in the united states district court for the district of new mexico verified

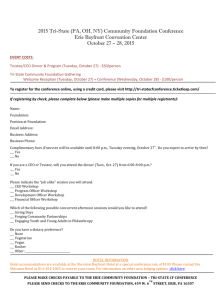

advertisement

Case 1:13-cv-00085 Document 1 Filed 01/25/13 Page 1 of 25 IN THE UNITED STATES DISTRICT COURT FOR THE DISTRICT OF NEW MEXICO TRI-STATE GENERATION AND TRANSMISSION ASSOCIATION, INC., a Colorado Nonprofit Cooperative Corporation, Plaintiff, v. No. 13-CV-85 NEW MEXICO PUBLIC REGULATION COMMISSION, a New Mexico Agency, and its members, Commissioners Patrick H. Lyons, Theresa Becenti-Aguilar, Ben 1. Hall, Valerie Espinoza, and Karen 1. Montoya, acting in their official capacities, Defendants. VERIFIED COMPLAINT FOR DECLARATORY AND INJUNCTIVE RELIEF Plaintiff Tri-State Generation and Transmission Association, Inc. ("Tri-State"), for its Complaint against the New Mexico Public Regulation Commission and its Commissioners acting in their official capacities (collectively, the "Commission"), states and alleges as follows: NATURE OF THE ACTION 1. This is an action for declaratory judgment and injunctive relief involving Tri- , State's sale of electricity in interstate commerce to its member distribution cooperatives and public power districts ("Member Systems") located in Colorado, Nebraska, New Mexico and Wyoming that. then resell the electricity to their own members-consumers. To the extent New Mexico's regulatory scheme described below PUl'pOlis to authorize the Commission to assert jurisdiction and control over Tri-State's wholesale rates in New Mexico, it impermissibly regulates interstate commerce in violation of the Commerce Clause of the United States Constitution, Article I, Section 8, Clause 3 (the "Commerce Clause"). Case 1:13-cv-00085 Document 1 2. Filed 01/25/13 Page 2 of25 Tri-State is a not-for-profit, regional generation and transmission cooperative corporation organized under the laws of the State of Colorado. Tri-State provides wholesale electric power to forty-four Member Systems in four states that, in tUl'll, provide electricity at retail to more than 1.5 million people. 3. Tri-State's sales of electricity to its Member Systems occur in interstate commerce. The United States Court of Appeals for the Tenth Circuit has held that Tri-State generates, transports and sells electricity in interstate commerce since "[t]he electrical energy involved in [its wholesale power] transactions undoubtedly moves across state lines." See Tri- Siale Gen. & Trans. Ass'n, Inc. v. Public Servo Comm. o/Wyoming, 412 F.2d 115, 118 (10th Cir. 1969) ("Tri-State V. Wyoming Commission") ("We think it clear that the trial court erred in determining that Tri-State was not engaged in interstate commerce."). The Tenth Circuit further held that the Wyoming Public Service Commission had no jurisdiction over Tri-State's rates and that the Commission had interfered with interstate commerce unlawfully when it entered directives that resulted in Tri-State's Wyoming Member Systems not paying an increased wholesale rate to Tri-State. Id at 118-19. 4. Following the Tenth Circuit's decision in Tri-State V. Wyoming Commission, the Public Utilities Commission of the State of Colorado (the "Colorado Commission") concluded that it had no jurisdiction over Tri-State's wholesale rates: There is no question as shown by substantial evidence of record in this proceeding, and as determined by the U.S. COUlt of Appeals for the Tenth Circuit, that Tri-State is engaged in interstate commerce. No specific permission has been granted by Congress to Colorado or any other state to regulate the rates of interstate transmission of power, and this Commission has no jurisdiction to regulate the rates Tri-State charges to its wholesale customers. 2 Case 1:13-cv-00085 Document 1 Filed 01/25/13 Page 30f25 Colorado Commission Decision No. 86499 at 10; see also Colorado Commission Decision No. C99-l285, p. 3 & n.1 (citing Tl'i-State v. Wyoming Commission and confirming that the Colorado Commission "does not regulate" Tri-State's rates). 5. As described below, to the extent New Mexico's regulatory scheme at issue in this case purports to authorize the Commission to regulate Tri-State's wholesale electric rates, the scheme has extraterritorial effects that adversely impact economic activity in other states, including Colorado, Wyoming and Nebraska, and effectively allows the Commission to establish wholesale electric rates for use in New Mexico that will necessarily and materialIy affect Member System rates in the other states served by Tri-State. New Mexico's regulatory scheme also discriminates against out-of-state producers of electricity such as Tri-State. As in Tl'i-State v. Wyoming Commission, and for other reasons explained below, to the extent New Mexico's regulatory scheme purP01iS to authorize the Commission to regulate Tri-State's wholesale electric rates, it violates the Commerce Clause of the United States Constitution. PARTIES 6. Pursuant to Title VII, Article 55 of the Colorado Revised Statutes ("C.R.S."), Tri- State is a Colorado member-owned, not-for-profit cooperative corporation having its principal place of business at 1100 W. 116th Avenue, Westminster, Colorado 80234. See C.R.S. §§ 7-55- 101 et seq. Tri-State is not a New Mexico rural electric distribution cooperative and is not organized under New Mexico's Rural Electric Cooperative Act, NMSA 1978, Chapter 16, Section 15. 3 Case 1:13-cv-00085 Document 1 7. Filed 01/25/13 Page 4 of 25 Defendants are the Commission, a New Mexico governmental agency having its principal place of business at 1120 Paseo De Peralta, Santa Fe, New Mexico 87801, and the Commissioners of the Commission acting in their official capacities.! JURISDICTION 8. The Court has subject matter jurisdiction under 28 U.S.C. § 1331, 28 U.s.C. §-220I and42 U.S.C.§ 1983. 9. Venue is propel' in this District pursuant to 28 U.S.C. § 1391(b), because the Defendants reside in this District and a substantial pOltion of the events or omissions giving rise to Tri-State's claims occurred here. FACTUAL ALLEGATIONS A. Tri-State's Corporate Mission and Structure 10. Tri-State is a generation and transmission cooperative corporation ("G&T") founded in 1952 by its original member systems. All of Tri-State's CUl1'ent fOlty-four Member Systems are not-for-profit rural electric distribution cooperatives or public power districts. Twelve ofTri-State's Member Systems are located in New Mexico. 11. The primary characteristic of a cooperative corporation such as Tri-State is that its business "shall not be carried on for profit, but for the mutual benefit of all the members." C.R.S. §7-55-101(I)(b). Tri-State's mission is to provide its fOlty-four Member Systems located in foul' states with a reliable supply of interstate electricity while maintaining a sound financial position. I Two of the present Commissioners, Commissioners Valerie Espinoza and Karen L. Montoya, were elected to the Commission effective January 1,2013 and did not participate in the Order entered December 20, 2013 refen-ed to in paragraph 53 of this Complaint. A copy ofthat Order is attached as Exhibit D. 4 Case 1:13-cv-00085 Document 1 12. loads. Filed 01/25/13 Page 5 of25 Tri-State is a wholesale electric supplier - an aggregator of its Member Systems' Tri-State is not an investor owned utility. Tri-State has Member Systems, not shareholders, and does not seek to generate a profit for outside investors. Unlike an investor owned utility or distribution cooperative, Tri-State has no retail customers or exclusive service tel1'itory established by the Commission. Instead, Tri-State buys and generates electric power, and transmits,delivers, and sells electricity, to its Member Systemsillillterstate-commcl'ce;-Tl1.e·---- - - Member Systems, in turn, distribute and resell the electricity they purchase at wholesale from Tri-State to their own member-consumers. In short, Tri-State's Member Systems serve retail customers but Tri-State does not. 13. Tri-State's wholesale rates, service, and other business matters are governed by a forty-foul' member, democratically elected Board of Directors consisting of one director elected by each Member System, including the twelve Member Systems located in New Mexico. Members of the Board of Directors live in the rural areas served by Tri-State's Member Systems. Local, democratic control and service on the basis of mutuality between Member Systems are fundamental principles of Tri-State's not-for-profit cooperative operations. Tri-State's Board is directly accountable to its Member Systems and in turn to the Member Systems' retail memberconsumers. n. The Rural Electrification Act 14. In 1936 Congress passed the Rural Electrification Act, 7 U.S.C. § 901 et seq. ("RE Act"). Among other things, the RE Act created the Rural Electrification Administration ("REA") as a federal agency empowered to provide rural areas of the United States with affordable electricity by lending funds directly to rural electric systems at below market rates. 5 Case 1:13-cv-00085 Document 1 15. Filed 01/25/13 Page 6 of 25 TIu'ough a federal reorganization, the REA was later transferred to the Department of Agriculture and, subsequently, renamed as the Rural Utilities Service ("RUS"). 16. Under the RE Act, providing affordable electricity to lUral America is a matter of serious national concern. See, e.g., Tri-State Gen. & Trans. Ass'n, Inc. v. Shoshone River Powel~ Inc., 874 F.2d 1346, 1348-51 (10th Cir. 1989) ("Tri-State v. Shoshone IF'). As the Tenth Circuit then engaged in the bllsiness of generating electrical energy had failed to extend electric service to the rural communities of America and determined that the national interest would be served by subsidizing the rural user of electricity." Id. at 1348. 17. In response to the RE Act, rural electric distribution cooperatives were formed to seek government subsidized loans and deliver electricity to rural consumers. These cooperatives, in turn, banded together to form G&Ts, such as Tri-State, in an effort by the rural cooperatives to secure and more economically obtain long-term, reliable sources of power. 18. Among other things, Tri-State and other G&Ts borrow federal funds from the RUS under the RE Act for the purposes of generating, purchasing, transmitting, and delivering electric energy sold at wholesale to their respective rural electric cooperative members that, in turn, distribute and sell electricity at retail to ultimate consumers. 19. Only one G&T other than Tri-State presently sells electricity at wholesale to rural electrical cooperative members in New Mexico. Western Farmers Electrical Cooperative serves four members located in eastern New Mexico. 2 2 Western Farmers Electrical Cooperative also scrves nineteen electric cooperatives in Oklahoma. 6 Case 1:13-cv-00085 Document 1 C. Filed 01/25/13 Page 7 of25 Tri-State's Multi-State Electrical System Operates In Interstate Comlncrcc 20. As futther described below and as set forth in the maps attached hereto as Exhibits A and B, Tri-State's electrical system is integrated into an interstate grid to facilitate the generation and transmission of electricity across a 250,000 square-mile area in four states. TriState's fOlty-four Member Systems cover all or parts of29 counties in New Mexico, all or parts of56cQuntiesin Colorado, all or paftsof20-counties in westei'n NebrasKa, and all-or paitsofTlI counties in central and northern Wyoming. In addition, celtain of Tri-State's Member Systems provide service that extends into Arizona, Utah and Montana. See Exhibits A and B (Tri-State's Member Map and Tri"State's System Map). 21. In 2011, Tri-State had $1.2 billion in operating revenues from its sales of electricity, approximately 80% of which occurred in interstate commerce entirely outside of New Mexico. As of June 30,2012, Tri-State owned physical assets in five states (including Arizona) worth over $3 billion and calTied long-term debt exceeding $2.7 billion. 22. In 2011, Tri-State sold 15.4 million megawatt-hours of electricity to its Member Systems. Of that amount, approximately 3.0 million megawatt-hours of electricity - 01' about 20% of the total- was sold to Tri-State's twelve Member Systems located in New Mexico. 23. Tri-State currently owns and operates more than 2,900 megawatts ("MW") of electrical generating capacity in Arizona, Colorado, New Mexico and Wyoming. Tri-State's base load generation includes the 418 MW Springerville Generating Station Unit 3, near Springerville, Arizona; a 24 percent interest in the 1,710 MW Laramie River Station near Wheatland, Wyoming; 613 MW of capacity at Craig Station, neal' Craig Colorado (a 205 MW share of Craig Units 1 and 2 and a 100% leasehold interest in Craig Unit 3); the 100 MW Nucla 7 Case 1:13-cv-00085 Document 1 Filed 01/25/13 Page 8 of 25 Station near Nucla, Colorado; a 40 MW share of San Juan Generating Station Unit 3 near Farmington, New Mexico; and a 100% ownership interest in the 250 MW Escalante Generating Station near Prewitt, New Mexico. Tl'i-State's intermediate generation and peaking resources include the Brush Generation Facility in eastern Colorado (307 MW); combustion turbines that comprise the Burlington Station near Burlington, Colorado (100 MW); combustion turbine units --- th-at-conlpnsethe- Limon Generating-stationnear Liiriori;-Colorauo(r40-MW); com15ushon~·- - turbine units that comprise the Frank R. Knutson Generating Station near Brighton, Colorado (140 MW); and combustion turbines that comprise the Pyramid Generating Station southeast of Lordsburg, New Mexico (160 MW). 24. Tri-State currently has more than 825 MW of renewable energy resources,. including long-term power purchase agreements with the Kit Carson Windpower Project in southeast Colorado (34 wind turbines generating 51 MW) and the Cimarron Solar Facility in northeastern New Mexico (500,000 photovoltaic panels generating 30 MW). 25. In addition to its own generating capacity, Tri-State purchases power from various third parties, including the Western Area Power Administration ("WAPA") through long-term federal hydropower allocations that are held by Tri-State. These allocations have a total annual peak contract delivery rate of 669 MW. WAPA markets and transmits federally produced power in 15 cenh'al and western states, specifically Arizona, California, Colorado, Kansas, Iowa, Minnesota, Montana, Nebraska, Nevada, New Mexico, North Dakota, South Dakota, Texas, Utah and Wyoming. WAPA's corporate services office is located in Lakewood, Colorado, and its Rocky Mountain Region office is located in Loveland, Colorado. 8 Case 1:13-cv-00085 Document 1 26. Filed 01/25/13 Page 9 of 25 Tri-State is also contracted to purchase aImually 285 MW of power from Basin Electric Power Cooperative ("Basin"), whose generating facilities are located in North Dakota, South Dakota, Wyoming, Montana, Minnesota and Iowa, and whose corporate headquarters is located in Bismarck, North Dakota. 27. ~~~~ ~ To facilitate the operation of its interstate system and the interstate sale of ~~-~-~-~~---~-~-~--~ _.. --- --- --~- - --~ ---- electricity to its Members-Owners, Tri-State owns and operates more than 5,200 miles of highvoltage transmission lines in Colorado, Nebraska, New Mexico, and Wyoming. See Ex. B. TriState owns and operates approximately 128 substations and switching stations in those four states. Its transmission system is interconnected with most of the major electric utilities in the western United States. ld. Tri-State also owns and operates the David A. Hamil DC Tie at Stegall, Nebraska, which joins the country's eastern and western power grids by convelting alternating current to direct current, and then converting it back to alternating cunenl. 28. Tri-State's New Mexico Member Systems do not receive electricity solely or even substantially from Tri-State's generation resources located in New Mexico. Rather, Tri-State injects electricity into the regional grid from its various generation resources in Arizona, Colorado, New Mexico and Wyoming (and its separate power purchases from third parties in various states described in Paragraphs 25 and 26 above) as part of interstate commerce that serves all of Tri-State's Member Systems, whether located in Colorado, New Mexico, Nebraska or Wyoming. See Exs. A and B. 29. Tri-State's management is headed by a General Manager under the gove1'llance of the forty-four member Board of Directors. All of Tri-State's business activities are directed by the General Manager and staff located at Tri-State's corporate headquatters office in 9 Case 1:13-cv-00085 Document 1 Filed 01/25/13 Page 10 of 25 Westminster, Colorado (the "Colorado Office"). These activities include power marketing, power generation, engineering, operations, maintenance, planning, finance, administrative services, general counsel, environment, and other suppOlting services. 30. Tri-State's multi-state transmission system is centrally managed through executive and management staff located at its Colorado Office. The real-time operation of the - - ----system is accompT1slle([lhrough a centralize,! coiitrol center at the -Colorado Office tliat peHorms--switching and security functions for the transmission system. 31. Tri-State must work closely with state and federal regulators to assure that it is in compliance with environmental and safety standards. The siting of new Tri-State generation and transmission facilities is also coordinated with state and local governments through siting and permitting processes. Tri-State's engineering activities, which include planning, design, and construction, are accomplished at the Colorado Office. 32. Tri-State's transmission maintenance activities are performed by employees in field offices located throughout its Member Systems' four states. These field offices report to management and staff at the Colorado Office. Tri-State depends on the effective, reliable operation of all of the generation and transmission facilities in all four states in order to meet its power sales and service obligations. Tri-State management and staff participate in numerous regional groups that jointly study interstate electrical system capabilities, implement operational practices, plan and construct transmission expansion projects, monitor system security, and assure adequate generation reserves for the Rocky Mountain Region of the Western Systems Coordinating Council. 10 Case 1:13-cv-00085 Document 1 33. Filed 01/25/13 Page 11 of 25 In summary, Tri-State engages in commercial activity that spans more than foul' states and that requires integration of resources, central management of assets, compliance with federal and multi-state regulations, and integration with the activities of other interstate entities. These facts confirm the Tenth Circuit Court of Appeals' decision holding that Tri-State generates, transpotts and sells electricity in interstate commerce. See Tri-State v. Wyoming Commission, 412 F.2d at 118. D. Tri-State's Federal Funding Requirements And The All Requirements Contracts Establish The Rate-Setting Principles Applied by the Board of Directors In Setting Tri-State's Historical "Postage Stamp" Wholesale Electric Rate 34. All ofTri-State's Member Systems, including those in New Mexico, have entered into long-term, all requirements wholesale power contracts with Tri-State for electric service (the "All Requirements Contracts"). In 2007, forty-two of Tri-State's Member Systems (including eleven of the twelve located in New Mexico) signed new AU Requirements Contracts extending the term of the Contract by ten years through December 31, 2050. The All Requirements Contracts of the other two Tri-State Member Systems (including Kit Carson Electric Cooperative, Inc. ("Kit Carson") headqualtered in Taos, New Mexico) expire December 31, 2040. 35. In general, the All Requirements Contracts provide that each Tri-State Member System will purchase and receive from Tri-State (with nominal exceptions not relevant here) all the electric power and energy the Member System requires to operate its electric system. As the Tenth Circuit has recognized, "[w]ith the all-requirements contracts in place, the G&T system provided a stable, interdependent network whereby the distribution cooperatives could pool their II Case 1: 13-cv-00085 Document 1 Filed 01/25/13 Page 12 of 25 resources and band together to obtain power at wholesale prices, build central facilities, obtain favorable loans, and attempt to keep costs down." Tri-State v. Shoshone II, 874 F.2d at 1349. 36. Tri-State and other G&T's rely upon federal loan programs administered by RUS (and previously REA) for a principal source of their capital structure. The long-term revenue stream Tri-State receives under the All Requirements Contracts with its Member Systems is "an essential factor to the cohesiveness and financial strength of the G&T systems" becausetne-contracts "place the financial strength of the distribution cooperatives behind G&T loans." Tl'i- State v. Shoshone II, 874 F.2d at 1349-50. 37. Each of the All Requirements Contracts between Tri-State and its forty-four Member Systems include the following provision: "[Member] acknowledges that [Tri-State] and the Government and other lenders are relying on this [all requirements] commitment from [Member], and similar commitments from aU other [Tri-State] Members having similar contracts to purchase electric service for its present and future load requirements hereunder and provide for (a) the financing of [Td-State's] facilities, (b) the development of an organization to serve [Member], and (c) for a long-term planning and power supply acquisition program." 38. As partial security for the loans it makes and as mandated by federal law, RUS requires Tri-State and other G&Ts to charge rates to their members-customers that produce "revenues sufficient to enable the [G&T] to make payment on account of all indebtedness of the [G&T]" to RUS. See 7 C.F.R. § 1717.301(b). 39. Consistent with RUS requirements and federal law, the All Requirements Contracts provide that Tri-State will charge rates to its Member Systems that generate revenues which are sufficient, combined with other revenue sources, to meet Tri-State's cost of operation 12 Case 1:13-cv-00085 Document 1 Filed 01/25/13 Page 13 of25 (inclusive of reasonable reserves), debt and lease costs and equity development, all as established, voted upon and approved by Tri-State's Board of Directors. 40. For many decades, Tri-State's Board of Directors has voted to adopt a single rate at which Tl'i-State sells wholesale electric power to each of its Member Systems. That is, regardless of the size, location, and structure of a Member System, each Member System is charged the same wholesale rate for the capacity and energy delivered to iissystem-:-Thfs longstanding "postage stamp,,3 rate philosophy comports with the mutual support nature of the cooperative corporation business model under which Tri-State is organized. E. Tri-State's Board of Directors Set Tri-State's Wholesale Rate For 2013 41. As mandated by RUS requirements, federal law, and Tl'i-State's All Requirements Contracts with its Member Systems, Tri-State's Board of Directors began the budget process for 2013 with the goal of charging a wholesale rate to its Member Systems that generates revenues which are sufficient, combined with other revenue sources, to meet Tri-State's cost of operation (inclusive of reasonable reserves), debt and lease costs and equity development. The allllual budget process began with a review ofTri-State's consolidated budget (including cost of service and capital), and a determination of the total 2013 revenue requirement for ratemaking purposes. The Board also considered the results of its multi-year effort to examine new rate designs and methodologies for calculating wholesale rates. During its August and September 2012 Board meetings, Tri"State's Directors carefully reviewed forecasted costs and anticipated sales and 3 A "postage stamp" rate structure refers to charging a single wholesale power rate to customers no matter where they are located. "Postage stamp'; rate is derived from the fact that no matter how fur a letter travels within the United States, the U.S. Postal Service charges the same amount per ounce to deliver itas opposed to charging by the mile for the distance the letter travels. Cf Pan-Alberta Gas Ltd. v. F.E.R.C., 251 F.3d 173,175 (D.C. Cil'. 2001) (in the context of shipping natural gas, "postage stamp" rate means "the same price [is charged] to ship gas across the country as ... to ship gas across town"). 13 Case 1: 13-cv-00085 Document 1 Filed 01/25/13 Page 14 of 25 revenues for calendar year 2013, and determined that, with a new rate design, a 4.9% rate increase is necessary to maintain Tri-State's financial health. In early September 2012, the Board of Directors formally voted on and passed a Resolution authorizing the rate increase and new rate design to be effective January 1, 2013. Based upon consumption of 1,000 kWh per month, an average end-use consumer served by one ofTri-State's Member Systems would see a --- power supply cost increase of $3.37 per month. 42. As a G&T cooperative corporation, Tri-State's mission is to provide its Member Systems electricity at the lowest reasonable price on a basis of mutuality. As a Member-owned and Member-governed organization, Tri-State has every incentive to keep the rates to its Member Systems as low as possible. The Board of Directors, comprised of one representative from every Member System, determined that the 2013 wholesale rate change is necessary to cover the cooperative corporation's costs and sustain its financial health. Members of the Board of Directors who voted on whether to approve the 2013 wholesale rate change included a representative from each of Tri-State's twelve Member Systems located in New Mexico. 43. After Tri-State's Board of Directors approved the 2013 budget and the wholesale Member System rate, Tri-State filed an advice notice on October 19, 2012 ("Advice Notice No. 15") informing the Commission of the new rate. (Advice Notice No. 15 is contained in Ex. 1 to Ex. C hereto.) A copy of Advice Notice No. 15 was simultaneously provided to Tri-State's Member Systems. By filing Advice Notice No. 15 with the Commission voluntarily (as with other Advice Notices Tl'i-State had previously filed), Tri-State did not agree to the Commission's jurisdiction to review, suspend or set Tri-State's rates, nor did Tri-State waive any right to 14 Case 1: 13-cv-00085 Document 1 challenge the Commission's jurisdiction. Filed 01/25/13 Page 15 of 25 Indeed, Tri-State expressly reserved the right to challenge the Commission's jurisdiction at any time. F. New Mexico's Regulation Of G&T Electric Rates 44. New Mexico law provides the Commission authority to regulate intrastate public utilities that sell power at retail to end use customers. N.M. Const. Art. XI, Sec. 2; NMSA 1978, § 62-3-3G. Tri-State i~ not a public utility andifopei'ates iii Interstate commerce.-Assnch;-§-623-3G provides no authority to the Commission to regulate Tri-State's rates. 45. New Mexico Statute § 62-6-4(A) provides that the Commission "shall have general and exclusive power and jurisdiction to regulate and supervise every public utility in respect to its rates and service regulations and in respect to its securities, all in accordance with the provisions and subject to the reservations of the Public Utility Act [NMSA 1978, §§ 62-13-1 et seq.]." (Emphasis added). 46. shall apply to The Public Utility Act provides that "[n]either this act nor any provision thereof 01' be construed to apply to commerce with foreign nations 01' commerce among the several states of this Union, except insofar as the same may be permitted under the provisions of the constitution of the United States and the acts of congress." NMSA 1978, § 62-13-4. That provision limits application of the Public Utility Act, including Section 62-6-4, to intrastate transactions, and prohibits application of the Public Utility Act to transactions in interstate commerce. Therefore, read in harmony with other statutory provisions, Section 62-6-4(D) may apply to G&Ts operating solely intrastate in New Mexico, but it does not apply to G&Ts such as Tri-State, whose business and operations in New Mexico are solely interstate. 15 Case 1:13-cv-00085 Document 1 47. Filed 01/25/13 Page 16 of 25 Section 3(b) of the All Requirements Contracts between Tri-State and each of its fotty-four Member Systems (including all of the New Mexico Member Systems) provides: "The Board of Directors of [Td-State] at such intervals as it shall deem appropriate, but in any event not less frequently than once each calendar year, shall review the rates for electric service furnished hereunder ... and, if necessary, shal1 revise such rates ... , all as approved by the Board of Directors of [Tri-State]." Section 3(a) of the All Requireinents Contracts fulther expressly requires as follows: "The Member shall pay [Td-State] for all electric service furnished hereunder at the rates and on the terms and conditions set forth in the rate schedule(s), adopted from time to time by [Td-State' s] Board of Directors." (Emphasis added). 48. As mandated by Sections 3(a) and (b) of the All Requirements Contracts, the rate at which Tl'i-State sells electricity to its forty-foul' Member Systems is determined wholly as a matter of contract by Td-State's democratically elected Board of Directors, which includes representatives from Tri-State's twelve Member Systems located in New Mexico. A protesting Member Systems' remedies lie first in Tri-State's democratic process to which all Members have agreed, and second, in judicial resolution of contractual disputes if the Member System or TriState choose to pursue such claims. The Commission has no authority to offer protesting Member Systems any remedy. G. A Minority of New Mexico Member Systems Protested T!'i-State's 2013 Rate 49. The twelve Member Systems of Tri-State located in New Mexico and the site of their respective headquarters are: Central New Mexico Electric Cooperative, Inc. in Mountainair; Columbus Electric Cooperative, Inc. in Deming; Continental Divide Electric Cooperative, Inc. ("Continental Divide") in Grants; Jemez Mountains Electric Cooperative, Inc. 16 Case 1:13-cv-00085 Document 1 Filed 01/25/13 Page 17 of25 in Espanola; Kit Carson in Taos; Mora-San Miguel Electric Cooperative, Inc. in Mora; NOlihern Rio Arriba Electric Cooperative, Inc. in Chama; Otero County Electric Cooperative, Inc. in Cloudcroft; Sierra Electric Cooperative, Inc. in Elephant Butte; Socorro Electric Cooperative, Inc. in Socorro; Southwestern Electric Cooperative, Inc. in Clayion; and Springer Electric Cooperative, Inc. ("Springer") in Springer. 50. Only three of Tri-State's twelve New Mexico Member Systems - Continental Divide, Kit Carson and Springer - filed protests with the Commission purpoliing to object to TriState's 2013 wholesale rate. Those Member Systems are hereinafter referred to as the "Protesting Member Systems." H. Tri-State Filed A Response To The Protests; The Commission Rejected Tl'i-State's Objections -- And Entered An Order Suspending Tri-Statc's 2013 Rate 51. Prior to filing this lawsuit, Tri-State filed a Response to the Protests (the "Response") with the Commission on November 29, 2012 (a copy of the Response is attached hereto as Exhibit C). As further explained in the Response, the 2013 rate approved by TriState's Board of Directors includes two components: (1) a rate increase; and (2) a change in rate design. The Protests, as filed, did not object to the rate increase component. However, the two components work together and cannot be considered or implemented in isolation. See Ex. C at 9-12. 52. In its Response, Tri-State requested that the Commission refrain from exercising jurisdiction over or suspending Tri-State's 2013 wholesale rate because: (1) the Constitution and laws of the State of New Mexico do not provide authority to the Commission to regulate the rates of an interstate entity selling wholesale power in interstate commerce such as Tri-State; (2) to the extent New Mexico's regulatory scheme purports to authorize the Commission to assert 17 Case 1:13-cv-00085 Document 1 Filed 01/25/13 Page 18 of 25 jUl'isdiction over, suspend and determine Tri-State's rates in New Mexico, it is unconstitutional under the Commerce Clause of the United States Constitution; (3) three New Mexico Member Systems had not submitted valid protests to the rate; (4) the Protesting Member Systems had failed to exhaust their remedies within Tri-State; and (5) "just cause" did not exist for the Commission to review the 2013 rate change. -- 53. State~s At an open meeting held on December 20, 2012, the Commission rejected Tri- Response and, by a 4-1 vote, suspended the 2013 rate by issuance of its December 20, 2012 Order Appointing Hearing Examiner and Suspending Rate Schedules. A copy of that Order is attached as Exhibit D. 54. Solely in an attempt to mitigate a pOliion of its damages pending determination by this COUli of the issues raised by this Complaint, and to avoid unfairness to the nine New Mexico Members which did not protest Tri-State's 2013 rate, Tri-State has filed with the Commission three Advice Notices (Advice Notice Nos. 16, 17, and 18) concerning interim rates to be effective pending issuance of injunctive relief andlor declaratory judgment in this case, filing of a fmiher Original Rate Advice Notice, or further Order of the Commission. Copies of Advice Notice Nos. 16, 17, and 18, and explanatory letters to the Commission concerning their filing, are attached as Exhibits E, F, G, and H. - FIRST CLAIM FOR RELIEFVIOLATION OF FEDERAL COMMERCE CLAUSE (Burden on Interstate Commerce) 55. The allegations set forth above are incorporated into Tri-State's first claim for -56. To the extent the provisions of New Mexico Statute 62-6-4(D) purport to relief. empower the Commission to exercise jUl'isdiction over, suspend, and detelmine Tri-State's 18 Case 1:13-cv-00085 Document 1 Filed 01/25/13 Page 19 of 25 wholesale rates, those provisions have extraterritorial effects that impact adversely interstate commerce, including economic activity in Colorado, Wyoming and Nebraska. Among other things, if Section 4(D) is read to apply to interstate commerce, the practical effect would be to control interstate commerce that occurs entirely outside the boundaries of New Mexico by, among other things, allowing the Commission to establish rates for use in New Mexico that will inevitably and materially affect rates for members in the tln'ee other states served by TI·i-State. 57. By suspending Td-State's 2013 rate, the Commission has effectively forced Tri- State to modify its postage stamp rate and business model, and increase its wholesale rate. This is so because Tri-State's loan agreement with RUS and federal law requires Td-State to generate revenues which are sufficient to meet its cost of operation (inclusive of reasonable reserves), debt and lease costs and equity development. Since Tri-State has no investors, it cannot simply reduce dividends 01' other shareholder distributions to cover a revenue shOltfall. Rather, as a notfor-profit cooperative corporation, the only way Trl-State could increase its revenues to make up for a shortfall in revenues received from its New Mexico Member Systems would be to charge a higher wholesale rate to its Member Systems in Colorado, Nebraska and Wyoming. Stated another way, lack of recovery of revenues from a segment of Tri-State's Member Systems in New Mexico would unfairly place additional financial burdens upon other Member Systems to make up the difference. Accordingly, any differential rate treatment to New Mexico Member Systems would inevitably have a material and detrimental impact on the rates paid by Member Systems in other states and would attack the core business model and foundation upon which Tri-State's interstate cooperative corporation rests. Even if Tri-State's interim rates (referred to 19 Case 1:13-cv-00085 Document 1 Filed 01125113 Page 20 of25 in paragraph 54 of this Complaint) take effect, the issue of whether the Commission may regulate Tri-State's wholesale rates will remain for decision by this Court. 58. The Commission's exertion of jurisdiction to suspend and subsequently review and establish Tri-State's rates in New Mexico constitute economic protectionism and impose a burden on interstate commerce in violation of the Commerce Clause for this reason alone. See Trl-State v. Wyoming Commission, 412 F.2d at 118-19. SECOND CLAIM FOR RELIEF.VIOLATION OF FEDERAL COMMERCE CLAUSE (Out-of-State Discrimination) 59. The allegations set fOlih above are incorporated into Tri-State's second claim for 60. Section 4(D) discriminates against out-of-state producers of electricity by failing relief. to limit the time within which a G&T's proposed rate increase may be suspended pending a hearing on the reasonableness of the rate. The comparable New Mexico law regulating in-state investor owned public utilities, NMSA 1978, § 62-8-7(C), limits the duration of the Commission's suspension of proposed rates. These differing regulatory schemes and others described above discriminate against out-of-state wholesale suppliers of electricity such as TriState in violation of the Commerce Clause. 61. For all of the foregoing reasons, New Mexico Statute 62-6-4(D) impermissibly regulates interstate commerce in violation of the Commerce Clause of the United States Constitlltion. 20 Case 1:13-cv-00085 Document 1 Filed 01/25/13 Page 21 of25 THIRD CLAIM FOR RELIEF- DECLARATORY JUDGMENT 62. The allegations set forth above are incorporated into Tri-State's third claim for 63. New Mexico law presently purports to mandate that Tri-State comply with relief. Section 4(D) and orders of the Commission relating to Tri-State's rates. 64. Tri-State believes that, to the extent New Mexico's regulatory scheme purports to authorize the Commission to assert jurisdiction over, suspend and determine Tri-State's rates in New Mexico, the scheme violates the Commerce Clause of the United States Constitution. 65. An actual controversy exists as to whether New Mexico's regulatory scheme purports to authorize the Commission to assert jurisdiction over, suspend and determine TriState's rates in New Mexico and, if so, whether the scheme is unconstitutional under the United States Constitution. 66. A declaratory judgment of this Court will serve to establish the respective rights and obligations of Tri-State and the Commission and terminate the uncertainty and controversy as to whether the purported grant of jurisdiction to the Commission to regulate Tri-State's interstate rates is unconstitutional. 67. Pursuant to Fed. R. Civ. P. 57 and 28 U.S.C. § 2201, Tri-State requests an order of the Court declaring that: (a) the Commission lacks jurisdiction over Tri-State's rates in New Mexico and any attempt by the Commission to exercise jurisdiction over, suspend and/or determine Tri-State's rates is unconstitutional under the United States Constitution; (b) the Commission's order suspending Tri-State's 2013 wholesale rate and setting a rate hearing is 21 Case 1:13-cv-00085 Document 1 Filed 01/25/13 Page 22 of25 unconstitutional under the United States Constitution; (c) the Commission may not take any action with respect to Tri-State's rates. FOURTH CLAIM FOR RELIEFVIOLATION OF 42 U.S.C. § 1983 68. The allegations set fOlih above are incorporated into Tri-State's fourth claim for 69. The Commission and its Commissioners act under color of New Mexico law in relief. considering whether to assert jurisdiction over Tri-State. 70.. To the extent New Mexico's regulatory scheme pUt'polis to authorize the Commission and the Commissioners to assert jurisdiction over, suspend and determine TriState's rates in New Mexico, the scheme violates Tri-State's federal constitutional rights as set fotih above. 71. New Mexico law affords no remedies or the remedies available are inadequate to address the deprivation of Tri-State's constitutional rights by the Commission and the Commissioners. Tri-State is therefore entitled to entry of declaratory and injunctive relief in its favor under 42 U.S.C. § 1983, and to an award of its costs incurred herein, including without limitation attorneys' fees, pursuant to 42 U.S.C. § 1988. FIFTH CLAIM FOR RELIEFINJUNCTIVE RELIEF 72. The allegations set forth above are incorporated into Tri-State's fifth claim for 73. Unless the Commission and its Commissioners are enjoined from asseliing relief. jurisdiction over Tri-State's rates and from suspending andlor determining Tri-State's 2013 22 Case 1:13-cv-00085 Document 1 Filed 01/25/13 Page 23 of 25 wholesale rate, Tri-State, its Member Systems outside of New Mexico, and the consumers of those Member Systems outside of New Mexico, will suffer immediate, irreparable harm. 74. Tri-State has no adequate remedy at law, to wit: (a) absent an injunction, Tri- State will have to respond to the Commission's attempts to regulate Tri-State's 2013 rate and will also be unable to implement its 2013 rate in New Mexico in light of the Commission's Order suspending Tri-State's 2013 wholesale rate; and (btTJ:i-State will suffer hTeparable injury in the absence of an injunction. 75. Tri-State is likely to prevail on the merits of its claims and any prejudice caused to the Commission and(or its Commissioners is outweighed by the threatened injury to Tri-State. 76. The injunctive relief requested by Tri-State is in the public interest. 77. Tri-State requests a permanent injunction prohibiting the Commission and its Commissioners from (a) asserting jurisdiction over Tri-State's rates, and (b) suspending and/or determining Tri-State's 2013 wholesale rate. Tri-State reserves the right to file a Motion for Preliminary Injunction prohibiting the Commission and its Commissioners from (a) asserting jurisdiction over Tri-State's rates, and (b) suspending andlor determining Tri-State's 2013 wholesale rate. PRAYER FOR RELIEF WHEREFORE, Tri-State prays for relief as foJIows: A. A declaratory judgment as set fOlih above; B. Injunctive relief as set forth above; C. An award of Tri-State's costs incurred herein, including without limitation attorneys' fees, pursuant to 42 U.S.C. § 1988 and as otherwise appropriate; 23 Case 1:13-cv-00085 Document 1 D. Filed 01/25/13 Page240f25 For such other and fmiher relief as the Court may deem just and equitable under the circumstances. DATED this 25'" day of January, 2013. MODRALL SPERLING ROEHL HARRIS & SISK, P.A. Electronically Filed Bv lsi John R. Cooney, Attorney at Law John R. Cooney (jcooney@modrall.com) Earl E. DeBrine (edebrine@modrall.com) Joan E. Drake (jdrake@modrall.com Atto1'lleys for Plaintiffs P. O. Box 2168 Albuquerque, NM 87103-2168 (505) 848-1800 Fax (505) 848-9710 and Robert E. Youle (ryoule@shermanhoward.com) Brian G. Eberle (beberle@shermanhoward.com) SHERMAN & HOWARD, LLC 633 17th Street, Suite 3000 Denver, CO 80202 (303) 297-2900 Fax (303) 298-0940 24 Case 1:13-cv-00085 Document 1 Filed 01/25/13 Page 25 of25 VERIFICATION I, KENNETH V. REIF, hereby swear, depose, and state as follows: 1. I am Vice President and General Counsel of Tri-State Generation and Transmission Association, Inc. (,'Tri'Stai()") 2. I have read and know the contents of Tri-State's Complaint for Declaratory Judgment and Injunctive Relief ("Complaint") in the above-captioned action. The statements contained therein are true and COlTect to the best of my knowledge and belief. 3. I have reviewed the following exhibits to Tri-State's Complaint and, to the best of my knowledge and belief, they are true and correct copies of: a. Tri-State System Map (Exhibit A) b. Tri-State Member Map (Exhibit B) c. Tri-State's Response to Protests filed with the New Mexico Public Regulation Commission (Exhibit C). d. The Commission's Order entered December 20,2012 (Exhibit D) e. Tri-State's filings of Advice Notices Nos. 16, 17, and 18 conce1'11ing interim rates, letters to the Commission conce1'11ing such filings, Notification of such filings, and certificates of service (Exhibits E, F, G, and H). /~u Kenneth V. Reif STATE OF COLORADO COUNTY OF AI>-A~ ) ) ss. ) SUBSCRIBED AND SWORN to before me Kenneth V. Reif. On~c.Nv.A~ d. ~ ,2013, by NotaryP My commission expires:~;!:~L---=:Jc,~:LI.l..(2 25