Japan: BOJ into uncharted territory

advertisement

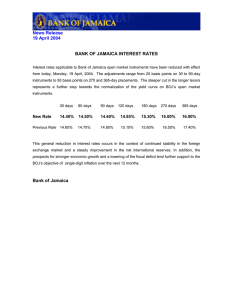

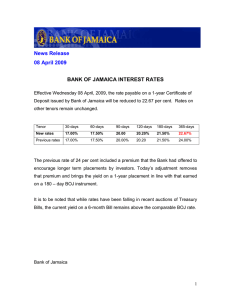

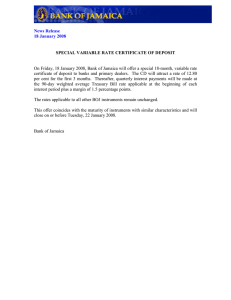

Japan: BOJ into uncharted territory 2 February 2016 Economics Japan: BOJ into uncharted territory DBS Group Research 2 February 2016 • For the first time, the BOJ starts to charge interest on banks’ excess reserves • Credit transmission remains uncertain • The inflation and growth outlooks remain elusive • The financial market impact may be greater than the real economy one • JGB yields will continue to face downward pressures • The BOJ’s rate move per se is only a moderate surprise compared to the previous two actions on QQE in 2013 and 2014 The Bank of Japan (BOJ) will implement negative rates on financial institutions’ excess reserves in a move to address the downward pressure on inflation / inflation expectations. Effective from 16th Feb, the BOJ will charge 0.1% on the amount of new deposits that exceeds required reserves. Further rate adjustments are possible according to the BOJ, depending on economic developments. This is the first time the BOJ applied negative rates to banks’ reserves. Similar experiences have only been witnessed in Europe in recent years. In order to combat deflation, the European Central Bank (ECB) has pushed the interest rates applied on its deposit facility below zero since 2014, and Sweden’s central bank followed suit in 2015. The central banks in Switzerland and Denmark also instituted similar policies in recent years, albeit for different reasons – mainly to contain capital inflows and relieve upward pressure on their currencies. The credit transmission channel may or may not work By charging interest rates on banks’ excess reserves, the BOJ hopes to encourage bank lending into the economy so as to support consumption and investment. Success is not guaranteed. Banks won’t necessarily pass on the negative rates to customers for fear of losing them. They may choose to tolerate a small loss in earnings rather than to lend to perceived risky borrowers. Alternatively, if banks decide to pass the negative rates to customers, it may help to revive credit growth, but also hurt the depositors. For an aging economy like Japan, the adverse impact of negative deposit rates on pensioners and other fixed-income earners can't be dismissed. The overall impact of negative rates on consumption and domestic demand is likely to be mixed. Deposit and lending rates in Japan’s banking system have fallen to record lows since the BOJ introduced the quantitative and qualitative easing (QQE) program in 2013. But loan growth has picked up only slightly from 1.8% in 2013 to 2.5% in 2015 (Chart 1). Loan demand has been sluggish due to structural factors, namely, the aging of population, shrinking of domestic consumer base, and relocation of corporate investment to overseas emerging economies. It is hard to imagine a Ma Tieying • (65) 6878-2408 • matieying@dbs.com 1 Japan: BOJ into uncharted territory 2 February 2016 Chart 2: Eurozone: credit growth vs. interest rates Chart 1: Japan: credit growth vs. interest rates % pa, % YoY % YoY 4 16 14 12 10 8 6 4 2 0 -2 -4 -6 -8 Jan-08 3 2 1 0 -1 Bank loan growth -2 Avg lending rates: new loans Avg time deposit rates -3 Jan-08 Jan-10 Jan-12 Jan-14 % pa Corporate loan growth 3.5 Household loan growth 3.0 ECB: rate on deposit facility (RHS) 2.5 2.0 1.5 1.0 0.5 0.0 -0.5 Jan-10 Jan-12 Jan-14 modest further decline in capital costs tackling these structural problems. In the Eurozone, even after the ECB introduced a negative deposit rate in 2014 and cut it twice from -0.1% to -0.3%, credit growth has risen only marginally in the past 1.5 years (Chart 2). The inflation outlook remains elusive The BOJ also hopes that negative rates will boost public inflation expectations so as to encourage consumers to spend and businesses to invest. But inflation expectations are influenced by many factors including exchange rates, the output gap and commodity prices, amongst others. The two charts below show that inflation and inflation expectations in Japan were most correlated with the movements in JPY and oil prices in recent years, if stripping out the distortion impact from a consumption tax hike. Negative rates could weaken the JPY, lift import prices, and therefore boost inflation/inflation expectations. But oil prices will remain a wild card and they are not under the control of the BOJ. If global oil prices were to remain low on the back of supply-demand imbalance, it would continue to pose a threat to Japan’s inflation outlook and put pressure on the BOJ to ease policy further later this year. Chart 3: Japan: inflation vs. JPY, oil prices Chart 4: Japan: inflation expectations vs. JPY, oil % YoY 3.0 2.0 CPI (tax adjusted) USD/JPY (RHS) Oil import prices in US$ (RHS) 1.0 160 140 140 120 120 100 100 0.0 80 60 -1.0 40 -2.0 -3.0 Jan-08 20 0 Jan-10 Jan-12 Jan-14 80 60 % consumers expecting prices to go up USD/JPY 40 20 0 Jan-08 Oil import prices in US$ Jan-10 Jan-12 Jan-14 2 Japan: BOJ into uncharted territory 2 February 2016 Chart 5: Japan: JGB yields Chart 6: Germany: Bund yields % pa % pa 2.00 1Y 3Y 5Y 10Y 5.00 1Y 3Y 5Y 10Y 4.00 1.50 3.00 1.00 2.00 0.50 1.00 0.00 -0.50 Jan-08 0.00 Jan-10 Jan-12 Jan-14 Jan-16 -1.00 Jan-08 Jan-10 Jan-12 Jan-14 Jan-16 Impact mainly in the financial markets The impact of the BOJ’s latest policy move is likely to be reflected in the financial markets more than in the real economy. Bonds: Negative returns on reserves should prompt banks to look for other liquid, risk-free assets to substitute, which benefits sovereign bonds. The 1-3Y JGB yields have already turned slightly negative since late last year, due to the large-scale bond purchases by the BOJ under the QQE program. The 5Y yield also dipped below zero last Friday, immediately after the BOJ announced the negative rates policy (Chart 5). In the Euro Area, short-term government bonds in the highlyrated countries (e.g., Germany, Austria, the Netherlands) also recorded negative yields after the ECB cut deposit rate in Jun14 (Chart 6). The phenomenon of negative bond yields could persist. Banks would continue to hoard government bonds if they expect capital gains returns to offset the negative yields, such as due to the BOJ’s expansion of bond purchases, or an increase in bond demand caused by heightened risk aversion. This means bond prices will remain distorted for some time – failing to reflect the risks of Japan’s rising public debt and downgraded sovereign credit ratings. Equities: Negative rates on reserves could encourage financial institutions to buy equities and other risk assets. The Nikkei reacted positively to the BOJ’s policy announcement last Friday. But a high degree of uncertainty remains. Slow global growth, low oil prices and a strong US dollar weighing on emerging market debt all factor into the risk equation. Yen: Negative rates should weaken the currency. In search of positive yields, Japanese financial institutions could allocate more funds into foreign bonds/equities, and increase the cross-border lending to foreign counterparts. The incentives for carry trade between the JPY and the high-yield currencies would also be strengthened. Unsurprisingly, the yen has depreciated notably against the dollar since last Friday, moving from the 118 level to 120-121. Currency depreciation was also witnessed in the Euro Area after the ECB adopted negative rates in Jun14. Still, capital flows and carry trade depend on the development in global risk environment and the factors noted above are relevant here as well. From this perspective, the BOJ’s policy move Friday only came as a moderate surprise, both in terms of the timing and the form of easing. The psychological impact may be shallower than that of the previous two moves in 2013 (when the BOJ made a policy overhaul to establish the QQE) and in 2014 (when the size of QQE was expanded as the Fed‘s QE wound down). Markets could continue to demand bolder easing 3 Japan: BOJ into uncharted territory 2 February 2016 measures from the BOJ going forward – a further expansion in the scale of asset purchases. But given the re-activation of the interest rate tool, whether QQE expansion remains the BOJ’s priority option has become increasingly unclear. Sources: All data are sourced from CEIC, Bloomberg. Forecasts and transformations are DBS Group Research. 4 Japan: BOJ into uncharted territory 2 February 2016 Recent Research CNH: will capital controls help? 2 Feb 16 G4: who’s winning the currency wars? 25 Sep 15 Mid-quarter FX update: Not just about CNY 1 Feb 16 IN: RBI – another window opens 22 Sep 15 IN: RBI to await budget cues 1 Feb 16 Japan’s “go global” experience (3) 21 Sep 15 IN: fading boost from low oil prices 28 Jan 16 SG: mandate for inclusive policy 17 Sep 15 TH: consumption the weak link 25 Jan 16 Qtrly: Economics-Markets-Strategy 4Q15 10 Sep 15 CN: how to end the vicious cycle 21 Jan 16 Triangulating Asian Angst: the US, China and the 97 question 7 Sep 15 Global crude: still spilling onto the floor 20 Jan 16 TW: after the election 19 Jan 16 IN: back at fiscal crossroads 19 Jan 16 CNH: “Taken” – the RMB episode 15 Jan 16 Rates: UST curve: belly’s too big 15 Jan 16 CN: services and manufacturing are codependent 14 Jan 16 IN: prepared, not immune Qtrly: Economics-Markets-Strategy 1Q16 CN: the need for institutional reform 21 Aug 15 SG: when China devalues 20 Aug 15 TW: the impact of yuan devaluation 19 Aug 15 SG: saving manufacturing 17 Aug 15 IN: inflation remains key 6 Aug 15 IN Gilts: greater foreign ownership mooted 4 Aug 15 16 Dec 15 IDgov bonds: 2Y sector looks attractive 31 Jul 15 10 Dec 15 JP: Japan’s “go global” experience (2) 29 Jul 15 Holiday Heresies 2016 7 Dec 15 IN: harnessing demographic dividend 27 Jul 15 ID: manufacturing still a drag 3 Dec 15 CN: fiscal reforms to accelerate (2) 24 Jul 15 CNH: billion dollar baby 16 Nov 15 EZ: will more QE help? 4 Nov 15 Rates: regional rates rundown 2 Nov 15 FX: monetary policy divergences intact 2 Nov 15 Rates: UST Curve - the next flattening leg 30 Oct 15 JP: deciphering the BOJ 23 Oct 15 ID: no room to cut 12 Oct 15 IN: the lowdown in exports 9 Oct 15 SG: slowest growth in six years 9 Jul 15 CN Rates: stock market woes driving onshore/offshore divergence 9 Jul 15 Greece: near the tipping point 6 Jul 15 ID: investors staying put 6 Jul 15 VN: Asia’s latest electronics spark 1 Jul 15 Japan’s “go global” experience: implications for 30 Jun 15 China SG: watch core inflation 16 Jun 15 Disclaimer: The information herein is published by DBS Bank Ltd (the “Company”). It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. 5