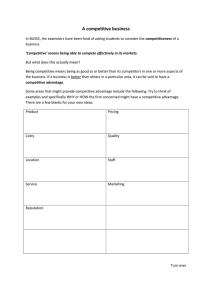

Towards a New Industrial Policy for Europe

advertisement