BBVA BANCO FRANCÉS S.A.

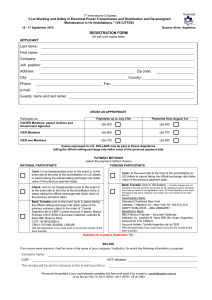

advertisement