AGN 112.3 - Australian Prudential Regulation Authority

advertisement

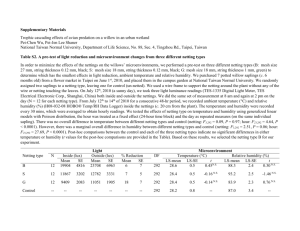

May 2006 Guidance Note AGN 112.3 Netting 1. Netting is a process by which all outstanding transactions between two counterparties are combined and reduced to a single (net) sum for a party to either pay or receive. The process is formalised in a netting agreement. 2. From a prudential viewpoint, the key issue is whether an authorised deposittaking institution's (ADI’s) exposure against a counterparty (or counterparties) is effectively limited to the net sum determined by a netting agreement ensuring that the ADI’s credit risk is genuinely reduced. Scope 3. An ADI may only net for capital adequacy purposes off-balance sheet marketrelated transactions (across both the “banking” and “trading” books) with a single counterparty that are subject to a legally valid form of bilateral netting agreement – e.g. “close-out” netting or “netting by novation” agreement. This may include netting across different market-related product types. 4. This does not encompass netting market-related transactions against on-balance sheet items (e.g. loan receivable against a negative revaluation on a marketrelated transaction) with the same counterparty. However, on-balance sheet items may qualify as cash collateral for risk weighting the net sum of marketrelated transactions. 5. The netting provisions set out in this Guidance Note include “credit derivatives” to the extent that they are recognised as market-related transactions for capital adequacy reporting purposes. However, they do not include “payments netting”. Payments netting is designed to reduce operational costs and risks associated with daily settlement of transactions and is not recognised for capital adequacy purposes since an ADI’s credit risk arising from a counterparty’s gross obligations to the ADI is not in any way affected by payments netting. 6. “Close out netting” (sometimes called contractual netting) is a contractual process designed to apply on the default of a counterparty when all outstanding transactions between counterparties subject to the netting agreement are combined and reduced to a single net payment. There are two stages to this process: AGN 112.3 – 1 May 2006 (a) fixing of obligations on the occurrence of an event (typically insolvency); and (b) calculating the cost to each party in closing out transactions according to a prescribed formulae (often related to the cost of replacing a transaction by buying an equivalent position in the market at the prevailing time). The amounts due to both counterparties may be calculated in one currency or converted to one currency and then netted to one single payment due by one party to the other. 7. “Netting by novation” refers to a “master” contract between two counterparties under which any obligation between the parties to deliver a given currency (or equity or debt instrument or commodity) on a given date is automatically amalgamated with all other obligations under the agreement for the same currency (pairs) and value date. The result is to legally substitute a single net amount for the previous gross obligations. Eligible bilateral netting agreements 8. An ADI may only net for capital adequacy purposes, claims and obligations arising from off-balance sheet market-related contracts with a counterparty that is covered by a legally valid (i.e. eligible) bilateral netting agreement, subject to the following conditions: (a) the bilateral netting agreement is in writing; (b) the bilateral netting agreement creates a single legal obligation covering all transactions included in the agreement such that an ADI would have either a claim to receive or an obligation to pay only the net sum of the positive and negative mark-to-market values of individual transactions covered by the agreement in the event that either party fails to perform due to the default, liquidation or bankruptcy (or other similar circumstances); 1 (c) the ADI has obtained a written and reasoned legal opinion(s) to the effect that in the event of the default, liquidation or bankruptcy (or other similar circumstances) of a party to the bilateral netting agreement, the relevant courts and authorities would find the ADI’s claims and obligations are limited to the single net sum determined in the eligible bilateral netting agreement under: (i) 1 the law of the jurisdiction in which the counterparty is incorporated and, if a foreign branch of the counterparty is involved, the law of In some countries there are provisions for the authorities to appoint an administrator/conservator to a troubled bank. Under statutory provisions applying in those countries, the appointment of an administrator may not constitute grounds for the triggering of netting agreements. Such provisions do not prevent the recognition of affected netting agreements for the purposes of these guidelines provided that a netting agreement can still take effect in the event the bank under administration does not meet its obligations under market-related transactions as they fall due. AGN 112.3 – 2 May 2006 the jurisdiction in which the branch is located; (ii) the law that governs the individual market-related transactions involved; and (iii) the law that governs any contract or agreement necessary to give effect to the netting; 9. 2 (d) the ADI has procedures in place to monitor possible changes in relevant laws or other legal developments (e.g. court decisions) to ensure that the bilateral netting agreement continues to be fully effective (in the event that legal developments adversely affect the enforceability of netting agreements, an ADI must move promptly to report the transactions affected on a gross basis rather than as a net sum); (e) the ADI has adequate systems and controls in place to record and manage the transactions covered by the netting arrangements on a net basis in accordance with the terms of the bilateral netting agreement; and (f) the bilateral netting agreement is not subject to a walkaway clause. 2 An ADI which wishes to utilise netting provisions in this Guidance Note must inform APRA of its intention to do so and provide a copy of the ADI’s netting policy and a description of its systems and controls covering netting. An ADI should inform APRA of any material changes in its netting policy and systems and controls. The description of its systems and controls should include, as a minimum, the following: (a) who has responsibility for setting and reviewing policy on netting (and the frequency at which netting policy is reviewed); (b) types of counterparties and transactions covered by bilateral netting agreements; (c) types of netting being utilised (e.g. close-out, novation, etc); (d) who has responsibility for approving the application of an individual bilateral netting agreement to transactions, to enable calculation of exposures on a net basis (including determining compliance of individual agreements with existing legal opinion or whether separate legal opinions are required for them); (e) jurisdictions affecting netting agreements to which the ADI (or a member of the consolidated group) is a party. The ADI should note any jurisdictions in which doubt might exist as to the enforceability of netting and what action the ADI had taken as a result in reporting affected transactions for capital adequacy purposes; A walkaway clause is a provision which applies to a netting agreement that permits a nondefaulting counterparty to make only limited payments, or no payments at all, to a defaulting party, even if the defaulting party is a net creditor. AGN 112.3 – 3 May 2006 (f) sources of legal opinions used by the ADI, and the basis of their expertise; (g) how the ADI monitors legal developments affecting its netting agreements, and the need to obtain additional legal opinions for new jurisdictions; (h) procedures for monitoring roll-off of exposures and the impact of this on the ADI’s credit exposure and capital adequacy; and (i) processes for determining and reporting net exposures to individual counterparties. 10. It is the responsibility of an ADI to ensure that it has fully complied with all the requirements set out in this Guidance Note before the netting agreement(s) is utilised for capital adequacy purposes. 11. External auditors should include, in their opinion provided to APRA each year regarding an ADI’s compliance with minimum capital ratios, whether they are satisfied with the ADI’s compliance with the systems and records requirements set out in this Guidance Note for netting of transactions. Legal opinion 12. An ADI with a general legal opinion covering the enforceability of netting in a particular jurisdiction, may rely on that opinion when assessing the enforceability of individual bilateral netting agreements involving the jurisdiction, provided the ADI has determined that the type of individual bilateral netting agreement involved is encompassed by the general legal opinion. 13. An ADI must satisfy itself that the bilateral netting agreement, and supporting legal opinions, are applicable to each counterparty, transaction and product type undertaken with the counterparty, and in all jurisdictions involved in such transactions (regard should be given to counterparties governed by special rules relating to insolvency e.g. local authorities, banks and insurance companies). The ADI should verify the existence of any facts referred to in the bilateral netting agreement and that all documentation is complete. It should also satisfy itself that all parties involved in a bilateral netting agreement have the capacity, power and authority in relation to the agreement and that the agreement has been properly executed. 14. If a positive legal opinion regarding enforceability of a bilateral netting agreement is subject to assumptions and/or qualifications, these must not be unduly restrictive. They should be specific and of a factual nature and should be adequately explained in the opinion. An ADI should review and assess all assumptions, qualifications and omissions in legal opinions on bilateral netting agreements as to whether they give rise to any material doubts as to the enforceability of a bilateral netting agreement. Where there is any material doubt as to the enforceability of a bilateral netting agreement, the agreement cannot be recognised for capital adequacy purposes. AGN 112.3 – 4 May 2006 15. In the event that legal developments adversely affect the enforceability of netting agreements, an ADI must move promptly to report the transactions affected on a gross basis rather than as a net sum. 16. Where a satisfactory legal opinion cannot be obtained regarding the enforceability of netting transactions involving a specific jurisdiction (e.g. in the case of transactions done through or with a specific branch), but that the netting of other transactions under the agreement continues to be enforceable, the former transactions will need to be excluded from netting in determining the net sum due to/from the counterparty involved. Transactions excluded from being netted must be reported on a gross basis. 17. Where an ADI is aware that a regulator or supervisor of a counterparty has given notice that it is not satisfied netting is enforceable under the laws of its country, the netting agreement will not qualify as an eligible bilateral netting agreement for capital adequacy purposes regardless of any opinion obtained by the ADI. 18. An ADI utilising netting for capital adequacy purposes must maintain records adequate to support the application of an eligible bilateral netting agreement. This includes records necessary to demonstrate compliance with the requirements set out in this Guidance Note (e.g. appropriate legal opinions, assessment of the applicability of netting agreements to counterparties, etc). Records should incorporate a copy of the netting agreement, and any other relevant legal documentation (including English translations where appropriate). Collateral and guarantees 19. Where a legal agreement with a counterparty contains provisions for applying collateral and/or guarantees to netted exposures outstanding between an ADI and the counterparty, the ADI must ensure that the provisions comply with the requirements set out in Guidance Note AGN 112.1 Risk-Weighted On-Balance Sheet Exposures with respect to eligible collateral and guarantees. 20. Collateral and guarantees may be used in calculating the risk weight to be applied to the net sum calculated under an eligible netting agreement which is covered by the collateral and/or guarantee. Risk weights may not be assigned based on collateral and guarantees unless the collateral and/or guarantees have been posted and are legally available for all individual transactions making up the net sum of exposures involved. For example, where collateral covers only a specific class of transactions in a pool of netted transactions (e.g. US/DM foreign exchange transactions or contracts with a maturity under one year), the collateral only provides protection against those transactions and not to the net sum (which may be produced by netting all forms of foreign exchange, interest rate swaps and other transactions of multiple maturities undertaken with a counterparty). Consequently, the collateral must not be used in determining the risk weight to be applied to that net sum. AGN 112.3 – 5 May 2006 Application of eligible bilateral netting agreements 21. Where an ADI satisfies all the requirements in this Guidance Note for bilateral netting, it may report off-balance sheet market-related transactions with a counterparty on a net basis and calculate the credit equivalent amount of those transactions in accordance with the methodology outlined below. Credit equivalent amount 22. Exposures on transactions falling under netting agreements must be calculated for capital adequacy purposes using the current exposure method. 23. The credit equivalent amount (CEA) of transactions subject to an eligible bilateral netting agreement is calculated as the sum of the net current credit exposure (NCCE) (i.e. net mark-to-market replacement cost) of all transactions covered by the netting agreement, if positive, plus an “add-on” (PFCEadj) for potential future credit exposure based on the notional principal of all the individual underlying contracts (i.e. the gross potential future credit exposure) adjusted to reflect the effects of the netting agreement. Thus: CEA = NCCE (if positive) + PFCEadj Net current credit exposure 24. NCCE is the sum of all positive and negative mark-to-market values of all individual contracts covered by an eligible bilateral netting agreement (i.e. positive mark-to-market values of transactions may be offset against negative mark-to-market values on other transactions covered by the netting agreement). If the net sum of individual mark-to-market values is positive then, the NCCE is equal to that sum. If the sum of mark-to-market values is zero or negative, then the NCCE is set equal to zero. Potential future credit exposure 25. For the purposes of calculating gross potential future credit exposure, matching opposing transactions included in a netting agreement may be taken into account as a single transaction with a notional principal equivalent to the net receipts on those transactions. Matching transactions are defined to represent forward foreign exchange and other similar market-related transactions in which notional principal is equivalent to cash flows, where the cash flows fall due on the same value date and are in the same currency. Thus, the notional principal for such transactions would be the net receipts falling due on each value date in a given currency. The transactions are treated as a single transaction since offsetting transactions in the same currency maturing on the same date will have a lower future potential exposure as well as a lower current exposure. 26. The effects of netting agreements on potential future credit exposure are recognised through the application of a formula that produces an adjusted “addon” amount for potential future credit exposure on all contracts subject to the netting agreement (PFCEadj). The formula is: AGN 112.3 – 6 May 2006 PFCEadj = 0.4(PFCEgross) + 0.6 (NGR x PFCEgross) 27. The approach makes some allowance for potential fluctuations in net current exposure arising from future price or rate movements on netted exposures which are not matched (as defined in paragraph 25). 28. Gross potential future credit exposure (PFCEgross) is given by the sum of potential future credit exposure for each individual transaction covered by an eligible bilateral netting agreement with one counterparty as if no netting would occur (subject to paragraph 25). Potential future credit exposure for each transaction is calculated by multiplying the notional principal amount of the transaction by the appropriate credit conversion factor for that transaction as set out in Attachment B to Guidance Note AGN 112.2 Risk-Weighted Off-Balance Sheet Exposures. 29. NGR is the “net to gross ratio” – i.e. the ratio of the net current exposure of all transactions included in the bilateral netting agreement (i.e. NCCE to the gross current credit exposure (GCCE) of these same transactions). GCCE is the sum of the mark-to-market values of all transactions covered by the netting agreement with a positive mark-to-market value with no offsetting against any contracts with negative mark-to-market value (except as allowed under paragraph 25). NGR reflects the risk reducing portfolio effects of bilaterally netted transactions with respect to current credit exposure. Thus: NGR = NCCE/GCCE 30. NGR may be calculated in two ways: Counterparty by Counterparty Approach Under this approach, a unique NGR is applied to each counterparty in calculating the credit equivalent amount of transactions conducted with that counterparty. The NGR is defined as the net current credit exposure of all transactions with an individual counterparty covered by an eligible bilateral netting agreement (i.e. NCCEindividual) divided by the gross current credit exposure of all the transactions with that counterparty covered by the netting agreement (i.e.GCCEindividual ). In calculating GCCEindividual, negative mark-to-market values for individual transactions with the same counterparty may not be used to offset positive markto-market values for other transactions with the same counterparty. Aggregate Approach Under this approach, one NGR is calculated and applied to all counterparties in calculating the credit equivalent amounts for transactions with each counterparty separately. AGN 112.3 – 7 May 2006 The NGR is the ratio of the sum of all of the net current credit exposures of all the transactions of all counterparties subject to eligible bilateral netting agreements (i.e. NCCEaggregate) to the sum of all of the gross current credit exposures for all the transactions of all counterparties subject to eligible netting agreements (i.e. GCCEaggregate). In calculating GCCEaggregate, negative mark-to-market values of transactions with one counterparty cannot be used to offset positive mark-to-market values of transactions with that counterparty or any other counterparty included in the aggregate calculations. 31. An ADI must consistently use either the “counterparty by counterparty” approach or the “aggregate” approach to calculate NGR. An ADI must inform APRA which approach it intends to use. Other criteria 32. An ADI may, with APRA’s prior agreement, elect to include foreign exchange contracts with an original maturity of fourteen calendar days or less with other transactions in calculating netted exposures. Where an ADI chooses to include contracts under fourteen days, it must do so for all counterparties for whom it calculates net exposures. An ADI cannot selectively include such contracts in calculating net exposures. All such foreign exchange contracts will need to be included in calculating current credit exposures and potential future credit exposures (with a credit conversion factor of 1.0%). Market-related instruments traded on recognised exchanges where they are subject to daily margining requirements, are excluded from netting. Risk weighted amount 33. Once the CEA has been determined for transactions netted under an eligible bilateral netting agreement, that amount is then assigned the risk weighting appropriate to the counterparty, or if relevant, the risk weighting of a guarantor or collateral. The maximum risk weight applicable to the CEA of netted marketrelated transactions is 50 per cent. 34. A worked example of the calculation of risk-weighted amount of off-balance sheet market-related transactions involving eligible bilateral netting agreements is set out in the Attachment. AGN 112.3 – 8 May 2006 Attachment Worked Example for Calculation of Risk-Weighted Amount of OffBalance Sheet Market-Related Transactions Covered by Eligible Bilateral Netting Agreements Assumptions Assume that an ADI has a portfolio of foreign exchange transactions outstanding with four counterparties. Counterparties A and C are ADIs while counterparties B and D are corporates. The transactions with each counterparty have the following terms: Counterparty A Counterparty B Counterparty C Counterparty D Notional Residual Mark- Notional Residual Mark- Notional Residual Mark- Notional Residual MarkPrincipal Maturity to- Principal Maturity to- Principal Maturity to- Principal Maturity to(Years) Market (Years) Market (Years) Market (Years) Market (Value) (Value) (Value) (Value) 400 1,500 400 300 200 1000 800 1 2 2 1 3 5 5 5 8 4 1 6 3 -2 200 2,000 200 100 1 2 3 3 5 -5 1 -1 700 200 1,000 800 900 700 500 1 5 4 1 1 2 3 -1 -8 -7 -1 9 2 4 100 800 300 100 500 600 2 2 5 1 1 1 -1 9 5 3 9 -4 Assume in addition that certain transactions with Counterparties A and B involve the same currencies and have the same value date. In calculating capital requirements, it is assumed that an ADI has chosen to match transactions in accordance with paragraph 25 of this Guidance Note and, as a result, these transactions (contracts) have been effectively replaced by new notional transactions marked with #. After Matching Counterparty A Counterparty B Counterparty C Counterparty D Notional Residual Mark- Notional Residual Mark- Notional Residual Mark- Notional Residual MarkPrincipal Maturity to- Principal Maturity toPrincipal Maturity to- Principal Maturity to(Years) Market (Years) Market (Years) Market (Years) Market (Value) (Value) (Value) (Value) 400 1 5 200 1 5 700 1 -1 100 2 -1 1,500 2 8 2,000 2 -5 200 5 -8 800 2 9 400 2 4 3 0 1,000 4 -7 300 5 5 100# 300 1 1 800 1 -1 100 1 3 200 3 6 900 1 9 500 1 9 5 1 700 2 2 600 1 -4 200# 500 3 4 Net 25 0 -2 21 NCCE 25 0 0 21 AGN 112.3 – 9 May 2006 If no bilateral netting (or matching of transactions) applied Counterparty A Sum of the mark-to-market value of transactions with positive replacement cost Potential future credit exposure Credit Equivalent Amount (CEA = net mark-to-market + potential future credit exposure) Risk Weighted Assets (CEA x Counterparty Risk Weight) Counterparty Counterparty Counterparty B C D 27 6 15 26 74 202 117 144 72 535 229 123 159 98 609 45.80 61.50 31.80 49.00 188.10 Gross Potential Future Credit Exposure (PFCEgross) Add-on for Each Individual Transaction: For the purpose of this example, assume the gross potential future credit exposure for each individual transaction is obtained by multiplying the transaction’s notional principal by a credit conversion factor (ccf) of 1% for transactions with a residual maturity of up to (and including) one year and a ccf of 5% for those transactions with a remaining term to maturity of greater than one year and up to (and including) 5 years. Thus: After Matching Counterparty A Counterparty B Counterparty C Counterparty D 4 2 7 5 75 100 10 40 20 5 50 15 3 8 1 10 9 5 10 35 6 25 PFCEgross 122 Total 107 144 72 AGN 112.3 – 10 May 2006 Calculation of Risk Weighted Amounts Counterparty Counterparty Counterparty Counterparty A B C D Total Counterparty Risk Weight 20% 50% 20% 50% Net Current Credit Exposure (NCCE) 25.00 0.00 0.00 21.00 46.00 Gross Current Credit Exposure (GCCE) 25.00 5.00 15.00 26.00 71.00 122 107 144 72 1.00 0.00 0.00 0.81 Gross Potential Future Credit Exposure (PFCEgross) If bilateral netting applied Net to Gross Ratio (NGR = NCCE/GCCE) 0.65∗ Where ∗ indicates the NGR for all counterparties. Applying NGR on counterparty by counterparty approach: 122.00 42.80 57.60 63.79 Credit Equivalent Amount (CEA = NCCE + PFCEadj) 147.00 42.80 57.60 84.79 Risk Weighted Assets (CEA x Counterparty Risk Weight) 29.40 21.40 11.52 42.40 Potential Future Credit Exposure (Adjusted) PFCEadj = 0.4 (PFCEgross) + 0.6 (NGR x PFCEgross) Where the individual NGR for a counterparty is applied for that counterparty AGN 112.3 – 11 104.72 May 2006 Applying NGR on a aggregate approach: 96.38 84.53 113.76 56.88 Credit Equivalent Amount (CEA = NCCE + PFCEadj) 121.38 84.53 113.76 77.88 Risk Weighted Assets (CEA x Counterparty Risk Weight) 24.28 42.27 22.75 38.94 Potential Future Credit Exposure (Adjusted) PFCEadj = 0.4 (PFCEgross) + 0.6 (NGR x PFCEgross) Where NGR = 0.65 for all counterparties AGN 112.3 – 12 128.24