Components of nodal prices for electric power systems

advertisement

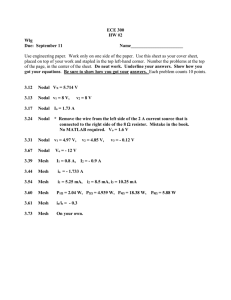

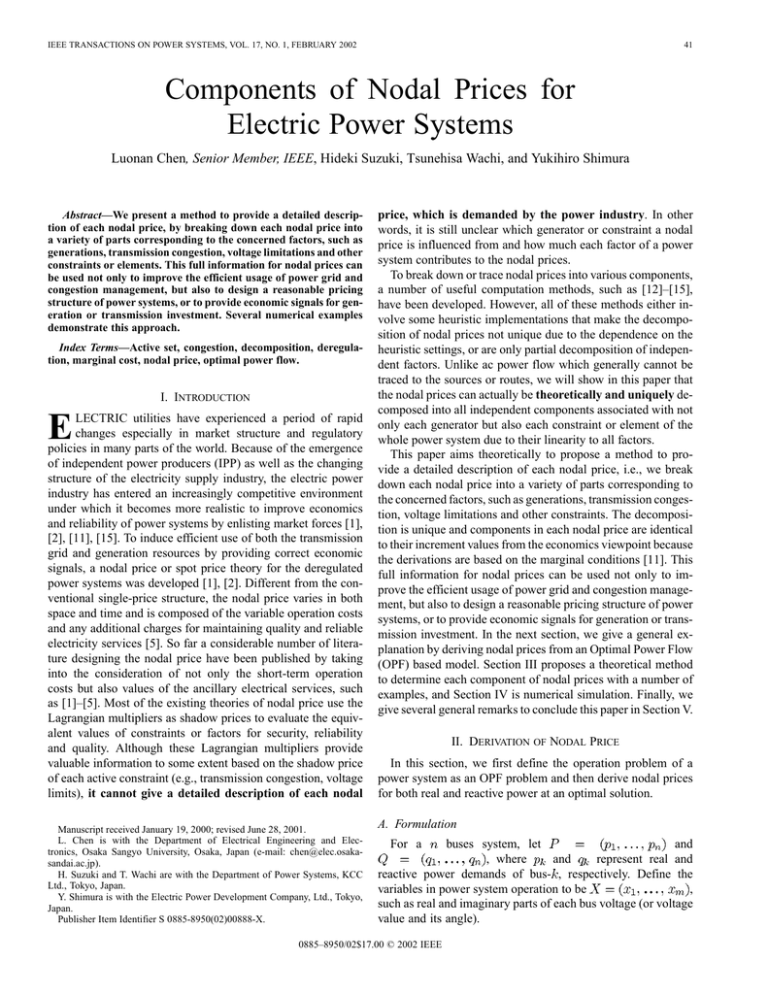

IEEE TRANSACTIONS ON POWER SYSTEMS, VOL. 17, NO. 1, FEBRUARY 2002 41 Components of Nodal Prices for Electric Power Systems Luonan Chen, Senior Member, IEEE, Hideki Suzuki, Tsunehisa Wachi, and Yukihiro Shimura Abstract—We present a method to provide a detailed description of each nodal price, by breaking down each nodal price into a variety of parts corresponding to the concerned factors, such as generations, transmission congestion, voltage limitations and other constraints or elements. This full information for nodal prices can be used not only to improve the efficient usage of power grid and congestion management, but also to design a reasonable pricing structure of power systems, or to provide economic signals for generation or transmission investment. Several numerical examples demonstrate this approach. Index Terms—Active set, congestion, decomposition, deregulation, marginal cost, nodal price, optimal power flow. I. INTRODUCTION E LECTRIC utilities have experienced a period of rapid changes especially in market structure and regulatory policies in many parts of the world. Because of the emergence of independent power producers (IPP) as well as the changing structure of the electricity supply industry, the electric power industry has entered an increasingly competitive environment under which it becomes more realistic to improve economics and reliability of power systems by enlisting market forces [1], [2], [11], [15]. To induce efficient use of both the transmission grid and generation resources by providing correct economic signals, a nodal price or spot price theory for the deregulated power systems was developed [1], [2]. Different from the conventional single-price structure, the nodal price varies in both space and time and is composed of the variable operation costs and any additional charges for maintaining quality and reliable electricity services [5]. So far a considerable number of literature designing the nodal price have been published by taking into the consideration of not only the short-term operation costs but also values of the ancillary electrical services, such as [1]–[5]. Most of the existing theories of nodal price use the Lagrangian multipliers as shadow prices to evaluate the equivalent values of constraints or factors for security, reliability and quality. Although these Lagrangian multipliers provide valuable information to some extent based on the shadow price of each active constraint (e.g., transmission congestion, voltage limits), it cannot give a detailed description of each nodal Manuscript received January 19, 2000; revised June 28, 2001. L. Chen is with the Department of Electrical Engineering and Electronics, Osaka Sangyo University, Osaka, Japan (e-mail: chen@elec.osakasandai.ac.jp). H. Suzuki and T. Wachi are with the Department of Power Systems, KCC Ltd., Tokyo, Japan. Y. Shimura is with the Electric Power Development Company, Ltd., Tokyo, Japan. Publisher Item Identifier S 0885-8950(02)00888-X. price, which is demanded by the power industry. In other words, it is still unclear which generator or constraint a nodal price is influenced from and how much each factor of a power system contributes to the nodal prices. To break down or trace nodal prices into various components, a number of useful computation methods, such as [12]–[15], have been developed. However, all of these methods either involve some heuristic implementations that make the decomposition of nodal prices not unique due to the dependence on the heuristic settings, or are only partial decomposition of independent factors. Unlike ac power flow which generally cannot be traced to the sources or routes, we will show in this paper that the nodal prices can actually be theoretically and uniquely decomposed into all independent components associated with not only each generator but also each constraint or element of the whole power system due to their linearity to all factors. This paper aims theoretically to propose a method to provide a detailed description of each nodal price, i.e., we break down each nodal price into a variety of parts corresponding to the concerned factors, such as generations, transmission congestion, voltage limitations and other constraints. The decomposition is unique and components in each nodal price are identical to their increment values from the economics viewpoint because the derivations are based on the marginal conditions [11]. This full information for nodal prices can be used not only to improve the efficient usage of power grid and congestion management, but also to design a reasonable pricing structure of power systems, or to provide economic signals for generation or transmission investment. In the next section, we give a general explanation by deriving nodal prices from an Optimal Power Flow (OPF) based model. Section III proposes a theoretical method to determine each component of nodal prices with a number of examples, and Section IV is numerical simulation. Finally, we give several general remarks to conclude this paper in Section V. II. DERIVATION OF NODAL PRICE In this section, we first define the operation problem of a power system as an OPF problem and then derive nodal prices for both real and reactive power at an optimal solution. A. Formulation buses system, let and , where and represent real and reactive power demands of bus- , respectively. Define the , variables in power system operation to be such as real and imaginary parts of each bus voltage (or voltage value and its angle). For a 0885–8950/02$17.00 © 2002 IEEE 42 IEEE TRANSACTIONS ON POWER SYSTEMS, VOL. 17, NO. 1, FEBRUARY 2002 Therefore, the operation problem of a power system for the given loads ( , ) can be formulated as an OPF problem [8]–[10] (6) Min s.t. for (1) (2) (3) and have and equations, respectively, and are column vectors while stands for the transpose of a vector . : scalar, short-term operating cost, such as fuel cost; : vector, equality constraints, such as bus power flow balances (Kirchoff’s laws); : vector, inequality constraints including limits of all variables includes all variable limits and function where limits, such as upper and lower bounds of transmission lines, generation outputs, stability or security limits [10], etc. When is a fuel cost function of the system, can be expressed as where is the fuel cost of the th generator. Notice that can also be a benefit function although this paper takes as a cost function. Obviously, (1)–(3) are a typical OPF problem as far as the demands ( , ) are given. There are many efficient approaches which can be used to obtain an optimal solution, such as successive linear programming, successive quadratic programming, the Newton method, the – decomposition approach [6], [7], the surrogate constraint and functional transformation approaches [8]–[10]. where B. Nodal Price Define the Lagrangian function (or system cost) of (1)–(3) as , then (4) and where are the Lagrangian multipliers (or dual variables) associated to (2) and (3), respectively, and are usually explained as shadow prices from the viewpoint of ecoand nomics. Hence, . Actually, the Lacan also be viewed as an equivalent grangian function system cost. ) and for a set of given Then at an optimal solution ( ( , ), the nodal prices of real and reactive power for each bus are expressed below for (5) and are nodal prices of real and reactive power where and are usually at bus- , respectively. considered as the real and reactive power transaction charges from bus- to bus- . Notice that the nodal prices derived by differentiating the maximized social welfare function with respect to the real and reactive demands, yield the same results as (5) and (6). That is, first replace (1) with “ for ” subject to the same constraints as (2) and (3), is short-term value-added function of the where customers connected to bus- . Then we can prove that nodal prices are the same as (5) and (6), by letting the marginal equal to the nodal prices of real benefit and reactive power at the optimal solution, respectively [5]. the nodal price of real Therefore according to (5), power at bus- can be viewed as the system marginal cost plus a set (the sum of a marginal generation cost of premiums corresponding to their respective constraints) created by an increment of real power load at bus- . The same explanation is also applicable to the nodal price of . reactive power A significant property for nodal prices is that each nodal price is actually defined simply as a linear summation of all factors can according to (5) and (6) because each nodal price, e.g., be rewritten as This property is completely different from that of AC power flow which is generally nonlinear to each source or route, and is also fundamental to the decomposition or coloring of nodal prices in this paper. Therefore, theoretically it is possible to trace the contributions of all factors involving in the operations of power systems to each nodal price. C. Problem and Example Equation (5) or (6) seems to have given a full description of each component for a nodal price even without any further analysis. However, in contrary to intuitive observation, we will show late that it is incorrect. Actually there are generally only one or two terms remaining nonzero at an optimal solution for (5) and (6) depending on the formulation, even though many constraints become active (or binding) and many generators contribute to this nodal price. The main reason is that ) in the Lagrangian function (4) [or the variables ( OPF equations (1)–(3)] are all independent variables and only a few equations among (2) and (3) or have direct relation with certain bus demand or . Therefore, most of the terms in (5) or (6) are eliminated after differentiating with certain demand or , irrespective of any solution. We take a four-bus system shown in Fig. 1 and Table I, as an example to show this point. CHEN et al.: COMPONENTS OF NODAL PRICES FOR ELECTRIC POWER SYSTEMS 43 By solving OPF (1)–(3), we have an optimal solution where , and line flow from bus 3 to bus 2 reaches its limit – . In addition, the voltage values of bus 2 and bus 4 also reach and their lower and upper bounds, respectively, i.e., . Therefore, there are only a few Lagrangian multipliers nonzero (related to four equalities and three active inequalities) which are (8) (9) (10) Fig. 1. Four-bus test system. TABLE I TRANSMISSION LINE DATA OF A FOUR-BUS TEST SYSTEM Example 1: For the system shown in Fig. 1 and Table I, upper and lower bounds for generators G1 and G4 are , ; , . The voltage values for all buses are bounded between 0.95 and 1.05. Besides, the real power flow in line 2–3 is also restricted between 0.3 and 0.3. All of the values are indicated by p.u. The fuel cost function for generators G1 and G4 is expressed as . For this four-bus system, there are four equalities for (2) corresponding to their respective real and reactive power balances (or Kirchoff’s laws) of load-buses 2 and 3, and 18 inequalities for (3) corresponding to four pairs of voltage, 2 2 pairs of generation output, and one pair of line flow upper and lower bounds, respectively. In this paper, we take real and imaginary which has 2 4 elparts of bus voltages as state variable and in , ements. Therefore, and can be represented in terms of and by using real power balances of their respective buses. Regardless of the solution, according to (5), the nodal prices of real power have the forms as (7) and are the Lagrangian multipliers related to where and real power balances of the respective buses 2 and 3. are the Lagrangian multipliers related to the upper and lower bounds of real power generation for generator , respecand are for generator . tively, while Obviously, nodal price at demand bus- is expressed only by the Lagrangian multiplier corresponding to the power flow balance of bus- , and all other terms in (5) vanish due to their relation independent of . It is also true for the nodal prices of reactive power. and are the Lagrangian multipliers related to where the lower and upper bounds of buses 2 and 3, and – corresponds to the line flow constraint from bus 3 to bus 2. Since the at bus 4 is cheaper than the generator , electric generator through bus 3 toward bus power is mainly transferred from 2. As a result, power flow in line 3-2 reaches its limit (0.3 p.u.) which causes the congestion problem, although the cheaper genstill has generation capability. erator Substituting the values of the Lagrangian multipliers and ) into (7), we have the nodal prices of real power ( (11) . where Hence, even although we can obtain the nodal prices according to (5) and (6), it is still unknown exactly what components of each nodal price are and how the constraints (congestion or other limits) and generators influence the value of each nodal price. III. COMPONENTS OF NODAL PRICE There are many factors or constraints affecting the operation of power systems, e.g., generators, voltage limits, line flow limits, power flow balance conditions (Kirchoff’s laws). Some of them (e.g., voltage limits) have market values which may be relaxed (e.g., from 1.00 1.05 to 0.95 1.05) and taken as tradable goods depending on market needs. The relaxation for these limits may be realized by technology innovations or facilities investments, etc. But some of them actually cannot be traded, e.g., for real power flow balance condition at each bus, the summation of all injected real power at each bus must be zero which cannot be relaxed or violated because it is a physical law. Therefore the evaluation or pricing for the factors with no market value is meaningless, even although we can theoretically trace the contributions of all factors involving in the operations of power systems to each nodal price. Hence, before breaking down the nodal prices, we have to classify all constraints in the operations of power systems into two groups, i.e., tradable constraints which should be components of each nodal price, and nontradable constraints which are mandatory constraints during the operation and are not components of nodal prices. In this section, we theoretically propose a method to break down the nodal prices into a variety of components by using the marginal conditions of operation, which are derived from 44 IEEE TRANSACTIONS ON POWER SYSTEMS, VOL. 17, NO. 1, FEBRUARY 2002 nontradable constraints and Karush–Kuhn–Tucker (KKT) conditions [10]. In other words, we try to identify or trace all factors from a nodal price not qualitatively but quantitatively. A. Conditions of Optimality Let and be the active inequalities among , and their respective Lagrangian multipliers among at an optimal solution for a set of the of (1)–(3). Then the optimal solution satisfies given demands (12) (13) (14) where the other Lagrangian multipliers in but not in are all zero because their respective inequalities are not active (or nonbinding). is a column vector while is a row vector. According to the definition of nodal prices, (12)–(14) are necessary optimality conditions, which must be satisfied when evaluating nodal prices. algebraic equations which have the same number as variables . and have the same elements as those of and , respectively, according to their definitions. Equation (15) is necessary condition to keep the Lagrangian function (or equivalent system cost) always at a minimum while (16) can be viewed as compulsory constraints for which the operation of a power system must obey. On the other hand, may be considered as the factors which can be traded (or tradable goods) and have market values, in contrast to . Therefore, from the viewpoint of economics, (15) and (16) are the marginal conditions for the decomposition of nodal prices, which are identical to (12)–(14) at the optimal solution. C. Description of Nodal Price and Next, we first establish the relations between based on the marginal conditions (15) and (16), and then use these relations to decompose the nodal prices. of Assume that (17) holds at an optimal solution (1)–(3) (17) B. Classification of Constraints From the viewpoint of economics, the Lagrangian function in (4) is the sum of operating cost plus a number of the equivalent charges related to their constraints. Needless to say, each in is an important factor which we element of intend to distinguish from nodal prices. Besides, to break down the nodal prices in a more detail manner, as mentioned before, we have to decide which components we (or participants of the market) are interested among all of constraints in . For instance in Example 1, there are two voltage and one line flow constraints active in addition to four equalities. We are interested in, how the generators G1, G4 and voltage limitations and line congestion influence each nodal price of (5) and (6), comparing to the terms of (5) related to the power balance constraints (or Kirchoff’s laws) of load-buses 2 and 3. We will show these in Example 2. be the constraints (nontradable constraints) among Let which we are not interested or we do not intend exbe the plicitly to count their charges for nodal prices, and remaining constraints (tradable constraints). Define to be the Lagrangian multipliers corresponding to the constraints of , and to be the remaining Lagrangian multipliers corresponding except , to . Then we drop other equations among and rewrite (12)–(14) as follows: Then according to the implicit function theorem, there exists , in open a unique differentiable mapping . In other words, the variables neighborhoods of the given are not independent of but functions of as far as (15) and (16) hold. Actually (17) is a partial Hessian matrix of , which is usually used in sensitivity analysis of OPF solution. and as functions of By considering , (15) and (16) can be rewritten as follows: (18) (19) , Let , , , . The above notion is appli- or . cable to Differentiating (18) and (19) with respect to is an element of , we have that and noting (20) (15) (16) where Therefore, by solving (20) and considering (17), we have at the optimal solution as follows: (21) for the simplicity of expression, and are all column vectors while , are row vectors. Note that (15) and (16) are where and . CHEN et al.: COMPONENTS OF NODAL PRICES FOR ELECTRIC POWER SYSTEMS As the same way, D. Algorithm and Examples can be obtained (22) and . where Then we are at the position to decompose the nodal prices. and are functions of , the Noting that Lagrangian function of (4) is reformulated as follows: (23) Therefore, differentiating of (23) with respect to nodal prices of (5) and (6) become 45 and , (24) (25) where we take into account of the second part of (20), i.e., or for , and also and at an optimal solution, for the derivation use of (24) and (25). Next, we show that (24) and (25) are actually the deof composed nodal prices. If the objective function (1) is constructed by many factors (e.g., many gen, then erators), i.e., for the first term of (24), or for the first term of (25). Furthermore, let and where and are the th equation of and its respective Lagrangian multiplier. Then the second term of (24) or (25) can be represented as or . Therefore, and are the components associated to the factor (e.g., the th generator) for real and reactive power, respecand tively, while represent the terms of for real power and reactive power, the respective constraint respectively. Generally, each term in (24) and (25) is nonzero at an optimal solution, in contrast to the terms of (5) and (6). includes all of the constraints among both and , If then all of the factors appearing in are nonzero and will explicitly expressed in the nodal prices. On the other hand, if includes all of the constraints among both and , then all of the terms except those among disappear in (24) and (25). In the extreme, if none of (12)–(14) is used in deriving (21) and and are all independent due to the elim(22) [i.e., ination of (15) and (16)], then (24) and (25) simply reduce to (5) and (6) which have no information left except the values of nodal prices, e.g., (24) becomes (7) for Example 1. Evidently the nodal prices of (24) and (25) hold as long as the marginal conditions of (15) and (16) or (21) and (22) are satisfied. Equations (24) and (25) are certainly identical with (5) and (6) in terms of the values of nodal prices but have more detail information for their components. We will use several examples to show this fact next. We straightforward have the following procedure computing nodal prices as well as their components. 1) For a set of the given demands , solve the optimization problem (1)–(3) to obtain an optimal solution and . their dual solution whose costs will explicitly be 2) Choose the constraints counted in the evaluation of the nodal prices, and then or according to (21) or (22). calculate and and their compo3) Evaluate the nodal prices nents according to (24) and (25). Note that the Lagrangian multipliers are zero for nonbinding equations, thereby having no influence on the nodal prices or the Lagrangian function. Example 2: Assume the same conditions as Example 1. And then calculate the components of the nodal prices. According to Example 1, there are seven binding constraints, including three active inequalities (voltage lower bound at bus 2, voltage upper bound at bus 4, line flow bound from bus 3 to bus 2) among (3), and four equalities (two pairs of real and reactive power balances for demand buses 2 and 3) of (2). Besides, there are two energy resources appearing in of (1), i.e., generators G1 and G4. [Case-1]: We intend to express the nodal prices in the following form: charge from generator G1 charge from generator G4 compensation for voltage lower bound at bus-2 compensation for voltage upper bound at bus-4 congestion charge of line 3–2. Nodal price at bus- (nontradable constraints) includes all four For this case, power balance equalities of (2), and (tradable constraints) is composed of the three active constraints among (3). Hence, and – . We or according to (21) or (22) at the opfirst calculate timal solution of Example 1. Then we have the nodal prices or and their components according to (24) and (25) summarized in Table II. The results in Table II are the same as (11) for the values of nodal prices but have detailed descriptions for each term. For instance, the nodal price of real power at bus 2 is composed of five terms corresponding to the equivalent charges or compensations for generator G1 (1.5599), generator G4 (19.6789), lower bound of bus 2 voltage ( 0.6433), upper bound of bus 4 voltage (1.3856) and congestion of line 3–2 (5.8805), i.e., generator G1 generator G4 lower bound of bus-2 voltage upper bound of bus-4 voltage congestion of line 3–2 (26) which shows equivalent charges for their respective factors when there is an increment of real power load at bus 2, and these charges are certainly identical with the cost increment of the total system for one unit change of . From (26), obviously power supply is mainly from generator G4 but is 46 IEEE TRANSACTIONS ON POWER SYSTEMS, VOL. 17, NO. 1, FEBRUARY 2002 TABLE II NODAL PRICES AND THEIR COMPONENTS FOR CASE 1 TABLE III NODAL PRICES AND THEIR COMPONENTS FOR CASE 2 partially restricted due to the congestion of line 3–2 for an increment of the real power at bus 2. In addition, from Table II it is evident that the congestion of line 3–2 considerably incurs the expense of customers at bus 2, in contrast to other buses. [Case-2]: We intend to express the nodal prices in the following form: Nodal price at bus- TABLE IV NODAL PRICES AND THEIR COMPONENTS WITHOUT LINE FLOW CONSTRAINTS charge from generator G1 charge from generator G4 congestion charge of line 3–2 without explicit expression of compensations for voltage bounds at bus 2 and bus 4 (i.e., further assume that bounds of bus 2 and bus 4 are not tradable goods besides power balance constraints of each bus). includes six equations including all four For this case, equalities of (2) and two active inequalities related to voltage lower bound at bus 2 and voltage upper bound at bus 4, respecis composed of only one active tively. On the other hand, , constraint related to line 3–2 flow constraint. Hence , , and - . As the same way as the computation of Case-1, we have the nodal prices summarized in Table III, which shows the same values of nodal prices as (11) or Table II of Case 1 but has different descriptions due to the setting of this case. For instance, as shown in Table III, the nodal price of real power at bus 2 is composed of three terms corresponding to the equivalent charges or compensations for generator G1 (2.5482), generator G4 (19.6326), and congestion of line 3–2 (5.6809), i.e., generator G1 generator G4 congestion of line 3–2 (27) which shows equivalent charges when there is an increment of real power load at bus 2, as far as only these three factors are concerned. In this example, the constraints of voltage bounds at buses 2 and 3 as well as the four real and reactive power balance equalities may be viewed as compulsory conditions and cannot be traded in the market. Example 3: Assume the same conditions as Example 1 but without the real power flow constraint in line 3–2. Then recalculate the components of the nodal prices. There are four equalities of corresponding to their respective real and reactive power balances of demand buses 2 and 3, and 16 inequalities of corresponding to four pairs of voltage and four pairs of generation output, respectively. By solving OPF (1)–(3), we have an optimal solution where , . In this case, real power of generator G4 reaches its upper bound 0.7, and line flow from bus 3 to bus 2 increases to 0.31 more than the previous limit of Example 1. In addition, the voltage values of bus 2 and bus 4 also reach their lower and upper bounds and . Therefore, there are respectively, i.e., seven Lagrangian multipliers nonzero, related to four equalities of , the lower bound of bus 2 voltage, the upper bound of bus 4 voltage and the upper bound of real power for generator G4, respectively, (instead of line 3–2 limit in Example 1). In this example, we intend to express the nodal prices in the following form: charge from generator G1 charge from generator G4 compensation for voltage lower bound at bus-2 compensation for voltage upper bound at bus-4. Nodal price at bus- The nodal prices as well as their components are depicted in Table IV, which shows that the price at bus 2 is significantly reduced from 27.8616 to 24.6495 due to the elimination of the congestion in line 3–2. Actually the generation of G4 has no effect on nodal prices due to its binding to the upper bound, and can be dropped from the components. Different from Example 2, according to Table IV, the power supply as well as the generation charges comes completely from generator G1 for an additional increase of real power at any bus because generator G4 has reached its upper bound. IV. SIMULATION AND POWER LOSSES A. Numerical Simulation A IEEE 30-bus test system shown in Fig. 2 and Table V is used in this section for numerical simulation. The voltage values for all buses are set between 0.95 and 1.05. Besides, the real power flow in line 2–5 is also restricted between 0.6 and 0.6. The main loads are at buses 5,7 and 8 while the four generators CHEN et al.: COMPONENTS OF NODAL PRICES FOR ELECTRIC POWER SYSTEMS 47 Fig. 2. IEEE 30-bus standard test system. are located at buses 1, 2, 22 and 27. All of the values are indicated by p.u. The objective function of (1) is the total fuel costs . of generators, i.e., For this system, there are 2 26 equalities of corresponding to their respective real and reactive power balances of the buses without a generator, and 78 inequalities of corresponding to 30 pairs of voltage, 2 4 pairs of generation output, and one pair of line flow upper and lower bounds, respectively. Table VI shows the optimal outputs of generators, demand of each bus and nodal prices of real power. At the optimal solution, five inequalities become active, which are related to upper , lower bound of buses 11 and 27 voltages and upper bounds of real power for generators at bus 1 and bus , and upper bound of 27, respectively, . The components of line flow from bus 2 to bus 5 – nodal prices in Table VI are obtained by setting five terms of the nodal prices as follows: Nodal price of real power at bus- generators G2, G22 voltages congestion of – where we drop the components related to fuel costs of generators G1 and G27, which are actually all zero and have no influence on the nodal prices because they have reached their limits of outputs and do not provide power for an increment of demand at any bus as long as the necessary conditions of optimality of (15) and (16) hold. TABLE V CONSTRAINTS AND FUEL COSTS OF GENERATORS For this case, includes all 2 26 equalities of (2) and two active inequalities corresponding to lower and upper bounds and , respectively. Note of real power that the charges from generators include the power loss. From Table VI, it is evident that the nodal prices at buses 5 and 7 are mostly influenced by the congestion of line 2–5, while the voltage bound of bus 11 mainly affect the nodal price at bus 5. On the other hand, the fuel (or generation) charges of demands at bus 5 and bus 21 are mainly from generator G2 and generator G22, respectively, while the fuel charge for the demand at bus 8 is almost equally shared by both generators G2 and G22 according to Table VI from the viewpoint of marginal cost. As the , we can calculate the nodal same way as the computation of in terms of the concerned compoprice of reactive power nents. B. Consideration of Power Losses Although the components of nodal prices include all independent factors in OPF formulation, there are still important depen- 48 IEEE TRANSACTIONS ON POWER SYSTEMS, VOL. 17, NO. 1, FEBRUARY 2002 TABLE VI DEMAND, GENERATION AND NODAL PRICES STANDARD TEST SYSTEM FOR IEEE 30-BUS a total reactive power balance equality in (2), or evaluate the real and reactive power losses in reactive nodal price of (25). V. CONCLUSION dent elements, e.g., power losses, which are not explicitly handled in (24) and (25). Since power loss (real or reactive power loss) is not an independent factor in the objective function or constraints, it cannot be directly expressed as a component of nodal prices. If it is necessary to evaluate effect of real power loss, (2) can be reorganized in the following way. Deleting one real power balance equation at any bus, we instead add the total real power balance equality This paper proposes a methodology directly to link each concerned factors to the nodal prices, i.e., we break down each nodal price into a variety of parts corresponding to different factors, such as generations, transmission congestion, voltage limitations and other constraints. Different from the ac power flow which cannot generally be identified to its sources or routes, this paper shows that the nodal prices can theoretically be traced to each factor based on the marginal conditions from the economics viewpoint. The decomposition is unique, and components of each nodal price are identical to their increment costs or benefits for total system. These detail information for nodal prices can be used not only to improve the efficient usage of power grid, energy resources and congestion management, but also to design a reasonable pricing structure of power systems, or to provide economic signals for generation–transmission investment [11]. Several numerical simulations have been used to demonstrate our approach. If the decomposed components are all required to be positive, the components can be recalculated by first letting the negative components be zero, and then proportionally allocating the nodal prices to the positive components depending on their contributions (values). Although this paper uses OPF-based model with static constraints as an example to demonstrate the decomposition of the nodal prices which are actually based on the short-term marginal cost principle, the nodal prices incorporating the long-term investment as well as dynamical constraints can be decomposed in the same manner provided that the long-term expansion planning model or dynamical constraints are adopted instead of the static OPF model. For example, the values or prices of control devices such as PSS and AVR can also be evaluated as the same way as (24) and (25) if the transient stability constraints are considered in OPF [10]. ploss REFERENCES into (2), where and are the summations of real power generations and loads, respectively, and ploss is total real . Then the power power loss which is a function of loss is explicitly expressed in the reformulated by (1)–(3), which are theoretically equivalent to the original (1)–(3). From the dual theory of mathematical programming, there generally exists a for the new equality at any nonzero Lagrangian multiplier optimal solution of the reformulated (1)–(3). Take real power loss ploss as an independent factor, i.e., assume ploss tradable. In other words, the total real power balance equality should be added into . Then there is a term in the components of nodal price of (24), which corresponds to real power loss and can be viewed as the value of real power loss. As the same way, we can also evaluate the value of the reactive power loss as in real nodal price of (24) when one reactive power balance equality of any bus is replaced by [1] F. C. Schweppe, M. C. Caramanis, R. D. Tabors, and R. E. Bohn, Spot Pricing of Electricity. Boston, MA: Kluwer, 1988. [2] W. W. Hogan, “Contract networks for electric power transmission,” J. Regulatory Econ., vol. 4, pp. 211–242, 1992. [3] R. J. Kaye, F. F. Wu, and P. Varaiya, “Pricing for system security,” in Proc. IEEE Winter Power Meeting, 1992, Paper 92-WM-100-8. [4] S. Oren, P. Spiller, P. Varaiya, and F. F. Wu, “Nodal prices and transmission rights: A critical appraisal,” Electricity J., vol. 8, no. 3, pp. 24–35, 1995. [5] M. L. Baughman, S. N. Siddigi, and J. W. Zarnikau, “Advanced pricing in electrical systems,” IEEE Trans. Power Syst., vol. 12, pp. 489–502, Feb. 1997. [6] D. Sun, B. Ashley, B. Brewer, A. Hughes, and W. Tinney, “Optimal power flow by Newton approach,” IEEE Trans. Power Apparat. Syst., vol. PAS-103, pp. 2864–2880, Oct. 1984. [7] R. Shoults and D. Sun, “Optimal power flow based upon P–Q decomposition,” IEEE Trans. Power Apparat. Syst., vol. PAS-101, pp. 397–405, Feb. 1982. [8] L. Chen et al., “Mean field theory for optimal power flow,” IEEE Trans. Power Syst., vol. 12, pp. 1481–1486, Nov. 1997. [9] L. Chen et al., “Surrogate constraint method for optimal power flow,” IEEE Trans. Power Syst., vol. 13, pp. 1084–1089, Aug. 1998. CHEN et al.: COMPONENTS OF NODAL PRICES FOR ELECTRIC POWER SYSTEMS [10] L. Chen, Y. Tada, H. Okamoto, R. Tanabe, and A. Ono, “Optimal operation solutions of power systems with transient stability constraints,” IEEE Trans. Circuits Syst. I, vol. 48, pp. 327–339, Mar. 2001. [11] L. Chen, H. Suzuki, T. Wachi, and Y. Shimura, “Analysis of nodal prices for power systems,” Trans. Inst. Elect. Eng. Jpn. B, vol. 120-B, no. 5, pp. 686–693, 2000. [12] M. Rivier and I. J. Perez-Arriaga, “Computation and decomposition of spot prices for transaction pricing,” in Proc. 11th PSCC, 1993, pp. 371–378. [13] J. Finney, H. Othman, and W. Rutz, “Evaluating transmission congestion constraints in systems planning,” IEEE Trans. Power Syst., vol. 12, pp. 1143–1150, Aug. 1997. [14] X. Kai, Y. Song, E. Yu, and G. Liu, “Decomposition model of optimal spot pricing and interior point method implementation,” in Proc. POWERCON, 1998, pp. 32–37. [15] H. Chao and S. Peck, “A market mechanism for electric power transmission,” J. Regulatory Econ., vol. 10, pp. 25–59, 1996. Luonan Chen (M’92–SM’98) received the B.S.E.E. degree from Huazhong University of Science Technology, Wuhan, China, and the M.E. and Ph.D. degrees in electrical engineering from Tohoku University, Sendai, Japan, in 1984, 1988, and 1991, respectively. He joined KCC, Ltd., Tokyo, Japan, in 1991. Since 1997, he has been a Faculty Member at Osaka Sangyo University, Osaka, Japan, where he is currently an Associate Professor in the Department of Electrical Engineering and Electronics. His research interests include nonlinear dynamics and optimization for power systems. 49 Hideki Suzuki received the B.S. degree from the Science University of Tokyo, Tokyo, Japan, in 1987. Since 1993, he has been working at KCC Ltd., Tokyo, as a System Engineer. His interests include operation and planning of power systems. Tsunehisa Wachi received the B.S. and M.S. degrees from Gakushuin University, Tokyo, Japan, in 1995 and 1997, respectively. Since 1997, he has been with KCC, Ltd., Tokyo. His research interests include operation and analysis of power systems. Yukihiro Shimura received the B.S. degree from Tohoku University, Sendai, Japan, in 1988. Since 1988, he has been working at the Electric Power Development Company, Ltd., Tokyo, Japan. His interests are operation and analysis of power systems.