1/ no. 4 sentence 1 of the EStG. If these securities are sold or redeemed, the profits from sale or redemption are taxed according to the so-called market yield, which is defined as the (positive or negative) difference between the consideration paid upon purchase and the proceeds upon sale or redemption of the securities. Losses stemming from sale or redemption result in a negative market yield, which may be tax-deductible as negative revenue from capital assets. Interest income tax (Zinsabschlagsteuer): In the case of the sale or redemption of ‘financial innovations’, the (positive) market yield is subject to the interest income tax (plus 5.5% solidarity surcharge on that tax charge) if the securities were bought or sold via a domestic 34 Appendix German bank or financial services provider where the customer’s account is maintained, and which has kept the securities in safe custody since the purchase. Otherwise such domestic German bank or financial services provider is obliged to withhold the interest income tax (plus 5.5% solidarity surcharge on that tax charge), applying a flat rate of 30% of the profits from the sale or redemption of the securities. This flat-rate withholding tax procedure only covers interest income tax, but is irrelevant for the assessment of income or corporation tax. The definition of a ‘domestic German bank or financial services provider’ also covers domestic branches of a foreign bank or financial services provider, but excludes foreign branches of a domestic bank or financial services provider. Taxation of business assets of persons subject to unlimited tax liability in Germany Persons or entities who are subject to unlimited tax liability in Germany, and who hold the securities as part of their business assets in Germany are subject to trade tax (with a varying tax rate among municipalities) and income or corporation tax (plus 5.5% solidarity surcharge on the income or corporation tax) on profits made on such securities, calculated on the basis of the positive difference between the sales proceeds or the redemption payment and the cost of purchase. No distinction is made as to whether the securities include a guaranteed full repayment of capital. Taxation of non-resident taxpayers under German law Where securities are held by a person whose residence (or ordinary residence) is outside Germany, or a legal entity whose registered office or place of management is outside Germany, the positive difference between the sales proceeds and/or the redemption payment and the cost of purchase is subject to income or corporation tax (plus 5.5% solidarity surcharge on the income or corporation tax liability) insofar as these securities form part of the business assets of a place of operations (in which case the taxable income may also be subject to trade tax) or another permanent establishment the creditor maintains in Germany. Interest income tax and the solidarity surcharge are treated as a prepayment on the investor's income tax liability (including solidarity surcharge thereon), and are refunded in the event of an overpayment. Appendix 35 Notes All products – all brochures Please detach the fax form, and fax the completed form to +49 69 910-38673. Alternatively, post the form to Deutsche Bank AG, X-markets Team, Große Gallusstrasse 10-14, 60272 Frankfurt/Main, Germany. © 2003 Deutsche Bank AG. This document is a summary of the characteristics of the securities presented. The complete terms and conditions can be found in the detailed sales prospectuses, which are available from Deutsche Bank AG, free of charge. Details specified in this document do not represent investment advice, but shall be construed exclusively for the purposes of product description. In any case an investment decision should be made on the basis of the respective sales prospectus. Any opinions expressed reflect the current views of Deutsche Bank AG and are subject to change without notice. Although details included in this document were taken from sources considered to be reliable, the Bank will not assume any liability for their accuracy, completeness or adequacy. Past performance is not indicative of future returns. As described in the individual sales prospectuses, the sale of the securities is restricted in various jurisdictions. In particular, these securities must not be marketed in the United States of America, and must not be offered for purchase or sale to, or for the benefit of, any US person. This document, and the information contained therein, may only be disseminated or published in such states in which this is permissible pursuant to the prevailing statutory provisions. The direct or indirect distribution of this publication in the USA, the UK, Canada and Japan, or its distribution to US persons, are forbidden. Xetra DAX® Index, Dow Jones EURO STOXX 50SM Price Index, Dow Jones STOXX 600SM Price Index, Dow Jones Industrial Average® Index, S&P 500® Index, Nikkei 225 Index, Dow Jones EURO STOXXSM Automobile Index, Dow Jones EURO STOXXSM Insurance Index (jointly the “Indices”), S&P Biotechnology, and S&P Oil are registered trade or service marks of Deutsche Börse AG, STOXX Limited and Dow Jones & Company, Inc., Market Inc., Standard & Poor’s, Nihon Keizai Shimbun Inc. (jointly the “Holders”). The Holders neither promote nor issue, sell or advertise the certificates. The Holders neither assume liability for the results achieved by the use of the Indices, nor do they guarantee the level of one of the Indices described above on a given date. The Holders are free of all responsibility and are not subject to a duty to provide advice regarding any possible mistakes in the Indices. Publication Description X-pert Certificates The particular characteristic of X-pert certificates is that they do not have a finite lifetime. In every other respect X-perts work like traditional certificates: investors participate in a one-to-one relation in the development of the underlying index. Discount Certificates DoubleChance Certificates Parachute Certificates Other certificates Stock at mi market one-t nimal o-one cost ts -per – Inde x Cert ifica tes with out mat urity A discount certificate allows investors to participate in the development of an index or a share, up to a certain cap level. The price of a discount certificate is, in turn, lower than the price of the underlying instrument. An op return portunit y for s wit h a ris attrac tive k cus Disc hion ount Cert ifica The “double chance” evoked by the name of the product means that at maturity – if the underlying instrument has reached the cap level – investors will not only get the price of the share, but additionally the difference between the cap level and the issue price. Doub le witho your pro ut ad dition fits al ris Dou bleC k Parachute certificates, which are available based on a variety of indices, include a limit to the downside, which will buffer potential losses at maturity – just like a parachute would. Keep protecthe upsid e, t the down side Para tes hance chut e Cert Cert ifica ifica tes TM te TM Deutsche Bank AG offers a wide variety of strategy, theme and guarantee certificates. We will be glad to send you a current overview of our certificates product range. If you require information on a particular product, please indicate the name, or the securities ID number. Name / Securites ID Number X-press Magazine X-press – the client magazine published by X-markets – will bring you new information about certificates and warrants every month. It will give you a unique overview of the broad range of products offered by X-markets and help you to take the right investment decision. The integrated, comprehensive X-markets product overview can be easily detached. Please send the free brochures indicated to the following address: First name Last name Street address Postcode 36 Appendix Order Number Town/city ZB