The Miracle with a Dark Side: Korean Economic Development under

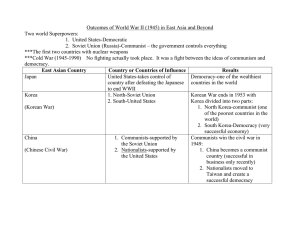

advertisement