April 2016

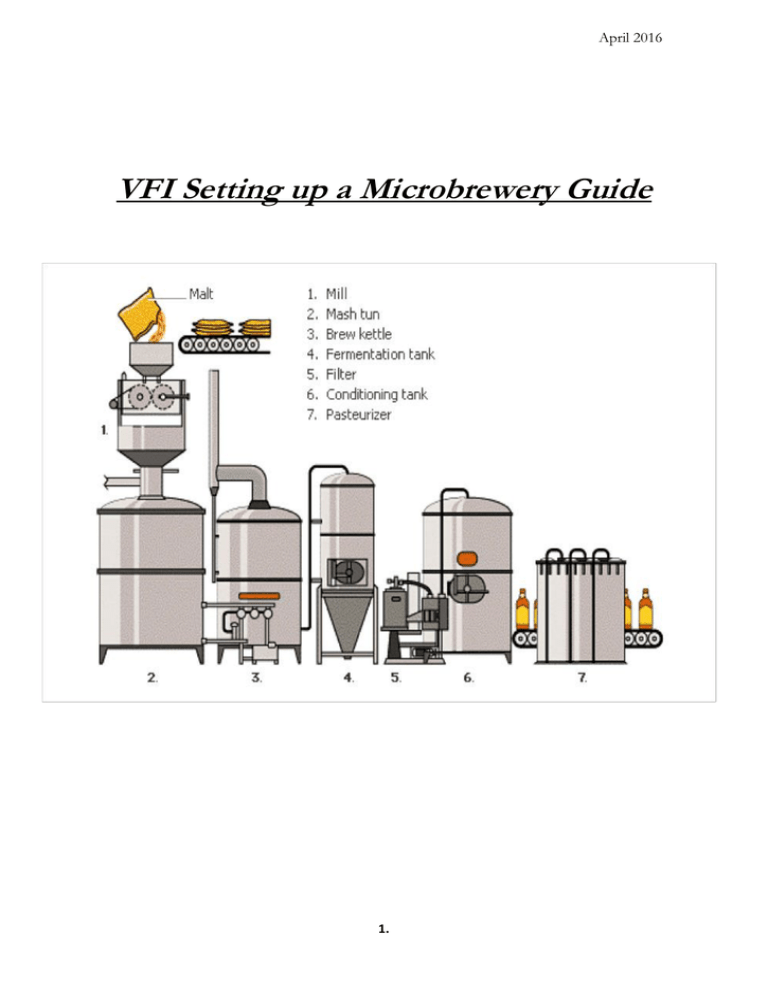

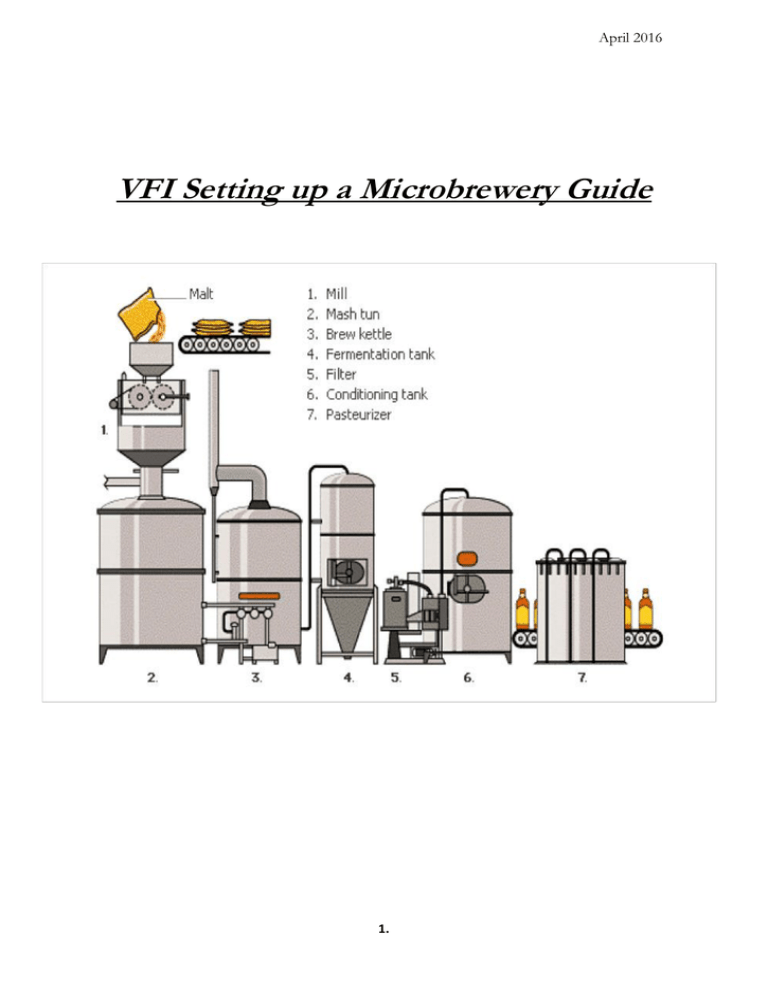

VFI Setting up a Microbrewery Guide

1.

Setting up A Microbrewery

Thinking of setting up your own Brewpub/Microbrewery. This is very achievable but it will require a good measure

of careful planning, research and development, liaison with the different Authorities, sourcing of equipment and

ingredients, good management systems to meet revenue requirements, considerable funding and a lot of hard work

and patience etc.

The following are some comments from people who have already set up successful Breweries:

Your Business Plan should allow for expansion

The costs of running a Brewery and the time required will be more than you planned on

Getting permissions and other legal issues are complicated and take a lot of time. The brewing

business is heavily regulated

Opening a Brewery is more than just brewing beer – Get ready for a lot of administrative work

Talk to other Brewers and do your research

Do a course that’s specific to your requirements i.e. setting up a brew pub and not a microobiology

course on microbrewing.

The following information may be of assistance!

1. LICENCE:

A Manufacturing Licence is required by Brewers, Cider Manufacturers, Distillers, Rectifiers or Compounders. A

manufacturer’s licence also authorises Wholesale dealing at the premises where the liquor is manufactured,

providing the liquor being sold is the produce of the Manufacturer and is sold from that premises. However the

sale of beer under the licence must be in wholesale quantities. Wholesale quantities are defined as in the case of

beer & cider in any quantity not less than four and a half gallons, or not less than two dozen reputed quart bottles,

but not in any less quantities. This application will trigger a visit from the local Excise Control Officer.

In preparation for the visit of the Excise Control Officer it is very important that you have studied the

Public Notices referred to in Section 3 below.

How do I apply for a new Manufacturer's Licence?

An

Application Form (PDF, 347KB) must be submitted to the National Excise Licence Office.

Requirements:

Tax Clearance Certificate (This Certificate does not need to be submitted. Revenue automated systems

will verify that a current Tax Clearance Certificate is in place. A Licence can issue only where a current

Tax Clearance Certificate is held by the Licensee.)

Short Certificate of Incorporation (if Licensee is a company)

Certificate of Registration of Business Name

Please note these documents are not to be submitted with your application.

If this Application is approved the Revenue Commissioners will issue you with a First Time Application

Notice to apply for the Licence. On receipt of your First Time Application Notice, you will be asked to declare

that these documents are in your possession. Please be advised that you must retain them for a period of six years

as they may be requested for inspection by Revenue (these will also be listed on the First Time Application

Notice).

Tax Clearance Certificate

A valid Tax Clearance Certificate is required where the applicant is an individual. Corporate applications will

require a valid Tax Clearance Certificate for the company. Certificates do not need to be submitted. Revenue

automated systems will verify that current Tax Clearance Certificates are in place.

2.

Short Certificate of Incorporation

If the Applicant is a Limited Company, a Short Certificate of Incorporation dated not earlier than 4 weeks

before the date of application, will be required to take up the Licence. Duplicate Certificates of Incorporation are

available at: www.cro.ie LoCall 1890 220 226 or 01 804 5200.

Certificate of Registration of Business Name

If the Applicant trades using a name which is not that of the beneficial owner of the business, a Certificate of

Registration of Business Name will be required to take up the Licence. Duplicate Certificates of Registration of

the Business Name can be obtained at: www.cro.ie , LoCall 1890 220 226 or 01 804 5200.

The Application should be signed by the Licensee if a Sole Trader, by one of the Partners if a Partnership or, in

the case of an incorporated firm by the Company Secretary or a Director of the Company.

On receipt of your First Time Application Notice you may apply for your Licence using the Payment Options as

follows. The cost of the licence is currently €500 per licensing year – 1st October to 30th September.

Revenue On-Line Services (ROS):

You can apply for your Excise Licence on-line using ROS See the

Licences User Guide for ROS (PDF,

846KB)

Or

By completion of the Payslip located at the bottom of the First Time Application Notice/Renewal Notice:

Payment should be made by cheque/bank draft and made payable to the Collector-General using the prepaid

envelope provided. Do not enclose cash!

2. PLANNING/PREMISES:

You will need to decide on what type of Brewery you want to set up. Is it a Brewpub or a Microbrewery? You will

also need to decide whether you want the brewery purely as an industrial production activity or as an integral part

of the retail strategy. The volume of beer that you will want to produce and the number of different types of beer

that you want to offer will dictate the space required and possibly the location choice. Also build in room for future

expansion in your plans. Whichever business type you select, the premises should include areas for brewing,

fermenting, conditioning, bottling/kegging, wash up, storage, office, laboratory, toilets, loading etc. Consideration

should also be given to access/exits and supply of the following services – electricity supply, water supply, gas

supplies, oil supplies, drainage/waste removal etc.

Modern programmable brew equipment can now have a quite small footprint with optional ingredient packs

available to order. In-house training & tutorials make the process far simpler.

A change of use of existing space is the easiest & most cost effective way in obtaining planning for a brew

pub/brew kitchen.

With regards to planning you should consider the option of engaging a competent architect. You should meet with

the local planner prior to making your planning application. A pre-planning application should be considered. The

following should also be investigated – does the proposed application conform to the Local Area Development

Plan/County Development Plan/is there a requirement for a Traffic Impact Assessment/an Environmental Impact

Study/are Health & Safety requirements satisfied/Waste water disposal/Odours & emissions/noise pollution

/impact of business on neighbours etc. It is advisable to visit and engage with other similar established businesses.

3.

3. REVENUE/EXCISE/SEEKING APPROVAL:

The following Revenue Public Notices should be read:

Authorisation of Warehousekeepers & Approval of Tax Warehouses Manual (Rev March 2015)

authorisation-of-w

arehouskeepers-and-approval-of-tax-warehouses-manual.pdf

Excise, Revenue’s Guide for Tax Warehousekeepers (Alcohol Products) N No. 1877

http://www.revenue.ie/en/tax/excise/leaflets/pn1877.pdf

Excise, Authorization of Warehousekeepers & Approval of Tax Warehouses N No 1890

http://www.revenue.ie/en/tax/excise/leaflets/pn1890.pdf

Repayment of Alcohol Products Tax on Beer produced in qualifying microbreweries PN 1888

www.revenue.ie/en/tax/excise/leaflets/pn1888.html

Alcohol Products Tax N No 1886 http://www.revenue.ie/en/tax/excise/leaflets/pn1886.pdf

Please note that these Public Notices are subject to updates & revisions.

The rules for Rebate have changed since 1st January 2016 and warrants now exclude rebate upon

payment.

4. POSSIBLE GRANTS SUPPORTS:

Consideration should be given to the following groups when considering seeking Grant Aid:

Local Enterprise Office. Local Enterprise Offices (LEO’s) provide a range of financial supports designed to

assist with the establishment and/or growth of enterprises (limited company, individuals/sole trader,

cooperatives and partnerships) employing up to ten people.

These include:

Feasibility/Innovation Grants

Priming Grants

Business Expansion Grants

These financial supports are designed to provide a flexible suite of supports to LEO clients and potential clients.

CEDRA (The Commission for the Economic Development of Rural Ireland). It is anticipated that

CEDRA may receive funding in the near future which could be used to promote and develop rural projects

which would add to rural development. Please refer to the following link: http://www.ruralireland.ie/ for

updates.

Leader New Programme 2014 – 2020 (New Name Change due shortly). At the time of writing this agency

is still in the finalising stage. (It looks like that the Leader New Programme will not be available until Autumn

2016 and as yet craft brewing is not a surety on the list of businesses eligible).

Údarás Na Gaeltachta. Údarás Na Gaeltachta can provide assistance by way of capital grant to enterprises

that are based in Gaeltacht regions and are seeking aid for an initial investment for capital expenditure costs for

businesses. Instances where a proposed investment qualifies as an initial investment include the following:

The setting up of a new establishment

4.

The extension of an existing establishment

Diversification of the output of an establishment into new, additional products

A fundamental change in the overall production process of an existing establishment

Please refer to the following link: http://www.udaras.ie/en/forbairt-fiontraiochta/cunamh-airgid/deontas-caipitil/

Teagasc (Farm Diversification Scheme/Rural Economy Development).

The following link should also be of interest: www.localenterprise.ie/smeonlinetool/ . All you have to do is

answer a few very simple questions about the business and it comes up with a list of all available government

grants and supports that may be applicable based on the answers to the questions.

Publicans with farming

backgrounds should seek advice from Teagasc with regards to options on grant aids etc.

5. FINANCE/BANKING:

If you plan on dealing with the Banks you should prepare a well thought out Business Plan. Your Business Plan will

focus your mind and force you to answer questions about your premises, your products, your personnel, your

market area and indeed the very reason/s for setting up your brewery. It will also enable you see if the business is

financially viable going forward. Your Local Enterprise Board may be able to offer assistance in starting up your

business.

The following points should be of help when preparing same:

Detail the business name, address, owners and legal status.

Clearly outline your business idea, aims and goals.

Provide detail on the marketing plan and strategy, including details of your target market, unique

selling proposition and competitor information.

Demonstrate the viability of your business through sales targets, objectives & profitability.

Outline operational requirements including premises, equipment, staff, suppliers, licensing, cash

flow etc.

The key to any business plan and business sustainability is cash flow.

Ensure your plan is properly constructed showing cash receipts and outlays and also allow for a level

of unexpected expenditure.

You may find the following link “Guidance to creating a Business Plan” of some assistance:

http://business.aib.ie/content/dam/aib/business/docs/help-and-guidance/Business-Plan-Guidance-CCABIand-IBF-(Final-Version).pdf

6. EQUIPMENT SOURCING:

There are numerous equipment suppliers in the market. Many will provide a full comprehensive service. It is always

best to initially contact a number of suppliers and to get a number of quotes. References should be sought and

should be thoroughly followed up. Aftersales service on parts & service are important. Cost can vary considerably

depending on what you require, size and volume, how automated etc. Discussion with other microbrewery

owners/brewers would be beneficial. You will need to consider whether you will be supplying your brew in

kegs/bottles or both. Filling kegs is easier but supporting kegs in the field can be difficult. However, using kegs is

ideal if you are brewing for your own premises. The movement of bottles is easier but the outlay on equipment

such as bottle sterilizers, filling machines, labelling equipment etc. is very expensive. It is typically the most

expensive equipment in a brewery.

Some suppliers include: Home Brew West (agents for Speidel): CoEnCo, Belgium: MEURA, Belgium: PRODEB

Belgium: ABUL, UK: Mossbrew, UK: David Porter, UK: David Smith, UK: Brewing Design Services, UK:

You may also have to give consideration to sourcing or getting agreement with regards to sharing a gas supply for

dispensing the beer.

7. INGREDIENTS:

5.

The main ingredients used are water, malt, hops and more recently fruits. The malt is usually made by tricking the

cereal into beginning to germinate and consequently commencing the process of converting the starch in the grain

into fermentable sugar. There are numerous types of malts – pale ale malt, lager malt and wheat malt to name a

few. Hops are used for flavour and as they contain acids that kill bacteria they are also used as a preservative.

Some Malt suppliers include: Muntons: Bairds Malts: Edwin Tucker: French & Jupp:

Some Hop suppliers include: Wealden Hops: Botanix: Lupofresh:

At the lower level of brewing capacity i.e. suitable for publican entry, grains & ingredients are

probably better sourced locally. In some cases, one can buy all in one brew packs for up to 500 litres.

This allows fixed pricing and ease of EHO regulation.

8. TRAINING:

Brewing is a specialised business and not for the faint hearted. It requires lots of hard work and experience and

know how. If you are relatively new to brewing you should give serious consideration to formal training. There

are a number of options available. Many of the design and installation companies offer training as part of the

package. See www.brewingservices.co.uk for example. Joe Sheridan (087 9897072), Galway Craft Brew, Dunmore

offers training classes at very reasonable rates for Start Ups. Brewlab in the UK offers a range of courses from Start

Ups, taste evaluation, brewing skills development, recipe creation etc. The Institute of Brewing & Distilling is a

member’s organisation dedicated to the education and training needs of brewers & distillers & those in related

industries. They do this by offering a range of internationally recognised qualifications and the training to support

them, either through direct instruction or distance learning. Taste 4 Success (Skillnets) also run a Diploma in

Brewing Course. See the following link http://taste4success.ie/current-courses

9. INSURANCE:

You should also speak to your Insurer as you will probably require Manufacturers and Wholesalers insurance cover.

Some areas for insurance cover consideration should include the following:

Material damage insurance

Business interruption insurance

Employer’s liability insurance

Public & products liability insurance

Goods-in-transit insurance

Fidelity cover insurance

Personal accident insurance

Engineering insurance

Assigning your Brew Pub Insurance liabilities to your existing insurance policy (approx. 50% of cost)

More tips for the aspiring microbrewer:

1. The rate at which you can learn is proportional to how often you can brew. Consider how much time

2.

3.

4.

5.

6.

7.

8.

you have after family and other commitments.

Visit as many breweries as you can and offer yourself for unpaid work.

Don’t blow your capital all at once – used equipment is generally fine for starting a microbrewery.

If you already have a steady income or small business, keep it going to subsidise your first brews.

Finding suitable, affordable premises is tricky – keep an eye out for former dairies, unusedschoolhouses/aesthetic buildings etc.

Know the competition well and imagine it doubled when looking ahead.

Give careful consideration to who you supply product to – will you get paid and when.

Make the beer you’ve always wanted to make – it’s about craft, not consensus.

6.

The information provided here is for guidance only. Whilst every effort has been taken in compiling the “VFI

Setting up a Microbrewery Guide” the authors do not accept responsibility for errors or omissions contained herein.

© copyright: Vintners Federation of Ireland 2016 (April).

All Rights Reserved. No part of this publication may be copied, reproduced or transmitted in any form or by any

means, without written permission of Vintners Federation of Ireland.

A special thanks to all members of the “VFI Setting up a Microbrewery Guide” Technical Group for all of their

hard work, time & worthwhile contributions.

7.