Chairman`s Perception of Board Work Upon Female Board

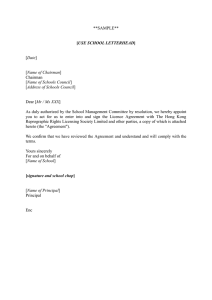

advertisement