File - ECONOMIC SOCIETY

advertisement

Exiting Quantitative Easing: which expectations

matter?

Lorenzo Rigon1

September 2014

1

Il presente documento è di esclusiva pertinenza del relativo autore ed è esclusivamente riservato per

l’uso espressamente consentito dall’autore medesimo, senza il cui preventivo espresso consenso

scritto non può essere ulteriormente distribuito, adattato, memorizzato ovvero riprodotto, in tutto o in

parte e in qualsiasi forma e tecnica.

1

Table of Contents

1.

Abstract................................................................................................................................................. 3

2.

Introduction .......................................................................................................................................... 4

3.

Theorical Framework: A Different prospective on Expectations........................................................ 5

4.

Independent Variable representing QE: Stock or Flow? Spot looking or Forward looking? ............. 8

a.

Stock dimension vs Flow dimension. ............................................................................................... 9

b.

OMO Expectation Revision… ........................................................................................................... 9

c.

…which in practice translates into Spot looking analysis: ............................................................ 10

d.

Program Expectation Revision: a Forward looking Analysis ........................................................ 11

5.

Dependent Variable: Capturing the effects of QE Expectation Revision, all channels considered. 13

6.

Average Maturity, Control Variables and Caveats ............................................................................ 15

a.

Average Maturity ........................................................................................................................... 15

b.

Business Cycle Controls .................................................................................................................. 16

c.

Omission of Other UMP tools ........................................................................................................ 16

d.

Major Assumptions used to project Expectations ........................................................................ 17

7.

Empirical Evidence. ............................................................................................................................ 19

8.

Conclusions ......................................................................................................................................... 27

9.

References .......................................................................................................................................... 28

2

1. Abstract

When will the US Quantitative Easing actually be over? This work intends to contribute to this

question by investigating two related questions: Is QE a stock variable or a flow one? Is QE

relevant in its present or future expected size? We first formulate these two questions

rigorously in terms of relevant expectation revisions. The four possible answers lead us to

define four forms of the independent variable representing QE. Then, thanks to a reasonable

assumption on the data, we translate two of such variables into more practical and meaningful

ones, and build the remaining two through a series of projections of expected path of the size

of QE. Finally, including some relevant controls, we will look at which form of the independent

variable provides us with the best explanation for the effects of QE on Yield Curves, and draw

our conclusions.

3

2. Introduction

Many of the most important central banks embarked in quantitative easing (QE) programs

during the Great Recession. Now, some of those economies are moving out of recession and

the central banks are pondering the exit from previous extraordinary measures.

In order to understand the impact of the end of QE, it is important to firm the understanding of

the impact of the QE programs, when they were firstly introduced. However, there is not a

consensus on the origin of the effect of the QE on the yields curves; some (BoE) tend to

emphasize more a stock effect while others (Fed) tend to put more weight on a flow effect.

Moreover, it is yet not clear if the relevant measure of QE is its current size, or its expected

future size.

This work, starting from these two questions, tries to shed light on that debate in order to get

better reading on the implications of a future exit from the QE programs.

Section 3 traces a general theorical framework for Unconventional Monetary Policy according

to recent Literature. This will provide us with some orientation, since our two questions arise

from a change of prospective on a part of this framework.

Section 4 formulates our two questions in rigorous theorical terms of expectation revisions, and

from the four possible answers draws four different “measures” QE expectation revisions.

Then, an assumption on the data will allow us to redefine two of these variables in terms of

actual size of Fed Permanent holdings. We end up with four forms of the independent variable,

each representing an interpretation of QE.

Section 5 defines and justifies the choice of the dependent variable.

Section 6 will integrate our analysis with a measure of actual and expected Average Maturity,

and with some Control Variables that are necessary to compare QE effects in different

moments of the business cycle. Then some caveats and limitations of our analysis are

highlighted. In particular, assumptions used to project expectations are shown.

Section 7 presents the results of the regression analysis, and considers some robustness checks.

Section 8 draws the conclusions.

Section 9 includes the reference that was fundamental in shaping this research and some more

essential reference on the topic.

4

3. Theorical Framework: A Different prospective on Expectations

Quantitative Easing (QE) is an unconventional monetary policy (UMP) tool.

Unconventional Monetary Policy aims at stabilising financial markets and lowering effective

interest rates charged on funding to real economy, when the short-term rates on central bank

reserves have reached their effective lower bound1.

Quantitative Easing serves this purpose through assets purchases that are larger in scale and

include a broader range of assets than conventional purchases of treasury securities. QE is

usually implemented when conventional purchases have already pushed the short-term rates

on reserves at their lower floor2, set at the effective lower bound.

Just a small part of the effects of QE happens when the purchases are settled. These small,

intraday “Local Supply Effects” are mostly due to imperfect arbitrage and market frictions3.

The bulk of the effects come instead from Expectation Revisions, happening on

Announcements4.

Literature5 has so far focused on disaggregating the effects of Quantitative Easing Expectation

Revisions on Yield Curves into different “channels”, as the diagram below summarises.

By contrast, our focus will shift the prospective on the nature of expectations that are the most

relevant. This new focus is explained in the second diagram below, and will be used in the next

section to formulate four different measures of QE expectation revisions.

1. From Harrison, 2012: “In principle, ELB may be higher than zero if there are transactional costs associated with

holding money (see Yates, 2003). But in practice, it may be positive for a number of reasons. For example, low levels

of policy rates may cause difficulties for the functioning of financial intermediaries that maintain a spread between

deposit and lending rates to cover the costs of providing banking services and to make a return on capital (see Bank

of England, 2009)”.

2. The lower floor in the US is currently set by the Reverse Repo facility interest rate, since not all the holders of

reserves, namely the GSEs, have access to the Interest Rate on Excess Reserves.

3. On the relevance and nature of Local Supply effects, I refer to D’Amico and King, 2012, “Flow and Stock Effects of

LSAP: Evidence on the importance of Local Supply”, FEDS, and to Daines, Joyce and Tong, 2012, “QE and the gilt

market, a disaggregated analysis”, BoE Working Paper 466. Please notice that D’Amico and King define Stock and

Flow Effects what we define respectively Expectation Revision Effects and Local Supply Effects.

4. This statement will be discussed in depth in Section 5, with regard to the observations of Foerster and Cao, 2013,

“Expectations of Large Scale Asset Purchases”, Economic Review Second Quarter 2013, Kansas City FRB.

5. Reviewed Literature is fully listed in the reference appendix. For the channel analysis, I mainly refer to Krishnamurhy

and Vissing-Jorgestern, “The Effects of QE on Interest Rates, Channels and Implications for Policy”, 2011 NBER; Wu,

2013, “Unconventional Monetary Policy and Long Term Interest Rates, IMF; IMF Report 2013a and the 5two papers at

point 4.

Literature Analysis: Focus on Channels for Expectation Revisions

UNCONVENTIONAL MONETARY POLICY TOOLS

Tools to stabilise markets and/or lower interest rates when effective lower bound on short-term

reserve rates is reached

QUANTITATIVE EASING

(Larger-scale asset

purchases)

LIQUIDITY PROVISION

(Longer term, cheaper,

and/or emergency lending)

EXPECTATION REVISION EFFECTS

(Major effects on announcements due to

expectation revision)

LOCAL SUPPLY EFFECTS

(Minor effects on settlements

due to imperfect arbitrage)

FORWARD GUIDANCE

(Announcements on long-term

future policy rates)

SIGNALING CHANNEL

(Announced purchases lower

expected future policy rates)

PORTFOLIO BALANCE

CHANNELS

(Announced purchases alter

expected future relative supply

of assets, altering term premia)

INFLATION CHANNEL

(Announced purchases higher

expected future inflation rate)

DURATION PREMIA CHANNEL

(Announced purchases of longer duration assets lower expected future relative supply of longer-duration

assets, lowering the duration premia)

LIQUIDITY PREMIA CHANNEL

(Announced purchases of treasury securities lower expected future relative supply of liquid securities, rising

the liquidity premia, lowering treasury rates and rising non-treasury rates)

SAFETY PREMIA CHANNEL

(Announced purchases of government securities lower expected relative future supply of “super-safe”

securities, rising the safety premia, lowering government security rates, rising non–government rates)

DEFAULT RISK PREMIA CHANNEL

(Announced purchases of higher default risk assets lower expected future relative supply of default-risky

assets, lowering the default risk premia)

PREPAYMENT RISK PREMIA CHANNEL

(Announced purchases of prepayable assets (in general MBS) lower expected future relative supply of

prepayment-risky securities, lowering the prepayment risk premia)

6

Our Analysis: focus on nature of Expectation Revisions

UNCONVENTIONAL MONETARY POLICY TOOLS

Tools to stabilise markets and/or lower interest rates when effective lower bound on short-term

reserve rates is reached

FORWARD GUIDANCE

QUANTITATIVE EASING

(Announcements on long-term

future policy rates)

(Larger-scale asset

purchases)

EXPECTATION REVISIONS EFFECTS

(Major effects on announcements

due to expectation revision)

LIQUIDITY PROVISION

(Longer term, cheaper,

and/or emergency lending)

LOCAL SUPPLY EFFECTS

(Minor effects on settlements

due to imperfect arbitrage)

OMO ANNOUNCEMENT

EXPECTATION REVISIONS

Revisions of one-day

expectations due to single Open

Market Operations

announcements

STOCK DIMENSION

OF EXPECTATION

REVISIONS

Difference with Pre-QE

Expectation

FLOW DIMENSION

OF EXPECTATION

REVISIONS

Difference with previous

Expectation Revision

PROGRAM

ANNOUNCEMENT

EXPECTATION REVISIONS

Revisions of longer –term

expectations due to

announcements on the longerterm path of QE Program

EXPECTATION REVISIONS DUE

TO OMO ANNOUNCEMENTS IN

THEIR STOCK DIMENSION

EXPECTATION REVISIONS DUE

TO PROGRAM

ANNOUNCEMENTS IN THEIR

STOCK DIMENSION

EXPECTATION REVISIONS DUE

TO OMO ANNOUNCEMENTS IN

THEIR FLOW DIMENSION

EXPECTATION REVISIONS DUE

TO PROGRAM

ANNOUNCEMENTS IN THEIR

FLOW DIMENSION

7

4. Independent Variable representing QE: Stock or Flow? Spot

looking or Forward looking?

As represented in the diagram above, we think that there are two relevant questions to answer

in order to understand the effects of QE arising from expectation revisions:

1. Whether expectation revisions are relevant in their Stock or Flow dimension

2. Whether relevant expectation revisions are the revisions of one-day expectations,

arising from OMO announcements on single purchases, or the revisions of longer- term

expectations, arising from Program announcements on the future path of the

purchases.

The possible answers questions will lead us to formulate four different theorical measures of

revision of expectations on the “Level of QE”, or “QE Level”.

Let us first define “FED Size” at time t(-∞,T), in days1 , the total amounts of assets purchased

by the FED in settled Permanent Open Market Operations, net of principal and coupon

repayments.

𝐹𝐸𝐷𝑆𝐼𝑍𝐸 (𝑡) ≡ 𝑁𝐸𝑇 𝑉𝐴𝐿𝑈𝐸 𝑂𝐹 𝐴𝑆𝑆𝐸𝑇𝑆 𝐹𝑅𝑂𝑀 𝑆𝐸𝑇𝑇𝐿𝐸𝐷 𝑃𝐸𝑅𝑀𝐴𝑁𝐸𝑁𝑇 𝑂𝑀𝑂𝑠(𝑡)

Now, we will define “QE Level” as the difference between the current FED Size, and the FED size

just before the first QE Program Announcement.

𝑄𝐸𝐿𝐸𝑉𝐸𝐿 (𝑡) ≡ 𝐹𝐸𝐷𝑆𝐼𝑍𝐸(𝑡) − 𝐹𝐸𝐷𝑆𝐼𝑍𝐸(0)

Then, the four theorical measures of revision of expectations on the level of QE will be:

Theorical Specifications

Indipendent Variable

expressing Expectation

Revisions on QE Level.

Expectation Revision due to

Announcements on Single

Purchases

Expectation Revision due to

Announcements on Program Path

Stock Dimension of Expectation

Revision

How much OMO Announcement

changes the previous 1-day

expectation on Level of QE

How much Program

Announcement changes the

previous longer-term expectation

on Level of QE

Flow Dimension Of Expectation

Revision

How much OMO Announcement

changes the previous change of

1-day expectation on Level of QE

How much Program

Announcement changes the

previous change of longer-term

expectation on Level of QE

1. t=0 is the start of QE, and will be set at the first QE Program. The time framing actually used for our analysis of the

8

data may and shall not be daily. In fact, we will use weekly data.

a. Stock dimension vs Flow dimension.

Analysing the Stock Dimension of Expectation Revisions means to consider how much

announcements change expected QE Level, which is, look at first order differences. If this

dimension is the relevant one, effects on interest rates must be expected to unwind as soon as

expectations on QE Level become zero.

Analysing the flow dimension of Expectation Revisions means considering how much

announcements change variations of expected QE Level, which is, look at second order

differences. If this dimension is the relevant one, effects on interest rates must be expected to

unwind as soon as changes of expectations on QE Level become zero.

b. OMO Expectation Revision…

The most intuitive way to analyse QE is to consider the effects on expected QE Level of single

permanent purchases at their announcement, when each single Permanent OMO result is

announced and the total amounts allotted into the specific securities that are to be purchased

the following day. We shall call these one-day expectations “OMO Expectations” and their

change “OMO Expectation Revision”. The graph in terms of QE Level described by OMO

Expectations will track exactly the graph drawn by the actual QE Level, but one day in advance.

1. The OMO EXPECTATION at time t is the QE Level expected in t for t+1,resulting from

Permanent OMO net purchases announced in t with certain settlement in t+1:

𝑄𝐸𝐿𝐸𝑉𝐸𝐿𝑒𝑂𝑀𝑂 (𝑡) ≡ 𝐸𝑡 [𝑄𝐸𝐿𝐸𝑉𝐸𝐿 (𝑡 + 1)]

= 𝐸𝑡 [𝐹𝐸𝐷𝑆𝐼𝑍𝐸(𝑡 + 1) − 𝐹𝐸𝐷𝑆𝐼𝑍𝐸(0)]

= 𝐹𝐸𝐷𝑆𝐼𝑍𝐸(𝑡 + 1) − 𝐹𝐸𝐷𝑆𝐼𝑍𝐸(0)

= 𝑄𝐸𝐿𝐸𝑉𝐸𝐿 (𝑡 + 1)

I.

The Stock Dimension of OMO Expectation Revision in day t shall be the difference of

OMO Expectations in t for the day t+1 and the OMO Expectations in t=-1 for the day of

start of QE, t=0:

𝑂𝑀𝑂 𝑆𝑇𝑂𝐶𝐾(𝑡) ≡ 𝐸𝑡 [𝑄𝐸𝐿𝐸𝑉𝐸𝐿 (𝑡 + 1)] − 𝐸−1 [𝑄𝐸𝐿𝐸𝑉𝐸𝐿 (0)]

= 𝑄𝐸𝐿𝐸𝑉𝐸𝐿𝑒𝑂𝑀𝑂 (𝑡) − 𝑄𝐸𝐿𝐸𝑉𝐸𝐿𝑒𝑂𝑀𝑂 (−1)

9

= [𝐹𝐸𝐷𝑆𝐼𝑍𝐸(𝑡 + 1) − 𝐹𝐸𝐷𝑆𝐼𝑍𝐸(0)] − [𝐹𝐸𝐷𝑆𝐼𝑍𝐸(0) − 𝐹𝐸𝐷𝑆𝐼𝑍𝐸(0)]

= 𝐹𝐸𝐷𝑆𝐼𝑍𝐸(𝑡 + 1) − 𝐹𝐸𝐷𝑆𝐼𝑍𝐸(0)

= 𝑄𝐸𝐿𝐸𝑉𝐸𝐿𝑒𝑂𝑀𝑂 (𝑡)

= 𝑄𝐸𝐿𝐸𝑉𝐸𝐿 (𝑡 + 1)

II.

The Flow dimension of OMO Expectation Revision shall be the difference of OMO

Expectations in t for the day t+1 and the OMO Expectations for day t:

𝑂𝑀𝑂 𝐹𝐿𝑂𝑊 (𝑡) ≡ 𝐸𝑡 [𝑄𝐸𝐿𝐸𝑉𝐸𝐿 (𝑡 + 1)] − 𝐸𝑡−1 [𝑄𝐸𝐿𝐸𝑉𝐸𝐿 (𝑡)]

= 𝑄𝐸𝐿𝐸𝑉𝐸𝐿𝑒𝑂𝑀𝑂 (𝑡) − 𝑄𝐸𝐿𝐸𝑉𝐸𝐿𝑒𝑂𝑀𝑂 (𝑡 − 1) = 𝑄𝐸𝐿𝐸𝑉𝐸𝐿𝑒𝑂𝑀𝑂 (𝑡)

= 𝐹𝐸𝐷𝑆𝐼𝑍𝐸(𝑡 + 1) − 𝐹𝐸𝐷𝑆𝐼𝑍𝐸(𝑡)

= ∆𝑄𝐸𝐿𝐸𝑉𝐸𝐿 (𝑡 + 1)

c. …which in practice translates into Spot looking analysis:

Evidently, if we consider weekly data, the data on one-day expectations on Fed Size are almost4

equal to the data on the actual FED Size.

Therefore, the weekly data on OMO Expectation are almost equal to the actual weekly QE Level

data, and the analysis of OMO Expectation Revisions can more practically be done with an

analysis of current QE Level, with no loss for the conceptual relevance of this variable.

Daily Data: time t(-∞,T) is in days

in weeks

𝑂𝑀𝑂 𝑆𝑇𝑂𝐶𝐾(𝑡) = 𝑄𝐸𝐿𝐸𝑉𝐸𝐿 (𝑡 + 1)

𝑂𝑀𝑂 𝐹𝐿𝑂𝑊(𝑡) = ∆𝑄𝐸𝐿𝐸𝑉𝐸𝐿 (𝑡 + 1)

Weekly Data: time t(-∞,T) is

𝑂𝑀𝑂 𝑆𝑇𝑂𝐶𝐾(𝑡) = 𝑄𝐸𝐿𝐸𝑉𝐸𝐿 (𝑡)

𝑂𝑀𝑂 𝐹𝐿𝑂𝑊(𝑡) = ∆𝑄𝐸𝐿𝐸𝑉𝐸𝐿 (𝑡)

We will call this analysis “Spot Looking”, since it focuses on the current QE Levels, and rename

the above variables as “Spot Stock” and “Spot Flow”.

Notice that the stock variable reaches zero when the Balance Sheet returns to Pre-QE size. This

1. Differences for any week X arise only from

a) The difference of the amount of Permanent purchases announced the last day of the week X-1, but settled in the first day of

week X, and amount of Permanent purchases announced the last day of week X, but settled in the first day of week X+1.

b) The difference in amounts of coupons and principal repayments received from Permanent Purchases in the first day of week X

and their amounts for the first day of week X+1.

We assume these differences to be zero.

10

is the extremisation of the Stock interpretation of Exit Strategy of the BoE.

By contrast, the flow variable reaches zero when no new purchases are made. This is the Flow

interpretation of Exit Strategy of the Fed.

d. Program Expectation Revision: a Forward looking Analysis

Market reactions to more general announcements on the future of QE programs suggest that

the approach above may not yield a satisfactory explanation. To capture the effects of such

program announcements the idea is to infer how much these announcements change the

expected path of future permanent purchases, and utilise this change in longer-term QE

expectations as independent variable. We shall call these longer-term expectations “Program

Expectations” and their change “Program Expectation Revision”. We shall consider as Program

Expectation the expected QE Level S month in the future, as inferable from the latest Program

Announcement.

1. The PROGRAM EXPECTATION at time t is the QE Level expected for t+S, resulting from

Permanent OMO net purchases announced in t with settlement up to t+S. We set S as

time to longer-term Program Expectation:

𝑄𝐸 𝑒𝑃𝑅𝑂𝐺𝑅𝐴𝑀 (𝑡) ≡ 𝐸𝑡 [𝑄𝐸𝐿𝐸𝑉𝐸𝐿 (𝑡 + 𝑆)]

= 𝐸𝑡 [𝐹𝐸𝐷𝑆𝐼𝑍𝐸(𝑡 + 𝑆) − 𝐹𝐸𝐷𝑆𝐼𝑍𝐸(0)]

= 𝐸𝑡 [𝐹𝐸𝐷𝑆𝐼𝑍𝐸(𝑡 + 𝑆)] − 𝐹𝐸𝐷𝑆𝐼𝑍𝐸(0)

I.

The Stock Dimension of Program Expectation Revision shall be the difference of Program

Expectations for the day t+S and the Program Expectations for the day of start of QE

𝑃𝑅𝑂𝐺𝑅𝐴𝑀 𝑆𝑇𝑂𝐶𝐾 ≡ 𝐸𝑡 [𝑄𝐸𝐿𝐸𝑉𝐸𝐿 (𝑡 + 𝑆)] − 𝐸−𝑆 [𝑄𝐸𝐿𝐸𝑉𝐸𝐿 (0)]

= 𝑄𝐸 𝑒𝑃𝑅𝑂𝐺𝑅𝐴𝑀 (𝑡)−𝑄𝐸 𝑒𝑃𝑅𝑂𝐺𝑅𝐴𝑀 (−𝑆) =

11

= 𝐸𝑡 [𝐹𝐸𝐷𝑆𝐼𝑍𝐸(𝑡 + 𝑆) − 𝐹𝐸𝐷𝑆𝐼𝑍𝐸(0)] − 𝐸−𝑆 [𝐹𝐸𝐷𝑆𝐼𝑍𝐸(0) − 𝐹𝐸𝐷𝑆𝐼𝑍𝐸(0)]

= 𝑄𝐸 𝑒𝑃𝑅𝑂𝐺𝑅𝐴𝑀 (𝑡) = 𝐸𝑡 [𝑄𝐸𝐿𝐸𝑉𝐸𝐿 (𝑡 + 𝑆)]

Strictly speaking, the above Expectation 𝑄𝐸 𝑒𝑃𝑅𝑂𝐺𝑅𝐴𝑀 (−𝑆) makes sense only if

the first QE Program Announcement was announced in t≤-S, which is not true if

we set this announcement at t=0. To settle the formality, we impose that if the

First QE announcement is after –S, then

𝑄𝐸 𝑒𝑃𝑅𝑂𝐺𝑅𝐴𝑀 (−𝑆) = 0

II.

The Flow dimension of Program Expectation Revision shall be the difference of Program

Expectations in t for the day t+S and the Program Expectations in t-1 for day t-1+S:

𝑃𝑅𝑂𝐺𝑅𝐴𝑀 𝐹𝐿𝑂𝑊 ≡ 𝐸𝑡 [𝑄𝐸𝐿𝐸𝑉𝐸𝐿 (𝑡 + 𝑆)] − 𝐸𝑡−1 [𝑄𝐸𝐿𝐸𝑉𝐸𝐿 (𝑡 − 1 + 𝑆)]

= 𝑄𝐸 𝑒𝑃𝑅𝑂𝐺𝑅𝐴𝑀 (𝑡)−𝑄𝐸 𝑒𝑃𝑅𝑂𝐺𝑅𝐴𝑀 (𝑡 − 1) = ∆𝑄𝐸 𝑒𝑃𝑅𝑂𝐺𝑅𝐴𝑀 (𝑡)

Since these variables focus on the future, we will call their analysis “Forward Looking” and will

refer to PROGRAM STOCK and to PROGRAM FLOW calling them FORWARD STOCK and

FORWARD FLOW.

Practical Specifications of the

Independent Variables

expressing Expectation

Revisions on QE Level

Spot Looking Analysis

Forward Looking Analysis

Stock Dimension

𝑄𝐸𝐿𝐸𝑉𝐸𝐿 (𝑡)

𝐸𝑡 [𝑄𝐸𝐿𝐸𝑉𝐸𝐿 (𝑡 + 𝑆)]

Flow Dimension

∆𝑄𝐸𝐿𝐸𝑉𝐸𝐿 (𝑡)

∆𝐸𝑡 [𝑄𝐸𝐿𝐸𝑉𝐸𝐿 (𝑡 + 𝑆)]

12

a. .How to compare the explanations?

To compare the plausibility of our four different interpretations, we will consider which of the

previous forms of the independent variable is more relevant in accounting for the change in the

shape and form of the yield Curve. We will focus on USA BB+ Bonds Yield curves, comparing the

adjusted R2 coefficients in significant regressions.

5. Dependent Variable: Capturing the effects of QE Expectation

Revision, all channels considered.

Coherently with the prospective of our research, explained in Section 1, we need to capture the

effects of expectation revisions conveyed through all the channels that Literature has instead

disaggregated. The logical Yield Curves to observe then are the ones for medium quality

corporate bonds.

We shall use the USA BB+ Bonds Yield Curves published by Standard&Poors Global Fixed

Income Research, since they provide us with a nice weekly time series of effective rates on

Wednesdays, for 5, 10, 15, 20 and 25 years maturities of industrial Corporate Bonds1.

We will consider the average level of Yield Curves in its stock dimension, intended as the

difference between initial (pre-QE) and current levels, since this is the most relevant dimension

to understand the consequences of the Exit Strategy.

An interesting integration of our analysis would have been to consider also shape features of

the Yield Curves, such as their Slope and Convexity, or to focus on specific Maturities. This,

however, is beyond the scope and resources of the present analysis, and is a possible extension

of it.

1. AGGREGATE EFFECT ON YIELD CURVE

Let us define i(t,s) as BB+ spot curve at time t(0,T) for s months of maturities,

s(0,S).

𝑆

Its average vertical value is 𝐼(𝑡) = {[∫𝑠=0 𝑖(𝑡, 𝑠) 𝑑𝑠 ] /𝑆}

Its slope is 𝑆𝐿𝑂𝑃𝐸 (𝑡) = {[𝑖(𝑡, 𝑆) − 𝑖(𝑡, 0)]/𝑆}

13

Its convexity shall be 𝐶𝑂𝑁𝑉 (𝑡) = 𝑖 (𝑡, 𝑆/2) − {[𝑖(𝑡, 𝑆) − 𝑖(𝑡, 0)]/2}

I.

Then the variation in average Level can be computed as:

𝑆

[𝑖(𝑡, 𝑠) − 𝑖(0, 𝑠)]𝑑𝑠

∫

∆𝐼(𝑡) = 𝑠=0

𝑆

Since in practice Yield Curves will be described by discrete points, the

integral will be approximated as a discrete sum:

∑𝑆𝑠=0 𝑖(𝑡, 𝑠) − 𝑖(0, 𝑠)

∆𝑖(𝑡) =

𝑆

II.

The Convexity Variation Shall be defined as

∆𝐶𝑂𝑁𝑉(𝑡) = 𝐶𝑂𝑁𝑉(𝑡) − 𝐶𝑂𝑁𝑉(0)

III.

The Slope Variation shall be

∆𝑆𝐿𝑂𝑃𝐸(𝑡) = 𝑆𝐿𝑂𝑃𝐸(𝑡) − 𝑆𝐿𝑂𝑃𝐸(0)

2. EFFECT ON SPECIFIC MATURITIES

For some relevant Maturities 𝑀 ∈ { 0, 3, 6, 12, 24, 36, 60, 120 } we may compute

the change

∆𝑀(𝑡) = 𝑖( 𝑡, 𝑀) − 𝑖(0, 𝑀)

1 We choose S&P data over Dow Jones Investment Grade Corporate Bonds because

a) S&P yields are effective, which is already corrected by volatility, whereas Dow Jones most suitable data would be

Yield to worse, which is the Yield for a particular holding period.

b) S&P Bond data is disaggregated for a wide range of ratings: BBB, A, AA and AAA data will be used for some

robustness checks.

c) Dow Jones Data are a mix of Investment Grade Bonds, including AAA. Safe Bonds are differently affected by the

default risk channel. The total effect of Expectation Revision would be distorted by such a mix, since some channels

(like the duration channel) would be considered always whereas some others (like the default risk) would be

underrepresented.

d) S&P Yield curve points are regularly spaced at 5y, 10y 15y, 20y and 25y maturities, therefore we may improperly

consider arithmetical averages as some loose sort of 15-years equivalent.

14

6. Average Maturity, Control Variables and Caveats

a. Average Maturity

Up to now, in the definition of our four Independent Variables, we have overseen the “quality”

of QE purchases, and only focused on their size. Evidently, we need to control for the average

maturity (AM) of the purchases, since ceteris paribus a different the AM of the purchased

assets will bring about different impact on the Yield Curves.

For the spot Analysis, we will include the stock and flow dimension of the Average Maturity of

non MBS SOMA Assets. The data here has been built1 using numerous “screenshots” of CUSIPlevel composition of SOMA balance sheet, completing the gaps with a linear evolution where

the changes were small enough. MBS information is dropped, since it depends on complex

expectations on prepayments.

With regard to the Forward looking analysis, we will include the same variables with S weeks

perfect foresight if a clear announcement on the future AM path is in place (like operation

TWIST announcement). In absence of such an announcement, and if the NY Fed Operational

Releases signals that the AM of purchases or reinvestments differs substantially from current

AM, we will infer a reasonable path for future AM based on said releases.

AM in years

Three Models for SOMA nonMBS Average Maturity

Model1: Correct AM using

Weekly BS Data on remaining

Face Values, ignores Coupons"

10 years

9 years

Operation

Twist

Model 2: Approximative AM

modelling H41 release on

Maturity Breakdown"

8 years

7 years

6 years

Date

Model 3: AM using Daily OMO

Data since 25/08/2005,

computing expected coupons

and repayments. Initially

imprecise due to dynamic of

holdiongs already held at

25/08/2005 "

1. The resulting time series (Model1) has been compared with the result of a much more extensive analysis based on

CUSIP level Permanent OMO Purchases since 2005 (Model2), and a model of H.4.1 FED Release. The result is

accurate enough for the period when the comparison was possible.

15

2. The main reference for macro control variables is Wu, 2013.

b. Business Cycle Controls

We consider the inclusion of some standard2 coincident controls for the business cycle and

other economic and market conditions that may influence Yield Curves:

1. Output Gap: US Output gap as a percentage of Nominal Potential GDP published by the

CBO.

2. Unemployment Gap: Seasonally Adjusted Civilian Unemployment- Natural Rate of

Unemployment by the CBO

3. Inflation: Trimmed-Mean 1-month PCE Inflation, Annual Rate (%), by FRB Dallas

4. Consumer Confidence on Present Situation: Seasonally adjusted, by the Conference Board,

indexed 1985.

5. Financial Market Volatility: Bank of America Merrill Lynch Option Volatility 1 month (MOVE

1m)

6. Industrial Production: Seasonally adjusted, by Haver Analytics, indexed 2007.

Selection among these Control Variables will be Justified in Section 6

Clearly, we will not control for Expected Inflation, Expected Volatility, or Consumer Confidence

for the Future, etc., since these controls on expectations would interfere with our analysis of

the Independent Variable. We will only control for the differences in present economic

conditions.

c. Omission of Other UMP tools

First and foremost, our analysis has the limit of not considering the effects of Forward

Guidance, which is deeply intermingled with the QE tool1. It would have been useful to control

for Forward Guidance Announcements, but it is beyond our scope and resources.

Secondly, we are not going to consider the Local Supply effects on the tern structure and on the

aggregate Yield Curve. Especially considering the period that we are going to analyse, at the

height of the crisis, intraday effects can be relevant, if minor compared to Expectation Revision

effects2. However, since BAA Corporate Bonds were not directly purchased in QE operations,

1. The issue of interrelation between Forward Guidance and QE Effects is central in Wu, 2013.

2. See Daines, Joyce and Tong, 2012, “QE and the Gilt Market, a Disaggregated Analysis”, BOE Working Paper 466 and

D’Amico and King, 2012, “Flow and Stock Effects of LSAP: Evidence on the importance of Local Supply”, FEDS

Working Papers.

16

and since we are taking weekly data, our concerns greatly diminish.

Finally, the same applies for the effects of the Emergency Liquidity facilities that the Fed

created at the height of the Crisis. Controlling for their effects would be useful, but it is not

possible here.

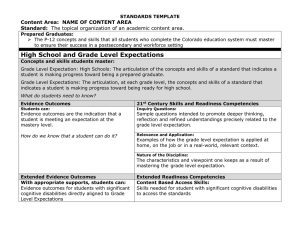

d. Major Assumptions used to project Expectations

In the process of projection of the future expected paths of the Fed Size, some

assumptions had to be made. In particular,

1. Expectations paths and revisions are designed after the details officially announced by

the Fed1. In reality, market participants have sometimes2 anticipated, overestimated or

underestimated these announcements. Therefore, Yield Curve reactions on

announcements may at times reflect the effect of a partial correction of expectations, as

some revision has already taken place3. This limitation is almost inevitable, and common

to all Literature studying the Effects of QE by channels3. Controlling for the amount and

quality of QE action already priced in by the markets is well beyond the scope and

resources of our work, and probably impossible. Even limiting our attention to the

expectations of the Primary Dealers, the Primary Dealer Survey published by the NY Fed

is only available after 2011, and its detail is insufficient3 to design expected paths for

expected Fed size. Moreover, even assuming that it was possible to build such paths, we

are interested in reconstructing the effects of QE, not of its perception. As a

consequence, we would need to distinguish to what extent the changes of these curves

are an anticipation of a determined future announcement, how much they overestimate

or underestimate it, or to what extent, for instance, they are a correction for the

reaction to a previous announcement …Such distinctions would be largely arbitrary.

These considerations however do not prevent us from using consensus information to

firm the interpretation of some parts of QE announcements.

2. The weekly decays of Treasuries, Agency Debt and MBS that are expected to take place

in case of no new purchases or no reinvestment of principal and coupon repayments

have been assumed to be equal to a 12 months moving average of the reductions of the

above listed balance sheet items unjustified by net purchases. The resulting decays are

approximatively consistent with the (scarce) information provided by the NY Fed

releases on reinvestments. Decays are assumed linear, and not exponential: this implies

1. Some general inspiration and guidance on this point came from Wu, 2013.

2. See Foerster and Cao, 2013, “Expectations of Large Scale Asset Purchases”, Economic Review Second Quarter 2013,

Kansas City FRB, where the problem is discussed in depth.

3. For instance, consider the case of the market reactions to Jackson Hole Speech of Bernanke in 27/08/2010,

anticipating QE2 official Announcement on 03/11/2010. Even more interesting is the 100Bp jump of 10 years

treasury Yields in the weeks following mid May 2013, as ex-post misleading news of imminent tapering started to

spread.

17

3.

4.

5.

6.

7.

that our projections of expectations become inaccurate for distant times in the future.

Finally, if a reinvestment policy is in place, we derive that holdings are expected to never

decay, coherently with the assumption at point 1 above.

Purchases of any given asset are assumed to be distributed smoothly between the date

of start of purchases of that asset and the date of ending of purchases for that asset,

where not differently announced.

The starting dates of purchases are set for the week after announcement where not

differently announced, and then possibly modified according to a reality check on the

actual start of purchases.

For QE1, the 2008 announcements do not specify how much time it would have taken to

complete the purchases of Agency Debt and MBS. We assume that “Several Quarters”

on 25/11/08 and then “Few Quarters” on 30/12/08 mean “by 15 September 2009”

consistently with subsequent announcement of slowdown and available surveys.

For QE2, the announced program was due to purchase 600Bn of treasuries by June

2010. However, these purchases were completed by early May, and by the end of June

additional 175Bn were purchased. I assume that the program expected ending date was

kept on June 30 until 11/05/2010, when it is suddenly revised since the total amount of

scheduled purchases is reached.

When tapering is announced, I assume that the expectation path includes a 10Bn taper

for all following meetings, in line with consensus at that date and reality so far. This is

justified as an interpretation of the FOMC Statements formula “ If incoming information

supports… (etc.), the committee will likely reduce the pace of assets purchases in

further measured steps at future meetings”

Expected Fed Size ($Mil)

Projected Expectations: QE1

1200000

1000000

800000

600000

400000

200000

0

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24

Horizon of Expectation: Months ahead

05 November 2008

12 November 2008

19 November 2008

26 November 2008

03 December 2008

10 December 2008

17 December 2008

24 December 2008

31 December 2008

07 January 2009

14 January 2009

21 January 2009

28 January 2009

04 February 2009

11 February 2009

18 February 2009

25 February 2009

04 March 2009

11 March 2009

18

7. Empirical Evidence.

a. The Data Set

We will consider 300 Weekly Observations, from 19/11/2008 to 13/08/2014.

The Dependent Variable, as explained in Section 4, is the difference between current BB+

Average Yield and Pre QE BB+ Average Yield.

All the coefficients represent the impact in Basis Points on the dependent variable of a unit

variation in the Independent or Control Variable, and the unit for all QE Variables is $100

Billion.

Even if their values are not reported, all regressions include a constant.

Coefficients whose significance is weak are underlined.

The Forward Looking analysis includes Program Expectation Variables with expectation

projected for horizons S of 1 month, 2 months, 3 months, 6 months and 12 months.

b. A first comparison without control variables

A first comparison is possible among the explanatory power of the four different forms of the

Independent Variable before control variables are included.

Tables 1 and 2 below show the results for independent Variables in their Stock and Flow

dimension:

Table1

Stock of Independent

Variable (100Billion$)

QE Level

Expected QE Level 1m

Expected QE Level 2m

Expected QE Level 3m

Expected QE Level 6m

Expected QE Level 12m

Coefficient (Bp/100Bil$)

t-Statistic (P-Value)

Adjusted R2

-17,3181

-17,4984

-17,5191

-17,3796

-16,2159

-13,4351867084359

-32,6347 (0,0000%)

-31,3802 (0,0000%)

-29,7432 (0,0000%)

-27,8339 (0,0000%)

-23,0163 (0,0000%)

-21,7261 (0,0000%)

78,0635%

76,6902%

74,7180%

72,1270%

63,8780%

61,1700%

19

Table2

Flow of Independent

Variable (100Billion$)

ΔQE Level

Δ Expected QE Level 1m

Δ Expected QE Level 2m

Δ Expected QE Level 3m

Δ Expected QE Level 6m

Δ Expected QE Level 12m

Coefficient (Bp/100Bil$)

t-Statistic (P-Value)

Adjusted R2

96,3804553774222

85,9803825412457

77,1580712385115

63,6975640299625

3,36548010422004

12,9896522642099

2,1025 (3,6341%)

2,4463 (1,5010%)

2,6666 (0,8080%)

2,6881 (0,7589%)

2,5159 (1,2397%)

1,2831 (20,0450%)

1,1274%

1,6397%

2,0029%

2,0398%

1,7514%

0,2157%

We can see that even if all forms are significant,

1. Independent Variables in their Stock Dimension are far more significant and explicative

to the Dependent Variable than in their Flow Dimension.

2. Both significance and explanatory power fade away as Expectation Horizon stretches

further in the future.

An interesting detail to notice is how Flow Explanatory Power initially increases with time

Horizon.

Robustness check: The regressions in the tables above have been replicated for BBB Average

Yields. For BBB data, we witness a generalised reduction in explanatory power (Adjusted R2

ranging from 39% to 34% for Stocks and from -0,003% to -0,001% for Flows) and significance (Tstatistic ranging from 19 to 12,5 for Stocks and from -0,69 to -0,19 for Flows). In particular,

flows are not significant at any conventional level. However, aside from this generalised loss,

the two trends underlined above for BB+ Yield Curves remain perfectly confirmed.

c. Explanatory power, significance and selection of Control Variables.

Now, let us turn to the Macroeconomic Controls. We will first check how much explanatory

power and significance these controls provide on their own, before including the independent

variables.

The results are included in table 3 below.

20

Table3

Consumer

Confidence

MOVE (Index)

Unemployment Gap

Output Gap

PCE 12m

Industrial

Production

Adjusted R2

F Statistic

Selected Controls

-7,3101460522772

29,409081778305

-132,6226738880630

-78,3014214411354

90,6167%

722,8761 (0,0000%)

T Stat

-7,91317

-12,3581

19,75933

-13,5184

All Controls

-4,59956361264181

1,38672195835272

-152,83974381166600

26,11446395301120

15,63967035468080

-37,80446337363200

T Stat

-9,3149

9,3198

-19,0411

3,0752

2,6846

-15,5255

94,8347%

915,9452 (0,0000%)

We notice that the set including all controls have high significance and explanatory Power.

However, in our complete regressions we will drop PCE Inflation and Industrial Production,

retaining only the “Selected Controls”. Here is why:

1. Industrial Production. Industrial Production generates a major problem of

multicollinearity with Output gap: this is evident from the massive reshuffle in T

Statistics between the two whose sum, however, is stable. In fact, a quick check shows

that their correlation in our data is 94%.

After some further checks, we decided to exclude IP rather than Output Gap.

2. Inflation. We can notice from the table above that PCE Inflation shows already a weaker

significance than the other variables. Secondly, its inclusion generated a discrete drop in

significance of the QE Independent Variables when they are included. This is probably

due to the particular relevance that inflation data has had on QE decisions. Moreover,

since we focus on expectations, considering expected inflation is likely to pose a

dangerous problem. Final and decisive remark: Inflation generates a serious problem of

multicollinearity with all other control Variables (Linear Correlation with MOVE: - 76%,

with Consumer Confidence:-79%, with Unemployment Gap: -72%, and with Output Gap:

81%)

Robustness Check: The above regression including the set of Selected Control Variables has

been replicated on Average Yields for BBB, A, AA and AAA bonds. The explanatory power drops,

but not beyond reasonable levels (BBB, 66%; A: 78%, AA: 70%, AAA: 68%) and even though

some variables lose significance at times, overall regression significance remains very high.

21

d. Controlling for Average Maturity

As previously anticipated in Section 5, we will include a control for Fed’s Average Maturity, both

current and Expected.

This will give traction to Twist Program Announcements, even if they did not announce a

change in the future size of the Fed, but just a change in its future Balance Sheet composition.

We will only consider Average Maturity of Non-MBS Holdings, since the data on MBS maturity

is scarcely informative due to the complexity of MBS prepayment expectations.

The outcomes of Average Maturity inclusion are shown in table 4 below.

Table4

Consumer

Confidence

MOVE

Unemployment Gap

Output Gap

AM (Days)

Adjusted R2

F Statistic

Selected Controls+ AM

T Stat

AM

T Stat

-6,7611

2,8539

-139,0428

-80,6626

-0,000319220272

90,7820%

589,931 (0,0000%)

-10,8037

18,8325

-13,8283

-11,7413

-2,5082 -0,00175647894963713 -14,076

39,7339%

Robustness Check: We considered the impact on significance and explanatory power of AM

inclusion in regressions for BB+ and BBB Average Yields. The results in terms of T Statistics and

Adjusted R2 are shown below in table 5:

Table5

T Statistics

Consumer

Confidence

MOVE

Unemployment Gap

Output Gap

AM (Days)

Adjusted R2

BB+ including

AM

BB+ excluding

AM

-10,80

18,83

-13,83

-11,74

-2,51

90,78%

BBB including

AM

-12,3581

19,76

-13,52

-11,40

90,62%

BBB excluding

AM

3,73

-9,40

8,58

8,44

1,29

65,99%

4,46

-9,95

8,52

8,33

65,91%

Clearly, the impact on significance is limited, and positive for certain variables. Similar checks

have been done on regressions including QE Independent Variables.

22

e. The complete regression comparison

We will now include both Independent and Control Variables in complete regressions. Tables 6

and 7 below include Independent Variables in their Stock dimension, whereas tables 8 and 9

include their Flow dimension.

Table6

Stock

QE Level

T Stat

QE Level

Expected QE

Level 1m

Expected QE

Level 2m

Expected QE

Level 3m

Consumer

Confidence

MOVE

Unemployme

nt Gap

Output Gap

-13,1

-12,32

AM (Days)

Adjusted R2

F Statistic

0,3984

1,6571

0,52

10,56

1 Month

T Stat

-8,5949

-8,63

2 Month

T Stat

-10,3351

-9,65

-0,98

13,13

10,40

10,15

-7,01

-3,3688

2,1263

-4,83

13,76

-0,8027

2,0445

-95,6082 -10,74

-106,7836

-10,85

-100,8789

-45,2343 -7,20

-0,1147 -9,29

93,91%

768,81

-49,0812

-0,0468

92,86%

648,98

-7,32

-6,13

-62,9949

-0,0836

93,03%

665,70

For Stock Variables we can see that:

1. All QE Variables, for both current and expected QE Levels, are highly significant.

2. Significance of both overall regressions (F-Statistics) and of QE variables (T-Statistics)

diminish as expectation horizon increases. However, the dynamic near 2-3 months

horizon seems a partial exception to this trend.

3. Explanatory Power (Adjusted R2) slightly diminishes as expectation horizon increases.

Once more, the dynamic near 2-3 months horizon seems a partial exception to this

trend.

4. The coefficients are negative, just as we would expect. In particular, their magnitude is

consistent with the magnitude of Yield reactions that literature1 associates with QE

Programs.

23

5. The magnitude of QE coefficients diminishes as expectation horizon increases. Again,

the dynamic near 2-3 months horizon seems a partial exception to this trend.

Table7

Stock

Expected QE Level

3m

Expected QE Level

6m

Expected QE Level

12m

Consumer

Confidence

MOVE

Unemployment

Gap

Output Gap

AM(Days)

Adjusted R2

F Statistic

3 Month

T Stat

-9,2071

-8,85

- 1,6172

2,1727

6 Month

T Stat

-6,2030

-6,20

12 Month

T Stat

-3,6775

-4,27

-2,03

14,24

-3,3795

2,5510

-4,12

17,22

-5,0621

2,6910

-6,44

18,21

-105,7872 -10,67

-65,3578 -10,59

-0,0727 -6,69

92,84%

647,28

-115,6254

-70,3961

-0,0477

92,02%

575,63

-11,05

-10,95

-4,93

-125,1953

-64,9754

-0,0353

91,57%

542,26

-11,87

-9,43

-4,34

1. Compare, for instance, our coefficients with the table at page 8of Foerster and Cao, 2013, “Expectations of

Large Scale Asset Purchases”, Economic Review Second Quarter 2013, Kansas City FRB. Consider, for

instance, QE2, which announced 600Bn purchases to be completed in approximatively six months. Our QE

Level coefficient suggests an 84 Bp Drop, a reasonable 20% above the upper estimate that Literature gives

for the 10 years Treasury Yields drop. In a separate regression, for better comparability, I considered only 10

years BB+ Yields, instead of Yield Curve Averages, and the coefficients were almost unchanged

(-13.95 Bp/100Bn$) still giving an 84 Bp drop for QE2.

24

Table8

Flow

Δ QE Level

ΔQE Level

48,3641

Δ Expected QE

Level 1m

Δ Expected QE

Level 2m

Δ Expected QE

Level 3m

Consumer

Confidence

-7,0435

MOVE

2,8088

Unemployment

Gap

-141,5315

Output Gap

-74,9964

AM (Days)

-0,0368

2

Adjusted R

91,08%

F Statistic

509,8574

For Flow Variables we can see that:

T Stat

3,29

Δ 1 Month

T Stat

23,0263

2,13

Δ 2 Month

T Stat

25,2479

2,82

-11,33

18,76

- 7,4782 -13,01

2,773 18,53

-6,7722 -11,19

2,7932 18,50

-14,27

-10,75

-2,92

-142,0844 -14,37

-69,988 -10,12

-0,0328 -3,94

-139,7197 -14,03

-77,6951 -11,44

-0,0392 -3,18

91,05%

508,0607

91,18%

516,2049

1. Not all QE Variables are highly significant.

2. Significance of QE variables (T-Statistics) diminishes as expectation horizon increases.

However, the dynamic near 2-3 months horizon seems a partial exception to this trend.

3. Explanatory Power (Adjusted R2) remains almost constant as expectation horizon

increases. This is a consequence of the scarce impact of Expectation Variables.

4. The coefficients are positive, differently from what we would expect. A possible

explanation for this may be that the positivity of the “Second derivative” of QE is

associated with the worsening of market conditions. Still, the explanation that is more

likely to be sensible is that the flow dimension of our QE variables is simply not reliable.

5. The magnitude of QE coefficients diminishes as expectation horizon increases. The

dynamic near 2-3 months horizon seems a partial exception to this trend.

25

Table9

Flow

Δ Expected QE

Level 3m

Δ Expected QE

Level 6m

Δ Expected QE

Level 12m

Consumer

Confidence

MOVE

Unemployment

Gap

Output Gap

AM(Days)

Adjusted R2

F Statistic

Δ 3 Month

T Stat

19,9334

2,76

-6,9052 -11,82

2,7499 18,13

Δ 6 Month

T Stat

13,472

2,79

T Stat

5,8477

1,93

-7,3104

2,7913

-12,67

18,62

-1,4189 -14,22

-1,4083 -14,13

-1,417

-76,5711 -11,44

-74,7132 -11,15

-72,7178

-0,0422 -3,71

-0,0377 -3,77

-0,0333

91,16%

91,21%

91,16%

-14,28

-10,68

-4,00

514,7078

-7,0528 -12,26

2,7624 18,31

Δ 12 Month

517,9684

514,707

Robustness Check: All the regressions shown in the four tables above have been replicated

using BBB Yield Curves Averages as dependent variable. Significance and Explanatory Power of

overall regressions diminish, but remain at acceptable levels. However, regressions in which

one or more variables turn out to be not significant are more frequent. In any case, the analysis

BBB Yields does not contradict the ten points highlighted above.

26

8. Conclusions

Our empirical analysis suggests that a Flow interpretation of QE seems less reliable than a Stock

one, and that information on the current levels of the size of QE retain more explanatory power

than our projections of expectations for the longer term.

In particular, our results for the Stock dimension confirm the relationship between QE and Yield

Curves that is presented in the Literature, both in its sign and, for QE current levels, in its

magnitude.

In general, we have observed that the further in time we project expectations, the lower their

relevance becomes. This conclusion seems to support a stronger relevance of current levels of

asset purchases than future expected ones. However, this result may depend on two other

factors. First, the models that we have used to project expectations becomes less accurate for

longer horizons. Second, as discussed in the “Caveats” section, real expectations for the longer

term are created in a more complex process than the one that can be modelled after official

announcements. Actually, this process includes a variable degree of anticipation of official

announcements, and continuous adjustments of these anticipations. Our model, centred on

official FOMC announcements, inevitably approximates the real process of expectation

formation.

Moreover, the fact that current levels seem more significant and explanatory should not shade

another result of our analysis, possibly more relevant: Expectations for the longer term in their

Stock dimension retain high significance and explanatory power on the Average level of

Medium-Quality Yield Curves.

Therefore, even if caution is needed in emphasising current size of the FED’s Balance Sheet over

its future expected one, as far as implications for the exit strategy are concerned, this enquiry

suggests that a normalisation of the effects of QE will take some time, coherently with a stock

interpretation of it.

27

9. References

Fundamental reference for this analysis:

Daines, Martin, Michael A.S Joyce and Matthew Tong, 2012. “QE and the gilt market, a

disaggregated analysis”, Bank of England Working Paper No 466.

D’Amico, Stefania and Thomas B.King, 2012. “Flow and Stock Effects of Large Scale Asset

Purchases: Evidence on the importance of Local Supply”, Finance and Economic Discussion

Series, No 2010-52, Washington: Board of Governors of the Federal Reserve System,

September.

Foerster, Andrew and Guangjye Cao, 2013. “Expectations of Large Scale Asset Purchases”,

Economic Review Second Quarter 2013, Kansas City Federal Reserve Bank.

IMF Report 2013a “Unconventional Monetary Policy- Recent Experience and Prospects”

Krishnamurhy, Arvind and Annette Vissing-Jorgestern, 2010 “The Aggregate Demand for

Treasury Debt”, Northwestern University.

Krishnamurhy, Arvind and Annette Vissing-Jorgestern, 2011. “The Effects of Quantitative

Easing on Interest Rates, Channels and Implications for Policy”, NBER.

Wu, Tao, 2013. “Unconventional Monetary Policy and Long Term Interest Rates”, IMF.

Other essential reference on topic:

Bernanke, Ben S., Vincent R. Reinhart and Brian P. Sack, 2004. “Monetary Policy Alternatives

at the Zero Lower Bound: an Empirical Assessment”, Brookings Papers on Economic Activity,

Vol.1, pp. 1341-93.

Chen, Han, Vasco Curdia and Andrea Ferrero, 2012. “The Macroeconomic Effects of LargeScale Asset Purchases Programs: Rationale and Effects”, Federal Reserve Board, Working

Paper.

Eggertson, Gauti, and Michael Woodford, 2003. “The Zero Bound on Interest Rates and

Optimal Monetary Policy”, Brookings Papers on Economic Activity, Vol.1, pp. 139-211.

Gagnon, Joseph, Matthew Raskin, Julie Remache and Brian Sack, 2011. “The Financial

Market Effects of the Federal Reserve’s Large-Scale Asset Purchases”, International Journal

of Central Banking in a Zero Lower Bound Environment, Vol.7, No 1, pp. 3-43.

Hamilton, James D. and Jing Cynthia Wu, 2012. “The Effectiveness of Alternative Monetary

Policy Tools in a Zero Lower Bound Environment”, Journal of Money, Credit and Banking,

Vol.44, pp. 3-46.

28

Harrison, Richard, 2011. “Asset Purchase Policies and Portfolio Balance Effects: a DSGE

Analysis”, in Chadha, J., and Holly, S., (eds), Interest Rates, Prices and Liquidity, Cambridge

University Press, Chapter 5.

Harrison, Richard, 2012. “Asset Purchase Policy at the Effective Lower Bound for Interest

Rates” Bank of England Working Paper No 444.

Neely, Christopher, 2011. “The Large –Scale Asset Purchases Had Large International

Effects”, Federal Reserve Bank of Saint Louis, Working Paper.

Swanson, Eric T., 2011. “Let’s Twist Again: a High-Frequency Event-Study Analysis of

Operation Twist and Its Implications for QE2”, Federal Reserve Bank on San Francisco,

Working Paper No 2011-08.

Vajanos, Dimitri and Jean-Luc Vila, 2009. “A Preferred Habitat Model of the Term Structure

of Interest Rates”, NBER Working Paper No 15487.

29