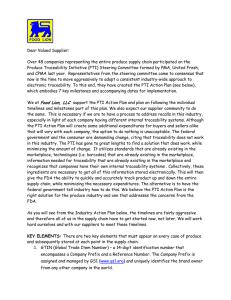

Industry Roadmap: Building the Fresh Foods Supply

advertisement