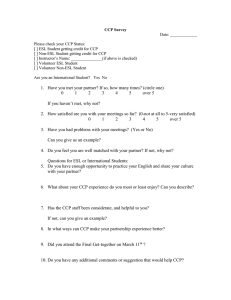

Considerations for CCP Resolution

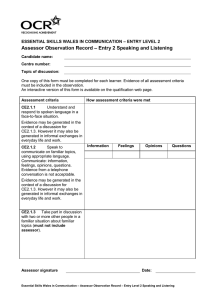

advertisement