Greater Toronto Area Office Market Report

advertisement

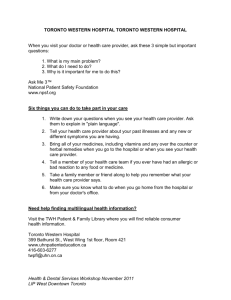

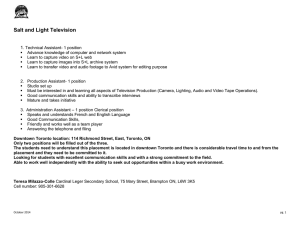

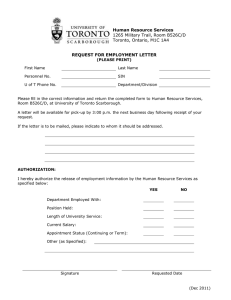

2 ND QUARTER 2014 Greater Toronto Area Office Market Report Partnership. Performance. GREATER TORONTO AREA HISTORIC OFFICE MARKET TRENDS Market Overview After a poor first quarter, the Greater Toronto Area (GTA) office market CHANGE IN TOTAL TOTAL spread M KK EE TT FF A C T S MAA RRbetween experienced higher leasing velocity in the second quarter of 2014,NEWasSUPPLY OCCUPIED AREA VACANT RATE AVAILABLE (%) RATE (%) Ava+Vac occupied area increased in the Downtown, Midtown and Toronto West (YTD) (SQ. FT.) markets. However, soft conditions prevailed in Toronto East and North as more space returned to the market than was leased - spoiling what 3,407,812 would 6,148,725 '00 5.6% 6.8% 1.2% otherwise have been a positive quarterly result. Class A product continued '01 2,879,872 -1,197,220 8.2% 9.9% 1.7% to benefit at the expense of class B and C buildings in almost'02every district 3,390,524 -1,233,702Financial 11.0% 12.2% Core overall availability1.2% Downtown class A buildings with and node. The second quarter concluded with an overall vacancy rate550,040 '03 -1,547,390rate vs.12.3% 13.3% an overall vacancy rate of1.0% largest contiguous available area 1,841,342 2,848,552 11.5% 1.0% (physically unoccupied space) of 9.4% - unchanged from the'04 previous 6.5% 12.5% >=50,000 sf vs. 29 in the suburbs '05 lease) 1,687,599 3,876,835 10.0% 11.2% 1.2% quarter - while the overall availability rate (space marketed for '06 873,913 4,302,979 7.8% 9.9% 2.1% increased marginally (+10 basis points (bps)) to 12.1%. Sublet availability '07 1,794,207 3,204,546 6.8% 8.5% 1.7% (3.7 msf or 18% of total available space) lingers and is most prominent in '08 1,011,293 1,784,179 6.4% 8.5% 2.1% Downtown Toronto (35% of total GTA sublet available). Construction is '09 4,755,533 593,343 8.7% 10.7% 2.0% steady with 27 buildings (7.3 msf / 58% preleased) underway,'10 of which 5 1,520,727 1,153,346 8.7% 10.6% 1.9% msf (7 towers / 56% preleased) is scheduled for completion starting next '11 2,439,089 Number of tenants (>10,000 sf)2.1% Sublet availability rate in class A 1,302,713 7.7% 9.8% '12 585,343 assessing quarter, through to 2017. 1,120,254 7.9%options in9.3% Downtown1.4% buildings in Toronto North vs. 2% '13 -846,622 2.5% 1,683,952 11.6% Toronto, 9.1% representing over 5.3 msf one year ago Toronto’s Downtown market saw a noticeable uptick in leasing activity, YTD 2.8% -388,494 9.4% 12.2% centred on class A and B buildings along the University Ave.,Q2'14 Bay St.202,606 and Front St. W. corridors, spanning the Financial Core, Downtown North Greater Toronto Area and West nodes. Well-priced large blocks of space either currently Historic Office Market Trends - All Classes vacant or soon to be vacated by some of the tenants relocating to new 7,000 14.0% developments are highly sought after. While transactions were varied as to industry and size, the banks have been busy, leasing upwards of 300,000 6,000 12.0% sf during the quarter, and are expected to stay active with several large 5,000 requirements in the works. Though tour activity continued in the new 10.0% 4,000 developments, no deals were inked as the market is set to welcome the 8.0% 3,000 first two of seven towers (RBC Waterpark Place and Bremner Tower) this fall. Downtown saw its availability (10%, -50 bps) and vacancy (6%, -30 bps) 2,000 6.0% rates fall during the quarter. 1,000 4.0% Vacancy in Toronto’s Midtown market declined 20 bps to 6.8%, owing to an 0 increase in leasing activity largely in class B buildings in the Eglinton and 2.0% -1,000 St. Clair nodes. Workplace strategies undertaken by major space users to reduce footprints and occupancy costs continue to impact the market. In 0.0% -2,000 '00 '01 '02 '03 '04 '05 '06 '07 '08 '09 '10 '11 '12 '13 YTD the second quarter, Manulife Financial opted to re-stack its operations at Q2'14 250 Bloor St. E. - starting in early 2015 and eventually freeing up almost New Supply Change In Occupied Area Vacancy Rate Availability Rate 202,000 sf, consolidating some staff to its complex at 200 Bloor St. E. As a result, overall availability in the Bloor node jumped 360 bps between quarters to 8%, while vacancy sits at 4.8%, for now. Manulife’s impending space rationalization has elevated Midtown’s availability rate 110 bps to 10% - up from 6.5% one year ago. Turning to the suburban market, Toronto West had another strong showing with the majority of transactions completed in class A product, leading to declining availability (16.1%, -10 bps) and vacancy (13.7%, -20 bps) during the quarter. Unfortunately, the Toronto East and North markets experienced a notable rise in availability and vacancy (80 to 100 bps) from the previous quarter. For example, in Toronto East, Imperial Oil returned more than 172,000 sf to the market at 90 Wynford Dr. in the Don Mills and Eglinton node - the result of ongoing outsourcing and consolidation. In Toronto North, sublease space has doubled over the past year, largely concentrated in a handful of class A buildings in North Yonge and Vaughan. Collectively, the suburban market ended the first half of 2014 with higher availability (14.5%) and vacancy (12.7%) rates. 26 82 4.3% Square Feet (000's) Total Available/Vacant Rate (%) 11.7% G G R ER A T T E ER R TTOORROONNTT OO A A EA A RR EE A Availability Trend MA A RR KK EE TT SSUUMMMMAARRY Y M Change in Occupied Area (000’s of sf) Vacancy Trend New Supply (000’s of sf) 12 months ago 3 months ago Current Quarter 12 months ago 3 months ago Current Quarter Current Quarter Year-toDate Year-to-Date Completions Under Construction % Pre-Leased 10.5% 12.1% 12.2% 8.6% 9.4% 9.4% -13 -388 203 7,326 58% C O M P ACROI MS POA N L FE AL ES AI SNI N G G OOPP TT II OONNS S F OF RO TRE NTAENNT SA N R I SOO FN O - TG TS A Available Space G T A Availability Rate No. of Bldgs. Buildings with more than 50,000 sf Buildings with largest contiguous available area greater than 50,000 sf Number of spaces between 4,000 sf and 8,000 sf Direct % Sublet % Total % Downtown All Classes 398 41 29 175 8.2 1.8 10.0 Downtown Class A 113 34 26 76 9.0 2.1 11.1 Midtown All Classes 136 8 2 43 8.1 1.9 10.0 Midtown Class A 35 3 1 15 5.2 2.6 7.8 12 128 13.2 1.4 14.6 10 69 14.4 1.5 15.9 4 37 6.1 3.2 9.3 Office Space at Selected Districts Toronto East All Classes 302 22 Asking Net Rent Additional Costs Toronto East Class(Avg. A $psf) 126(Avg. $psf) 15 Q2-14 Downtown $ 20.53 $ 17.94 Toronto North All Classes 107 7 Midtown $ 17.04 $ 18.48 Q2-14 East $A 12.6050 $ 13.09 Toronto North Class 7 Sublet North $ 16.73 $ 16.08Available (sq. ft.) Toronto West All Classes 465 $ 38as % of Total Available Sublet West $ 14.98 12.74 GTA Overall $ 15.59 $ 14.45 Toronto West Class A 224 24 Total Available Downtown Midtown East 22 North West GTA 4 5.9 4.3 Overall 10.2 1,288,925 308,102 416,721 440,323 1,255,275 3,709,346 24 180 16.1 18% 19% 10% 35% 13.1 19% 3.0 18% 15 7,061,316 Downtown Midtown East Asking Net Rent (Avg. $psf) Asking Net Rent (Avg. $psf ) North 11.2 3.5 14.7 6,658,387 20,972,721 1,258,520 GTA - Sublet Availability - All Classes GTA - Sublet Availability - All Classes GTA - Occupancy Costs - All Classes 000’s sq. ft. $p.s.f GTA - Occupancy Costs - All Classes $45.00 $40.00 $35.00 $30.00 $25.00 $20.00 $15.00 $10.00 $5.00 $0.00 102 4,362,941 1,631,557 West GTA Overall 40% 35% 30% 25% 20% 15% 10% 5% 0% 4,000 3,500 3,000 2,500 2,000 1,500 1,000 500 0 Downtown Midtown Additional (Avg.$psf $psf) Additional Costs Costs (Avg. ) East Sublet Available Sublet Available(sq. (sq.ft.) ft.) North West GTA Overall Sublet % of ofTotal TotalAvailable Available Sublet as as % E RR TOONR T OO NTO G R E A TGERRE ATT O A RA ER EAA SS I GGNNI FI IFCI ACNAT NT TR ATN RS AACNT SI OANCS T I O N S Address District Tenant Size 277 Front St. W. Downtown Metrolinx 93,000 sf 2200 Yonge St. Midtown Canadian Tire 28,000 sf 155 Gordon Baker Rd. Toronto East Dell Canada 60,000 sf 1124 Finch Ave. W. Toronto North Griffin Centre 21,200 sf 80 Courtneypark Dr. W. Toronto West Just Energy 48,500 sf For more information on this report, please contact Avison Young: Bill Argeropoulos 416.673.4029 Vice President & Director of Research, Canada avisonyoung.com © 2014 Avison Young Commercial Real Estate (Ontario) Inc., Brokerage E. & O.E.: The information contained herein was obtained from sources which we deem reliable and, while thought to be correct, is not guaranteed by Avison Young. Acknowledgement: Data for graphs, charts and tables used in this report are sourced from Avison Young and Altus InSite. Some of the data in this report has been gathered from third party sources and has not been independently verified by Avison Young. Avison Young makes no warranties or representations as to the completeness or accuracy thereof. Avison Young 18 York Street Suite 400, Mailbox #4 Toronto, ON M5J 2T8 T 416.955.0000 F 416.955.0724