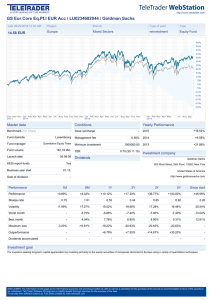

Comgest Growth Plc 31 December 2015

advertisement