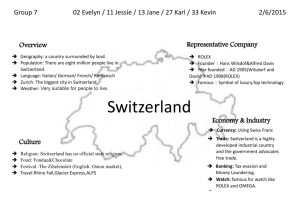

Switzerland`s supplementary report

advertisement