Moving to reliable next-day switching Target Operating

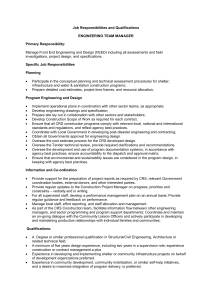

advertisement