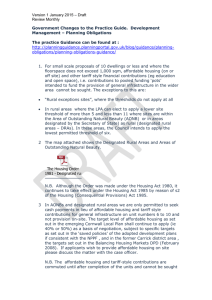

11 units or more? 1001 sqm or more?

advertisement

Briefing note on changes to National Planning Policy When will affordable housing and tariff style planning obligations be sought in the East Riding of Yorkshire? Overview On 28 November 2014 National Planning Policy was amended through a Written Ministerial Statement1 to define the specific circumstances when contributions for affordable housing and tariff style planning obligations (i.e. contributions to pooled funding pots intended to provide common types of infrastructure for the wider area, such as contributions towards off-site open space) can be sought. The Planning Practice Guidance (PPG) was also updated to reflect this change2. There are no 'designated rural areas' in the East Riding. Therefore, affordable housing and tariff style planning obligations should only be sought from residential developments comprising of 11 or more dwellings and residential developments which have a combined gross floorspace of 1,001sqm or more. This change does not affect other forms of planning obligations which are necessary to make a development acceptable in planning terms, such as site specific infrastructure, or measures needed to meet other regulatory requirements (such as the habitats regulations). A 'vacant building credit' has also been introduced. This will apply where a vacant building (which has not been abandoned) is to be brought back into any lawful use, or is to be demolished and replaced by a new building, as part of the development. In such instances, the developer will be offered a financial credit equivalent to the existing gross floorpsace of the relevant vacant building when the affordable housing contribution is calculated. Affordable housing contributions would be required for any net increase in floorspace. The vacant building credit will not affect the collection of tariff style contributions, such as contributions towards off-site open space. How can I determine whether affordable housing or tariff style contributions may be sought? The flow diagram below illustrates how the number of dwellings proposed, and their combined total gross floorspace, influences whether affordable housing or tariff contributions may be sought: 11 units or more? Yes Can take affordable housing and tariff style contributions 1 No 1001 sqm or more? Yes No Cannot take affordable housing or tariff style contributions Can take affordable housing and tariff style contributions See http://www.publications.parliament.uk/pa/cm201415/cmhansrd/cm141128/wmstext/141128m0001.htm#14 112842000008 2 See http://planningguidance.planningportal.gov.uk/blog/guidance/planning-obligations/planningobligations-guidance/ A number of example scenarios are outlined in the table below; Scenario Can it provide AH or tariff style contributions? Explanation: 11 unit scheme, with a total combined gross floorspace of 1,100 sqm. Yes 11 or more units are being provided. 11 unit scheme, with a total combined gross floorspace of 900 sqm. Yes 11 or more units are being provided. 15 unit scheme, with a total combined gross floorspace of 750 sqm. Yes 11 or more units are being provided. 10 unit scheme, with a total combined gross floorspace of 1,100 sqm. Yes There are less than 11 units but it will provide more than 1,001 sqm. 7 unit scheme, with a total combined gross floorspace of 1,001 sqm. Yes There are less than 11 units but it will provide 1,001 sqm. 10 unit scheme, with a total combined gross floorspace of 900 sqm. No There are less than 11 units and it will provide less than 1,001 sqm. 5 unit scheme, with a total combined gross floorspace of 1,000 sqm. No There are less than 11 units, and it will provide less than 1,001 sqm. 10 unit scheme, with a total combined gross floorspace of 1,100. The scheme involves the conversion of a 600sqm building which has not been abandoned (and so there is a net gain of 500 sqm). Yes There are less than 11 units, but it will provide more than 1,001 sqm combined gross floorspace. A vacant building credit will applied equivalent to 600 sqm when the affordable housing contribution is calculated (see example below). Are there any other types of developments that are exempt from a requirement to make affordable housing or tariff style contributions? Yes. The following types of development will also be exempt from any requirement to make affordable housing or tariff style contributions; Schemes consisting only of the construction of a residential annex or an extension to an existing home Schemes coming forward under the Starter Home Exception Sites policy3 Are there any exceptions to these rules? Yes. The restriction on affordable housing and tariff style contributions does not apply to rural exception sites. This means that developments of less than 10 dwellings and 1,001 sqm can still be permitted as exceptions sites under the provisions of Policy H2 of the Proposed Submission Strategy Document and required to provide all (or at least 80% of the units if this is not achievable) as affordable housing. 3 For information on the Starter Homes Exception Site policy, see http://planningguidance.planningportal.gov.uk/blog/guidance/starter-homes/ What should be taken into account when calculating the combined gross floorspace of a scheme? When determining whether a scheme of less than 11 dwellings would be exempt from making affordable housing or tariff style contributions the Gross Internal Area (GIA) of the scheme will be considered. This is the area of the building measured to the internal face of the perimeter walls at each floor level. The use of GIA is consistent with the guidance of the PPG in relation to calculating floorspace for the purposes of the Community Infrastructure Levy4. This measurement should take into account the gross internal floor area of new dwellings, extensions, conversions, garages and any other buildings ancillary to residential use. It should include all rooms, circulation and service space, including lifts, floorspace devoted to corridors, toilets, ancillary floorspace (e.g. underground parking). In flatted developments, it should include communal entrances, landings etc, and any related internal parking. Best practice guidance for measuring GIA is set out within the Royal Institute of Chartered Surveyors (RICS) Code of Measuring Practice5. What happens if it is not possible to determine from the information submitted with an outline application whether or not the development will exceed these thresholds? In some instances it may not be possible to determine whether an outline proposal will exceed the thresholds for requiring contributions to affordable housing and tariff style contributions. For example, the exact number of dwellings and/or their combined gross floorspace may not yet have been determined and so will be subject to approval at reserved matters stage. In such instances, conditions should be attached to any approval which make clear that any necessary contributions to affordable housing or tariff style contributions will be calculated at Reserved Matters stage. How will the vacant building credit be taken into account when affordable housing contributions are calculated? When a development exceeds the 11 dwellings or 1,001 sqm combined gross floorspace threshold, and there there will be an overall increase in floorspace as a result of the proposed development, the affordable housing contribution will be calculated on the basis of the total number of dwellings proposed by the scheme, in accordance with the percentage requirements set out in Policy H2 of the Proposed Submission Strategy Document. A 'credit' will then be applied which is the equivalent of the gross floorspace of any relevant vacant building that is to be brought back into use, or demolished and replaced by a new building, as part of the proposal. 4 See http://planningguidance.planningportal.gov.uk/blog/guidance/community-infrastructure-levy/cilintroduction/ 5 See http://www.lambertsurv.co.uk/downloads/RICS%20Code%20of%20Measuring%20Practice.pdf A worked example is provided below for a scheme which has the following characteristics; The development is proposed on a site which contains a 1,200 sqm warehouse (which has not been abandoned). The proposal is to demolish the warehouse, and develop 40 dwellings which each have a GIA of 100sqm, and so have a total combined gross floorspace of 4,000 sqm. The site is within Beverley and Central sub-area, where Policy H2 of the Proposed Submission Strategy Document identifies there is a 25% affordable housing requirement. Step Example 1. Work out what the affordable housing requirement would normally be for this scheme. 25% of 40 dwellings = 10 affordable dwellings 2. Work out what proportion the existing floorspace (which is to be demolished and replaced, or converted, as part of the development) is of the total gross combined floorspace. 3. Apply a discount, equivalent to the % of the scheme which is existing floorspace, to the affordable housing requirement. 1,200 sqm ÷ 4,000 sqm = 0.3 (or 30%) 30% of 10 = 3 dwelling discount 10 - 3 = 7 affordable dwellings required If, in this example, the existing building was... 2,000 sqm: this is 50% of the total combined gross floorspace, and so a 50% discount to the affordable housing requirement would be applied. 5 dwellings would be expected to be provided as affordable housing. 4,000 sqm: there would be no net increase in floorspace, and so no affordable housing contribution would be required (i.e. a 100% discount). What factors will be taken into account when considering how the vacant building credit should apply? In accordance with the guidance of the PPG, the council will have regard to the intention of national policy. As part of this, it will be recognised that the vacant building credit is intended to incentivise brownfield development, including the reuse or redevelopment of empty and redundant buildings. Account may also be taken of other factors, such as whether the building has been made vacant for the sole purpose of redevelopment, or whether the building is covered by an extant or recently expired planning permission for the same, or substantially the same, development. Will account be taken of buildings that were previously on a site but which were cleared before planning permission was sought? No. Only the floorspace of buildings that are on site the day planning permission is granted will be taken into account when calculating the vacant building credit. Forward Planning May 2015