Undergraduate Accounting - Course Learning Objectives

advertisement

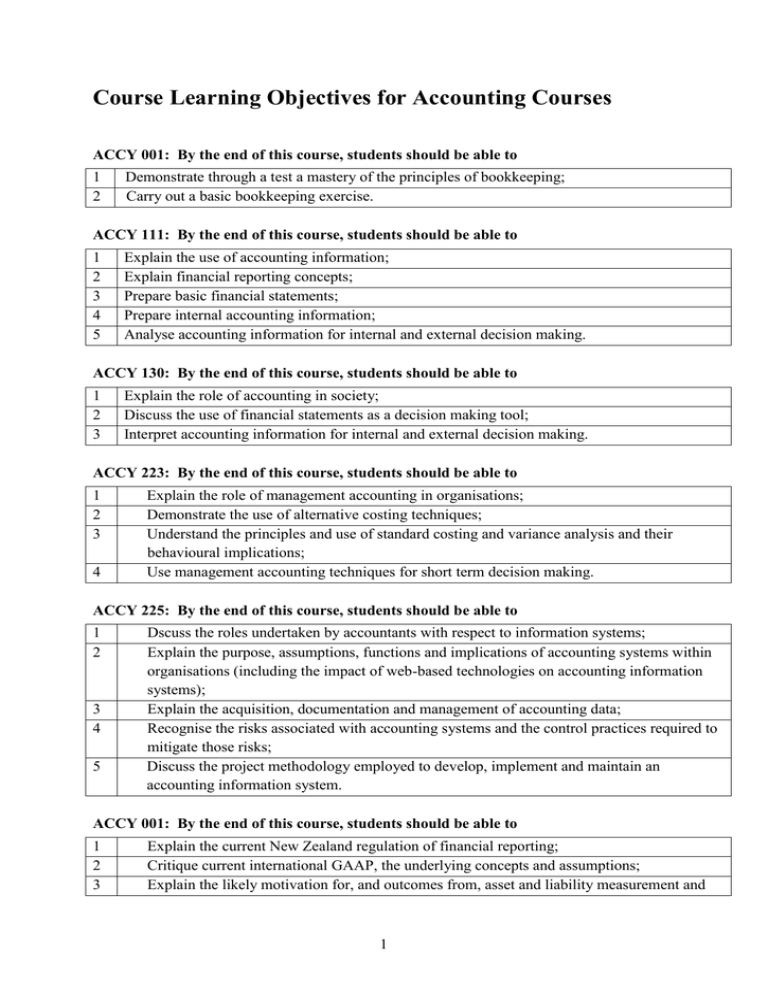

Course Learning Objectives for Accounting Courses ACCY 001: By the end of this course, students should be able to 1 2 Demonstrate through a test a mastery of the principles of bookkeeping; Carry out a basic bookkeeping exercise. ACCY 111: By the end of this course, students should be able to 1 2 3 4 5 Explain the use of accounting information; Explain financial reporting concepts; Prepare basic financial statements; Prepare internal accounting information; Analyse accounting information for internal and external decision making. ACCY 130: By the end of this course, students should be able to 1 2 3 Explain the role of accounting in society; Discuss the use of financial statements as a decision making tool; Interpret accounting information for internal and external decision making. ACCY 223: By the end of this course, students should be able to 1 2 3 4 Explain the role of management accounting in organisations; Demonstrate the use of alternative costing techniques; Understand the principles and use of standard costing and variance analysis and their behavioural implications; Use management accounting techniques for short term decision making. ACCY 225: By the end of this course, students should be able to 1 2 3 4 5 Dscuss the roles undertaken by accountants with respect to information systems; Explain the purpose, assumptions, functions and implications of accounting systems within organisations (including the impact of web-based technologies on accounting information systems); Explain the acquisition, documentation and management of accounting data; Recognise the risks associated with accounting systems and the control practices required to mitigate those risks; Discuss the project methodology employed to develop, implement and maintain an accounting information system. ACCY 001: By the end of this course, students should be able to 1 2 3 Explain the current New Zealand regulation of financial reporting; Critique current international GAAP, the underlying concepts and assumptions; Explain the likely motivation for, and outcomes from, asset and liability measurement and 1 4 recognition according to international GAAP; Explain the differences in meeting user needs through financial reporting of profit orientated entities and public benefit entities. ACCY 302: By the end of this course, students should be able to 1 Evaluate an organisation’s strategy and associated risks using a strategy-based value chain and examine the linkages to and between strategy, processes and activities; 2 Explain the importance of strategic decision-making and the resulting implications for an organisation at the strategic, process and activity level; 3 Evaluate divisionalisation options, alternative transfer pricing systems, and performance management systems; 4 Discuss supplier and customer value and the management accounting implications of supplier and customer linkages; Examine the management accounting contribution to the management of quality and sustainability. 5 ACCY 303: By the end of this course, students should be able to 1 2 3 4 Analyse current auditing issues through working with and debating with other students; Evaluate some of the issues precipitated by world events which are being faced by audit professionals; Explain what is meant by audit judgement, acceptable audit practices and auditor liability; Explain differences in auditing in the public and private sectors in New Zealand. ACCY 306: By the end of this course, students should be able to 1 2 3 4 Explain key concepts, principles, and relationships in financial statement analysis; Explain the principles of valuation; Apply the concepts of risk analysis; Adapt and apply those principles and concepts to the valuation of a real firm. ACCY 307: By the end of this course, students should be able to 1 2 3 4 Describe the public sector environment in New Zealand and how the country is governed; Understand accounting, financial management and auditing in the public sector; Describe the integrated management cycle – strategic planning; budgeting & resource allocation; operations and budget implementation; and monitoring and reporting; Analyse whether, and how, financial management in New Zealand addresses these four questions regarding the operations of the Government: - Is it managing its financial affairs prudently? [the money thing] - Is it achieving what it set out to achieve? [efficiency vs effectiveness] - Is it looking after its assets (people, infrastructure, intellectual capital); so it can deliver results (outcomes and outputs) in the future? [capability & risk management] - Is it carrying out its activities in accordance with the law and expected standards of 2 5 conduct and probity? [authority & probity]; Analyse particular public sector accounting and reporting issues and practices. ACCY 308: By the end of this course, students should be able to 1 2 3 4 5 Explain how the nature of different reporting entities affects the financial reporting by those entities; Assess the implications of recent developments in external reporting in respect of both business and the wider context of society (including harmonisation and corporate social responsibility); Describe the applications and implications of various financial reporting standards in complex environments; Evaluate the strengths and weaknesses of the current financial reporting requirements for particular entities, transactions and events against underlying concepts of accounting; Develop new approaches to at least one circumstance where a weakness has been identified in the current reporting requirements. ACCY 309: By the end of this course, students should be able to 1 2 3 4 5 6 7 8 State national accounting concepts and procedures; Ppresent and analyse financial statements; Explain major differences between countries in their approaches to financial reporting; Understand harmonisation and standardisation; Understand functional currencies; Explain the development of international financial accounting standards and the role of the International Accounting Standards Board; Analyse the social, environmental and ethical issues that are involved in the internationalisation of business and the role of accounting within that; Analyse the implications of professionalism and the “public interest” in the international business environment. ACCY 314: By the end of this course, students should be able to 1 2 3 Understand accounting in a socio-political context; Analyse a variety of theoretical perspectives on the nature of accounting and its role(s) in society; Set a normative framework for accounting within which to evaluate existing systems and address practical problems. ACCY 317: By the end of this course, students should be able to 1 2 3 Analyse the purpose, function and implications of accounting information systems within an organisation and wider society; Explain AIS developments in respect of both business and the wider context of society; Explain the roles undertaken by accountants with respect to accounting information systems; 3 4 5 6 Explain the risks associated with accounting information systems and design and evaluate control practices to manage those risks; State the standard practices required to develop, implement and maintain an accounting information system, including the various information technologies commonly adopted within them, and analyse the impact of emerging accounting information systems and the issues associated with them; Analyse the impact of contemporary social issues on the development of accounting information systems. ACCY 320: By the end of this course, students should be able to 1 2 3 4 Explain the historical development of theoretical frameworks in accounting; Critically analyse different approaches to accounting theory and research and the roles of accounting in capital markets, organisations and the wider society; Critically analyse key theoretical concepts used in accounting frameworks; Analyse and develop theory-practice relationships. ACCY 321: By the end of this course, students should be able to 1 2 3 4 Examine various aspects of the history of accounting; Evaluate current research in accounting history; Analyse in depth one area of accounting history; Relate current accounting practices and environment to aspects of its past. ACCY 330: By the end of this course, students should be able to 1 Explain and evaluate the purpose of auditing and the role of the auditor; 2 Evaluate and apply professional standards and professional ethics; 3 Apply professional judgement in the areas of materiality, risk assessment and audit evidence; 4 Apply audit concepts and theory to the practice of auditing in the business world. 4