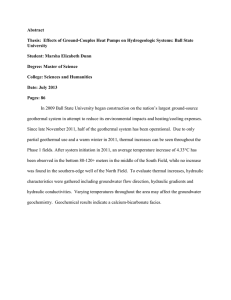

Full-Text PDF

advertisement