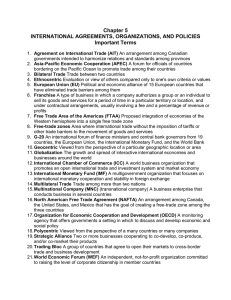

International Spillovers of Monetary Policy

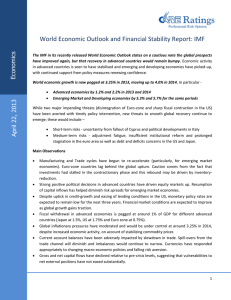

advertisement