Head Office: Edelweiss, 14 Floor, Express Towers, Nariman Point

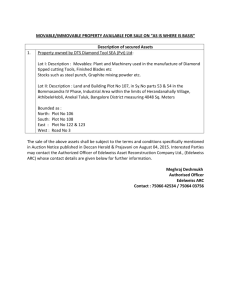

advertisement

Head Office: Edelweiss, 14th Floor, Express Towers,

Nariman Point, Mumbai 400 021 • www.edelcap.com

Edelweiss

Auditors' Report on the Consolidated Financial Statements of

Edelweiss Capital Limited and its subsidiaries

The Board of Directors

Edelweiss Capital Limited

1.

We have audited the attached consolidated balance sheet of Edelweiss Capital Limited ('the Company') and its subsidiaries ('the

Group') as at 31 March 2007 and the consolidated profit and loss account and the consolidated cash flow statement for the year

ended on that date annexed thereto. These financial statements are the responsibility of the Company's management and have

been prepared by the management on the basis of separate financial statements and other financial information regarding

components. Our responsibility is to express an opinion on these financial statements based on our audit.

2.

We conducted our audit in accordance with auditing standards generally accepted in India. Those Standards require that we plan

and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement.

An audit includes, examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An

audit also includes assessing the accounting principles used and significant estimates made by the management, as well as

evaluating the overall financial statement. We believe that our audit provides a reasonable basis for our opinion.

3.

We did not audit the financial statements of certain subsidiaries whose financial statements reflect total assets of Rs 942,745

(000's) as at 31 March 2007, total revenues of Rs 99,758 (000's) and total cash flow of Rs. 1,410 (000’s) for the year then ended.

These financial statements and other financial information have been audited by other auditors whose reports have been furnished

to us, and in our opinion in so far as it relates to the amounts included in respect of the subsidiaries, are solely on the report of the

other auditors.

4.

We report that the consolidated financial statements have been prepared by the Group in accordance with the requirements of

Accounting Standards issued by the Institute of Chartered Accountants of India, to the extent applicable and on the basis of the

separate audited financial statements of the Company and its subsidiaries included in the consolidated financial statements.

5.

Based on our audit and on consideration of reports of other auditors on separate financial statements and on the other financial

information of the components, and to the best of our information and according to the explanations given to us, in our opinion

the consolidated financial statements give a true and fair view in conformity with the accounting principles generally accepted in

India :

-

In the case of the consolidated balance sheet, of the state of affairs of the Group as at 31 March 2007;

-

In the case of the consolidated profit and loss account, of the profit for the year ended 31 March 2007; and

-

In the case of the consolidated cash flow statement, of the cash flows for the year ended on that date.

For BSR & Associates

Chartered Accountants

Mumbai

Date: 5 June 2007

Akeel Master

Partner

Membership No.: 046768

33

Edelweiss

Consolidated Balance Sheet as at 31 March 2007

Schedules

2007

2006

Capital

2

50.44

37.84

Reserves and Surplus

3

5,770.26

1,746.17

5,820.70

1,784.01

Currency Indian Rupees in millions

SOURCES OF FUNDS

Shareholders' Funds

Minority Interest

4

1,398.79

3.43

Loan Funds

Secured Loans

Unsecured Loans

5

6

67.55

3,802.28

71.22

433.92

3,869.83

505.14

11,089.32

2,292.58

213.27

105.72

75.85

38.48

137.42

67.24

32.69

-

170.11

67.24

8

824.38

323.65

24.6

11.26

4.18

9

10

5,756.43

583.19

1,404.52

364.09

Cash and Bank Balances

Other Current Assets

11

12

2,650.82

75.49

636.52

10.33

Loans and Advances

13

2,615.71

698.78

11,681.14

3,114.14

14

1,464.04

1,171.65

15

134.03

45.08

1,598.07

1,216.73

Net Current Assets

10,083.57

1,897.51

TOTAL

11,089.32

2,292.58

TOTAL

APPLICATION OF FUNDS

Fixed Assets

7

Gross Block

Less : Depreciation

Net Block

Capital work in Progress

Investments

Deferred Tax Asset (Net)

Current Assets, Loans and Advances

Stock-in-trade

Sundry Debtors

Less : Current Liabilities and Provisions

Current Liabilities

Provisions

Significant Accounting Policies

1

Notes to Financial Statements

24

The Schedules referred to above form an integral part of the Balance Sheet.

As per our report attached.

34

For BSR & Associates

Chartered Accountants

For and on behalf of the Board of Directors

Akeel Master

Partner

Membership No: 046768

Rashesh Shah

Managing Director

Mumbai

Date : 5 June 2007

Mumbai

Date : 5 June 2007

Venkat Ramaswamy

Wholetime Director

Shilpa Soti

Company Secretary

Edelweiss

Consolidated Profit and Loss Account for the year ended 31 March 2007

Currency Indian Rupees in millions

Schedules

INCOME

Fee and commission income

Trading and arbitrage income

Investment and dividend income

Interest income

Other income

16

17

18

19

20

TOTAL INCOME

EXPENDITURE

Employee costs

Operating and other expenses

Financial expenses

Depreciation

Goodwill on consolidation written off

21

22

23

2007

2006

2,154.30

1,142.19

264.67

128.59

22.78

989.63

442.81

63.42

26.26

11.21

3,712.53

1,533.33

808.18

932.91

186.89

37.70

0.30

331.33

463.46

53.82

20.49

-

TOTAL EXPENDITURE

1,965.98

869.10

PROFIT BEFORE TAXATION

1,746.55

664.23

647.35

(7.07)

5.70

221.39

1.49

3.34

1100.57

438.01

-

28.74

(4.03)

(3.99)

Provision for taxation (excluding impact of extraordinary items)

- Current tax

- Deferred tax (credit) / charge

- Fringe benefit tax

PROFIT AFTER TAXATION AND BEFORE EXTRAORDINARY ITEM

Extraordinary item

Less: Tax on extraordinary item

Less: Deferred tax asset on extraordinary item

PROFIT AFTER TAXATION AND EXTRAORDINARY ITEM

Share of minority interest in profit for the year

Adjustment on account of change in minority interest

PROFIT AFTER TAXATION AND MINORITY INTEREST

PROFIT AND LOSS ACCOUNT BALANCE BROUGHT FORWARD

Less: Adjustment on account of minority interest

-

20.72

1100.57

417.29

1.67

-

0.32

0.40

1,098.90

416.57

653.79

-

296.67

0.70

653.79

295.97

PROFIT AVAILABLE FOR APPROPRIATION

1,752.69

712.54

APPROPRIATIONS

Transfer to Special Reserve under Section 45-IC of the RBI Act, 1934

Proposed dividend

Interim dividend

Dividend distribution tax

Dividend distribution tax for prior year

Transfer to general reserve

Transfer to debenture redemption reserve

Profit and loss account balance carried to balance sheet

22.96

11.27

1.58

27.06

1.88

1,687.94

6.55

4.88

0.68

0.07

4.39

42.18

653.79

1,752.69

712.54

Basic earning per share before extraordinary item (Rs.) (Face value Re. 1)

Basic earning per share after extraordinary item (Rs.) (Face value Re.1)

24.4

24.4

26.81

26.81

13.46

12.82

Diluted earning per share before extraordinary item (Rs.) (Face value Re.1)

Diluted earning per share after extraordinary item (Rs.) (Face value Re.1)

24.4

24.4

24.91

24.91

11.77

11.21

Significant Accounting Policies

Notes to Financial Statements

1

24

The Schedules referred to above form an integral part of the Profit and Loss Account.

As per our report attached .

For BSR & Associates

Chartered Accountants

For and on behalf of the Board of Directors

Akeel Master

Partner

Membership No: 046768

Rashesh Shah

Managing Director

Mumbai

Date : 5 June 2007

Mumbai

Date : 5 June 2007

Venkat Ramaswamy

Wholetime Director

Shilpa Soti

Company Secretary

35

Edelweiss

Cash flow statement for the year ended 31 March 2007

Schedules

Currency Indian Rupees in millions

A Cash flow from operating activities

Profit before taxation

Adjustments for

Depreciation

Net Provision for Loss on Equity Index/Stock Options

Miscellaneous balance written off

Provision for gratuity

Profit on sale of investments

Income from investments in partnership firm

Dividend on current investments

Diminution in value of long term investments written back (net)

Diminution in value of current investments written back (net)

Goodwill on consolidation written off

Profit on sale of fixed assets (net)

Provision for doubtful debts written back

Provision for doubtful debts

Bad debts and advances written off

Effect of change in foreign exchange

Financial expenses

Extraordinary item

Interest income (gross)

Operating cash flow before working capital changes

2007

2006

1,746.55

664.23

37.70

124.61

8.33

(200.08)

(19.20)

(12.88)

(1.37)

0.30

(0.01)

(1.06)

3.81

2.89

186.89

(68.27)

20.49

2.42

0.28

1.75

(45.59)

(2.72)

(0.70)

(2.77)

(1.50)

0.01

0.12

(0.11)

53.83

(28.74)

(25.50)

1,808.21

635.50

Adjustments for

Increase in stock in trade

Increase in sundry debtors

Increase in other current assets

Increase in loans and advances

Increase in current liabilities

(4,351.91)

(224.74)

(36.73)

(2,039.22)

268.35

(1,142.36)

(242.28)

(201.16)

723.80

Cash used in operations

Income taxes paid

(4,576.04)

566.89

(226.50)

218.33

Net cash used for operating activities during the year- A

(5,142.93)

(444.83)

39.84

19.20

(140.76)

0.20

(286.70)

18.64

0.70

(55.48)

0.01

(169.81)

(368.22)

(205.94)

2,942.99

1,393.69

7.65

(16.15)

(2.26)

3,368.37

(3.67)

(165.17)

834.80

1.95

(0.11)

(2.80)

(0.44)

372.14

12.63

(50.84)

7,525.45

1,167.33

2,014.30

516.56

636.52

2,650.82

119.91

636.52

B Cash flow from Investing Activities

Interest received

Dividend received on current investments

Purchase of fixed assets

Proceeds from sale of fixed assets

Purchase of investments (net)

Net cash used for investing activities during the year - B

C Cash flow from Financing activities

Proceeds from issue of share capital including premium received

Change in minority interest

Share application money

Change in foreign exchange translation reserve

Dividend paid

Dividend distribution tax paid

Proceeds from unsecured loans

(Repayment of) / Proceeds from secured loans

Interest paid on loans

Net cash generated from financing activities during the year - C

Net Increase in cash and cash equivalents (A+B+C)

Cash and cash equivalent as at the beginning of the year

Cash and cash equivalent as at the end of the year

11

11

As per our report attached .

36

For BSR & Associates

Chartered Accountants

For and on behalf of the Board of Directors

Akeel Master

Partner

Membership No: 046768

Rashesh Shah

Managing Director

Mumbai

Date : 5 June 2007

Mumbai

Date : 5 June 2007

Venkat Ramaswamy

Wholetime Director

Shilpa Soti

Company Secretary

Edelweiss

Schedules to the consolidated financial statements for the year ended

31 March 2007

(Currency Indian Rupees in millions)

1

Significant accounting policies

1.1

Principles of consolidation

a)

The consolidated financial statements relate to Edelweiss Capital Limited (‘the Company’) and its subsidiary

entities and associates (‘the Group’). The consolidated financial statements have been prepared on the following

basis:

•

In respect of Subsidiary Enterprises (including partnership firm), the financial statements have been

consolidated on a line-by-line basis by adding together the book values of like items of assets, liabilities,

income and expenses, after as far as possible eliminating intra-group balances and intra-group transactions

resulting in unrealised profits or losses in accordance with Accounting Standard 21 - Consolidated Financial

Statements issued by the Institute of Chartered Accountants of India.

•

In case of Associate Enterprises (including partnership firm), the financial statements have been consolidated

as per Accounting Standard 23 – Accounting for investment in Associates issued by the Institute of

Chartered Accountants of India.

•

Assets and liabilities of the foreign subsidiaries are translated into Indian Rupees at the rate of exchange

prevailing as at the balance sheet date. Revenue and expense are translated into Indian Rupees at the

average exchange rate prevailing during the year and the resulting net translation adjustment has been

disclosed as Foreign Exchange Translation Reserve in Reserves and Surplus.

•

The excess of cost over the Company’s investments in the subsidiary company is recognised in the

consolidated financial statements as Goodwill which has been charged off in the Profit and Loss Account

in the year of acquisition. The excess of Company’s share in equity and reserves of the subsidiary company

over the cost of acquisition is treated as Capital Reserve.

•

The share of Minority Interest in the net profit of subsidiaries / partnership firms for the year is identified and

adjusted against the income of the group to arrive at the net income attributable to the Company.

•

The share of Minority Interest in the net assets of subsidiaries / partnership firms is identified and presented

in the consolidated financial statements separate from liabilities and the equity of the Company.

•

The consolidated financial statements are prepared using uniform accounting policies for like transactions

and other events in similar circumstances and are presented in the same manner as the Company’s

separate financial statements.

b)

Investments other than in subsidiaries and associates have been accounted as per Accounting Standard 13 on

Accounting for Investments.

c)

The subsidiaries enterprises and associates considered in the consolidated financial statements :

Name of the Entity

Country of

Incorporation

Proportion of

ownership interest

as on 31 March 2007

Edelweiss Securities Private Limited

India

100.00%

Crossborder Investments Private Limited

India

100.00%

Edelweiss Insurance Brokers Limited

India

71.91%

Edelweiss Commodities & Advisors Limited

India

100.00%

Edelweiss Capital USA, LLC

U.S.A.

100.00%

ECL Finance Limited

India

100.00%

EC Global Limited *

Mauritius

100.00%

Edelweiss Real Estate Advisors Private Limited

India

100.00%

Edelweiss Trustee Services Private Limited

India

100.00%

Edelcap Securities and Transaction Services Private Limited*

India

100.00%

(Formerly Tiffin Investments Private Limited)

* held through Crossborder Investments Private Limited

d)

During the year, the Company has increased its stake in Edelcap Securities and Transaction Services Private

Limited (Formerly Tiffin Investments Private Limited) from 49% to 100% on 12 December 2006 through Crossborder

Investments Private Limited, a 100% subsidiary of the Company.

37

Edelweiss

Schedules to the consolidated financial statements for the year ended

31 March 2007 (Continued)

(Currency Indian Rupees in millions)

1.1

1.2

Principles of consolidation (Continued)

e)

During the financial year 2005-06, the Company has diluted its interest in Edelweiss Insurance Brokers Limited, a

subsidiary company, from 99.95% to 79.96% on 24 October 2005 and from 79.96% to 71.91% on 31 March

2006. In the absence of separate financial statements drawn on the said dates of dilution, it is assumed that the

profits of the subsidiary has arisen evenly through out the year for arriving at the share of profit of the minority

interest in the consolidated financial statements.

f)

EC Global Limited, a subsidiary company of Crossborder Investments Private Limited, was incorporated on 29

December 2004. The first financial statements drawn by the subsidiary covering the period 29, December 2004

to 31 March 2006 has been considered for the purpose of consolidation for the previous year. The subsidiary had

no commercial operations during the period 29 December 2004 to 31 March 2006 and as such had no impact on

the previous year’s consolidated financial statements.

Basis of preparation of financial statements

The accompanying financial statements are prepared under the historical cost convention, on the accrual basis of accounting

and comply with the accounting standards issued by the Institute of Chartered Accountants of India (to the extent

applicable) and in accordance with the generally accepted accounting principles and the provisions of the Companies Act,

1956 as adopted consistently by the Company. The financial statements are presented in Indian rupees in millions.

1.3

Use of estimates

The preparation of the financial statements in conformity with the generally accepted accounting principles requires the

management to make estimates and assumptions that affect the reported amount of assets, liabilities, revenues and

expenses and disclosure of contingent assets and liabilities. The estimates and assumptions used in the accompanying

financial statements are based upon management's evaluation of the relevant facts and circumstances as of the date of

the financial statements. Actual results may differ from the estimates and assumptions used in preparing the accompanying

financial statements. Any differences of actual to such estimates are prospectively made in current or future periods.

1.4

38

Revenue recognition

•

Advisory and transactional services fee income is accounted for, on an accrual basis in accordance with the terms

& contracts entered into between the Company and the counterparty.

•

Brokerage income is recognised on trade date basis and is inclusive of service tax.

•

Profit / (loss) on Error trades are included in "Income from Arbitrage and Trading in Securities and Derivatives" and

"Income from Arbitrage and Trading in Commodity Derivatives" under the respective heads.

•

Brokerage and Commission income earned from Insurance companies is recognised on accrual basis exclusive of

service tax.

•

Portfolio management fees are accounted on accrual basis as follows:

a.

In case of percentage based fees, as a percentage of the unaudited Net Asset Value at the end of each

financial quarter, on a quarterly basis.

b.

In case of return based fee, as a percentage of the annual profit, on an annual basis.

•

Interest income is recognised on accrual basis.

•

Dividend income is recognised when the right to receive payment is established.

•

Revenue from fund management services is recognised in accordance with the terms and conditions of the

investment management agreement between the Company and the Fund. The amount recognised as revenue is

exclusive of service tax.

•

In respect of other heads of income, income from depository operations etc., the Company follows the practice of

accruing income on a prudent basis.

•

Revenue from rendering of trustee services is recognised in accordance with the terms and conditions of the

Compensation Agreement between the Company and the Fund. The amount recognised as revenue is exclusive

of service tax.

Edelweiss

Schedules to the consolidated financial statements for the year ended

31 March 2007 (Continued)

(Currency Indian Rupees in millions)

1.5

Equity index / stock - futures

a)

"Initial Margin", representing initial margin paid, and "Margin Deposits", representing additional margin over and

above initial margin, for entering into contracts for Equity index / stock futures, which are released on final settlement/

squaring-up of underlying contracts, are disclosed as under Loans and Advances.

b)

Equity index / stock futures are marked-to-market on a daily basis. Debit or credit balance disclosed under Loans

and Advances or Current Liabilities, respectively, in the "Mark-to-Market Margin - Equity Index / Stock Futures

Account", represents the net amount paid or received on the basis of movement in the prices of Index / Stock

Futures till the balance sheet date.

c)

As on the balance sheet date, profit / loss on open positions in index / stock futures are accounted for as follows:

d)

1.6

1.7

•

Credit balance in the "Mark-to-Market Margin - Equity Index / Stock Futures Account", being anticipated

profit, is ignored and no credit for the same is taken in the profit and loss account.

•

Debit balance in the "Mark-to-Market Margin - Equity Index / Stock Futures Account", being anticipated

loss is adjusted in the profit and loss account.

On final settlement or squaring-up of contracts for equity index / stock futures, the profit or loss is calculated as the

difference between settlement / squaring-up price and contract price. Accordingly, debit or credit balance pertaining

to the settled / squared-up contract in "Mark-to-Market Margin - Equity Index / Stock Futures Account" is

recognised in the profit and loss account. When more than one contract in respect of the relevant series of equity

index futures contract to which the squared-up contract pertains is outstanding at the time of the squaring-up of

the contract, the contract price of the contract so squared-up is determined using weighted average method for

calculating profit / loss on squaring-up.

Equity index / stock - options

a)

"Equity Index / Stock Options Margin Account", representing initial margin paid, and "Margin Deposit", representing

additional margin paid over and above initial margin, for entering into contracts for equity index / stock options,

which are released on final settlement / squaring-up of underlying contracts, are disclosed under Loans and

Advances.

b)

"Equity Index / Stock Option Premium Account" represents premium paid or received for buying or selling the

options, respectively.

c)

As at the balance sheet date, in the case of long positions, provision is made for the amount by which the premium

paid for those options exceeds the premium prevailing on the balance sheet date, and in the case of short

positions, for the amount by which premium prevailing on the balance sheet date exceeds the premium received

for those options, and reflected in "Provision for Loss on Equity Index / Stock Option Account".

d)

When the option contracts are squared-up before expiry of the options, the premium prevailing on that date is

recognised in profit and loss account. If more than one option contract in respect of the same index / stock with

the same strike price and expiry date to which the squared-up contract pertains is outstanding at the time of

squaring-up of the contract weighted average method is followed for determining profit or loss. On expiry of the

contracts and on exercising the options, the difference between final settlement price and the strike price is

transferred to the profit and loss account. In both the above cases premium paid or received for buying or selling

the option, as the case may be, is recognised in the profit and loss account for all squared-up / settled contracts.

Commodities stock - futures

a)

"Initial Margin", representing initial margin paid, and "Margin Deposits", representing additional margin over and

above initial margin, for entering into contracts for commodities futures, which are released on final settlement /

squaring-up of underlying contracts, are disclosed under Loans and Advances.

b)

Commodities futures are marked-to-market on a daily basis. Debit or credit balance disclosed under Loans and

Advances or Current Liabilities respectively, in the "Mark-to-Market Margin - Commodities Stock Futures Account",

represents the net amount paid or received on the basis of movement in the prices of Commodities Futures till the

balance sheet date.

c)

As on the balance sheet date, profit / loss on open positions in Commodities Futures are accounted for as follows:

•

Credit balance in the "Mark-to-Market Margin - Commodities Stock Futures Account", being anticipated

profit, is ignored and no credit for the same is taken in the profit and loss account.

•

Debit balance in the "Mark-to-Market Margin - Commodities Stock Futures Account", being anticipated

loss, is adjusted in the profit and loss account.

39

Edelweiss

Schedules to the consolidated financial statements for the year ended

31 March 2007 (Continued)

(Currency Indian Rupees in millions)

1.7

Commodities stock - futures (Continued)

d)

1.8

On final settlement or squaring-up of contracts for Commodities Futures, the profit or loss is calculated as the

difference between settlement / squaring-up price and contract price. Accordingly, debit or credit balance pertaining

to the settled / squared-up contract in "Mark-to-Market Margin - Commodities Stock Futures Account" is recognised

in the profit and loss account. When more than one contract in respect of the relevant series of commodities

futures contract to which the squared-up contract pertains is outstanding at the time of the squaring-up of the

contract, the contract price of the contract so squared-up is determined using weighted average method for

calculating profit / loss on squaring-up.

Fixed assets and depreciation

Fixed assets are stated at cost less accumulated depreciation. The cost of fixed assets comprises of purchase price and

any attributable cost of bringing the asset to its working condition for its intended use.

The Company provides pro-rata depreciation from the month in which asset is acquired / put to use. In respect of assets

sold, pro-rata depreciation is provided upto the month in which the asset is sold.

Depreciation is charged on written down value basis at the rates prescribed by the Schedule XIV of the Companies Act,

1956 as given below:

Class of asset

Rate of depreciation

Office equipment

13.91%

Computers

40.00%

Vehicles

25.00%

Electrical fittings

13.91%

Furniture and fixtures

18.10%

Leasehold improvements are amortized on a straight-line basis over the period of lease.

All fixed assets individually costing less than Rs. 5,000 are fully depreciated in the year of installation.

Software expense includes expenditure by way of license for various office applications which have been written off in the

year of purchase on a prudent basis.

1.9

Impairment of assets

The Company assesses at each balance sheet date whether there is any indication that an asset may be impaired. If any

such indication exists, the Company estimates the recoverable amount of the asset. If such recoverable amount of the

asset or the recoverable amount of the cash generating unit which the asset belongs to, is less than its carrying amount,

the carrying amount is reduced to its recoverable amount. The reduction is treated as an impairment loss and is recognized

in the profit and loss account. If at the balance sheet date there is an indication that a previously assessed impairment loss

no longer exists, the recoverable amount is reassessed and the asset is reflected at the recoverable amount subject to a

maximum of depreciable historical cost.

1.10

1.11

Stock-in-trade

a)

The securities acquired with the intention of short-term holding and trading positions are considered as stock-intrade and disclosed as current assets.

b)

The securities and commodities held as stock-in-trade under current assets are valued at lower of average cost

and market value. In case of units of Mutual Funds, Net Asset Value is considered as market value.

Investments

Investments are classified into long term investments and current investments. Investments which are intended to be held

for one year or more are classified as long term investments and investments which are intended to be held for less than

one year are classified as current investments.

Long term investments are accounted at cost and any decline in the carrying value other than temporary in nature is

provided for. Current investments are valued at cost or market / fair value, whichever is lower. In case of investments in

units of a Mutual Fund, the Net Asset Value of units is considered as the market / fair value, whichever is lower.

40

Edelweiss

Schedules to the consolidated financial statements for the year ended

31 March 2007 (Continued)

(Currency Indian Rupees in millions)

1.12

Foreign currency transactions

Foreign currency transactions are recorded at the rates of exchange prevailing on the date of the transaction. Exchange

differences, if any arising out of transactions settled during the year are recognised in the profit and loss account.

Monetary assets and liabilities denominated in foreign currencies as at the balance sheet date are translated at the closing

exchange rate on that date. The exchange differences, if any, are recognised in the profit and loss account and related

assets and liabilities are accordingly restated in the balance sheet except those related to acquisition of fixed assets which

are adjusted in the carrying amount of the related fixed assets.

1.13

Retirement benefits

Contribution payable to the recognised provident fund, which is a defined contribution scheme, are charged to the profit

and loss account in the period in which they occur.

Gratuity which is a defined benefit is accrued based on the actuarial valuation as at the balance sheet date carried out by

an independent actuary.

Unused leave of staff lapses at year end and accordingly is not encashable.

1.14

Debenture redemption reserve

In terms of Section 117C of the Companies Act, 1956, amounts equivalent to the principal value of the debentures is

transferred to Debenture Redemption Reserve proportionately over the term of the debentures.

1.15

Taxation

Income-tax expense comprises of current tax (i.e. amount of tax for the period determined in accordance with the IncomeTax law), deferred tax charge or credit (reflecting the tax effect of timing differences between accounting income and

taxable income for the period) and fringe benefit tax.

Deferred taxation

The deferred tax charge or credit and the corresponding deferred tax liabilities and assets are recognized using the tax

rates that have been enacted or substantively enacted by the balance sheet date. Deferred tax assets are recognised only

to the extent there is reasonable certainty that the asset can be realised in future; however, where there is unabsorbed

depreciation or carried forward loss under taxation laws, deferred tax assets are recognised only if there is a virtual

certainty of realisation of the assets. Deferred tax assets are reviewed as at each balance sheet date and written down or

written-up to reflect the amount that is reasonable / virtually certain (as the case may be) to be realised.

Fringe benefit tax

Provision for Fringe benefit tax (FBT) is made on the basis of applicable FBT on the taxable value of chargeable expenditure

of the Company as prescribed under the Income Tax Act, 1961.

Securities transaction tax

Securities transaction tax (STT) to the extent allowable u/s 88E of the Income Tax Act,1961 has been included in provision

for Income Tax.

1.16

Preliminary expenses

Preliminary expenses are charged to the profit and loss account in the year in which they are incurred.

1.17

Operating leases

Lease rentals in respect of operating lease are charged to the profit and loss account as per the terms of the lease

arrangement on a straight line basis.

1.18

Earnings per share

The basic earnings per share is computed by dividing the net profit attributable to the equity shareholders by weighted

average number of equity shares outstanding during the reporting year.

Number of equity shares used in computing diluted earnings per share comprises of the weighted average number of

shares considered for deriving basic earnings per share and also weighted average number of equity shares which would

have been issued on the conversion of all dilutive potential shares. In computing diluted earnings per share only potential

equity shares that are dilutive are included.

41

Edelweiss

Schedules to the consolidated financial statements for the year ended

31 March 2007 (Continued)

(Currency Indian Rupees in millions)

1.19

Employee Stock Option Plans

Pursuant to the Guidance Note issued by the Institute of Chartered Accountants of India on Accounting for Employee

Share-based Payments, the independent valuer computes the fair value of its shares using the earnings capitalization

method considering weighted average adjusted profit after tax for last 3 years of all the subsidiary companies. Accordingly

the difference, if any between the fair value and the issue price is charged to the profit and loss account as the compensation

cost on account of Employee Stock Option Plan over the period of grant and vesting date.

1.20

Provisions and contingencies

The Company creates a provision when there is present obligation as a result of a past event that probably requires an

outflow of resources and a reliable estimate can be made of the amount of the obligation. A disclosure for a contingent

liability is made when there is a possible obligation or a present obligation that may, but probably will not, require an

outflow of resources. When there is a possible obligation or a present obligation in respect of which the likelihood of

outflow of resources is remote, no provision or disclosure is made.

Provisions are reviewed at each balance sheet date and adjusted to reflect the current best estimate. If it is no longer

probable that the outflow of resources would be required to settle the obligation, the provision is reversed.

Contingent assets are not recognised in the financial statements. However, contingent assets are assessed continually

and if it is virtually certain that an economic benefit will arise, the asset and related income are recognised in the period in

which the change occurs.

1.21

Reserve Bank of India Prudential Norms

Crossborder Investments Private Limited and ECL Finance Limited, the subsidiaries of the Company follow the guidelines

issued by the Reserve Bank of India, in respect of income recognition, provisioning for non-performing assets and

valuation of investments.

42

Edelweiss

Schedules to the consolidated financial statements as at

31 March 2007 (Continued)

(Currency Indian Rupees in millions)

2007

2006

92.50

92.50

7.50

7.50

100.00

100.00

44.92

37.84

0.86

-

2.06

-

2.60

-

50.44

37.84

13.82

13.82

2 Share capital

Authorised :

92,500,000 ( Previous year 92,500,000 ) Equity Shares of Re. 1 each

7,500,000 ( Previous year 7,500,000 ) Preference Shares of Re. 1 each

Issued, Subscribed and Paid-up:

44,916,806 ( Previous year 37,836,166 ) Equity Shares of Re. 1 each,

fully paid-up

861,486 ( Previous year Nil ) 0.01% Convertible Preference Shares

of Re.1 each,fully paid-up (#)

2,059,107 ( Previous year Nil ) 8% Convertible Preference Shares

of Re.1 each,fully paid-up (#)

2,600,000 ( Previous year Nil ) 12% Reedemable Preference Shares

of Re.1 each, fully paid-up

# These shares will be converted into equity shares before an intial public offering

of the Company

3 Reserves and surplus

Capital Reserve

General Reserve

As per last Balance Sheet

Add : Transfer from Profit and Loss account

4.39

-

27.06

4.39

31.45

4.39

Foreign Exchange Translation Reserve

As per last Balance Sheet

(0.13)

(0.02)

7.65

(0.11)

7.52

(0.13)

987.36

161.80

2,930.39

825.56

3,917.75

987.36

74.45

32.28

1.88

42.18

76.33

74.45

As per last Balance Sheet

12.49

5.94

Add : Transfer from Profit and Loss account

22.96

6.55

35.45

12.49

1,687.94

653.79

5,770.26

1,746.17

Add : Additions during the year

Securities Premium Account

As per last Balance Sheet

Add : Additions during the year

Debenture Redemption Reserve

As per last Balance Sheet

Add : Transfer from Profit and Loss account

Special Reserve under Section 45-IC of the Reserve Bank of

India Act, 1934, of India

Balance in Profit and Loss account

43

Edelweiss

Schedules to the consolidated financial statements as at

31 March 2007 (Continued)

(Currency Indian Rupees in millions)

2007

2006

697.44

-

697.44

-

0.05

0.05

0.03

0.02

-

-

0.05

3.38

1.67

0.01

1.95

1.10

0.32

5.05

3.38

696.30

-

696.30

-

1,398.79

3.43

25.45

30.17

7.21

-

6.05

6.02

26.12

-

2.72

35.03

67.55

71.22

172.22

1,800.00

23.50

444.70

85.25

1,300.00

26.34

162.36

271.55

-

1,273.66

2.95

433.91

0.01

3,802.28

433.92

4 Minority Interest

EC Global Limited

Opening Balance

Add: Investment by Minority

Edelcap Insurance Advisors

Opening Balance

Add: Share of profit for the year

Less: Adjustment on account of change in minority interest

Edelweiss Insurance Brokers Limited

Opening Balance

Add: Investment by Minority

Add: Adjustment on account of change in minority interest

Add: Share of profit for the year

Crossborder Investments Private Limited

Opening Balance

Add: Investment by Minority

5 Secured loans

Bank overdraft

(Secured by way of pledge of securities and fixed deposits)

Loan from Bank

(Secured by way of pledge of fixed deposit)

Vehicles loan

(Secured by hypothecation of vehicles acquired)

Housing loan

(Secured by hypothecation of flat acquired)

Other loans

(Demand loan secured by way of pledge of securities, placed with the

Company by customers, includes interest accrued and due Rs. 2.72,

(Previous year Rs. 35.03))

6 Unsecured loans

(Due within one year, unless otherwise stated)

Optionally fully convertible debentures

13.4% Fully Convertible Debentures

Nifty linked Debentures

Inter Corporate Deposit

Deposits accepted

Commercial Paper

Less: Unamortised discount on commercial paper

Other loans

44

Previous year

58.77

105.72

9.88

Vehicles

Total

3.13

Furniture and fixtures

46.51

0.87

Electrical fittings

Computers

13.10

Office equipment

-

32.23

As at

1 April

2006

Leasehold improvements

Land

Particulars

7 Fixed Assets

55.48

108.07

2.26

0.39

38.12

-

7.48

20.01

39.81

Additions

during

the year

8.53

0.52

-

-

0.52

-

-

-

-

Deductions

during

the year

Gross Block

105.72

213.27

12.14

3.52

84.11

0.87

20.58

52.24

39.81

As at

31 March

2007

-

18.01

38.48

2.31

1.61

19.01

0.01

2.47

13.07

As at

1 April

2006

20.49

37.70

2.00

0.53

16.66

0.12

2.55

15.84

-

0.02

0.33

-

-

0.33

-

-

-

-

On Additions On Deductions

during

during

the year

the year

Depreciation

-

38.48

75.85

4.31

2.14

35.34

0.13

5.02

28.91

As at

31 March

2007

67.24

137.42

7.83

1.38

48.77

0.74

15.56

23.33

39.81

As at

31 March

2007

-

67.24

7.57

1.52

27.50

0.86

10.62

19.16

As at

31 March

2006

Net Block

Edelweiss

Schedules to the consolidated financial statements as at

31 March 2007 (Continued)

(Currency Indian Rupees in millions)

45

Edelweiss

Schedules to the consolidated financial statements as at

31 March 2007 (Continued)

(Currency Indian Rupees in millions)

2007

2006

60.78

183.76

153.90

5.01

Long term investments in equity/preference shares - unquoted

38.55

61.51

Less : Diminution in value of investments

18.41

31.29

20.14

30.22

- Quoted investments in units of mutual fund/securities

179.54

106.20

- Unquoted investments in units of mutual fund

400.19

-

579.73

106.20

0.17

1.54

579.56

104.66

10.00

-

824.38

323.65

8 Investments

Long term investments - quoted

Long term investment in units of mutual fund/venture capital fund - unquoted

Current investments (others)

Less : Diminution in value of investments

Application for UTI Gold Fund (pending allotment)

Aggregate of quoted long term investment

- At book value

60.78

183.76

117.79

325.61

153.90

5.01

20.14

30.22

- At book value

179.37

104.66

- At market value

185.09

158.83

400.19

-

- At market value

Aggregate of unquoted long term investment in units of mutual fund/

venture capital fund

- At book value

Aggrigate of unquoted long term investment in equity/ preference shares

- At book value

Aggrigate of quoted Current investment

Aggrigate of unquoted Current investment

- At book value

46

Edelweiss

Schedules to the consolidated financial statements as at

31 March 2007 (Continued)

(Currency Indian Rupees in millions)

Face value

Rupees

Quantity

(Nos.)

10

65,775

2007

Quantity

(Nos.)

2006

48.35

-

-

9 Stock-in-trade

A. Equity Shares (Quoted)

A C C Limited

Aban Loyd Chiles Offshore Limited

2

3,600

6.85

-

-

Aban Offshore Limited

2

400

0.77

-

-

ABB Limited

10

34

0.12

604

1.77

Abhishek Industries Limited

10

-

-

100,000

2.89

Aditya Birla Nuvo Limited

10

187

0.20

-

-

Ador Welding Limited

10

-

-

2,572

1.03

Aegis Logistics Limited

10

-

-

4,635

1.16

Ahmednagar Forgings Limited

10

-

-

6,248

1.02

Aksh Optifibre Limited

5

-

-

18,693

1.18

Alfa Laval India Limited

10

5,017

4.26

-

-

Allahabad Bank

10

2,450

0.18

-

-

Alok Industries Limited

10

-

-

2,600

0.19

Alstom Project India Limited

10

-

-

32,950

12.15

Amtek Auto Limited

2

600

0.22

3,300

1.04

Apollo Tyre Limited

10

740

0.20

685

0.20

Aptech Limited

10

10

0.01

-

-

Arvind Mills Limited

10

210,700

9.15

-

-

Ashok Leyland Limited

1

-

-

22,000

0.67

Asian Hotels Limited

10

-

-

3,355

2.01

Asian Paints India Limited

10

282

0.20

-

-

Associated Cement Company Limited

10

254,625

187.20

67,009

52.39

Atlanta Limited

10

550

0.15

-

-

Atul Limited

10

-

-

17,300

2.01

Aurobindo Pharma Limited

5

-

-

1,130

0.76

Aventis Pharma Limited

10

160

0.19

-

-

Bajaj Auto Finance Limited

10

4,282

10.39

-

-

Bajaj Auto Limited

10

32,100

77.91

8,611

23.59

Bajaj Hindusthan Limited

1

347,665

61.37

-

-

Balaji Telefims Limited

2

-

-

1,095

0.20

Balkrishna Industry Limited

10

-

-

15,765

14.00

Balmer Lawrie & Company Limited

10

5,214

2.11

-

-

Balrampur Chini Mills Limited

1

276,600

16.18

-

-

Bank of Baroda

10

281,400

57.48

5,730

1.32

Bank Of India Limited

10

5,700

0.81

2,038

0.27

Bannari Amman Sugars Limited

10

-

-

740

1.00

Bata India Limited

10

8,400

1.16

-

-

Bharat Earth Movers Limited

10

1,400

1.52

927

1.34

Bharat Electronics Limited

10

1,375

2.07

-

-

Bharat Heavy Electricals Limited

10

6,346

14.33

20,880

45.30

Bharat Petroleum Corporation Limited

10

33,290

10.08

31

0.01

Bharti Airtel Limited

10

1,520

1.16

-

-

Bharti Tele-Ventures Limited

10

-

-

948

0.38

Biocon Limited

5

200

0.10

405

0.18

Birla Corporation Limited

10

-

-

690

0.21

Bombay Dyeing & Manufacturing Company Limited

10

13,535

7.32

350

0.20

47

Edelweiss

Schedules to the consolidated financial statements as at

31 March 2007 (Continued)

(Currency Indian Rupees in millions)

Face value

Rupees

Quantity

(Nos.)

2007

Quantity

(Nos.)

2006

-

-

9 Stock-in-trade (Continued)

Bongaigaon Refinery & Petrochemicals Limited

48

10

9,000

0.37

Britannia Industries Limited

10

2,955

3.54

-

-

C & C Constructions Limited

10

111,815

18.99

-

-

Cadila Healthcare Limited

5

-

-

2,040

1.10

Cairn India Limited

10

70,000

8.71

-

-

Canara Bank

10

156,800

30.36

12,910

3.45

Carborundum Universal Limited

2

-

-

6,000

0.92

Centurion Bank Of Punjab Limited

1

11,200

2.18

-

-

Century Textiles & Industries Limited

10

239,700

129.70

-

-

CESC Limited

10

30,800

10.86

-

-

Chambal Fertilizers & Chemicals Limited

10

13,800

0.43

-

-

Chennai Petroleum Corporation Limited

10

1,100

0.20

-

-

622

0.15

20,031

12.87

-

-

400

0.20

CIPLA Limited

2

CMC Limited

10

Colgate Palmolive (India) Limited

10

-

-

10,500

4.35

Corporation Bank Limited

10

-

-

594

0.22

Crew B.O.S. Products Limited

10

100

0.02

-

-

CRISIL Limited

10

826

2.07

-

-

Cummins India Limited

2

70,300

17.94

-

-

Dabur India Limited

1

690

0.06

60

0.01

Deccan Aviation Limited

10

Deccan Chronicle Holdings Limited

2

4,238

0.39

-

-

109,105

13.65

2,800

1.16

Dena Bank

10

200

0.01

-

-

Development Credit Bank Limited

10

320

0.02

-

-

Disa India Limited

10

256

0.34

-

-

Divi's Laboratories Limited

10

1,250

3.72

-

-

Dolphin Offshore Enterprises Limited

10

2,197

0.42

-

-

Dr. Reddy's Laboratories Limited

5

7,334

5.04

3,308

4.70

East India Hotel Limited

10

-

-

7,112

4.97

Elder Pharamaceuticals Limited

10

-

-

700

0.20

Emkay Share and Stock Brokers Limited

10

5

0.01

-

-

Escorts Limited

10

4,800

0.55

-

-

Essar Oil Limited

10

1,491,432

77.26

-

-

Essar Shipping Limited

10

11,956,402

514.71

-

-

Everest Industries Limited

10

-

-

2,450

0.45

Financial Technologies (India) Limited

2

-

-

760

0.94

Firstsource Solutions Limited

10

100

0.01

-

-

GAIL (India) Limited

10

17,928

4.70

90

0.03

Gateway Distriparks Limited

10

14,000

2.31

-

-

Gayatri Projects Limited

10

350

0.08

-

-

Gemini Communication Limited

5

33,438

9.33

-

-

Geodesic Information System Limited

2

GlaxoSmithKline Pharmaceuticals Limited

10

Glenmark Pharmaceuticals Limited

2

-

-

10,000

2.03

668

0.74

-

-

2,400

1.47

9

0.01

Global Broadcast News Limited

10

274

0.15

-

-

GMR Infrastructure Limited

10

443,000

159.61

-

-

Godavari Fertilisers & Chemicals Limited

10

3,160

0.38

-

-

Edelweiss

Schedules to the consolidated financial statements as at

31 March 2007 (Continued)

(Currency Indian Rupees in millions)

Face value

Rupees

Quantity

(Nos.)

2007

Quantity

(Nos.)

2006

9 Stock-in-trade (Continued)

Goodlass Nerolac Paints Limited

1

-

-

1,200

1.01

Graphite India Limited

10

Grasim Industries Limited

10

-

-

1,650

0.48

68,149

142.62

11

0.02

Great Eastern Shipping Limited

10

55,800

11.17

5,500

0.89

Great Offshore Limited

10

340

0.20

-

-

GTL Limited

10

177,000

23.93

1,665

0.23

Gujarat Alkalies and Chemicals Limited

10

Gujarat Ambuja Cement Limited

2

Gujrat Heavy Chemicals Limited

10

46,200

5.37

-

-

1,162,122

123.97

128,142

12.10

-

-

9,780

1.17

Gujrat Sidhee Cement Limited

10

-

-

198,609

3.00

Hanung Toys and Textiles Limited

10

5,523

0.65

-

-

HCL Technologies Limited

2

44,072

12.84

176

0.11

HDFC Bank Limited

10

254

0.24

1,347

1.03

Hero Honda Motors Limited

2

160

0.11

7,221

6.43

Hexaware Technologies Limited

2

2,000

0.33

20,000

2.14

Himachal Futuristic Communication Limited

10

-

-

94,280

2.15

Hindalco Industries Limited (Partly paid up shares)

1

608,625

70.91

5,643

1.03

Hinduja TMT Limited

10

1,297

0.89

460

0.20

Hindustan Composites Limited

10

36,685

2.96

-

-

Hindustan Construction Company Limited

1

243,600

21.80

8,039

1.29

Hindustan Lever Limited

1

2,768

0.55

231

0.06

Hindustan Petroleum Corporation Limited

10

9,372

2.32

1,987

0.64

Hindustan Zinc Limited

10

2,600

1.47

1,380

0.51

Housing Development Finance Corporation Limited

10

200

0.30

1,226

1.64

IBP Limited

10

162,083

65.90

-

-

ICICI Bank Limited

10

2,821

2.41

7,638

4.50

Idea Cellular Limited

10

47,816

4.17

-

-

IFCI Limited

10

2,764,125

77.66

-

-

I-Flex Solutions Limited

5

37,570

74.88

-

-

India Cements Limited

10

732,250

118.59

-

-

Indiabulls Financial Services Limited

2

1,500

0.63

890

0.23

Indiabulls Real Estate Limited

2

2,901

0.87

-

-

Indian Bank

10

2,416

0.22

-

-

Indian Hotels Company Limited

10

-

-

40

0.05

Indian Oil Corporation Limited

10

30,939

12.36

125,000

5.53

Indian Overseas Bank Limited

10

-

-

2,597

0.25

Indian Petrochemicals Corporation Limited

10

251,898

67.48

97

0.03

Indian Resorts Hotels Limited

1

251

0.10

-

-

Indraprasta Gas Limited

10

-

-

1,360

0.20

Indus Fila Limited

10

337

0.05

-

-

IndusInd Bank Limited

10

46,200

1.94

-

-

Industrial Development Bank of India Limited

10

31,350

2.43

-

-

Infosys Technologies Limited

5

88,398

178.32

44,331

132.17

Infotech Enterprises Limited

5

3,355

1.21

345

0.18

Infrastructure Development Finance Company Limited

10

67,850

5.68

-

-

Ingersoll Rand (India) Limited

10

700

0.20

-

-

International Travel House Limited

10

21,885

3.32

-

-

49

Edelweiss

Schedules to the consolidated financial statements as at

31 March 2007 (Continued)

(Currency Indian Rupees in millions)

Face value

Rupees

Quantity

(Nos.)

1

81,764

IVRCL Infrastructure and Projects Limited

2

J.K. Industries Limited

10

Jain Irrigation System Limited

10

2007

Quantity

(Nos.)

2006

12.18

160,847

31.33

13,000

3.79

14,000

3.89

-

-

10,560

1.13

-

-

8,400

2.03

9 Stock-in-trade (Continued)

ITC Limited

50

Jaiprakash Associates Limited

10

69,300

36.78

-

-

Jaiprakash Hydro-Power Limited

10

406,250

11.52

-

-

Jet Airways (India) Limited

10

5,270

3.34

9

0.01

Jindal Steel & Power Limited

5

1,000

2.36

-

-

JSW Steel Limited

10

42,900

19.19

-

-

Jyoti Structured Limited

10

-

-

6,820

2.76

Kalpataru Power Transmissions Limited

10

-

-

25

0.05

KEC International Limited

10

4,500

2.32

-

-

Kirloskar Brothers Limited

2

Kotak Mahindra Bank Limited

10

-

-

3,040

1.01

24,205

10.60

320

0.08

KPIT Cummins Infosystems Limited

2

-

-

1,727

0.52

Krone Communications Limited

10

-

-

104

0.02

Lanco Infratech Limited

10

226,950

35.99

-

-

Larsen & Toubro Limited

2

1,629

2.62

2,014

4.90

LML Limited

10

-

-

17,425

0.61

Lupin Limited

10

1,050

0.64

700

0.67

Mahanagar Telephone Nigam Limited

10

30,904

4.54

66

0.01

Maharastra Seamless Limited

5

-

-

1,470

0.97

Mahindra & Mahindra Limited

10

39,571

30.11

23,774

14.91

Maruti Udyog Limited

5

232

0.19

60,210

51.81

Matrix Laboratries Limited

2

43,597

7.63

50,000

14.08

Mawana Sugars Limited

10

-

-

2,415

0.30

Mc Dowell and Company Limited

10

-

-

3,680

2.49

Moser-Baer Limited

10

-

-

4,000

0.90

Mphasis BFI Limited

10

167,497

46.51

1,600

0.33

Nagarjuna Construction Company Limited

2

6,000

0.95

3,000

1.02

Nahar Capital Financial Services Limited

5

18,300

2.58

-

-

Nahar Exports Limited

5

20,512

0.66

-

-

Natco Pharma Limited

10

-

-

16,585

2.22

Natioanal Thermal Power Corporation Limited

10

-

-

13,000

1.74

National Aluminium Company Limited

10

516

0.12

1,222

0.36

NELCO Limited

10

-

-

20,000

2.67

Network 18 Fincap Limited

5

436

0.15

-

-

New Delhi Television Limited

4

268,400

83.17

27,500

6.62

Neyvelilignite Corporation Limited

10

41,300

2.08

-

-

Nicholas Piramal India Limited

2

-

-

61

0.02

NIIT Technologies Limited

10

65

0.03

-

-

Nirma Limited

5

1,260

0.20

405

0.20

Northgate Technologies Limited

10

-

-

1,800

0.74

NTPC Limited

10

37,375

5.38

-

-

Nucleus Software Exports Limited

10

16,111

9.26

7,500

2.48

Oil and Natural Gas Corporation Limited

10

5,285

4.43

151

0.09

Orchid Chemicals & Pharmaceuticals Limited

10

448,350

114.80

-

-

Edelweiss

Schedules to the consolidated financial statements as at

31 March 2007 (Continued)

(Currency Indian Rupees in millions)

Face value

Rupees

Quantity

(Nos.)

Oriental Bank of Commerce

10

334,200

2007

Quantity

(Nos.)

2006

62.69

50,068

11.76

9 Stock-in-trade (Continued)

Oriental Hotels Limited

10

-

-

7,720

2.73

Pantaloon Retail Limited

2

-

-

3,590

3.65

Parsvnath Developers Limited

10

431,150

111.60

-

-

Patni Computer Systems Limited

2

-

-

650

0.29

Petronet LNG Limited

10

-

-

41,710

2.29

Pfizer Limited

10

270

0.20

-

-

Phoenix Lamps Limited

10

1

0.01

-

-

Polaris Software Lab Limited

5

37,800

6.83

-

-

Power Finance Corporation Limited

10

31,200

3.25

-

-

Praj Industries Limited

2

484,983

171.65

-

-

Prithvi Information Solutions Limited

10

3,501

0.93

-

-

Provogue Limited

10

-

-

9,000

1.24

PSL Limited

10

4,900

0.97

-

-

Punj Lloyd Limited

2

34,500

5.55

-

-

Punjab National Bank

10

113,694

52.92

155,547

73.17

Punjab Tractors Limited

10

40,530

12.40

1,640

0.39

Ranbaxy Laboratories Limited

5

241,395

81.49

248,049

107.24

Raymond Limited

10

-

-

2,460

1.13

Recron Synthetics Limited

10

-

-

80,000

0.77

Reliance Capital Limited

10

299,226

197.51

136,300

69.12

Reliance Capital Ventures Limited

10

-

-

770,000

18.73

Reliance Communication Ventures Limited

5

-

-

3,500

1.08

Reliance Communications Limited

5

507,038

209.02

-

-

Reliance Energy Limited

10

45,834

22.50

37,425

22.89

Reliance Energy Ventures Limited

10

-

-

462,146

20.06

Reliance Industries Limited

10

62,916

84.90

66,147

52.61

Rolta India Limited

10

-

-

780

0.20

Royal Orchid Hotels Limited

10

-

-

4,500

0.89

Sakthi Sugars Limited

10

-

-

10,800

2.02

Satnam Overseas Limited

10

Satyam Computers Services Limited

2

Sesa Goa Limited

10

-

-

10,000

0.75

6,528

3.01

361

0.30

182,485

310.85

5,291

6.32

Shanthi Gears Limited

1

-

-

7,450

0.55

Sharyans Resources Limited

10

991

0.23

-

-

Shipping Corporation of India Limited

10

-

-

31

0.01

Siemens Limited

2

12,886

13.85

-

-

Sobha Developers Limited

10

2,450

1.79

-

-

SRF Limited

10

663,000

80.39

19,500

6.47

SSI Limited

10

37,714

6.87

-

-

State Bank of India

10

358,672

355.48

203,763

197.34

Steel Authority of India Limited

10

257,110

28.16

-

-

Sterlite Industires India Limited

2

646,625

294.40

172

0.26

Sterlite Opticals Telenologies Limited

5

-

-

40,752

3.94

10,000

1.21

-

-

154

0.16

18

0.02

2,750

4.16

-

-

Sujana Metal Products Limited

10

Sun Pharmaceuticals Industries Limited

5

Sun TV Network Limited

10

51

Edelweiss

Schedules to the consolidated financial statements as at

31 March 2007 (Continued)

(Currency Indian Rupees in millions)

Face value

Rupees

Quantity

(Nos.)

2007

Quantity

(Nos.)

2006

9 Stock-in-trade (Continued)

52

Sundaram Fasteners Limited

1

1,081

0.07

-

-

Suven Life Science Limited

2

-

-

35,380

2.84

Suzlon Energy Limited

10

230

0.23

23,200

30.21

Syndicate Bank

10

-

-

2,178

0.19

Syngenta India Limited

10

29

0.01

-

-

Taj GVK Hotels & Resorts Limited

2

-

-

4,400

0.84

Tamil Nadu Newsprint & Papers Limited

10

-

-

12,000

1.17

Tata Chemicals Limited

10

-

-

6,023

0.97

Tata Coffee Limited

10

Tata Consultancy Services Limited

1

Tata Iron and Steel Company Limited

Tata Metaliks Limited

Tata Motors Limited

-

-

3,000

1.03

2,784

3.44

2,300

4.41

10

-

-

2,000

0.85

10

-

-

7,000

0.83

10

74,880

54.35

12,415

11.30

Tata Power Company Limited

10

158

0.08

20

0.01

Tata Sponge Iron Limited

10

-

-

1,450

0.20

Tata Steel Limited

10

84,166

37.18

236,328

124.20

Tata Tea Limited

10

-

-

6

0.01

Tata Teleservices (Maharashtra) Limited

10

700,150

14.77

-

-

Tech Mahindra Limited

10

400

0.57

-

-

Television Eighteen India Limited

5

-

-

364

0.09

The Dhampur Sugar Mills Limited

10

-

-

2

0.01

The Federal Bank Limited

10

-

-

520

0.10

The Karnataka Bank Limited

10

62,500

10.69

22,500

2.25

The Phoenix Mills Limited

10

9,125

13.14

-

-

Thermax Limited

2

-

-

6,510

2.03

Titan Industries Limited

10

54,053

45.56

17,062

14.04

7,700

0.38

-

-

20

0.01

-

-

3,000

0.36

5,610

0.51

Triveni Engineering & Industries Limited

1

Tulip IT Services Limited

10

TV Today Network Limited

5

TVS Motor Company Limited

1

8,900

0.53

-

-

UltraTech Cement Limited

10

20,800

16.06

-

-

Union Bank Of India

10

378,000

37.73

2,106

0.26

Unitech Limited

2

6,000

2.32

-

-

United Breweries Holdings Limited

10

4,722

0.73

-

-

United Phosphorus Limited

2

42,568

9.95

-

-

UTI Bank

10

-

-

1,170

0.40

Varun Shipping Limited

10

-

-

25,600

1.94

Videsh Sanchar Nigam Limited

10

240,153

96.60

98,705

46.10

Vijaya Bank

10

55,200

2.24

-

-

VIP Industries Limited

10

2,228

0.22

-

-

Voltas Limited

1

9,000

0.75

-

-

Wartsila India Limited

10

2,277

1.36

-

-

Welspun India Limited

10

1,010

0.07

-

-

Wipro Limited

2

13,154

7.36

150

0.08

Wire and Wireless (India) Limited

1

6

0.01

-

-

Wockhardt Limited

5

6,000

2.37

3,000

1.52

Yokogawa India Limited

10

35

0.02

-

-

Edelweiss

Schedules to the consolidated financial statements as at

31 March 2007 (Continued)

(Currency Indian Rupees in millions)

Face value

Rupees

Quantity

(Nos.)

2007

Quantity

(Nos.)

2006

9 Stock-in-trade (Continued)

Zee Entertainment Enterprises Limited

1

649

0.16

-

-

Zee News Limited

1

399

0.01

-

-

Zee Telefilms Limited

1

2,800

0.69

22,543

5.08

Zen Technologies Limited

10

-

-

22,000

3.68

Zensar Technologies Limited

10

-

-

2,430

0.49

31,812,343

5,522.68

4,513,672

1,404.18

Sub Total (A)

B. Equity Shares (Unquoted)

Ispat Industries Limited

10

9,000

0.12

9,000

0.20

Citigroup (erst while E-Serve International Limited)

10

1

0.01

1

0.01

9,001

0.13

9,001

0.21

6,000

0.13

6,000

0.13

6,000

0.13

6,000

0.13

9

0.01

-

-

9

0.01

-

-

737

0.11

-

-

737

0.11

-

-

Silver

7,713.3856

150.90

-

-

Gold

62.0000

57.74

-

-

Goldmini

26.2000

24.18

-

-

29,815.0000

0.55

-

-

37,616.5856

233.37

-

-

Sub Total (B)

C. Preference Shares (Unquoted)

Ispat Industries Limited

10

Sub Total (C)

D . Non Convertible Debentures (Unquoted)

Trent Limited

1000

Sub Total (D)

E. Warrants - Quoted

Trent Limited

Sub Total (E)

10

F . Commodity (Quantity in Kgs.)

Gaur Seeds

Sub Total (F)

Grand Total (A+B+C+D+E+F)

5,756.43

1,404.52

- At book value

5,522.68

1,404.18

- Market value

5,627.76

1,433.18

0.13

0.21

0.13

0.13

0.01

-

- At book value

0.11

-

- Market value

0.11

-

- At book value

233.37

-

- Market value

234.36

-

Aggregate of quoted stock in equity shares

Aggregate of unquoted stock in equity shares

- At book value

Aggregate of unquoted stock in preference shares

- At book balue

Aggregate of unquoted stock in debentures

- At book value

Aggregate of quoted stock in warrants

Aggregate of stock in commodities

53

Edelweiss

Schedules to the consolidated financial statements as at

31 March 2007 (Continued)

(Currency Indian Rupees in millions)

Face value

Rupees

Quantity

(Nos.)

2007

Quantity

(Nos.)

2006

9 Stock-in-trade (Continued)

Note :

Of the above, the following shares are pledged with the bank/

clearing member for availing overdraft / margin facility

54

Associated Cement Company Limited

10

231,750

170.39

67,009

52.39

Abhishek Industries Limited

10

-

-

10,000

0.29

Ador Welding Limited

10

-

-

2,572

1.03

Ahmednagar Forgings Limited

10

-

-

6,248

1.02

Aksh Optifibre Limited

5

-

-

18,693

1.18

Alok Industries Limited

10

-

-

2,600

0.19

Alstom Projects India Limited

10

-

-

22,950

8.48

Amtek Auto Limited

2

-

-

3,300

1.04

Asian Hotels Limited

10

-

-

3,355

2.01

Apollo Tyre Limited

10

740

0.20

-

-

Aptech Limited

10

10

0.01

-

-

Arvind Mills Limited

10

86,000

3.74

-

-

Asian Paints India Limited

10

282

0.20

-

-

Atul Limited

10

-

-

17,300

2.01

Aventis Pharma Limited

10

160

0.19

-

-

Bajaj Auto Limited

10

5,600

13.59

8,611

23.59

Bajaj Hindusthan Limited

1

28,250

5.02

-

-

Balaji Telefims Limited

2

-

-

1,095

0.20

Bannari Amman Sugars Limited

10

-

-

740

1.00

Balrampur Chini Mills Limited

1

59,600

3.45

-

-

Bank of Baroda Limited

10

252,000

51.47

-

-

Bank of India Limited

10

5,700

0.81

-

-

Biocon Limited

5

200

0.10

-

-

Bombay Dyeing & Manufacturing Company Limited

10

35

0.02

-

-

Bharat Petroleum Corporation Limited

10

5,500

1.67

-

-

Bharat Earth Movers Limited

10

-

-

700

1.04

Bharat Heavy Electricals Limited

10

-

-

1,800

3.90

Cairn India Limited

10

69,925

8.70

-

-

Canara Bank Limited

10

114,200

22.24

-

-

Cadila Healthcare Limited

5

-

-

2,040

1.10

Carborundum Universal Limited

2

-

-

6,000

0.92

CIPLA Limited

2

-

-

1,000

0.64

Century Textiles & Industries Limited

10

195,925

105.90

-

-

CESC Limited

10

2,200

0.70

-

-

Chennai Petroleum Corporation Limited

10

1,100

0.20

-

-

Crew B.O.S. Products Limited

10

100

0.02

-

-

Cummins India Limited

2

68,400

17.46

-

-

Development Credit Bank Limited

10

300

0.02

-

-

Dena Bank

10

200

0.01