market coordination of transmission loading relief across multiple

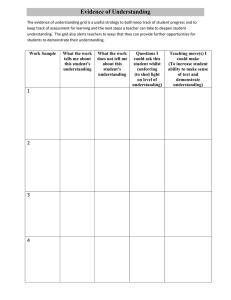

advertisement