Company analysis.

advertisement

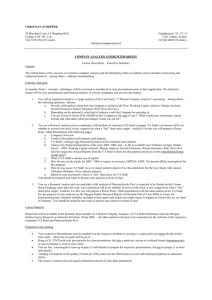

Company analysis. Buy Price target: € 34,00 Share price: € 28,00 06/02/06 12:07 h PM Last Rating/ Target Pr.: Buy / 32,00 € Letzte Analyse: 10/27/05 S&P-Rating: n.a. Explosion Protection Number of shares: 5,92 m Market capitalisation: € 170,66 m Index: Prime Industrial Index weight: 0,08 % R. Stahl 06/02/2006 Accelerated growth strategy temporarily weighing on earnings The expected earnings trend in the current year is weighing on the share price potential in the short-term. However, the resulting growth strategy is forming the basis for over-proportionate earnings improvements beginning in 2007. There is also a chance that we will see positive surprises in terms of demand as early as in 2006. We are therefore reiterating our Buy rating, particularly for investors with a horizon of more than six months. For the moment we are only increasing our price target marginally to € 34.00. Share Data EPS current EPS previous EV/Sales EV/EBITDA PER € € 2005 1,45 1,72 0,66 6,0 15,4 2006e 1,36 1,61 0,81 5,8 20,6 2007e 1,75 1,96 0,73 5,0 16,0 2008e 2,13 - 0,67 4,4 13,2 Beta: 0,80 Company Data Accounting: IFRS Kalender: Q1: 08.06.06 Dividende 2006e: 0,80 Sales EBITDA EBIT EBIT-Margin Net Profit €m €m €m % €m 2005 150,2 16,7 9,3 6,2% 0,1 2006e 164,1 22,8 15,6 9,5% 8,5 2007e 183,5 26,8 19,3 10,5% 10,9 2008e 199,6 30,6 22,8 11,4% 13,2 Continuing operations R. STAHL, MAV 200D ISIN: DE0007257727 30 30 25 25 20 20 15 15 10 10 Bloomberg: RSL1 GY Reuters: RSLG.DE 5 Harald Rehmet MBA (FH) Investment analyst Tel. +49 711 127-74504 harald.rehmet@LBBW.de 5 RELATIVE STRENGTH TO PRIME INDUSTRIAL 300 300 200 200 100 100 0 0 F M A M J J A S O N D J F Source: DATASTREAM Equity Research Pros and cons at a glance Landesbank Baden-Württemberg Am Hauptbahnhof 2 70173 Stuttgart ++ Growth strategy begun –– Declining operating profit in 2006 + High oil price favours future busi+ ness Accelerated earnings momentum as of 2007 www.LBBW.de Please note the disclaimer on the last page of this study. Landesbank Baden-Württemberg Page 2 Company analysis. Contact persons Equity Research ++49 / (0) 711 / 127 Head of Equity Research Horst Soulier – 740 61 horst.soulier@LBBW.de Machinery team Alexandra Hauser – 746 69 alexandra.hauser@LBBW.de Head of Large Caps Ingo Frommen – 746 48 ingo.frommen@LBBW.de Gerold Deppisch – 760 02 gerold.deppisch@LBBW.de Head of Mid/Small Caps Jürgen Graf – 741 14 juergen.graf@LBBW.de Patrick Hummel – 735 28 patrick.hummel@LBBW.de Head of Strategy Werner Bader – 730 63 werner.bader@LBBW.de Stefan Maichl – 784 49 stefan.maichl@LBBW.de Harald Rehmet – 745 04 harald.rehmet@LBBW.de Falk Reimann – 735 74 falk.reimann@LBBW.de Equity Sales ++49 / (0) 711 / 127 - Head of Equity Sales Uwe Müller-Kasporick - 250 50 uwe.mueller-kasporick@LBBW.de Sales Trading Ralf Schiller – 250 60 ralf.schiller@LBBW.de Institutional Sales Manfred Kuntzsch – 250 70 manfred.kuntzsch@LBBW.de Institutional Sales Trading Andreas Radtke – 250 65 andreas.radtke@LBBW.de Institutional Client Management Felix von Lewinski – 250 22 felix.vonlewinski@LBBW.de Derivatives Sales ++49 / (0) 711 / 127Head of Derivatives Sales Jan Krüger – 251 10 jan.krueger@LBBW.de Derivatives Marketing Oliver Gerst – 251 20 oliver.gerst@LBBW.de Derivatives Sales Institutionals Jan Krüger – 251 10 jan.krueger@LBBW.de Derivatives Product Management Volker Honold – 250 08 volker.honold@LBBW.de Landesbank Baden-Württemberg Page 3 Company analysis. Contents Executive summary 4 SWOT profile 5 Valuation 6 Recommendation 8 Company profile 9 Market and competition 13 Corporate strategy 20 The company in figures 25 Appendix 28 Landesbank Baden-Württemberg Page 4 Company analysis. Executive summary Focus on Explosion Protection. The course for growth and expansion had already been set in 2004 after the completion of the restructuring. The sale of Material Handling and the related cash inflow not only bring about a higher momentum for the strategic expansion of the company but also higher expectations of the capital market with respect to a rapid application of funds. We basically deem the concentration of capital and management resources on the Explosion Protection division positive, as this yields higher growth and margins. High oil price favours market growth. The growth of the company is furthermore benefited by structural changes in important customer industries. The higher price level of oil and gas, which can be assessed as sustainable, should lead to higher investments in the field of development, processing and transport in the foreseeable future. As the capacities in plant construction are insufficient for this, we do not expect an erratic process but rather a steady increase. This also indirectly benefits the establishment of LNG and bio fuel. Making use of growth opportunities. R. Stahl is considerably expanding its sales structure and assembly capacities, particularly in North America and Asia, in order to have an over-proportionate participation in these growth opportunities. The early implemented innovation offensive will continue and will now be more focussed on the system business. The value creation will be internationalised at the same time by relocating or purchasing simpler equipment and components, thus optimising the cost structures. Start-up costs burden profitability in 2006. In addition to the backlog of costs from the former company structure, the strategic investments in sales, personnel and manufacturing and the establishment of the system business will temporarily burden profitability. 2006 can therefore be perceived as a transition year, though it is forming the basis of accelerated growth and increased profitability beginning in 2007. Growth via acquisitions. The stated goal is to also expand the market position via acquisitions. Sales growth of more than € 100 m is targeted in the mid-term as the high cash inflow from the sale of the Material Handling division has enhanced the potential considerably. However, quality and strategic fit is deemed more important than speed, which is why we do not anticipate reports of success in the short-term. We are reiterating our Buy recommendation and raising our price target to € 34.00. Landesbank Baden-Württemberg Page 5 Company analysis. SWOT profile Strengths n One of the leading suppliers in the field of Explosion Protection n Broad diversification among customers and sectors n Solid balance sheet and high profitability n Lower cyclicality of the business following the sale of Material Handling Weaknesses n Market position outside of Europe still underdeveloped n High share of value creation concentrated in Germany n Backlog of costs in the holding following the sale of Material Handling Opportunities n High oil and gas prices lead to higher investments than expected n Acquisitions strengthening growth and profitability n Market share gains through new products and establishment of the system business n Expansion of sales organisation leads to faster development of new sectors and regions Threats n Political changes could limit investment behaviour considerably in certain regions n Significant weakening of the US dollar could burden competitiveness in North America and Asia n Integration risks associated with larger acquisitions Landesbank Baden-Württemberg Company analysis. Page 6 Valuation A crucial factor for the stock market valuation is the future development of earnings of the respective companies. However, as forecasts for the distant future are generally less certain, earnings estimates for the near future are usually used in the valuation of a company. In the following we have conducted different valuation approaches for R. Stahl which are universally based on a valuation using future earnings. We have conducted a valuation based on both the usual multiples and a discounted cash flow model. Multiplier valuation Peer Group PER 2006e 2007e EV/Sales 2006e 2007e EV/EBITDA 2006e 2007e EBITDAMargin 07e Cooper Industries 18,3 16,1 1,73 1,63 11,3 10,4 15,7% Hubbell Inc. 17,8 15,2 1,28 1,25 9,9 8,8 14,2% MTL Instruments 14,7 12,5 1,03 0,98 8,2 7,1 13,7% Median 17,8 15,2 1,28 1,25 9,9 8,8 14,2% Average 16,9 14,6 1,35 1,28 9,8 8,8 14,5% 21,4 16,4 0,84 0,76 6,1 5,2 14,6% 20,3% 7,9% -34,5% -39,5% -38,6% -41,2% R. Stahl Markup/markdown to peer group-Median Source: Value Line, I/B/E/S, LBBW The listed companies, which at least in certain parts compete with R. Stahl, are all located abroad. Crouse Hinds (USA) and CEAG (Germany, previously ABB), which together take on the leading position in the global explosion protection market, have belonged to Cooper Industries (Bermuda) since 1981 and 1995, respectively. Hubbell Inc. is the parent company of Killark, the former joint venture partner of R. Stahl in the field of marketing of control units, equipment and lamps in the USA. MTL Instruments Group is a smaller UK-based company with expertise in the field of MSR technology of explosion protection. The remaining competitors are not listed. R. Stahl has been valued on the basis of established market multiples by using a comparison with the median multiples of the peer group. This shows that the EV multiples are considerably below the median of the peer group as opposed to the PER. This should mostly be due to the “unfavourable” capital structure of R. Stahl following the sale of Material Handling, which should normalise over time. The lower operating profit contribution of the Material Handling division for the higher interest income of the low-interest liquidity has a negative impact on the net income. In contrast, the enterprise value is directly lowered by the sales proceeds. The below-average operating profitability seen in the past no longer exists following the sale of Material Handling. As was the case of MTL, only the lower liquidity of the share remains, which may justify a certain discount of the valuation multiples. Assuming equal weights for both the two PE-ratios and the other four EV-multiples with their respective median values, a value of € 34.48 is calculated. Landesbank Baden-Württemberg Company analysis. Page 7 Discounted cash flow method As an alternative to the multiplier approach, we have also valued R. Stahl on the basis of a discounted cash flow model (DCF). This approach sufficiently takes account of the company’s positive future perspectives for a longer time frame. The following assumptions underlie the model: DCF model - input parameters Riskfree interest rate Market risk premium equity Beta factor Cost of equity Cost of debt (after tax) Equity ratio (market value) WACC Terminal growth rate 3,9% 5,7% 0,8 8,5% 3,3% 80,0% 7,4% 1,0% Source: LBBW The operating free cash flow forecasts are displayed for the period 2006 to 2015, with detailed estimates underlying the first phase through 2008. In the second phase from 2009 to 2015, the essential value drivers are projected for the future at a declining rate. We are using a more cautious forecast for the EBIT margin compared to the last forecasting period. Free Cash Flow (€m) 2006e 2007e 2008e 2009e 2010e 2011e 2012e 2013e 2014e 2015e Sales growth (yoy) 164 9,3% 184 11,8% 200 8,8% 216 8,0% 232 7,5% 248 7,0% 267 7,5% 285 7,0% 304 6,5% 322 6,0% EBIT EBIT margin 15,6 9,5% 19,3 10,5% 22,8 11,4% 23,7 11,0% 24,3 10,5% 24,8 10,0% 25,3 9,5% 25,7 9,0% 25,8 8,5% 25,8 8,0% - taxes on EBIT Tax ratio 5,9 38,0% 7,3 38,0% 8,7 38,0% 9,0 38,0% 9,2 38,0% 9,4 38,0% 9,6 38,0% 9,8 38,0% 9,8 38,0% 9,8 38,0% + Depreciation of sales 7,2 4,4% 7,5 4,1% 7,8 3,9% 8,2 3,8% 8,6 3,7% 8,9 3,6% 9,3 3,5% 10,0 3,5% 10,6 3,5% 11,3 3,5% Accruals of sales + Delta accruals 42,5 25,9% 1,0 44,2 24,1% 1,7 45,8 23,0% 1,6 48,5 22,5% 2,7 51,0 22,0% 2,5 53,3 21,5% 2,3 56,0 21,0% 2,7 58,5 20,5% 2,5 60,8 20,0% 2,3 62,8 19,5% 2,0 = Operating Cash Flow 17,9 21,2 23,5 25,6 26,1 26,6 27,7 28,4 28,9 29,3 - Capex of sales 9,0 5,5% 9,2 5,0% 9,6 4,8% 9,7 4,5% 10,0 4,3% 10,2 4,1% 10,7 4,0% 11,4 4,0% 12,2 4,0% 12,9 4,0% 17,6 10,7% 3,4 19,1 10,4% 1,5 21,0 10,5% 1,9 22,4 10,4% 1,5 23,9 10,3% 1,4 25,3 10,2% 1,4 26,9 10,1% 1,6 28,5 10,0% 1,6 30,1 9,9% 1,6 31,6 9,8% 1,5 = Free Cash Flow 5,5 10,5 12,1 14,4 14,7 15,0 15,4 15,4 15,2 14,9 Present Value 5,3 9,4 10,0 11,2 10,6 10,1 9,6 8,9 8,2 Net Working Capital of sales - Delta Net Working Capital 7,5 Source: LBBW Landesbank Baden-Württemberg Company analysis. Page 8 A fair value of € 33.35 is derived per share on the basis of the DCF model, which yields an upside potential of 19 %. Fair Value per share (€m.) Present Value Free Cash Flow planned years + Present Value Terminal Value = Enterprise Value TV of Enterprise Value - Net Financial Debt - Minorities + Peripheral Assets = Market cap total / number of common stocks = Fair Value per share (€) 90,8 115,7 206,5 56,1% 8,2 0,7 0,0 197,6 5,9 33,35 Source: LBBW Recommendation The earnings trend expected in the current year is weighing on the share price potential in the short-term. However, the resulting growth strategy forms the basis for over-proportionate earnings improvements beyond 2007. There is also a chance that we will see positive surprises in terms of demand as early as in 2006. Furthermore, the search for acquisition targets could proceed more rapidly than is currently expected following the smaller takeover at the beginning of the year. We are therefore reiterating our Buy rating, particularly for investors with a horizon of more than six months. For the moment we are only increasing our price target marginally to € 34.00. Landesbank Baden-Württemberg Company analysis. Page 9 Company profile The history of R. Stahl AG in the past 130 years has not always been continuous and straightforward, but has rather been impacted by the need to adapt to new circumstances. The sale of the Material Handling division to KCI Konecranes at the end of 2005 marked the end of an era after more than 100 years. This was most similar to the sale of elevator production to Rheinstahl (later Thyssen Industrie AG) concluded in the 1970s. Active in Explosion Protection for 85 years The origins of explosion protection date back to the year 1921, when conveying equipment was equipped for German chemical conglomerates. The company has joined the ranks of the market leaders thanks to its innovations for explosionprotected electronic equipment. The EX switchgears and EX control gears have been run as independent company divisions since 1954 and witnessed an erratic upswing the subsequent years. The spin-off of the operating divisions into subsidiaries took place at the beginning of the 80s. This decision provided much greater leeway for the divisions. Following two divestments, R. Stahl Schaltgeräte GmbH remains as the key division (in addition to the small IT segment). A consolidation of the GmbH into the AG is possible in the mid to long-term, which would lead to leaner company structures. In this respect the business purpose (explosion protection or safety technology) could also become a part of the firm. The Explosion Protection division is among the leading suppliers of products, systems and services in hazardous industrial plants. Areas of application are mainly pharmaceutical, chemical and petrochemical industrial plants as well as natural gas and crude oil exploration. Both individual components and systems for the lightning, control and automation of these plants are offered. 2005 Sales per sector 5% 8% 28% 5% Oil and gas (off and onshore) Pharmaceutical industry Chemical industry Food & Beverage Shipbuilding Others 34% 20% Source: R. Stahl IT is not a core business The other division is Information Technology, which comprises ca. 60 employees with locations in Oberhausen, Berlin, Chemnitz, Frankfurt/M., Stuttgart and Vienna with some 400 customers in Germany. The focal points of altro consult Germany are consulting projects in the field of human resources & IT Services. Besides SAP® R/3® HR consulting, altro consult is active with its own data centre in the area of IT services with the outsourcing of human resources systems. SP Landesbank Baden-Württemberg Company analysis. Page 10 Solution offers ERP consulting with a focus on PeopleSoft® EnterpriseOne. The “Others” display in segment reporting clearly shows that the IT division is not perceived as a core business. Value creation mostly in Germany R. Stahl AG, headquartered in Waldenburg (Baden-Württemberg), is the holding company of the Group. The company made its IPO in 1997 and bundles all commercial functions as a holding. The product spectrum in the Explosion Protection division is marketed through more than 20 of its own subsidiaries and commercial agencies in more than 50 countries world-wide. Some 80 % of the value is generated at two production sites (Waldenburg, Weimar) in Germany. The Dutch Electromach subsidiary produces control units for large scale plant construction. The international companies have their own assembly capacities in order to react flexibly to customer demands. An expansion is planned in India and China to enable local assembly of the products with cheaper labour costs. A small component plant is being established in Croatia which should begin production in the summer of 2006. How an explosion emerges? Combination of... Ignition source Combustible materials Oxygen ... results in an explosion Source: R. Stahl The division delivers electric equipment for explosive areas of industrial plants. In the chemical and petrochemical industry, crude oil and natural gas production, the mining industry and many other industrial fields, gases, vapours, dust or fog may leak in the production, processing, transport and storage of combustible materials. Together with oxygen, these can form an explosive atmosphere. However, an explosion requires an ignition source at the same time and in the same place (energy in the form of heat or sparks). The goal of primary explosion protection is to prevent the hazardous mass of an explosive compound from being created. If that is not possible, the goal then becomes preventing an ignition in an explosive atmosphere (secondary explosion protection). If neither of these dangers can be eliminated, the tertiary explosion protection should limit the impacts of an explosion to a safe degree. Products must be certified In order to prevent explosion risks, most countries have developed protective provisions in the form of laws, regulations and standards which should guarantee a high degree of safety. The IEC, which implemented a global monitoring and certification process, is responsible for international standards in the field of electrical engineering. However, there is still a lot to be done before a worldwide standardisation of the provisions is achieved. As such, the National Electri- Landesbank Baden-Württemberg Company analysis. Page 11 cal Code (NEC) is effective in the US. This regulates the installation of electric plants. Systems have been developed which in part deviate from the IEC technology to a significant extent. Although IEC technology was approved 10 years ago, the North American market and also Asia in part is dominated by NEC technology. In addition to local approvals (which are always necessary), special products based on NEC technology have also been developed to be successful in the respective markets. There has recently been a trend towards products that can be approved in accordance with both standards. This is of particular interest to international customers using the same components around the globe. Sales of R. Stahl per product group With the main competitors: 100% 75% 17 Lamps CEAG,Hubbell, EGS, Schuch 11 Terminals MTL, P & F 18 Automation techn olog y P & F, MTL, Turck 54 Switching devices and installation technology Cooper/CEAG, EGS, Bartec 50% 25% 0% Source: R. Stahl R. Stahl offers one-stop products, systems and services in the business segments of lightning, terminals, switch gears and control gears as well as automation technology (measuring, control and feedback control technology) . The service encompasses consultancy, planning, development, start of operations and maintenance. According to its own statements, the company has advanced to become a technological leader due to its clear strategic direction and many decades of experience combined with high innovative power. The high quality of products and the global presence yield additional competitive advantages. This is an important aspect with respect to international key accounts both from plant construction and consumer sectors. No single customer contributes more than 2 % to Group sales thanks to the broadly diversified customer portfolio, which is shown in the following graphs: Landesbank Baden-Württemberg Company analysis. Page 12 Reference customers planning/ plant construction Broadly diversified customer portfolio Source: R. Stahl Reference customers Source: R. Stahl Landesbank Baden-Württemberg Company analysis. Page 13 Market and competition The company specialises in the manufacture and assembly of explosionprotected electrical equipment for areas with high explosion danger. These security products are installed in the highly endangered vicinities of industrial facilities (in the chemical – petrochemical industry, laboratories, colour manufacturing, the pharmaceutical industry and similar industries). Here they avoid ignition in the surrounding, potentially explosive atmosphere which can result from the failure of parts of electrical facilities and thus guarantee the security of personnel, installations and operating processes. Explosion protection is not a homogenous market Systems, machinery and components for explosion protection do not form a homogenous market but are rather diverse, usually electrical products which are produced in explosion-protected form (EX products). Entirely different types of ignition security are used in this process depending on the application. According to the German Association of Electrical Engineering and Electronics Industry (Zentralverband Elektrotechnik und Elektronikindustrie e. V. or ZVEI), the global electronics market amounted to ca. € 2,700 bn last year. Around 8 % to 9 % thereof came from electrical automation technology, to which the EX products by and large belong. According to ZVEI estimates, this market is growing by an average of ca. 6 % to 8 % p.a. for the long-term. The contribution of the German automation industry is ca. 13 % (€ 28.3 bn), while only 8 % of products are being sold in the German market. Following a rise in production in Germany by nearly 7 % in 2004, growth tailed off to 4 % in 2005. Foreign business performed over-proportionately with an increase of 11 %, which meant that the export quota has meanwhile risen to 77 %. Sector performance World-market process automation 2005 per region 26% 32% USA EU excl. Germany Germany Japan 11% ROW 10% 21% Source: ZVEI The second-largest segment in Germany after factory automation is process automation, which also managed to increase its volume by ca. 4 % to € 9.9 bn. Traditionally however, the process industry only responds with a certain delay to market developments, which means that growth was only driven by exports. This segment best illustrates the market development for explosion protection, Landesbank Baden-Württemberg Explosion protection is a niche market Company analysis. Page 14 as no other market data are available. Nevertheless, size alone demonstrates the differences. According to R. Stahl estimates, the global market for explosion protection reached a volume of ca. € 2.1 bn in 2005. The market for process automation on the other hand achieved a global volume of € 57 bn in 2005. 10 % of this was contributed by the German market while German suppliers cater for ca. 18 % of global demand. In 2005 they increased their exports by 13 % and thus reached an over-proportionate export quota of ca. 86 %. This high level illustrates the strong position of German suppliers. ZVEI estimates global growth for 2005 amounting to 7 % to 8 % and expects a slowdown to between 5 % and 6 % next year. Emerging markets such as China, India and Russia are growth drivers. Growth rates are extraordinary in the business with Russia, mainly due to the ample resources of raw materials. As a consequence of strongly risen prices, investments for both the exploitation and processing of resources are being substantially increased. In addition to the prevalent oil and gas sector, there was also dynamic growth in almost all other process industries. The largest single market, the USA, managed to grow overproportionately compared to Europe. World market of process automation 2005 per customer group 11% 6% Mining 15% Power industry 9% Crude oil and natual gas exploitation Crude oil processing 9% Chemicals 14% Pharmaceuticals Food and luxury foodstuff 6% Machinery Other customers 11% 19% Source: ZVEI Oil and gas price as growth drivers From the perspective of the sector development, the oil and gas sector in particular showed the strongest growth with double-digit growth rates. Due to the strong demand and the high prices, there is investment in both process optimisation and the tapping of new resources. Both have a positive effect on the sales of automation-specific components. Long planning phases usually precede big projects, meaning that investments should increase in scale in the next few years. The reserve replacement rate of the sector, closely watched in the capital markets, declined across the board, which should also indicate a higher demand in order to ensure that the mathematical reach of the secured oil and gas reserves does not melt down further. This is also demonstrated by the usual longterm investment plans of the oil industry which, compared to last year, were increased by a double-digit percentage point (sector average). According to estimates by the French petroleum institute (IFP), expenses for the exploration rose by 13 % in 2005 to USD 170 bn and are to be raised by another 8 % to 10 % in 2006. Emerson Electric, one of the largest process control system Landesbank Baden-Württemberg Page 15 Company analysis. manufacturers in the USA, expects a near doubling of oil and gas projects for the period of 2006 to 2010 compared to the period 2001 to 2005. Trend reversal in chemicals... There is also a turning point in the perennially declining investments in the chemicals industry. The fact that in this sector a mere 10 % of costs is spent on personnel while 35 % is spent on raw materials and energy illustrates the significance of the production process. The modern automation technology improves competitiveness through the optimisation of precisely regulated processes and the reduction of periods of standstill. The continuously high oil price with its repercussions on the most important refinery products and the good volume demand has meanwhile led to a trend reversal in the willingness to invest. Up to now, investment activity has mainly been driven by “bottleneck projects” rather than by capacity expansions. Investment budgets have declined accordingly in the last few years. The peak in capital expenditures in the chemical industry in Germany was reached in 2001 (in Germany as early as 1999) and declined until 2004. In 2005 the German CapEx ratio reached its lowest level since 1985. However, investments in Germany were increased by 2 percent to € 5.3 bn according to estimates by the VCI. On the other hand, the low-point had already been reached in Asia and North America in 2003 (cyclical peak in 1998). After a slight recovery in 2004, investment growth of the chemical industry should have accelerated in 2005. Europe is seeing a development similar to that in Germany and the low-point should have been overcome by now. This should also be supported by the sector’s sustained optimism for 2006. Olivier Appert, Chairman of the IFP, speaks of the end of cheap oil as a new paradigm. The overcapacity of the delivery chain, built up as a result of two oil price shocks in the 70s, has disappeared. As a result of 30 years of low margins, overly low investments have resulted in scarce refinery capacities. Despite some isolated new investments, the sector remains hesitant to expand its capacity as required. This is a result of the past experiences, where capacity was not fully utilised for a long time. ...and petrochemicals While the sector does not seem to believe in the sustainability of the high oil price, new projects are beginning in numerous regions on a calculation basis of USD 20 to USD 25. In addition to expansions of existing facilities, 14 new projects (as of January 2006) are to be launched in the refinery area by 2009, 78 % thereof in the Middle East or Asia. Plans for a new facility are even underway in the USA for the first time in 30 years. According to the basis scenario of the International Energy Agency, these expansions would not even cover half of the increased demand until 2010. The situation is comparable in the petrochemical industry. As far as the other customer groups are concerned, ZVEI stresses the strong growth in metallurgy, especially steel, as well as facility construction in the food and luxury food industry and power plant technology in the area of modernisation. Due to cost pressure in the pharmaceutical industry, investment growth Landesbank Baden-Württemberg Company analysis. Page 16 has slowed compared to before despite the fact that a number of projects are on the market. There is, however, a further upswing in the global pharmaceutical industry. For 2006 IMS Health forecasts global market growth of 6 % to 7 % and in Europe the sector is forecast to grow by 4 % to 5 %. On the whole, the speed of growth in process automation should also continue on a high level in the coming years. Market development of explosion protection Explosion Protection: Market volume and position 2005 Overall market electronic Explosion Protection (million €): Americas Central Asia/Pacific Total 690 840 540 2 070 550 300 1 180 12 115 15 142 3% 21 % 5% Relevant market for R. Stahl: 330 Sales R. Stahl: 12 % Source: R. Stahl Expansion of reachable market potential Given the development of new products and the entry into new business segments such as dust explosion protection, the market potential according to the company should increase by ca. 20 % in the medium term. The expansion of customer-specific system solutions should play an important role in this. These open up alternatives to the existing in-house solution for the client, thus yielding additional growth opportunities which offer additional potential to the market growth for R. Stahl. According to company estimates, the market in the second half of the 90s still showed average growth of 6 % p.a. (which is in line with the growth of R. Stahl, adjusted for acquisitions) prior to a breakdown after the new millennium. After the trend reversal of the most important customer segments and in accordance with the market expectations for process automation, we expect a continuation of the growth path which in the short to medium term could even exceed the company’s expectations of long-term growth of +6 % p.a. Landesbank Baden-Württemberg Company analysis. Page 17 Growth driver high-growth industries n Oil and gas industry n Transport industry n Chemical industry Sectors with strong growth n Pharmaceutical industry n Shipbuilding industry n Food and luxury foodstuff industry n Fertilizers and feeding stuff n Power generation Source: R. Stahl Sales of growth segments are likely to be higher at R. Stahl compared to process automation (see chart), although power plant construction only plays a minor role in explosion protection. Furthermore, structural changes in the important customer sectors benefit the sales of the company. We expect the higher price level, which should be sustainable, to lead to considerably higher investments in the relevant sectors in due course. Since the capacities in facility construction are not sufficient for this, we do not expect this process to progress in leaps and bounds, but rather continuously. Growth driver LNG ...as well as organic fuel There are also positive effects in other sectors. For example, the strong demand for electricity among other things also benefits the sale of gas, for which the IEA forecasts growth of 3.5 % p.a. until 2020. Transport increasingly takes place in liquidised form (LNG), even if this is due to diversification of gas supply. The IEA expects to see the production of LNG quadruple by 2020. This will lead to a sustained high demand in shipbuilding, e.g. for LNG tankers (with a need for EX products), of which currently up to 100 items are being built. Qatar alone is planning to expand its LNG fleet from 20 to 90 ships. In addition to this, new terminals are being built in many countries for unloading LNG tankers. There are also high growth rates for swimming production units for the extraction and refining of oil and gas. Another growth area is the area of organic fuel, for which the EU is targeting a market share of 5.75 % by 2010. Sales benefit from the higher price sensitivity of consumers to the same extent as state subsidies in the form of tax benefits and mandatory alloy quotas. As a result, production capacity must be expanded considerably, which leads to positive effects on demand, especially for EX products. Sector observers expect the construction of 100 new organic fuel facilities in Europe and 60 in the US by 2010. Of the investment volume of around € 6 bn, ca. € 200 m is spent on explosion protection. The market leader in the construction of facilities for organic fuel and a customer of R. Stahl is the GEA subsidiary Lurgi, which recently reported “unchanged strong demand”, i.e. it is being “swamped” by orders at the moment. Landesbank Baden-Württemberg Company analysis. Page 18 Competitors Market shares Explosion Protection in Germany 7% 15% Bartec CEAG 3% Pepperl & Fuchs 25% R. Stahl Others 20% Sources: R. Stahl, based on own product range The market consolidation in Germany is already well advanced. According to company estimates the big four dominate ca. 90 % of the relevant market. Externally, the performance of the competitors can only be verified in part, esp. as the German competitors are not listed and therefore usually do not publish any figures. The somewhat higher market share than before for Bartec and Pepperl & Fuchs should, however, primarily be the result of a series of smaller acquisitions. CEAG, a former subsidiary of ABB, has belonged to the global market leader Cooper Industries, Inc. since 1996. Since 2004 the company has operated under the name of Cooper Crouse-Hinds GmbH, so that only the brand has remained. The product range comprises explosion-protected lightning systems, switch gears, distribution panels and components for measurement and control technology. There are ca. 500 employees in Germany at three sites. In 2005 Pepperl & Fuchs achieved sales of € 280 m with 3,050 employees. The Mannheim-based company produces electronic sensors and components for the global market of automation technology. Two-thirds of sales are primarily achieved through sensors for factory automation while one-third goes to process automation. The company sees itself as the market leader in explosionprotected, intrinsically safe signal separating systems and components for process automation. Furthermore, there is a broad range of fill level products and the recently acquired, new business segment HMI (Human Machine Interfaces), which was integrated following the takeover of the Essling-based Extec Oesterle (this can indirectly be considered as a confirmation of R. Stahl’s strategy). Bartec generated sales of € 160 m in 2005 with 1200 employees. The Bad Mergentheim-based company operates internationally with 6 production sites and 24 distribution companies in the field of safety technology. The product range is very broad and comprises for example analysis and measurement technology, automation technology, electronic engineering for the mining sector, measurement and data collection systems, switch gears and engines and thermal engineering as well as control technology and joining parts technology. With the support of the financial investor Allianz Capital Partners, which has held Landesbank Baden-Württemberg Company analysis. Page 19 75 % since 2002, sales are to be doubled in the next five years. The mediumterm goal is to become the “global number one in safety technology”. World-market shares Explosion Protection 9% 7% EGS 35% Hubbell Crouse-Hinds/CEAG R. Stahl 20% Bartec Pepperl & Fuchs MTL Others 5% 7% 12% 5% Source: R. Stahl, based on own product range The competitors in the US usually offer a substantially larger range of electrical and electronic products beyond explosion protection. The individual segment figures can thus only provide rough indications of the business trends. The market consolidation, which has been going on for years now, should continue in our view and potentially even gain momentum. While today one provider is the market leader with no broad mid-field very close behind, three major market participants could become market leaders in the medium to long term according to R. Stahl. Accordingly, R. Stahl aims to become one of the global market leaders. In addition to the listed competitors (Cooper Industries, Hubbell and MTL Instruments), EGS is another American company among the most important competitors. EGS Electrical Group, LLC is a joint venture of the SPX Corporation and Emerson Electric Co., the latter being the leader. With sales of USD 400 m, the company offers a broad spectrum of electrical products for different target groups focusing on North America. Landesbank Baden-Württemberg Company analysis. Page 20 Company strategy As early as in 2004, the company again set the course for growth and expansion following the end of its restructuring. The sale of Material Handling and the related injection of funds indicates not only more clout in the strategic expansion of the company, but also higher expectations by the capital markets of a rapid application of funds. In principle, we consider the concentration of capital and management resources on the fast growing and more profitable segment of Explosion Protection to be positive. Goals in Explosion Protection The medium term goals in Explosion Protection have been defined as follows: − Become a global market leader − Internal sales growth > € 10 m p.a. − Sales growth through acquisitions of around € 100 m − Substantially increase sales contribution from America and Asia − EBT margin > 8 % to 10 % Innovations The innovation offensive launched in 2003 was and is an important factor in above-average growth. Growth driver innovation 60 50 42 - 45 % 38.0 40 30 28.8 40.0 32.0 20 10 0 2002 2003 2004 New products*-Share in total sales (in %) 2005 Ziel Säule 2 * Market launch in the last 5 years Source: R. Stahl Rising R+D ratio On the basis of more efficient internal processes and a gradual expansion of the development capacity, the sales contribution from the new products has increased substantially since 2003. This was an essential prerequisite for the strong growth of the last few years with significantly increased earnings power. The R+D ratio, which had already been increased to 6 %, is to be further increased towards 7 % to 8 % in order to realise sustained high innovation power. The contribution of new products should therefore move towards 45 % (up to 50 %), naturally at a more moderate speed than before. Exhibitions are always an important time for innovations. New products are often developed particularly with these dates in mind so that they can be presented to a broad expert public where they receive their initial feedback. In 2006, two of the most important exhibitions for process automation occurred in Landesbank Baden-Württemberg Sector exhibitions featuring product innovations Company analysis. Page 21 the same year. The Interkama+, which took place in the context of the Hanover fair from 24.04.2006 to 28.04.2006, called itself the “leading international exhibition for process automation”. Three weeks later (15.05.2006 to 19.05.2006), the suppliers presented themselves at the “world forum for the process industry”, the Achema in Frankfurt, which occurs every three years. There R. Stahl presented a number of new products and system solutions in all product areas. For process automation the company showed new solutions for Fieldbus systems (ISbus), optical ring transformers and new variations of the ISpac ex I isolators. Ex i or BU S CPU CPU BU S I /O I /O CPU Different solutions for field instruments Ex i or Ex i al on nti ve n Co m Re ote I/O ld Fie s bu Source: R. Stahl New fieldbus solutions With the explosion-protected Remote I/O System IS1, R. Stahl has offered the ideal solution for conventional and HART-enabled field instruments at an optimal cost for the last few years. Now this successful system with components and system solutions is being expanded and sensibly complemented for Foundation Fieldbus H1 and Profibus PA. The new system called ISbus comprises both appliances and accessories for the H1 or the PA Fieldbus. Fieldbus Solutions is the homogenous approach of connecting all existing generations of field instruments with control systems. With Fieldbus Solutions, R. STAHL offers an interface for conventional sensors and actors for HART field instruments as well as for Foundation Fieldbus H1 and Profibus PA with the new System ISbus. The explosion-protected Remote I/O System IS1 is complemented and expanded with ISbus for the H1 and PA Fieldbuses. R. STAHL expects Fieldbus Solutions sales of € 3 – 4 m in the next two years. A fieldbus is an industrial communications system that connects a number of field instruments (sensors and actors) with a steering device. The fieldbus technology substitutes digital transmission technology with analogue signal transmission. It is also increasingly used in the area of process automation, as it has a number of advantages (lower wiring, start-up and operating costs) compared to conventional technology. It is now possible for use in explosion-endangered areas as well, though this is even more complex and expensive than under more secure conditions. Landesbank Baden-Württemberg Company analysis. Page 22 Regional growth In addition to the introduction of new products, R. Stahl is increasingly concentrating on entering into markets which have not yet been penetrated systematically. This particularly applies to the growth regions in Asia. For example, the company is expanding assembly in India and China in addition to manufacturing components in India. Furthermore, there are regions with comprehensive raw material resources such as the Middle East or Russia which possess more than 26 % of the world’s gas reserves. A key account management was recently set up here. The distribution structure is also to be expanded in the whole of Eastern Europe. Canada is an attractive market New hauling capacities are being established in the Gulf of Mexico and new oil reserves are being tapped. Particularly noteworthy are the oil sands, which depend on a permanently higher oil price level in order to be adequately profitable. R. Stahl had already received a reference project eight years ago. However, such projects were put on hold following the oil price collapse at the end of the 90s. The second-largest deposit of fossil fuels in the world is stored there and, according to Emerson, which has already received orders for the automation as a general contractor, investments of more than USD 80 bn have already been announced. Therefore the launch of the company’s own subsidiary is planned in Canada. 2005 Sales per region 10,1% 6,3% 31,4% Germany Europe excl. Germany Americas Asia 52,2% Source: R. Stahl Expansion in Asia and America According to the regions with the greatest growth potential, the main focus is the expansion of business, particularly in Asia and America. While the sales contribution from Asia managed to increase from 6 to 10 % in the last ten years, the contribution from America fell from 10 % to 7 %. As the regional allocation depends on the respective billing, actual sales are somewhat understated. The vision of a near doubling of sales as announced in 2005 was achieved almost exactly (corresponding to a realised growth of 6.8 % p.a.), but not the planned substantial expansion of sales contributions outside of Europe. Here the Asian crisis as well as the separation from a joint venture partner in the USA had a negative influence. On the other hand, in these markets the installed basis is lower, meaning that the follow-up business is also weaker. The company therefore plans to increasingly invest in the expansion of distribution, especially in North America, for example through a doubling of the distribution team and local assembly. A possible component could also be more local Landesbank Baden-Württemberg Company analysis. Page 23 products. This particularly applies to products with NEC technology which continue to dominate the market even ten years after the market opening of the US for IEC technology. This is also served by the development of global products which can be used for both standards. This yields the advantage for globally active US companies to reduce their own variety of alternatives. In Asia, R. Stahl is already present in all major countries. Here the primary challenge is to realise competitive prices in the mid-market as well, i.e. for small to medium-sized projects with regional tenders against local suppliers. The establishment/launch of component manufacturing in Croatia and the expansion in India are also meant to contribute to this, so that better prices can be offered according to a mixed calculation. Optimisation of cost structures At the end of 2003 the initial steps were introduced in the shift towards simple products and components being purchased by third parties. Some preliminary work was therefore done and know-how was developed for the company’s own facility in Croatia. The expansion is likely to occur in a continuous process within three to five years to avoid personnel cuts at the main facility. In the medium term 20 % to 25 % of the volume and up to 150 employees could therefore settle in at the new site, which should help achieve a substantial contribution towards the reduction of value creation costs. Strategic expansion Explosion Protection Market > € 1 bn Higher customer loyalty Tailor-made system solutions Own development and production More complex (safety equipment) Simple serial de vices and components Complementary products for project business Acquisition or low-cost location Acquisitions Source: R. Stahl Development of systems business On the other hand, resources are being freed up in order to increase the focus on the expansion and development of the systems business. Facility construction companies now increasingly tend to buy partial systems within the context of concentrating on their core business. This particularly applies in the current situation of strong company growth. This is about intelligently combining the appliances, systems and application know-how of the customer with the explosion protection expertise of R. Stahl into a system. This yields stronger client relationships and the closer ties to the end customer open up important market information. Customer-specific system solutions in particular enable the company to set itself apart from the competition and thus to achieve a better basis for the marketing of components. The goal is to improve competitiveness through higher quantities and thus to increase the market share. An essential contribution to this is now also made by the improvement in delivery reliability, Landesbank Baden-Württemberg Page 24 Company analysis. which has meanwhile been achieved and which in the last two years has risen from 70 % to 92 % in almost half the lead time. Acquisitions Given the planned strategic orientation, acquisitions could help to reach individual goals more quickly. In this respect, possible purchases are decided upon based on whether they open up additional product areas, strengthen the expertise in the systems business or can expand the regional market position in Asia or America. Another prerequisite is that acquisitions are to contribute to earnings as of the first year. It is also intended that the management of the acquired companies will be retained. Smaller acquisitions more likely We expect R. Stahl to find a small, owner-led company which for example is looking for long-term security in its work or cannot expand internationally on its own. We therefore do not consider a “big solution” likely, but rather expect a series of smaller takeovers. This should also mean lower risks for the integration of the companies and we hope that paying top prices can be avoided. The first examples of smaller acquisitions were the two takeovers in Q1 2006 in the segment of light technology, which were carried out as asset deals. Although the volume appears rather modest these acquisitions show their advantages at second glance. After the integration of the acquired product series into the international distribution structure and the production in R.Stahl’s own facility, a doubling of sales from just € 2 m to over € 4 m with substantially improved earnings should be within reach. After the sale of Material Handling, up to € 100 m could be mobilised from liquidity and an adequate loan. In addition, the company’s own shares and a possible capital increase from authorised capital of 1.3 m shares could raise another € 40 m to € 50 m. This would make a “big solution” possible. However, the major competitors are lacking either the strategic fit or the willingness to sell. Landesbank Baden-Württemberg Page 25 Company analysis. The company in figures IFRS with negative impact on figures The sale of Material Handling to KCI Konecranes as of 31 Dec. 2005 and the transition of accounting from HGB to IFRS had major impacts on the 2005 financial figures. According to IFRS, almost all Group-internal allocations from 2004 and 2005 have been reversed, as netting is only allowed for continued business activities. This primarily refers to the field of commercial and administrative tasks which are concentrated in the holding for the individual segments. In addition, several costs were incurred associated with the sale. However, as only the direct costs of the sale can be allocated to discontinued activities, the remaining expenditures such as higher provisions for the coverage of potential guarantees also burdened the operating profit of continued activities. The company therefore provided a reconciliation of the operating profit to an economically reasonable profit. Reconciliation of profit from IFRS to German GAAP (HGB) 2005 million € EBT acc. to IFRS (P&L) -continuing operations 5,080 Cancellation of allocated services for Material handling 2,920 Income from deconsolidation of SPE "Abraxas" -0,351 XO expenditure related to the sale of Material handling 6,818 EBT (operating) acc. to IFRS Reconciliation to HGB EBT (operating) acc. to HGB 14,467 3,633 18,100 Source: R. Stahl The main plant in Waldenburg was leased through the leasing company Abraxas. This company was first included in the consolidated accounts in 2004 according to IFRS. After a new limited partner purchased the majority of the shares, Abraxas was deconsolidated in 2005 as R. Stahl was relieved from liability. Development in the past fiscal year Order intakes of continued activities rose by 7.2 % to € 153.8 m while the Explosion Protection division increased by 8 %. However, it should be considered that the sale of Material Handling activities from the sales organisations also had temporarily negative effects on order intake of Explosion Protection. Group sales expanded by 7.6 % to € 150.2 m with Explosion Protection contributing € 141.9 m (+8.4 %). Explosion Protection doubled EBT Reported EBT of the Group climbed by nearly 51 % to € 5.1 m. Adjusted for the effects from the sale of Material Handling, EBT of € 14.5 m resulted (see table profit reconciliation). EBT of Explosion Protection nearly doubled from € 8.1 m to € 15.8 m, equalling a gross return on sales of 11.1 %. This was due to im- Landesbank Baden-Württemberg Company analysis. Page 26 proved cost structures at higher sales volumes. Although earnings of the IT division were burdened by the shutdown of the SAP logistics advisory in Oberhausen and the restructuring of the consultancy business, a positive EBT of € 0.4 m was generated. Sales proceeds for Material Handling amounted to ca. € 80 m, which exceeded our estimate of € 65 m to € 75 m. This amount comprises a cash component of ca. € 40 m, with € 9 m thereof for the cash in hand and the working capital as well as the relief in terms of pension provisions of likewise € 40 m. This amount was calculated using a discount rate of 4.5 % (previous year 5.25 %). After deducting direct selling costs and taxes from the sale price largely received in 2005, a book gain of € 29.5 m resulted. The inclusion of the operating profit of Material Handling yielded a net income of € 32.6 m. Reported earnings per share of € –0.05 (continued activities) and € 5.43 (Group) distort the figures and require explanation. We therefore anticipate EPS of € 1.45, derived from adjusted EBT of € 14.5 m and a tax rate of 38 %. A doubling of the dividend to € 0.80, with € 0.20 thereof a bonus for the sales proceeds of Material Handling, will be proposed at the Annual General Meeting. Outlook Explosion Protection - Financials 200 20 150 15 100 10 50 5 0 0 -50 -5 2002 2003 2004 2005 2006e 2007e Sales (million €) EBT (Accounting standards: HGB until 2003, IFRS from 2004) 2008e Sources: R. Stahl, LBBW estimates Adjustment of the holding structure 2006 should be a transition year for the company, as a number of start-up costs and burdening factors will affect earnings. The sale of Material Handling requires an adjustment of the holding structure for the new size of the company. This particularly applies to the commercial area and the internal IT structure. Once part of the workforce retires e.g. by way of early retirement and as additional employees with commercial functions have been taken over by Material Handling, the remaining ca. 20 employees will be further trained for new tasks. Despite the allocation of provisions in 2005, a backlog of costs remains which should be gradually reduced. The optimisation of cost structures is a much more complex and long-term issue on R. Stahl’s agenda. This includes production in Croatia as well as the expansion of assembly in Asia in order to gradually achieve a more favourable cost situation and thus generate higher growth. The constant improvement process is well anchored into the company. The new corporate structure is appropriate Landesbank Baden-Württemberg Page 27 Company analysis. for starting a new wave of process cost analyses and design. New and simplified software for ERP, CRM and the financial department offer opportunities in the mid-term to reduce the complexity and IT costs. Start-up costs for expansion weigh on earnings The strategic expansion of the company comes with a number of investments in personnel, production and sales that temporarily weigh on earnings. This applies to the establishment of the systems business as well as regionally for Asia and the Americas. Furthermore, production will begin in Croatia, which in our view should lead to start-up losses. The product mix is another aspect. The currently rising share of the project business may result in a slight dilution of the margin in our assessment. This however strengthens the installed basis which is a major prerequisite for future replacement and component business. For 2006 R. Stahl expects sales between € 160 and 165 m (+6.5 % to +10 %) and EBT of € 12 m to € 14 m (-17 % to –3 %). We anticipate sales of € 164.1 m (+9.3 %) with the two smaller acquisitions at the beginning of the year contributing up to 2 pp to growth. Our earnings expectation of € 13.7 m (-5.4 %) is likewise at the upper end of the guidance. This yields EPS of € 1.36, which represents a marginal decline of 6 % compared to the calculated value of the previous year. Over-proportionate earnings improvement anticipated as of 2007 The measures implemented in 2006 should yield a higher growth momentum in 2007 as well as a margin increase. We are forecasting a sales increase of 11.8 % to € 183.5 m and EBT growth of 28 % to € 17.6 m with EPS of € 1.75. In 2008 we expect a marginal slow-down in the growth rate of 9 % to € 199.6 m and an earnings plus of 21 % to € 21.3 m. This yields earnings per share of € 2.13. Possible acquisitions represent a fundamental aspect for the development of profits in the future. Each acquisition which fulfils the pre-determined criteria should enable a direct positive earnings contribution. As the operating business can be financed by cash flows, the substitution of liquid funds of € 49.0 m which only generate low returns against a margin in the operating business yields considerable upside potential. Landesbank Baden-Württemberg Company analysis. Page 28 Appendix Income statement 2004 2005e 2006e 2007e 2008e 139,6 150,2 164,1 183,5 199,6 0,0 1,3 2,0 2,0 2,0 139,6 151,5 166,1 185,5 201,6 Cost of materials 44,5 45,9 49,5 55,3 60,1 Personnel expenses 60,3 62,8 67,1 73,6 78,5 Other operating expenses 27,2 30,1 29,7 32,8 35,4 €m Net sales Change in inventories + other own work capitalised Total operating performance Other operating income 8,1 4,0 3,0 3,0 3,0 EBITDA 15,6 16,7 22,8 26,8 30,6 Margin 15,2 11,2 11,0 13,7 14,4 Depreciation and amortisation 7,7 7,4 7,2 7,5 7,8 EBIT 8,0 9,3 15,6 19,3 22,8 Margin 5,7 6,2 9,5 10,5 11,4 - 4,6 - 4,2 - 1,9 - 1,7 - 1,5 EBT 3,4 5,1 13,7 17,6 21,3 Margin 2,4 3,4 8,2 9,5 10,6 Taxes on income 2,2 5,0 5,2 6,7 8,1 EAT 1,1 0,1 8,5 10,9 13,2 Financial result Margin 0,8 0,1 5,1 5,9 6,5 Earnings discontinuing operations 2,7 32,5 0,0 0,0 0,0 Minorities 0,2 0,4 0,5 0,5 0,6 Net profit 3,6 32,2 8,1 10,4 12,6 0,60 1,45 1,36 1,75 2,13 Earnings per share (€)* * earnings per share 2005 adjusted Shareholder structure 8% Families of company founders 25% Institutional investors 53% Private investors Treasury stock 14% Source: R. Stahl Landesbank Baden-Württemberg Company analysis. Page 29 Balance sheet 2004 2005 2006e 2007e 2008e €m Assets 197,9 154,9 154,3 163,5 173,8 Goodwill 0,1 0,2 0,2 0,2 0,2 Other intangible assets 4,9 5,3 5,5 5,7 5,9 71,6 38,9 39,7 40,4 41,4 0,4 Tangible assets Financial assets 0,4 0,4 0,4 0,4 Other fixed assets 10,5 4,3 4,3 4,3 4,3 Fixed assets 87,5 49,1 50,1 51,1 52,3 Inventories 36,7 22,1 23,8 25,5 27,1 Trade receivables 52,3 27,5 29,7 32,8 35,3 4,3 3,3 3,6 4,0 4,6 17,0 49,0 47,0 50,0 54,5 110,3 101,9 104,1 112,4 121,6 0,0 3,9 0,0 0,0 0,0 197,9 154,9 154,3 163,5 173,8 28,1 57,7 61,0 66,6 73,8 Minority interests 0,6 0,7 0,7 0,7 0,7 Pension provisions 74,7 41,5 42,7 44,2 45,8 12,4 Other receivables and assets Cash and cash equivalents Current assets Discontinued operations Liabilities Equity Other provisions 11,6 9,7 10,5 11,6 Financial liabilities 42,6 15,7 10,3 8,7 7,4 Trade payables 16,7 9,6 11,0 12,5 13,8 Other liabilities 23,7 19,4 18,1 19,3 20,0 0,0 0,5 0,0 0,0 0,0 2004 2005 2006e 2007e 2008e 13,2 Discontinued operations Cash flow statement €m Consolidated net profit 3,9 3,1 8,5 10,9 Depreciation and amortization 10,3 7,4 7,2 7,5 7,8 Change in pension provisions 2,6 1,6 1,2 1,5 1,6 Change in working capital 9,9 0,6 - 3,4 - 1,5 - 1,9 Other changes 1,1 1,6 0,0 0,0 0,0 Cash flow from operating activities 27,7 14,3 13,5 18,4 20,7 Capital expenditure - 9,6 - 6,7 - 5,1 - 9,0 - 9,2 Disposals/divestments 0,7 26,9 0,8 0,7 0,6 Other changes 0,0 0,0 3,4 0,0 0,0 - 6,0 21,8 - 4,8 - 8,4 - 9,0 0,0 0,0 0,0 0,0 0,0 - 1,2 - 2,4 - 4,8 - 4,8 - 5,4 Cash flow from investing activities Proceeds from capital increase Dividend payment Change in financial liabilities - 7,4 - 0,7 - 5,4 - 1,6 - 1,3 Other changes - 2,1 - 0,3 - 0,5 - 0,5 - 0,6 Cash flow from financing activities - 10,7 - 3,4 - 10,6 - 6,9 - 7,3 Other changes - 0,8 - 0,8 0,0 0,0 0,0 Change in cash and cash equivalents 10,2 31,9 - 2,0 3,0 4,4 Cash and cash equivalents at start of year 6,8 17,0 49,0 47,0 50,0 Cash and cash equivalents at end of year 17,0 49,0 47,0 50,0 54,5 Landesbank Baden-Württemberg Page 30 Company analysis. This research report is impartial investment research. A copy of our policy on impartial investment research is available on request. Please note that the individuals who prepared this research report may also be involved in the preparation of non-impartial research. This research report and the information contained therein is furnished and has been prepared solely for information purposes by LBBW. It is furnished for your private information with the express understanding, which recipient acknowledges, that it is not an offer or solicitation to buy, hold or sell, or a means by which such securities or related derivatives may be offered or sold. Percentage distribution of all current stock ratings of LBBW Buy Hold Sell 41.8 % 44.4 % 13.8 % Rating changes of the last 12 months: none This research report is not an invitation nor is it intended to be an inducement to engage in investment activity for the purpose of section 21 of the Financial Services and Markets Act 2000 of the United Kingdom ("FSMA"). To the extent that this research report does constitute such an invitation or inducement, it is directed only at (i) persons who are investment professionals within the meaning of Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2001 (as amended) of the United Kingdom (the "Financial Promotion Order"); or (ii) persons who fall within Articles 49(2)(a) to (d) ("high net worth companies, unincorporated associations etc.") of the Financial Promotion Order (all such persons together being referred to as "relevant persons"). Any investment or investment activity to which this research report relates is available only to such persons and will be engaged in only with such persons. Persons who are not relevant persons should not rely on this research report. The information in this report has been obtained by LBBW from sources reasonably believed to be reliable. LBBW can not verify such information, however, and because of the possibility of human or mechanical error by our sources, LBBW or others, no representation is made by LBBW that the information contained in this report is accurate in all material respects, reliable or complete. LBBW does not accept any liability for the accuracy, adequacy, or completeness of any information and is not responsible for any errors or omissions or the result obtained from the use of such information. None of LBBW, its affiliates, directors, officers or employees shall have any liability whatsoever for any indirect or consequential loss or damage arising from any use of this report. The recommendations contained in this report are statements of opinion and not statements of fact. Changes to assumptions, opinions and estimates may be made without notice and may have a material impact on any performance detailed. Historic information on performance is not indicative of future performance. LBBW may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect the different assumptions, views and analytical methods of the analysts who prepared them and LBBW is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report. However, where a recommendation in a research report differs from the recommendations in this report, concerns the same security, derivative or issuer and is issued within twelve months of this report, LBBW will indicate clearly and prominently such change and the date of this report in the new report. Nothing in this report constitutes legal, accounting or tax advice. This report has no regard to the specific investment objectives, financial situation or needs of any specific recipient. Investments in general involve some degree of risk. The investments discussed in this document may not be suitable for all recipients and an investor may not get back the amount originally invested. Recipients should make their own investment decisions based upon their own financial objectives and financial resources. If in doubt, prior to taking any investment decision recipients should contact an investment adviser. Where investment is made in currencies other than the investor's base currency, movements in exchange rates will have an effect on the value, either favourable or unfavourable. Levels and bases for taxation may change. Landesbank Baden-Württemberg Page 31 Company analysis. This document is intended for the benefit of market counterparties and intermediate customers (as detailed in the UK Financial Service Authority's rules). We would like to emphasise that LBBW or affiliated companies have concluded an agreement about the preparation of financial analyses about the issuer or its financial instruments and support the company in the market by issuing buying or selling orders. Distributed in the UK by LBBW, which is authorised and regulated by the Financial Services Authority.