Investor Fact Sheet

First Quarter Fiscal Year 2012

Company Overview

Analog Devices (NYSE: ADI) is

a world leader in the design,

manufacture, and marketing

of a broad portfolio of high performance analog, mixed-signal,

and digital signal processing (DSP)

integrated circuits (ICs) used in

virtually all types of electronic

equipment. Since our inception

in 1965, we have focused on

solving the engineering challenges associated with signal

processing in electronic equipment. Used by over 60,000 customers

worldwide, our signal processing products play a fundamental role

in converting, conditioning, and processing real-world phenomena

such as temperature, pressure, sound, light, speed, and motion into

electrical signals to be used in a wide array of electronic devices.

We focus on key strategic markets where our signal processing technology is often a critical differentiator in our customers’

products, namely the industrial, automotive, communications, and

consumer markets.

We currently produce a wide range of innovative products—including

data converters, amplifiers and linear products, radio frequency (RF)

ICs, power management products, sensors based on microelectromechanical systems (MEMS) technology and other sensors, and

processing products, including DSP and other processors—that are

designed to meet the needs of our broad base of customers. The largest

percentage of our revenue comes from our data converter products.

A majority of analysts who cover the converter market estimate our

market share to be between 40% and 47.5%,* and we are well recognized as the leader in this product area in every region of the world.

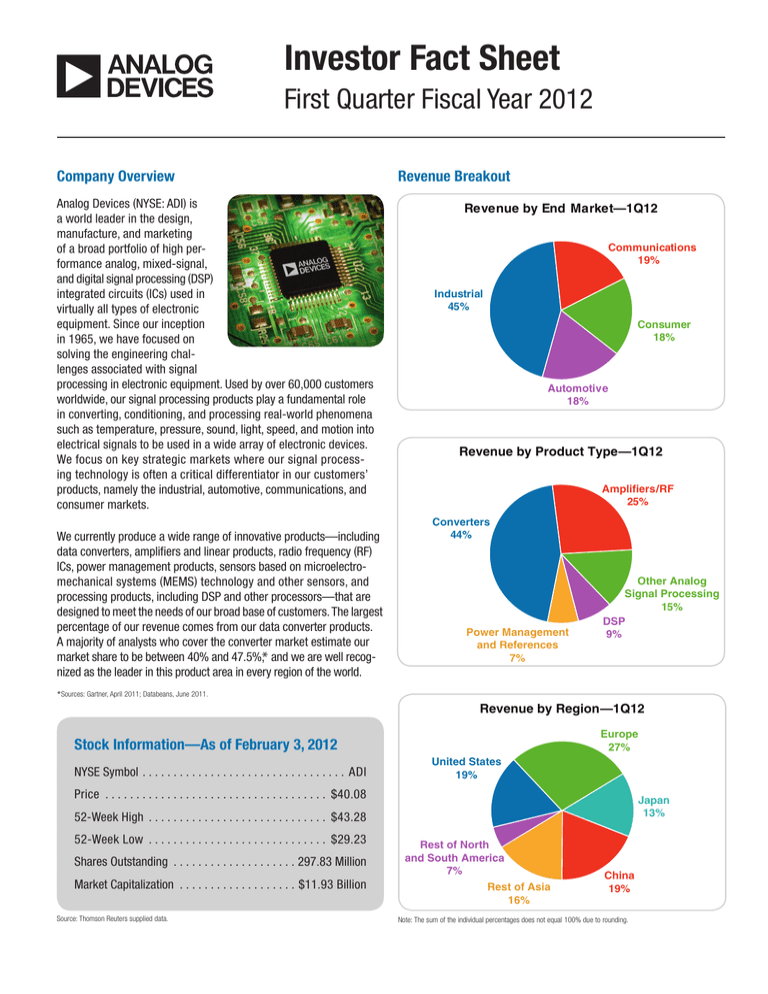

Revenue Breakout

Revenue by End Market—1Q12

Communications

19%

Industrial

45%

Consumer

18%

Automotive

18%

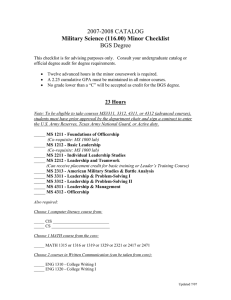

Revenue by Product Type—1Q12

Amplifiers/RF

25%

Converters

44%

Power Management

and References

7%

Other Analog

Signal Processing

15%

DSP

9%

*Sources: Gartner, April 2011; Databeans, June 2011.

Revenue by Region—1Q12

Europe

27%

Stock Information—As of February 3, 2012

NYSE Symbol. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ADI

United States

19%

Price . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $40.08

Japan

13%

52-Week High . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $43.28

52-Week Low . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $29.23

Shares Outstanding . . . . . . . . . . . . . . . . . . . . . 297.83 Million

Market Capitalization . . . . . . . . . . . . . . . . . . . . $11.93 Billion

Source: Thomson Reuters supplied data.

Rest of North

and South America

7%

Rest of Asia

16%

China

19%

Note: The sum of the individual percentages does not equal 100% due to rounding.

Financial Highlights

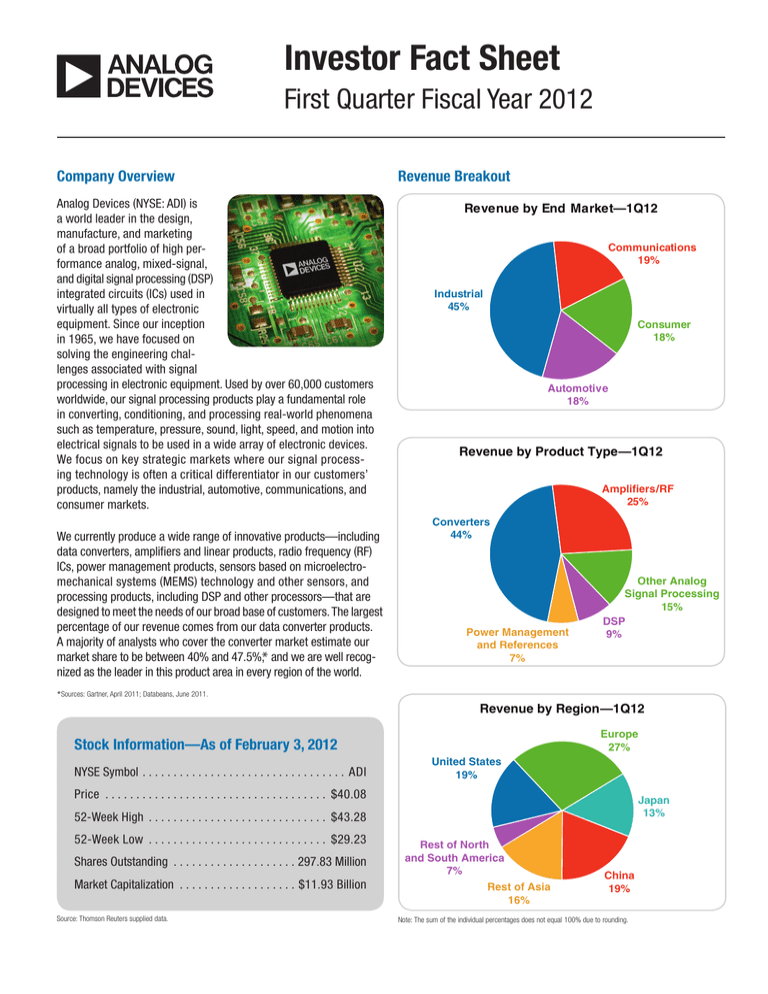

Quarterly Financial Performance

(In Millions Except Per Share Amounts)

FY2011

FY2010

FY2009

FY2008

Revenue from Continuing

Operations ($M)*

FY2007

Income Statement

Total Revenue from Continuing

$2,993.3 $2,761.5 $2,014.9 $2,582.9 $2,464.7

Operations

Gross Margin

Operating Income from

Continuing Operations

66.4%

65.2%

55.5%

61.1%

61.2%

$1,072.0

$900.1

$284.8

$625.0

$568.7

Operating Margin

35.8%

32.6%

14.1%

24.2%

23.4%

Net Income from Continuing

Operations

$860.9

$711.2

$247.4

$525.2

$502.1

Earnings per Diluted Share

from Continuing Operations

$2.79

$2.33

$0.85

$1.77

$1.51

Dividends Declared per

Common Share

$0.94

$0.84

$0.80

$0.76

$0.70

$800

$700

$600

$500

$400

$300

$200

$100

$0

1Q11

70%

Cash and Short-Term

Investments

$3,592.5 $2,687.8 $1,816.0 $1,309.7 $1,081.2

65%

Total Assets

$5,277.6 $4,328.8 $3,369.4 $3,081.1 $2,967.3

$886.4

$400.6

$379.6

—

—

2Q11

$758

3Q11

$716

4Q11

$648

1Q12

66.2%

67.6%

67.2%

64.3%

63.2%

60%

55%

50%

Cash Flow Statement

Net Cash Provided by

Operating Activities

$791

Gross Margins as a

Percentage of Sales*

Balance Sheet

Long-Term Debt

$729

$900.5

$991.2

$432.1

$669.4

$820.4

45%

40%

1Q11

2Q11

3Q11

4Q11

1Q12

Research Coverage

• Argus Research Co.

• Bank of America/

Merrill Lynch

• Barclays Capital

• Bernstein Research

• BMO Capital Markets

• Canaccord Genuity

• Caris & Company

• Citigroup

• Cleveland Research Co.

• Credit Suisse

• Deutsche Bank

• Goldman Sachs & Co.

• ISI Group

•

•

•

•

•

•

•

•

•

•

•

•

•

•

J.P. Morgan

Jefferies & Co.

Macquarie Research

MKM Partners LLC

Morgan Keegan

Morningstar, Inc.

Nomura Securities Intl.

Pacific Crest Securities

Raymond James

RBC Capital Markets

Robert W. Baird & Co., Inc.

Sterne, Agee & Leach, Inc.

UBS

Wells Fargo Securities

Operating Margin from Continuing Operations

as a Percentage of Sales

40%

35.6%

ADI Corporate Headquarters

Analog Devices, Inc.

One Technology Way

Norwood, MA 02062

Phone: 781-329-4700

www.analog.com

Investor Relations

Email: investor.relations@analog.com

Phone: 781-461-3282

investor.analog.com

32.9%

28.3%

30%

25%

20%

15%

10%

5%

0%

1Q11

2Q11

3Q11

4Q11

1Q12

Non-GAAP Diluted EPS

from Continuing Operations

$0.70

Investor Relations

36.8%

35%

$0.75

$0.80

Contact Information

37.8%

$0.66

$0.71

$0.60

$0.60

$0.46

$0.50

$0.40

$0.30

$0.20

$0.10

$0.00

*1Q11

*2Q11

3Q11

4Q11

1Q12

*Includes non-GAAP figures, which are reconciled to their most directly comparable GAAP

figures on ADI’s IR website at investor.analog.com.

©2012 Analog Devices, Inc. All rights reserved.

Trademarks and registered trademarks are the

property of their respective owners.

BR10212-0-3/12(C)