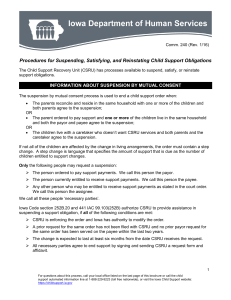

paternity and child support law in iowa

advertisement