Namibia`s Execution Strategy for Industrialisation

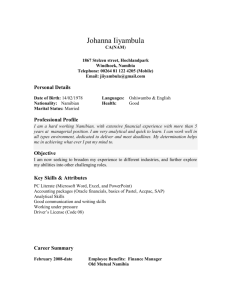

advertisement