CHEUVREUX

ITALY

IPO Radar

ASCOPIAVE (EUR1.60 – 2.15)

Gas utilities - Francesca Pezzoli

29 November 2006

Subscribe

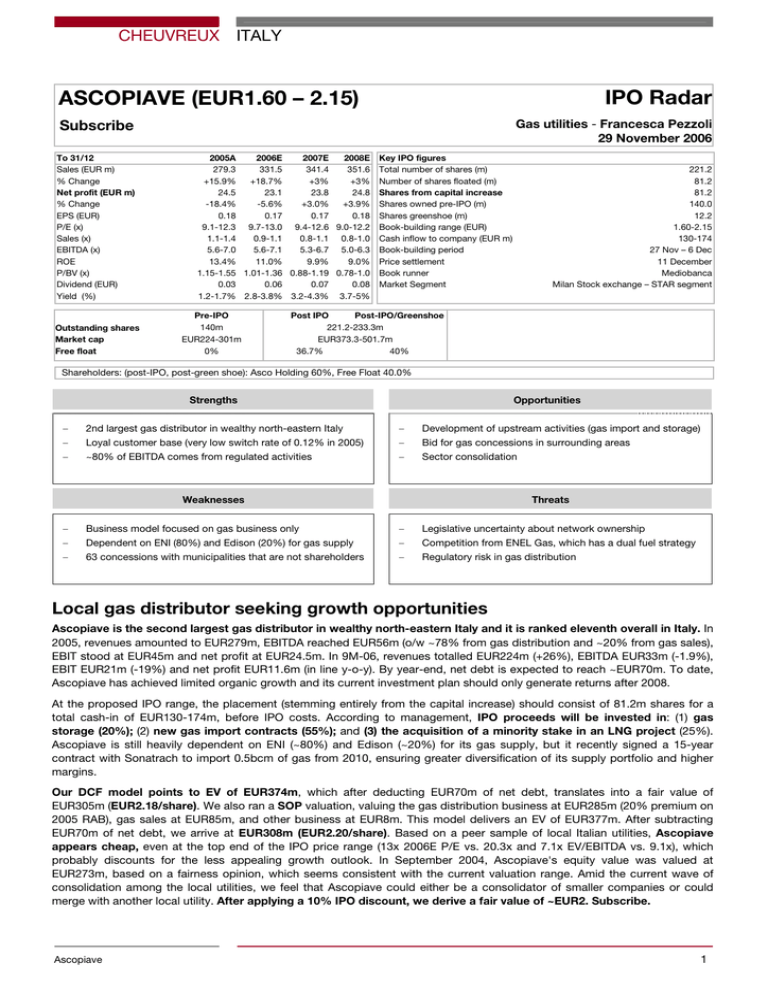

To 31/12

Sales (EUR m)

% Change

Net profit (EUR m)

% Change

EPS (EUR)

P/E (x)

Sales (x)

EBITDA (x)

ROE

P/BV (x)

Dividend (EUR)

Yield (%)

Outstanding shares

Market cap

Free float

2005A

2006E

2007E

2008E Key IPO figures

279.3

331.5

341.4

351.6 Total number of shares (m)

+15.9%

+18.7%

+3%

+3% Number of shares floated (m)

24.5

23.1

23.8

24.8 Shares from capital increase

-18.4%

-5.6%

+3.0%

+3.9% Shares owned pre-IPO (m)

0.18

0.17

0.17

0.18 Shares greenshoe (m)

9.1-12.3 9.7-13.0 9.4-12.6 9.0-12.2 Book-building range (EUR)

1.1-1.4

0.9-1.1

0.8-1.1 0.8-1.0 Cash inflow to company (EUR m)

5.6-7.0

5.6-7.1

5.3-6.7 5.0-6.3 Book-building period

13.4%

11.0%

9.9%

9.0% Price settlement

1.15-1.55 1.01-1.36 0.88-1.19 0.78-1.0 Book runner

0.03

0.06

0.07

0.08 Market Segment

1.2-1.7% 2.8-3.8% 3.2-4.3% 3.7-5%

Pre-IPO

140m

EUR224-301m

0%

221.2

81.2

81.2

140.0

12.2

1.60-2.15

130-174

27 Nov – 6 Dec

11 December

Mediobanca

Milan Stock exchange – STAR segment

Post IPO

Post-IPO/Greenshoe

221.2-233.3m

EUR373.3-501.7m

36.7%

40%

Shareholders: (post-IPO, post-green shoe): Asco Holding 60%, Free Float 40.0%

Strengths

Opportunities

−

2nd largest gas distributor in wealthy north-eastern Italy

−

Development of upstream activities (gas import and storage)

−

Loyal customer base (very low switch rate of 0.12% in 2005)

−

Bid for gas concessions in surrounding areas

−

~80% of EBITDA comes from regulated activities

−

Sector consolidation

Weaknesses

Threats

−

Business model focused on gas business only

−

Legislative uncertainty about network ownership

−

Dependent on ENI (80%) and Edison (20%) for gas supply

−

Competition from ENEL Gas, which has a dual fuel strategy

−

63 concessions with municipalities that are not shareholders

−

Regulatory risk in gas distribution

Local gas distributor seeking growth opportunities

Ascopiave is the second largest gas distributor in wealthy north-eastern Italy and it is ranked eleventh overall in Italy. In

2005, revenues amounted to EUR279m, EBITDA reached EUR56m (o/w ~78% from gas distribution and ~20% from gas sales),

EBIT stood at EUR45m and net profit at EUR24.5m. In 9M-06, revenues totalled EUR224m (+26%), EBITDA EUR33m (-1.9%),

EBIT EUR21m (-19%) and net profit EUR11.6m (in line y-o-y). By year-end, net debt is expected to reach ~EUR70m. To date,

Ascopiave has achieved limited organic growth and its current investment plan should only generate returns after 2008.

At the proposed IPO range, the placement (stemming entirely from the capital increase) should consist of 81.2m shares for a

total cash-in of EUR130-174m, before IPO costs. According to management, IPO proceeds will be invested in: (1) gas

storage (20%); (2) new gas import contracts (55%); and (3) the acquisition of a minority stake in an LNG project (25%).

Ascopiave is still heavily dependent on ENI (~80%) and Edison (~20%) for its gas supply, but it recently signed a 15-year

contract with Sonatrach to import 0.5bcm of gas from 2010, ensuring greater diversification of its supply portfolio and higher

margins.

Our DCF model points to EV of EUR374m, which after deducting EUR70m of net debt, translates into a fair value of

EUR305m (EUR2.18/share). We also ran a SOP valuation, valuing the gas distribution business at EUR285m (20% premium on

2005 RAB), gas sales at EUR85m, and other business at EUR8m. This model delivers an EV of EUR377m. After subtracting

EUR70m of net debt, we arrive at EUR308m (EUR2.20/share). Based on a peer sample of local Italian utilities, Ascopiave

appears cheap, even at the top end of the IPO price range (13x 2006E P/E vs. 20.3x and 7.1x EV/EBITDA vs. 9.1x), which

probably discounts for the less appealing growth outlook. In September 2004, Ascopiave's equity value was valued at

EUR273m, based on a fairness opinion, which seems consistent with the current valuation range. Amid the current wave of

consolidation among the local utilities, we feel that Ascopiave could either be a consolidator of smaller companies or could

merge with another local utility. After applying a 10% IPO discount, we derive a fair value of ~EUR2. Subscribe.

Ascopiave

1

CHEUVREUX

ITALY

Ascopiave

Operations

Investment plan & use of IPO proceeds

The local gas distributor, Ascopiave is ranked

second in wealthy north-eastern Italy and eleventh in

Italy. It operates a 6,289km network (fully owned) and in

2005, it sold 0.8bcm of gas to 304k clients. Ascotrade

holds 155 gas distribution concessions (o/w 92 are

awarded by municipalities, which also have stakes in the

company), 77% of these concessions expire after 2010.

At the proposed IPO range, the placement should

consist of 81.2m shares for a total cash-in of EUR130174m, before IPO costs.

Ascopiave is based mainly in the Veneto Region (~90%

of its client base) and Lombardy (~10%). Ascopiave runs

gas distribution operations and owns 100% of

Ascotrade, which is involved in gas sales. The group is a

pure gas player: in 2005, the gas business accounted for

>97% of all revenues; ~78% of EBITDA stemmed from

gas distribution (regulated) and ~20% from gas sales.

The IPO was launched: (1) to finance core business

expansion, as Ascopiave intends to bid on new gas

distribution concessions nearby and consolidate smaller

players in the Veneto region; (2) to pursue vertical

integration at the gas business. Upstream integration will

also require cash. Recently, Ascopiave acquired a 15%

stake in Ital Gas Storage, which should obtain

authorisation to develop gas storage activities in 2007.

This will require an investment of ~EUR60m.

Ascopiave is 100%-owned by Asco Holding (whose

shareholders are the 93 municipalities). After the IPO,

Asco Holding will control ~67% and the market ~37%

excluding the greenshoe and 40% post-greenshoe.

According to management, IPO proceeds will be

invested in: (1) gas storage (20%); (2) new gas import

contracts (55%); and (3) the acquistion of a minority

stake in an LNG project (25%). Investments are

expected to have an IRR of >10% and a NPV of

EUR120m-150m.

Recent results and company targets

Valuation Summary

In 2005, revenues amounted to EUR279m, EBITDA

reached EUR56m (o/w ~78% from gas distribution and

~20% from gas sales), EBIT stood at EUR45m and net

profit at EUR24.5m. In 9M-06, revenues totalled

EUR224m (+26%), EBITDA EUR33m (-1.9%), EBIT

EUR21m (-19%) and net profit EUR11.6m (in line y-o-y).

Net debt totalled EUR47m, but by year-end it is

expected to reach ~EUR70m.

Our DCF model (5.5% WACC, beta equal to 0.7 and g

of 1.5%), delivers an EV value of EUR374m, which

after deducting EUR70m of net debt, translates into a

fair value of EUR305m (EUR2.18/share). We also ran a

SOP valuation, valuing the gas distribution business at

EUR285m (20% premium on 2005 RAB), gas sales at

EUR85m (7x EV/EBITDA), and other business at EUR8m

(7x EV/EBITDA). This model delivers an EV of EUR377m.

After subtracting ~EUR70m of net debt, we arrive at

EUR308m (EUR2.20/share).

Financial

highlights:

Ascopiave

boasts

high

profitability and good cash generation, but lacks

momentum, as its current investments should only yield

returns after 2008.

Ascopiave recently signed a 15-year contract with

Sonatrach to import 0.5bcm of gas from 2010, which

should help diversify its supply portfolio and pave the

way for higher margins. In June 2006, it signed an

agreement to buy Bimetano Servizi's gas sales unit in

exchange for an 8-12% stake in Ascotrade (worth

EUR7-10m according to our estimates, implying a

EV/EBITDA multiple of 5.7x-8.5x).

In Sept-04, Ascopiave's equity value was valued at

EUR273m based on a fairness opinion, which is in line

with the current valuation range of EUR244-301m.

Multiples. Compared to local utility peers, Ascopiave

looks cheap even at the top end of the IPO range (13x

06E P/E vs. 20.3x and 7.1x EV/EBITDA vs. 9.1x),

implying that its less appealing growth outlook and

limited size are already priced in.

After applying a 10% IPO discount, we derive a fair

value of ~EUR2 so we suggest subscribing.

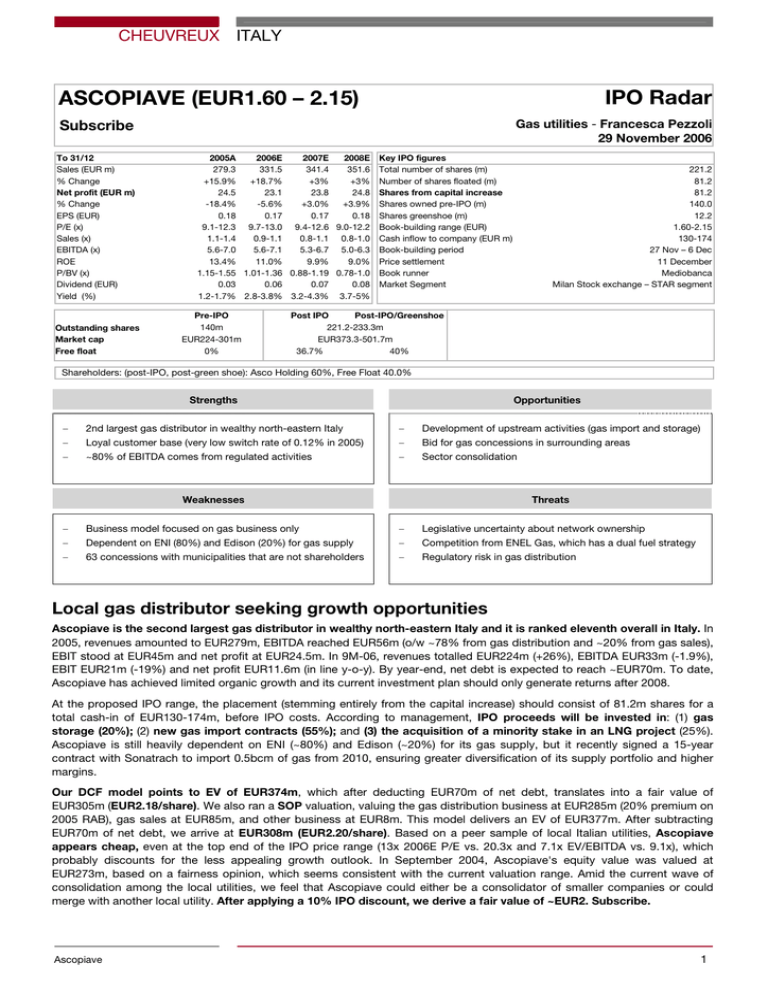

Ascopiave: 2005 EBITDA breakdown

Other

2%

Gas distribution

78%

Ascopiave: Peer comparison

Ascopiave

Peers

P/E

2006E

2007E

2008E

9.7-13.0

9.4-12.6

9.0-12.2

20.3

18.1

16.3

EV/EBITDA

2006E

2007E

2008E

5.6-7.1

5.3-6.7

5.0-6.3

9.1

8.5

7.6

EV/Sales

2006E

2007E

2008E

0.9-1.1

0.8-1.1

0.8-1.0

2.0

1.9

1.8

Gas sales

20%

Source: Cheuvreux

Ascopiave

2

R ESEARCH & D ISTRIBUTION C ENTRES

B ENELUX

C RÉDIT A GRICOLE C HEUVREUX – A MSTERDAM B RANCH

H O NTH OR STST RAA T 9

1071 DC A M ST E R D A M

T E L : +31 20 573 06 66

F AX : +31 20 672 40 41

F RANCE

C RÉDIT A GRICOLE C HEUVREUX S.A.

9, Q U A I P A UL D O U M E R

92400 C OU RB EVO IE

T E L : +33 1 41 89 70 00

F AX : +33 1 41 89 70 05

C RÉDIT A GRICOLE C HEUVREUX

G ERMANY

– F RA NKFURT B RANCH

M ESS E T UR M - F R IE D RI CH -E B E RT -A N LA G E 49

D-60308 F RA N KFU R T A M M A I N

T E L : +49 69 47 897 100

F AX : +49 69 47 897 530

I TALY

C RÉDIT A GRICOLE C HEUVREUX I TALIA SIM S. P .A.

V I A B R E RA 21

20121 M I LA N

T E L : +39 02 80 62 83 00

F AX : +39 02 86 46 15 70

S PAIN

C RÉDIT A GRICOLE C HEUVREUX E SPAÑA S.V. S.A.

P ASE O D E L A C A ST E LL ANA 1

28046 M A DR I D

T E L : +34 91 432 78 21

F AX : +34 91 432 75 13

C RÉDIT A GRICOLE C HEUVREUX

S WEDEN

N ORD IC AB

R EGER ING SG ATA N 38

10393 S TOC K HO L M

T E L : +468 723 5100

F AX : +468 723 5101

D ISTRIBUTION C ENTRES

J APAN

C HEUVREUX

C A LY ON C A P IT A L M A R KE T S A S I A B.V., T O KY O B R AN CH

S H IO D O ME S U M IT O M O B U I L D IN G , 15 T H F LO OR

1-9-2 H IG AS HI -S H I MB ASH I

M INAT O - K U

T O K YO 105-0021

T E L : +81 3 4580 8522

F AX : +81 3 4580 5534

U NITED S TATES

C RÉDIT A GRICOLE C HEUVREUX N ORT H A MERICA , I NC .

N E W Y OR K

1301 A V E NU E OF T H E A ME R ICA S

15TH F L OO R

N E W Y OR K , NY 10019

T E L : +1 (212) 492 8800

Fax: +1 (212) 492 8801

S AN F RAN C IS CO

O NE M A R KE T

S PEAR T O WE R , S U IT E 1610

S AN F RAN C IS CO , CA 94105

T E L : + 1 (415) 543.3111

F AX : + 1 (415) 618.0821

S WITZERLAND

C RÉDIT A GRICOLE C HEUVREUX – Z URICH B RA NCH

B AHN HOF STR ASS E 18

8001 Z UR ICH

T E L : +41 44 218 17 17

F AX : +41 44 212 25 50

U NITED K INGDOM

C RÉDIT A GRICOLE C HEUVREUX I NT ERNATIONAL L IMITED

8 TH F L O OR

122 L E A D E N HA LL S T RE E T

L ON D ON EC3V 4QH

T E L : +44 207 621 5100

F AX : +44 207 621 5101

Copyright © Crédit Agricole Cheuvreux, 2006. All rights reserved

This research report or summary has been prepared by Crédit Agricole Cheuvreux or one of its affiliates or branches (collectively “CA Cheuvreux”) from information believed to be reliable. Such information has not been independently verified

and no guarantee, representation or warranty, express or implied, is made as to its accuracy, completeness or correctness. Any opinions or estimates expressed herein reflect the judgment of CA Cheuvreux at this date and are subject to

change at any time without notice. Unless otherwise stated, the information or opinions presented, or the research or analysis upon which they are based, are updated as necessary and at least annually. Not all strategies are appropriate at all

times. Past performance is not necessarily a guide to future performance. Independent advice should be sought in case of doubt. In any event, investors are invited to make their own independent decision as to whether an instrument is

proper or appropriate based on their own judgment and upon the advice of any relevant advisors they have consulted. CA Cheuvreux, Calyon and their affiliates may effect transactions in the securities described herein for their own account

or for the account of others, may have positions with the issuer thereof, or any of its affiliates, or may perform or seek to perform securities, investment banking or other services for such issuer or its affiliates. The organisational and

administrative arrangements established by CA Cheuvreux for the management of conflicts of interest with respect to investment research are consistent with rules, regulations or codes applicable to the securities industry. These

arrangements can be found in CA Cheuvreux’s policy for managing conflicts of interest, available at www.cheuvreux.com. Current research disclosures regarding companies mentioned in this report are also available at

www.cheuvreux.com.

This report is provided for information purposes only. It is not intended as an offer, invitation or solicitation to buy or sell any of the securities described herein and is intended for use only by those professional investors to whom it is made available by

CA Cheuvreux. To the extent permitted by applicable securities laws and regulations, CA Cheuvreux accepts no liability whatsoever for any direct or consequential loss arising from the use of this document or its contents.

The delivery of this research report to U.S. persons in the United States of America is made by and under the responsibility of Crédit Agricole Cheuvreux North America, Inc. (registered with the SEC). This research report is only intended

for persons who qualify as Major U.S. Institutional Investors, as defined in Securities Exchange Act Rule 15a-6, and deal with CA Cheuvreux. However, the delivery of this research report or summary to any U.S. person shall not be

deemed a recommendation of Crédit Agricole Cheuvreux North America, Inc. to effect any transactions in the securities discussed herein or an endorsement of any opinion expressed herein. Crédit Agricole Cheuvreux North America,

Inc. may furnish upon request all investment information available to it supporting any recommendations made in this research report. All trades with U.S. recipients of this research shall be executed through Crédit Agricole Cheuvreux

North America, Inc. In the United Kingdom, this report is approved and/or distributed by Crédit Agricole Cheuvreux International Ltd (authorised and regulated by the Financial Services Authority (“FSA”)) and is directed at Market

Counterparties and Intermediate Customers (as defined in FSA Rules). As such, the investments referred to herein are only available to such persons. This report is not for distribution to Private Customers and investments mentioned in this

report will not be available to such persons. In Italy, this report is approved and/or distributed by Crédit Agricole Cheuvreux Italia SIM S.p.a. (regulated by CONSOB) and is not intended for circulation or distribution either to the public at large

or to any other parties other than professional investors, as defined in Art. 100 of decree law No. 58 of 24 February 1998 and in Art. 31 of CONSOB Resolution No. 11522 of 1 July 1998 and later amendments. In Spain, any decision by the

recipient to buy should be taken bearing in mind the existing public information on each stock, or, if applicable, the stock exchange prospectus registered in the CNMV (National Securities Market Commission). In Germany, this report is

approved and / or distributed by CA CHEUVREUX SA NIEDERLASSUNG DEUTSCHLAND regulated by Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin)).

THE DISTRIBUTION OF THIS DOCUMENT IN OTHER JURISDICTIONS MAY BE RESTRICTED BY LAW, AND PERSONS INTO WHOSE POSSESSION THIS DOCUMENT COMES SHOULD INFORM THEMSELVES ABOUT, AND OBSERVE,

ANY SUCH RESTRICTIONS. BY ACCEPTING THIS REPORT YOU AGREE TO BE BOUND BY THE FOREGOING INSTRUCTIONS. No part of this report may be reproduced in any manner or redistributed without the prior written permission of

CA Cheuvreux.