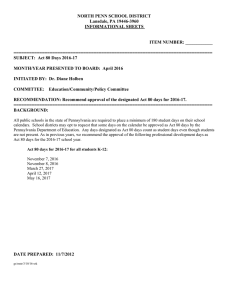

FY 17 Adopted Budget Policy

advertisement